AAPL Q3 Preview: $160, Mediocrity, or $400? The Uncomfortable Truths Wall Street Won’t Model.

A confession: I don't care how many iPhones Apple claims are "installed.” Nor "dormant users," or the parade of stats rolled out every ER call to assure us the Apple ecosystem is, in some metaphysical sense, expanding. The proof is in the earnings growth and that's all the Street really cares about.

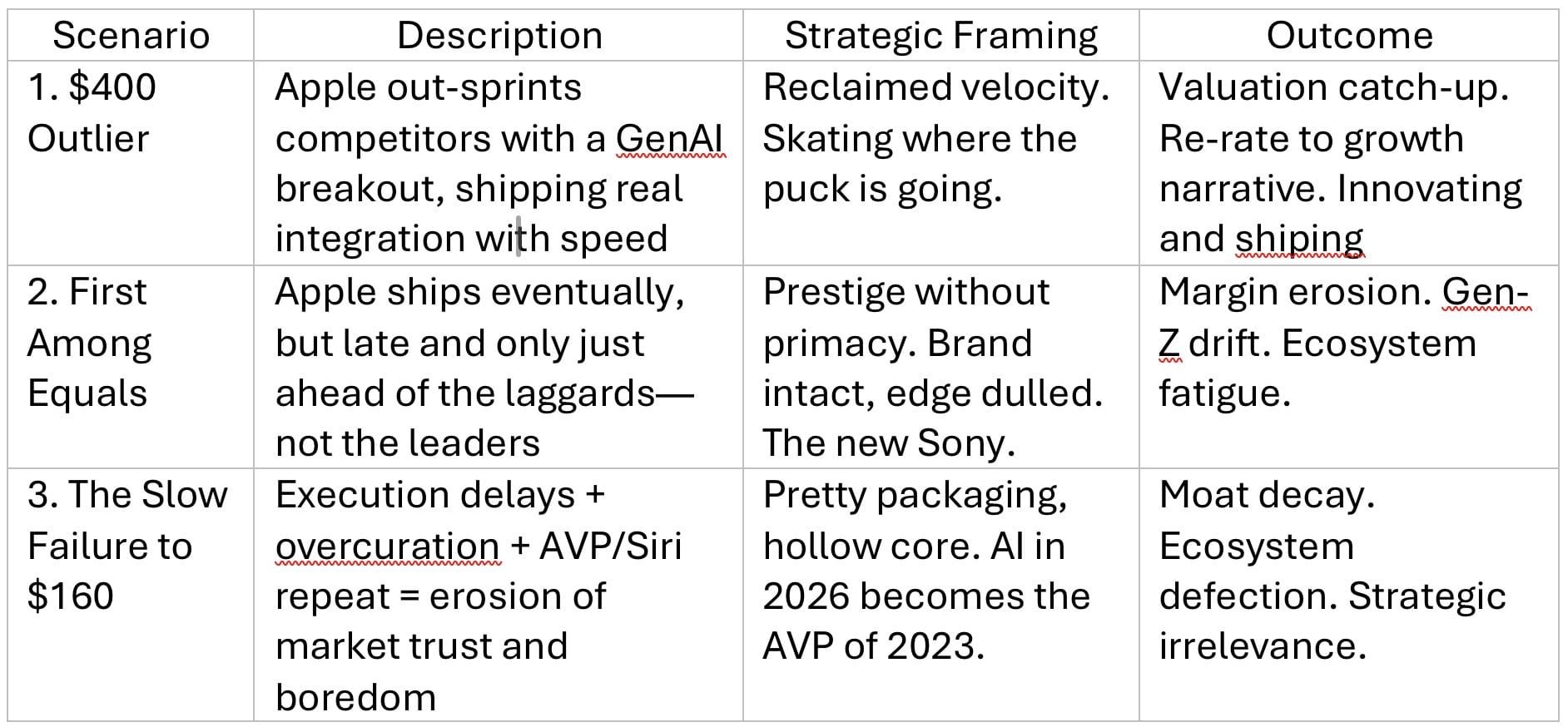

Three Roads From Cupertino: Hopium, Momentum, or Execution?

Introduction: The Illusion of Simplicity

In writing almost 30 .fyi articles and a 16,000-word thesis since May this year, I've noticed we're stuck in a weird market purgatory. The Apple commentariat, both professional and retail, has become adept at ignoring the obvious. Nobody wants to talk about the $169 bottom just months ago. Nobody wants to spell out what it would take to hit $400 by 2027. Instead, we get a kind of ambient, confused optimism: a refusal to look at either the bear or the bull case in the eye.

So let's do what nobody else seems willing to do: map all three roads ahead for Apple. Not just the upside, not just the downside, but the uncomfortable, probable middle path. Because Apple's future isn't binary. It's a "trilemma" and the cost of ignoring that is rising by the quarter.

