AAPL Intraday-Update 8th January - The Fall To $255 - support $252. AAPL is NOT OVERSOLD - yet.

Apple enters 2026 priced on promises. There’s no progress. AI is still “next year,” AVP is already a value write-down, and the stock has barely beaten inflation in twelve months. Strip out the hopium and the 5-year chart tells a quieter, more uncomfortable story near term. Today: $256 @ the open.

Apple started the New Year poorly, in spite of frothing upgrade and pom-pom talk by Dan Ives as usual, the ultimate contrarian sell-indicator.

A Summary of why I’d been saying $272 was too high, too fast, and it has nothing to do with buybacks or other irrelevant phenomenon. It’s a reality check.

I wrote this post following my observations earlier in the week, that as $272 broke, if $268 didn’t hold as key support, $262 was next.

“$268 must hold, or see $262.” - BOOM - That Happened The Next Day

And then I wrote in the comments that $255 was next. That comment requires zooming out to the 5-year chart, where AAPL IS NOT OVERSOLD - YET. TODAY - 8th Jan - AAPL opens at $257

Why AAPL was overvalued at $272 - let alone $288 - in 2025.

Comment written 6th Jan 2026, at the close:

“Here’s a quick take on the following day, 6th January… boom! $262 touched and held for now.

Next support is $255 if it doesn’t.”

The 5-year chart shows all the clues, not the 1-year, in terms of risk and, trajectory. AAPL on the 5-year is not oversold by any means. Support and trading around AAPL changes from the daily during brief periods of of intense momo-trading such as post-October, to the yearly during uptrends but peppered by the odd white swan, and the 5-year during period of long consolidation and awaiting any consequential news, once rumours and “bull-driven euphoria” tends to have driven up the stock too far, too fast.

As happened last autumn with Apple shooting absurdly into the high $280s

If you zoom out to the 5-year chart and check the Bollinger Bands, you ‘ll see the Middled BB at $262 (bang on support) and the lower BB at around $233.

The Upper BB is at $289.

Absent near term moves, and taking possible geopolitical turnouts into account, perhaps with AAPL in a possible period of slow growth, and AAPL not seen as a particularly safe harbour right now given its already high valuation, I’d not bet on anything here.

There could easily be a swoon to $233. That would hit oversold conditions on this chart.

in fact the chart makes a strong case for it. When AAPL takes out the Middle BB with conviction (currently $262) it usually heads for the lower BB before finding strong support.

If momo money comes out of AAPL and Dan Ives frothing at the mouth doesn’t get them back, and there’s a geopolitical wobble with more global impact than Venezuela, $233 or $225 could be the equivalent in 2025 of the $167 swoon in April.

AAPL ≠ a good tradable bet here.

So absent a reason for new money to pour in amidst rising tension and the possibility of another fall-out with China (you can say bye bye to China iPhone sales growth if China cuts Apple out of the $250 subsidy it offers buyers) until there’s genuinely new “stuff” on the table from Apple.

NOTE: for me, that doesn’t include a niche and enormously expensive “iPhone Phablet Pholdable Phone Pro Max iFold” …

… I still don’t see the near-term bull case for AAPL beyond a steady and slow grower.

Local basketball on the AVP is barely scratching the surface on a product now three years old and destined for the scrapheap the moment Apple can cut ⅔ of the price and deliver and almost equal experience but the use case for mass market adoption of goggles to wear around the house is questionable and unproven.

In fact so far, the case has been totally disproven by not just Apple, but the entire VR goggles segment which can’t get a grip. Unless Cook & Co can finally show there’s a genuine mass market use case for the AVP, it’s going to be a resource sapping distraction and an embarrassing one, given how much churn the project has caused internally to-date involving entries departments re-structuring and re-organising in the last 18 months.

- Apple topped 2024 at $260.

- It marginally beat inflation by topping out 2025 at $272.

- Going into 2026 it’s at $262 right now after almost recovering $280.

This morning pre-market on 8th January 2026, it’s at $257, within $2 of my call of $255 - key support to not trigger more sell-stops and head towards crucial support of $233

The drivers cited for each of these years which have so far failed to materialise?

- AI,

- Siri,

- mass-market AVP/AR Glasses,

- better spec’s MacBooks with more than just a new M-series CPU - like, please, a modem at the very least, and a better screen for the Air.

- I’m not including the “phabulous pholdable - I don’t believe it will be a just success, nor sell in sufficient numbers to move the needle anyway.