The Scenario Map: Three Roads From Cupertino

First Let's Pause, Reflect, and Recap: A Reality Check

That "Installed User Base?" A Misread Metric: Presence does not equate to Relevance

Let's be blunt: that well-worn metric and mantra – the "installed user base," isn't the same as future earnings growth. Dormant users aren't buyers. Past momentum isn't a moat. And an installed base is not the same as mindshare retention especially not with Gen-Z.

The market is mistaking presence for relevance. Apple's brand gravity persists, but its velocity signature has stalled. And in the AI era, velocity is the real moat.

Meta-Analysis: 27 Articles, 12 Months of Analyst Calls, and the Narrative Drift

Across my last 26 .fyi pieces, a pattern emerges: the Street and the retail base are both stuck in narrative purgatory. Analyst calls have oscillated between hope and hand-wringing, but the share price has mostly moved on rumour, not shipping.

Every "big moment"—Vision Pro, Siri relaunch, AI teasers is now met with a shrug, not a surge of momentum. The market is going "show us, don't talk about it," but still cutting the company some slack. When you're a stock market darling loved by all, you just know there's likely trouble brewing. Witness Microsoft, Motorola, and BlackBerry pre-2010. Microsoft had a narrow escape by changing tack. The others are footnotes.

All were “the stock you couldn't be sacked for investing client money in," before their dramatic fall from grace and favour. And it's taken Microsoft over a decade to recover.

The Data Behind the Drift

Share Price Movements

The stock has lagged the "Magnificent 7," underperforming both Microsoft and Nvidia. Apple bottomed at $167 just months ago, with a 52-week range from $167 to $260 and an average of $223. The all-time high was in December 2024 at $260, but since then, the trend has been downward and volatile, within a distinct channel.

Earnings vs. Expectations

iPhone sales have been flat for two years. Services growth has slowed. Margins are holding, but only because of buybacks and cost discipline, not top-line growth.

Narrative vs. Noise

The stock moves on rumours, not results. Perplexity integration? $5 pop. Actual product launches? Shrug. Why? What launch.

Analyst Sentiment: Bullishness peaked during the Vision Pro and AI hype, but has since soured. In the last three months, downgrades and lowered price targets have outnumbered upgrades, with the average target falling from $250 to $238, and the low end now at $167.

"The real risk isn't a crash. It's a slow fade into irrelevance—a company that's always almost there, but never quite first."

Community Voices: Graham, Randy, and the Perils of Complacency

Let's use the exchange with Randy as a microcosm. Randy, the dividend maximalist, sits on a pile of shares from 2001 and sees no reason to worry. Graham, an over-exuberant bull, sees only upside because he refuses to acknowledges risks he can't see. Both perspectives are privileged and neither is predictive. Both ignore upside, and downside.

"Your good fortune, Apple's past-and-future potential but current malaise are not mutually exclusive descriptions of the company. They're simply just historical fact, and a clear path for the next 12 months in terms of cause and waste of the choices we already know Apple has, or could make."

Holding a stock because it once returned well is not the same as evaluating where it's going. The refusal to engage with risk or with the possibility of genuine upside is the real danger. It's the equivalent of stagflation in investor sentiment terms.

The Cultural Shift: From Relentless Iteration to Over-Curation

Apple was once the company that shipped, iterated, and shipped again. Now, it's the company that prepares, polishes, and delays. Google, Meta, Microsoft, and OpenAI are moving at warp speed, shipping "messy but smart" AI features in public. Even Samsung is integrating AI, LLMs and Android with Gemini in a manner which has attracted attention. Apple is stuck in a calm after the squall, unable to catch the wind with AI and Siri and its own nascent LLM still "in training" and likely not due for integration properly until May or June 2026 – but that's their best guess (and not mine).

How far even more advanced, will the competition be by then? And how many more of Gen-Z will no longer care to have an iPhone hand-down from Dad? The upper age limit for Gen-Z is now almost 30 too, so they're no longer your kids; they'll be having kids of their own soon. Gen-Über?

If the company continues on this path, the moat will start to dry out. The garden will begin to wilt. And the market will finally price Apple not as a growth stock, but as a luxury staple: beautiful, but replaceable and without a walled garden people want to be stuck in.

Privacy as Legacy, Not Leverage

Apple's moat has historically been built on privacy. But is this still a universal selling point? Laura Martin of Needhams generational thesis, echoed by recent market research, suggests younger users care far less about privacy than previous cohorts. Gen Z, for instance, is comfortable trading data for better outcomes, embracing platforms like Perplexity, TikTok, and AI assistants as cognitive scaffolds.

Apple continues to tout privacy-centric AI, emphasising on-device processing and features like Private Cloud Compute. Yet, the competitive edge is eroding as rivals ship faster, and privacy as a unique selling proposition is losing resonance with the next generation.

If privacy is no longer a moat, what remains to differentiate Apple in a landscape where AI, openness, and speed are prized?