WARNING: SKIP THIS SECTION AND JUMP TO THE “AFTERS” IF YOU DON’T WANT A REMINDER OF HOW MY PAST COMMENTARY IS USUALLY PRETTY ACCURATE ON FUTURE OUTCOMES

Without more than iterative updates, Dan Ives $360 target will drift into 2027. Dan hasn’t explained just how this might happen, he’s just wearing a bullish hat spouting superlatives. I wrote the gameplan for it. Can Apple follow it?

Back in a series of articles from June 2025 to Octiber, explained what strategy Apple should pursue to achieve $400 by Q4 2027.

And…

Along with crucially, why Apple needs to change its culture, not just rent Google’s brains in the form of adopting Gemini in the sly to run Siri, for the company to succeed:

Change the Culture - Change the CEO .

And finally, why John Ternus is not the right guy - nice though he is - to achieve the above transformation.

Cook to Ternus = wrong move. Nice Guy, Wrong Guy.

AFTERS - the Summary Comment

So far, I’m not seeing any moves in the right direction other than vague indications of a consolidation of power and better internal management within Apple, out of necessity but vision though, and the sad adoption of Google’s Gemini and their chief AI expert to replace the last chief AI expert from Google who screwed it all up for Apple in 2018 (Giannandrea).

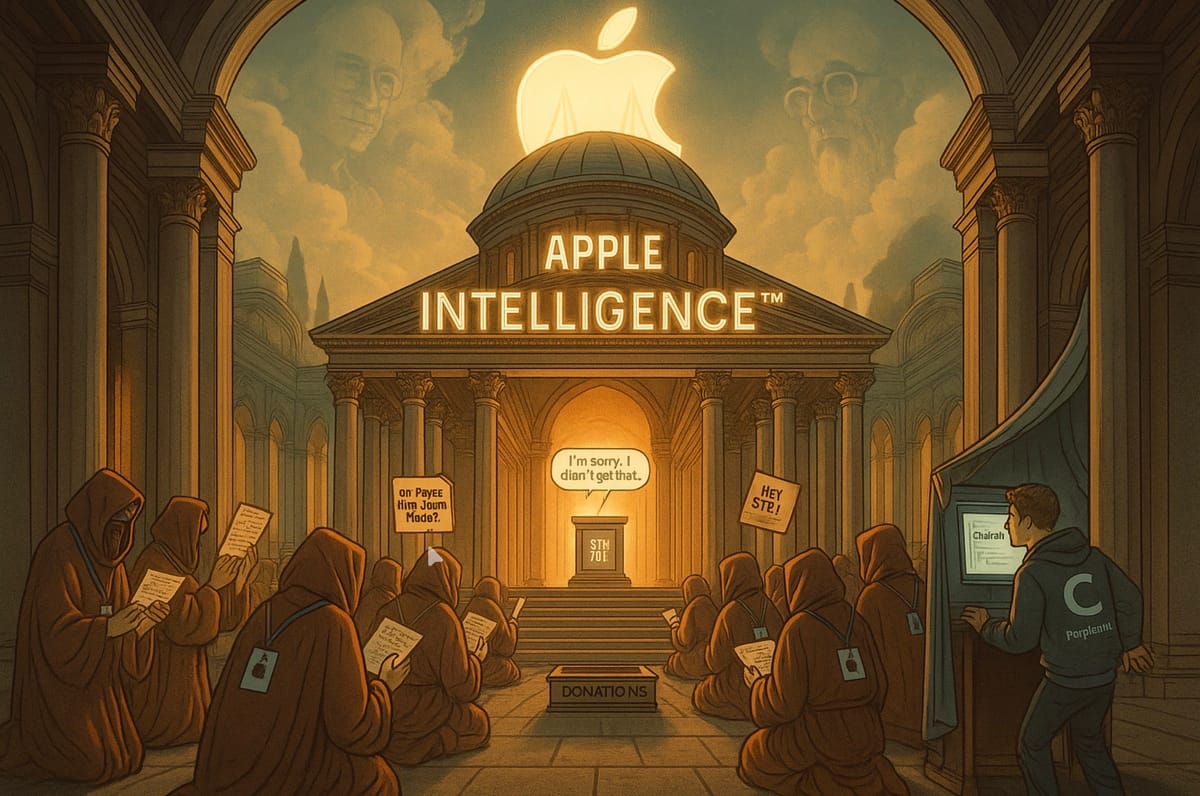

We’re still waiting for Apple to #FREESIRI 15 years after lobotomising it, and catching up on a decade of squandering a lead in AI and uses which would have made Steve Jobs vision of the iPod and iTunes combo the pace-setter for two decades.

If you haven’t read the sad squandering of the opportunity Siri offered before its future was ruthlessly axed when Scott Forstall was booted out and Craig Federighi put in charge of pretty much everything, have a read here:

15-years of Siri Strategic Errors, Culminating In the Flop of Apple Intelligence (akin to the Fall of Rome) and the forced adoption of Gemini from Google (a bit like letting in the barbarians to run and sack Rome, while people cheered at lower taxes - true story).

But let’s be optimistic, IMO they’ve until WWDC 2026 to correct this, if the stock stays where it is.

Meanwhile, it’s richly priced for zero progress except for what I can see is massive internally restructuring and a renewed and simplified product road map.

Will a grey Tim Cook manage to pull off a Brad Pitt style “F1: The Movie” stunt and make his final lap the winning one, or just exit spinning into the pit lane?

If only they would live-stream the C-Suite at Cupertino to the AVP, even I’d buy one!

Now remember, bugger excuses. You‘re investors not apologists.

- Take off your rosy coloured AVPs - gen 3 in 202 might deliver the goods but until then it is the future, not an earnings feature.

- Look at the 5-year chart, I posted above, and see what even a 5-year old could identify as a pattern.

If only they would live-stream the C-Suite at Cupertino to the AVP, even I’d buy one! 🍿

And for any auties on there (if you know, you know,) I’m sure you see the same unavoidable pattern I have been for months now.

Apple, prove me wrong. After 5 years of making a balls-up, much to my disappointment but in line with my predictions, sadly. I used to be the biggest AAPL bull. No longer.

Tim, time to adopt the persona of the wholly-ficitional Brad Pitt character from your cringe-movie, F1: The Movie, and win by breaking all the rules, rather than breaking the car in a tail spin into the tyre wall, as your lasting legacy to Apple.

Otherwise, you’ll be squandering your tenure of 16 years as CEO since Jobs departed, but leaving on a bum note, and Apple’s jewel in the crown, Siri, being run by Google. That would be sad.

So, stop staring at the 1-year cliff edge, zoom out, and notice this isn’t capitulation yet.

If there’s going to be capitulation then “we’re not there yet.” That doesn’t make it inevitable but there’s a familiar trajectory which doesn’t bear ignoring considering the price action in AAPL we’re familiar with from the past; the current velocity and momentum is more unprecedented than the norm after all.

These Intraday Updates will soon only be available to Newsletter Subscribers. If you’d like these updates in real-time, but in short-form rather than article length, plus updates via the new Intraday Updates interactive page, sign up below - still free for now! See the Sign-Up links below my sign-off 👇

PS - Dan Ives now has his own bloody ETF!

So this guy gets to talk up his favourite stocks all over the media, and literally talk up his book, and see his ETF boom as a result. Does anyone else think this is the market being captured by hot air, instead of hot air coming off the market? This, in my view, should not be allowed.

If he’s running an ETF, he should not be allowed to public comment as a third party analysts on his own interests and stocks - let alone his own ETF. This is manipulation 101. SEC? MIA. QED.

Tommo_UK, London 8th January 2026

© 2026 TOMMO.FYI

Free early-access invitation — no paywall, no spam. No Reason No To Sign-Up

Why This Matters:Real-time RSS feeds and FYI exclusive Intraday UpdatesReal-time updates before they hit CNBCReal-time chat with other investorsReal-tome chat with Tommo_UKBreaking News searchable archivesNo noise, just actionable contextLive chat with investors who actually read earnings calls

💌 Not signed up? Here’s a great reason to: Even the free tier gets you in for now. Just subscribe to the newsletter, or check your existing account.

🔔 Access Notice 🔔

👇

Turn on your Newsletter Subscription if you’re already signed-up as a member by checking your account settings here:

💡 This is where the live action, chat, and commentary will happen. Be there when the feed goes live for real-time market insight, member chat, and immediate coverage as it breaks.

👉 See the “Intraday” link at the top of the page? That’s where it’ll live. Feature requests? Click on the link below and leave them in the comments section. This is just a test landing page 🙏, at:

Why This Matters:Real-time RSS feeds and FYI exclusive Intraday UpdatesReal-time updates before they hit CNBCReal-time chat with other investorsReal-time chat with Tommo_UKBreaking News searchable archivesNo noise, just actionable contextLive chat with investors who actually read earnings calls

CONTACTING ME

💡 Reach out to me using the Confidential Drop Box form below.

CONTACT ME DIRECTLY: discreetly (and anonymously if you prefer)

👉 I’ll reach out personally, selectively, and with respect for your time and position, depending on the nature of your drop.