Faith vs Feedback: What the Preachers Refuse to Ask

Apple's retail investor base has long been defined by faith, sometimes to the point of denial. I've been writing about the stock and the company since 2001 and have about 70,000 posts to my moniker, along with super-enthusiasm until about 2015. But now as the stock lags, and the company has failed to execute since about 2021, denial is morphing into discomfort. Analysts on recent earnings calls have pressed Apple's management on supply chain risks, margin pressures, regulatory headwinds, and the slow pace of AI development. Key questions remain unanswered by analysts:

- Why isn't the stock higher if execution is fine?

- If the Apple Car didn't exist, where did the billions in R&D go?

- What is the timeline for meaningful Siri upgrades, and why are they

delayed? - What's happening with Vision?

- Where's Siri (Finding Nemo?)

- (They never ask about Genmoji, but that's all Tim's happy to discuss).

The refusal to confront these questions is not ignorance, but wilful avoidance. As one analyst noted, delays in AI features may cost Apple 10 million iPhone units in FY25 not catastrophic, but a sign that perfectionism is now a liability, not an asset, and the take-away from this cautious comment isn't the small loss in sales, but that it's now open season to speculate about Apple losing sales and earnings due to tariffs and more importantly, poor execution.

Ship or Shrink: Why Speed Now Beats Perfection

Apple's genius was once ruthless simplicity and relentless iteration. Today, its rivals ship fast, flawed, and fearless AI products, while Apple prepares, polishes, and delays. Google, Meta, and OpenAI are iterating in public, capturing mindshare and market share with rapid releases. Apple, by contrast, is still prepping demos and promising future updates.

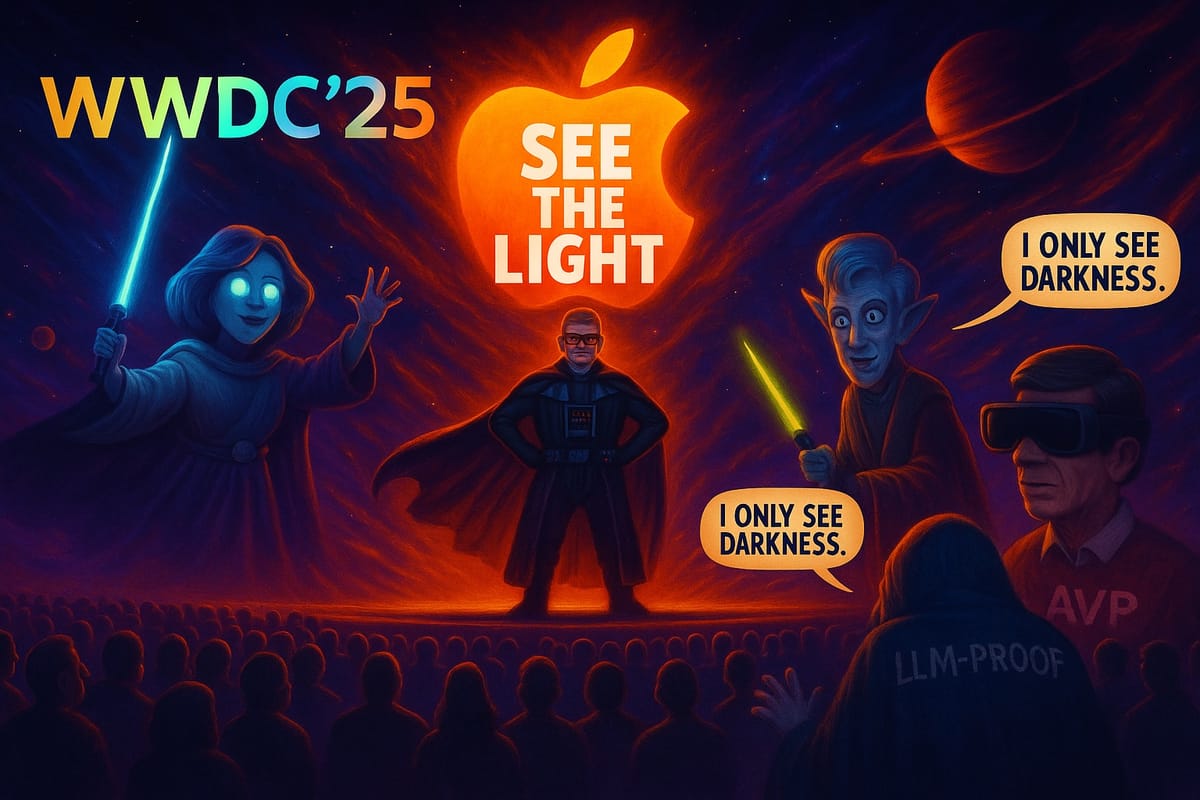

Recent WWDC presentations were seen as incremental, with many features already available in competing products. The market's response was swift: shares dipped, and analysts called for a more compelling narrative.

If Apple can't match the pace of iteration, the $160 gravity returns. If it can start shipping again - not just refining - it earns the $400 narrative.

The middle-ground? Just "successful competence," but no halo, and an opening for a new pirate ship to rise and close in. Just as happened to Apple's predecessors.

Let’s look at each possibility in turn:

I. The $400 by 2027 Outlier: Is Apple Still Capable of Outrunning the Pack?

My supposition on why this is possible even if not probable, solely due to Apple's sad caution and not just innovate, but actually ship.

Let's start with the scenario that sounds outlandish to outsiders (and even most AAPL bulls) but is mathematically plausible to anyone who's run the numbers. The $400 case is not hopium. It's conditional logic.

What Would It Take – In Terms Of AI?

- AI Integration That Isn't Just Cosmetic

Forget "on-device privacy" as a differentiator. The next iPhone needs

to be a cognitive leap. Siri must not only catch up, but leapfrog. The

iPhone 17 must offer something so compelling that even the TikTok

generation—who'd rather use Perplexity than iCloud—feels

it must upgrade. - A Product Roadmap That Surprises, Not Just Satisfies

Vision devices can't be the next Apple TV. It has to be the next iPhone

or, at worst, the next AirPods. If Apple can ship a new hardware

category that actually matters, the market will reward it. - Services Growth That's More Than a Hedge

Services must become a true growth engine, not just a margin buffer

for flat hardware sales. This means not just more Apple One bundles,

but genuine innovation in content, payments, and cloud. - A Multiple Re-Rating

If Apple can reignite an upgrade supercycle and maintain its margin

profile, the stock's P/E could expand back toward 35--40x, especially

if earnings growth surprises to the upside.

Analyst Perspective

JPMorgan's Samik Chatterjee, in his 2025 scenario modeling, projects iPhone shipments rising from 230 million to 263 million by FY27 if Apple can deliver a "must-have" GenAI experience. Services, he notes, could account for 44% of gross profit by then. That's the math behind $400. But it's not guaranteed. It's all about execution. And his target? Modest anyway. This is the bare minimum to simply placate shareholders. I say Apple needs to double that rise: a 20% rise in 2 years is not impossible, if they ship something other than just another, slightly thinner iPhone with yet more camera features issue 99% of users don’t know how to use.

The Cultural Challenge

But here's the rub: Apple's culture has shifted.

The company that once prided itself on ruthless simplicity and "it just works," and relentless iteration now seems paralysed by perfectionism. The "move fast and break things" spirit has left Cupertino.

If Apple can rediscover that muscle memory, $400 is plausible. If not, it's just a mirage.

Let's look at this a bit more deeply:

Several AI strategies could propel Apple toward a $400 valuation, but only if they address both the company's current execution gaps and the evolving demands of consumers and developers. The following approaches, grounded in recent analyst research and Apple's own disclosures, represent the most credible pathways:

1. Transform Siri into a True AI Agent

Turbocharge Siri with Generative AI: Apple's partnership with OpenAI is a crucial first step, but to justify a $400 valuation, Siri must become a genuinely proactive, context-aware assistant, capable of multi-step tasks, deep app integration, and seamless handoff between devices.

AI: Apple needs to deliver an AI agent that can orchestrate actions across the app ecosystem, not just answer questions. This means Siri should be able to book appointments, manage workflows, and interact with third-party apps using natural language and exist in the backstretch in-line with my SenseOS concept proactively and gently prompting. Not locked into its own ecosystem, only. That's what killed

Siri in 2010.

Developer Ecosystem: By opening up Siri's new AI capabilities to developers (as announced at WWDC 2025), Apple can foster a wave of AI-powered apps, driving device upgrades and ecosystem lock-in.

2. Leverage On-Device and Hybrid AI for Privacy and Performance

On-Device Processing as a Differentiator: Apple's focus on privacy - processing most AI tasks locally -remains a unique selling point (for now), especially as consumer distrust of cloud-based AI grows. However, Apple must ensure that its on-device models are as capable as cloud-based rivals and rivals are also develop on-edge capabilities having led Apple by years in server-based LLM and AI integration.

Hybrid Approach: Apple's new Private Cloud Compute allows seamless scaling between on-device and server-side AI, balancing privacy with the computational heft needed for advanced generative tasks.

Efficiency and Speed: Apple's custom silicon (M-series chips) is already optimised for AI inference, enabling fast, battery-efficient experiences that can outperform cloud-dependent competitors in certain contexts.

3. Ignite a Developer-Led AI App Revolution

Open Access to AI Models: Apple is now allowing developers to tap directly into its on-device foundation models, enabling a new generation of privacy-centric, intelligent apps. The usability of these will depend on the subtle implementation of on-device LLM. Will it have inter-session memory and understanding of context? How will the enormous battery demands to cope with this be managed on a mobile device in extended use, and many others.

App Store Flywheel: If hundreds of new generative AI-powered apps

emerge—especially those that are exclusive to the Apple ecosystem—this could drive a major upgrade cycle, as Dan Ives has been praying for since getting every bullish call wrong since early 2024. Nice guy, but too glowstick, not enough illumination.

Monetisation Opportunities: Apple can take a cut of AI-powered app

revenues, boosting Services growth and reinforcing its premium multiple.

4. Integrate AI Seamlessly Across the Hardware Ecosystem

Cross-Device Intelligence: Apple must deliver AI features that work

fluidly across iPhone, iPad, Mac, Watch, and Vision Pro, creating a "super-device" experience that competitors cannot match.

Spatial Computing and AR: Apple's AI strategy extends into spatial computing, with Vision Pro (VR) and what I called "Vision Go" (AR) features leveraging machine vision and context-aware intelligence, with wearables useable outside in the form of smart glasses. This can differentiate Apple in the next wave of computing beyond smartphones.

Personalised, Adaptive Interfaces: Enhanced on-device AI can make Apple devices more intuitive, anticipating user needs and preferences in real time.

5. Accelerate AI-Driven Upgrade Cycles

AI as Upgrade Catalyst: Analysts estimate that over 300 million iPhones are due for upgrade. If Apple can convincingly tie its best AI features to new hardware (e.g., iPhone 16/17), it could trigger a genuine super-cycle instead of a super-slump on AI-fatigue, driving both volume and ASPs. This might also help Apple fend off embarrassing class action suits against if for selling the iPhone 16 under false pretences with the narrative it would be a necessary upgrade to run Apple Intelligence (which turned out to be a very unintelligent promise to make).

Consumer AI Revolution: Generative AI, if successful, could add trillions to Apple's market cap by sparking a wave of consumer upgrades and developer innovation.

6. Expand AI-Driven Services and Monetisation

AI-Powered Services: Apple can leverage AI to enhance existing services (Apple Music, Fitness+, News, etc.) with smarter recommendations, automated content creation, and personalised experiences—fueling higher ARPU and retention. AI itself could be offered as part of an Apple Services/Apple One bundle opening up Services subscription to non-Apple device users and giving developers outside of the App Store a way of working with the Apple ecosystem through carefully controlled APIs, making Apple AI the legacy industry choice for all developers, who want to ensure their services are compatible with Apple Services and Apple Device end-users.

Enterprise and Productivity: By embedding AI into productivity tools (e.g., iWork, Final Cut Pro, Logic Pro), Apple can capture more value from prosumers and creative professionals.

7. Strategic Acquisitions and Partnerships

Acquire or Partner for AI Talent and IP: Apple's reliance on external LLMs (e.g., OpenAI) should be complemented by targeted acquisitions in AI hardware, software, and design. Such as Perplexity(see my 4-part series of articles about this). Instant plug and play brains into Apples new FMFs = supercharged and instant resurrection of Über-Siri and AI that "just works" straight off the bat.

Collaborate for AI Hardware Innovation: With OpenAI acquiring Jony

Ive's startup, Apple must ensure it stays at the forefront of AI-driven hardware design, potentially through deeper partnerships or its own investments. OpenAI won't be the first or the last to try and use AI to leapfrog Apple.

In summary:

To reach a $400 valuation, Apple must shift from cautious, privacy-first AI integration to bold, developer-driven, and cross-device AI innovation. This means transforming Siri into a true agent, igniting a generative AI app ecosystem, leveraging its hardware-software integration for seamless intelligence, and using AI as the catalyst for its next upgrade supercycle. Only by executing across these fronts—at the pace of its most aggressive competitors—can Apple justify the premium and escape the gravity of stagnation

NeXT (sorry..) let’s look at what happens if Apple just iterates, late, competently, but cautiously and not boldy..

II. First Among Equals: The Danger Zone of Mediocrity

This is the scenario nobody wants to talk about, but everyone should. In it, Apple ships, but late. It becomes a "first among equals." A premium brand, but not a pacesetter. The next Sony.

What Does This Look Like?

- AI Features That Arrive Just After the Leaders

Siri gets smarter, but not as smart as Gemini or Perplexity. Vision

Pro gets an update, but it's still a niche product, with rumours of

shipping dates stretching out to 2028 or 2029. iPhone upgrades are

iterative, not revolutionary. - Gen-Z Drift

The next generation doesn't care about Apple's privacy pitch. They use

Spotify, not Apple Music. They don't see iCloud as essential. The

"walled garden" starts to feel like a dead end to them. They get

bored, and move on. - Services Growth Stalls

Regulatory scrutiny bites. Growth slows. The narrative shifts from

"future optionality" to "defensive income stream." A utility company

in other words.

Analyst Perspective

Morgan Stanley's Erik Woodring notes that Apple's "installed base" is not the same as "engaged buyers." Dormant users don't drive earnings. And as Gen-Z's loyalty wanes, Apple risks becoming just another luxury staple—predictable, but not premium.

The Brand Risk

Apple's premium multiple has always been about future growth, not current performance. If the market decides Apple is just another Colgate—predictable, but replaceable—the P/E compresses. That's how you get to $160 without it seeming like a catastrophe. It's just a simple reset of what constitutes reasonable expectations. But this is the “mediocrity scenario,” so let’s not talk about $160. Yet.

The Danger Zone of "First Among Equals" — and the Anatomy of Drift

If there's one thing Apple's history should have taught us, it's that "catching up" is not a strategy but a warning sign. The risk isn't that Apple will suddenly collapse, but that it will drift into competing mediocrity, becoming merely the best-dressed in a room full of similarly attired incumbents. And if you want proof, you need only look at the company's own playbook over the last decade (and at it's beige period in the 1990s, before it bought NeXT and licensed MacOS to other OEMs).

Apple Maps vs. Google Maps:

Remember the launch of Apple Maps? It was, in a word, disastrous. Google Maps remained the gold standard for years, with Apple only gradually clawing back parity through relentless iteration and, let's be honest, a fair amount of user indifference. Even now, Google leads in features, while Apple's navigation is praised for polish but not forinnovation. The end result? Apple Maps is "good enough," but it's not the reason anyone buys an iPhone.

Apple Music vs. Spotify:

Apple Music overtook Spotify in paid US subscriptions, but globally, Spotify still dominates—especially among Gen-Z and outside the US. Spotify's free tier, partnerships, and relentless feature expansion have kept it ahead in mindshare, if not always in margin. Apple Music is a strong second, but it's still second.

Vision Pro and the AR/VR Race:

Vision Pro is a technical marvel, but it's yet to prove it's anything more than a high-end curiosity. The AR/VR market is moving fast, and Apple's "wait for perfection" approach risks repeating the Apple TV story: a product that's always polished, but never pivotal. The AVP is a perfect example of a quest for perfection which blew the opportunity by launched a bleeding edged concept before the hardware was ready for the experience, and no obvious use case.

Siri and the AI Arms Race:

In this scenario Siri, once a headline feature, is now the punchline of the AI assistant world. Google Assistant, Alexa, and now Gemini and Perplexity have all leapfrogged Apple in both capability and perception. Even Apple's recent AI announcements are framed as "catching up" not leading.

Middle Of The Road Summary

In this middle lane scenario, Apple doesn't leap, it iterates. AI features arrive, not disruptively, but decoratively. Siri improves just enough to claim progress, not enough to win hearts. AVP finds a niche, but not a purpose.

So here's a world where Apple doesn't break—but doesn't break out. It ships slower than Gen Z, faster than regulators. It doesn't stumbles badly but never steals the show. Because it's safe slow competent and becomes boringly reliable. Which for AAPL might be stabilising but for Apple is the road to competent obscurity, long term.

Valuation hovers in the 20-22x band, services carry sentiment, and growth investors quietly reallocate, leaving Apple as a healthy but increasingly safe bet for dividend queens, a flight to safety choice, and a stock market laggard compared to the Magnificent Six remaining growers. “First Among Equals” is the slow strangulation of premium. No fire. Just drift. Apple doesn't bleed but purpose slowly evaporates as does its core investor base.

Moving on to the case for $160

III. The air-pocket drop followed by slow failure: Moat Decay and Strategic Drift to $160 or lower (note: recovery possible, but requiring an enormous operational shift. New CEO?)

Here's the scenario that keeps me up at night. Not a crash, but a slow, grinding irrelevance after a sharp leg down. No "Apple is Doomed," more "AAPL is doomed." Apple fails to ship, or ships so late that the market has moved on. But its core user base is so strong it can survive and almost thrive on a much lower multiple, for years to come, becoming iteratively duller with every year, like it has become over the last 5 years as it fiddled, innovated, but couldn’t ship.

What Happens Then?

- The Moat Dries Out, the Garden Wilts

The brand remains beautiful, but hollow. Ecosystem defection

accelerates, especially among younger users. - AI Becomes the Apple TV of 2025

Siri is still a punchline. Vision Pro is a curiosity. The real action

happens elsewhere. Other devices host multiple LLMs not walled on or

half muted to respect Apple's idea of moral certainty. In fact, people

stop caring about the platform and the ecosystem. - Strategic Irrelevance

Apple is overtaken not by one competitor, but by a thousand tiny cuts;

each one a missed opportunity, delayed launches, features that arrives

too late to matter. - Brain Drain

The best are poached by up-and-coming start-ups offering huge bonuses.

Apple's notoriously tight and lean teams start to crack up under the

stress. Senior management and employees look at their stock options,

and opt out of Apple instead. New hires? Apple starts taking second

best, just to fill posts. The brightest are heading to AI houses, and… Microsoft.

Analyst Perspective

Bernstein's Toni Sacconaghi (yes Lord Voldemort to AAPL investors) has warned for years that Apple's "innovation gap" is narrowing. The company's R&D spend is up, but the output is down, and the products they have tried to launch either cancelled before or after launch, postponed, or left to wither – and worse still, kicked down the road for several years. If this trend continues, the moat will erode and the market will finally price Apple as a mature, slow-growth company with a drop of its multiple back to <20.

Apple has been in triage mode for so long it's like watching a re-run of MASH (younger readers will have to look that one up).

Summer 2025: The Environment

Let's get forensic about the $160 case for Apple: a scenario that, until recently, was dismissed as the stuff of perma-bears and professional contrarians. Yet, as I've argued (and as the market is finally starting to price in), this isn't about hysteria or "doom-mongering." It's about arithmetic, execution, and a set of externalities that are now moving from theoretical to existential and a looming and fast approaching present risk.

If you want to know how Apple could tank to $160, you need only look at the confluence of tariffs, rising production costs, and the market's collective refusal to model the impact of both on gross margins and earnings even while the tariff picture now begins to become clearer, and the impact on gross margins and earnings will begin to weaken in ERs.

A. The Tariff Trap: Not Yet Priced In

Let's start with the elephant in the room: tariffs. Analysts and many investors are still treating these as a "temporary" headwind, something Apple can either finesse through supply chain wizardry or simply wait out or ignore (like they did AI). That's magical thinking. The reality, as Needham, Morningstar, and others have now started to model, is that the impact of tariffs is neither trivial nor transient.

- US-Vietnam Deal: As of July 2025, Apple faces a 20% import tariff on

electronics from Vietnam—up from under 4%—directly impacting

iPads, AirPods, Apple Watches, and Macs. For context, Vietnam is now

the main assembly base for most of these products destined for the US,

thanks to Apple's much-lauded "China+1" strategy. That strategy has

just been kneecapped by a single Trump unilateral handshake. - China and India Tariffs: Tariffs on China-origin products are now at

54%, and India at 26% (with some product lines even higher). While

Apple has shifted a portion of iPhone assembly to India, a large proportion of global sales (outside the US) still originate from China,

and most of the US-bound non-iPhone hardware is now exposed to

Vietnam's new 20% rate. Trump stated last week a deal with China had

been struck and signed .. and yet, Washington and Beijing have gone

quiet. The market? Ignoring the silence and dancing like it's 1999.

B. Gross Margin Compression: The Math Nobody Wants to Do

Apple's vaunted gross margins, 47% at the company level, 36% for products, have been the envy of the industry. But these are now under direct assault:

Direct Cost Impact: In the June 2025 quarter alone, Apple took a $900 million charge for tariff-related costs. That's a 130 basis point drag on product margins—a figure that could balloon if tariffs persist or escalate.

Worst-Case Modelling: Needham estimates that if Apple cannot secure tariff exemptions and absorbs the costs (rather than passing them on to consumers), EPS could drop by 28%—from $7.32 to $5.27 per share. Morningstar models a 25% downside risk to earnings and intrinsic value if the full brunt of tariffs is realised.

Market Response: The last time this scenario was floated, Apple shares fell nearly 13% in two days, erasing $300 billion in market cap. That's not a "what if"—that's a preview.

In fact, the first real penny-drop moment came, after the April 2nd "Liberty Day," when AAPL was off from $260 to $225, and plunged to $169. This slashed over $1 Trillion Dollars of its market cap at the low. Nobody seems to want to discuss this, again. But it happened.

Just as tariffs are again about to take centre stage, and Trumps "Big Beautiful Bill" are combined, going to stoke inflation, suppress private sector employment, possibly even cause interest rates to rise, and the Dollar to fall. 1970s style stagflation all over again.

C. The Supply Chain Squeeze: No Easy Way Out

Apple's supply chain, once a marvel of global optimisation, is now a strategic liability. The company has spent years and billions shifting production out of China, only to find itself whacked by tariffs in Vietnam and India. The idea that Apple can simply "move production to the US" short term is a fantasy: domestic manufacturing at scale is years away and would be vastly more expensive in its current form, requiring a new (and very Apple) way of building assembly lines: modular, robotised with low staff costs.

- Production Costs Up, Flexibility Down: Apple now pays 9% more to

manufacture in Vietnam than it did in China, and that's before the new

20% US import tariff. These costs will ripple through the P&L, and

Apple's ability to pass them on to consumers is limited by price

elasticity especially in a market where Gen Z is already less loyal to

the Apple ecosystem and more price-sensitive than their predecessors

and somehow, the the young have into savers, and thrifty spenders.

They are price sensitive, less brand loyal especially outside of the

US, than their parents are.

D. The Earnings Call Domino Effect

Here's where the rubber meets the road: If, at the next earnings call, Apple forecasts flat or negative growth, or (worse) stops giving guidance and warns of further set-asides for tariff costs—think $2-4 billion in new charges instead of $900 million—the market will not shrug. It will panic.

- Multiple Contraction: Apple's P/E multiple is already under pressure.

If earnings drop by 20--30% and the market decides Apple is now a

"consumer staple" with no growth narrative, the multiple could

compress from 27x to 18--20x---right in line with historical norms for

mature hardware companies. - Share Price Gravity: Do the maths (that's English for "math" for

American readers):

If EPS drops to $5.30 and the multiple contracts

to 20x, you get a share price of $106. Even if the market is more

generous and gives Apple a 25x multiple, you're still looking at

$132. The $160 scenario is not bearish; it's arithmetic and its

horrifying, but it's not rocket science to do the maths.

A failed earnings forecast in July 2025 could indeed trigger a major correction in Apple's share price, especially given the current backdrop of tariff pressures, rising production costs, and a market already jittery about Apple's growth narrative.

E. Market Sensitivity Is Elevated

- Apple is already down 17-18% year-to-date and is the worst-performing

"Magnificent 7" stock in 2025. Even Microsoft is up 15% YTD. The

stock is still trading at a historically high P/E (~32--33) and

forward PE of ~26, making it unusually vulnerable if earnings

disappoint or guidance is weak, and worse still if warnings of tariff

or rising CapEx allowances are made in the risk statement. - Even when Apple beat both EPS and revenue forecasts in Q2 2025, the

stock fell nearly 4% in after-hours trading. This shows investors are

not just focused on headline beats, but are scrutinising forward

guidance and margin pressures.

F. Tariffs and Cost Pressures Are Mounting

Apple faces $900 million in additional costs from tariffs in the June quarter alone, with management warning these pressures are ongoing and could worsen. The company's attempts to diversify manufacturing to India and Vietnam have not fully insulated it: Vietnam now faces its own 20% tariff on US-bound products, and production costs there are up 9% compared to China.

If Apple signals that these costs will persist or increase, and especially if they announce further set-asides or reserves (as they did last quarter), the market could react sharply, as the impact of these have not been incorporated yet.

G. Guidance and Growth Concerns

- The market is watching for signs of flat or negative growth and any

change in Apple's guidance policy. If Apple stops giving guidance, or

issues risk warnings about future quarters, this would be interpreted

as a sign that management sees headwinds that are not yet fully priced

in. - Morningstar and other analysts have flagged that iPhone revenue and

Services growth are both under pressure, and that tariff risk is now a

material threat to profitability.

H. Multiple Contraction Risk

- If earnings disappoint and forward guidance is weak, Apple's premium

multiple is at risk. With a P/E still well above historical norms for

a company with flat or declining earnings, a reset to a lower multiple

(say, 20--25x) could see the stock fall sharply—potentially into the

$160--$180 range, especially if EPS is revised downward due to

sustained cost pressures.

Some analysts are already quietly flagging downside targets as low as

$139 to clients in notes not released to the public, citing unresolved issues around tariffs, China, and AI execution. Oddly, these never seem to make the headlines, ever. It's as if even the media don't want to touch this thesis. Cramer mentioned $180, but that's as far as he'd dare go. Mad money indeed.

I. Volatility Signals and Market Positioning

Options markets are pricing in a wide expected move around earnings, but much of the anticipated volatility is actually being deferred to later in the year, as the market appears to expect the full impact of tariffs to play out over multiple quarters. But my point is this: if those poisoned dishes are on the menu, but just due to be served in the next quarter and the one after that, how long can the dissonance between looming reality and ostrich-like burying heads in the sand be

sustained? Once it's not just on the menu but coming to the table, who is go to stay for the next course?

If Apple's July earnings call delivers a negative surprise—especially on margins, guidance, or tariff-related costs—the correction could be swift, as investors recalibrate expectations for growth and profitability. The Q3 report is potentially the most important event of the year, more so than WWDC.

J. Narrative Fatigue and Macro Risks

Apple's "safe haven" status is no longer unchallenged. With ongoing antitrust litigation, macroeconomic uncertainty, and a lack of clear AI leadership versus peers, any stumble on earnings could be the catalyst for the market to finally re-rate the stock.

In summary – Q3 Looms Large:

A failed earnings forecast on July 31st July 2025, particularly if accompanied by weak guidance, larger-than-expected tariff impacts, or further reserves, could easily trigger a major correction in Apple's share price. The market is already on edge about the company but hopium and faithium is still still strong, and with Apple's valuation still pricing in a premium for growth and resilience, any sign that these qualities are slipping could see the stock quickly reprice lower, potentially toward the $160--$180 range or below if the news is bad enough. Or revenues not "just good enough."

The Street is watching not just for numbers, but for narrative and right now, the narrative is fragile. Tim Cook on the last earnings call was still talking about the wonders of Genmoji as if it was 2024.

Is this a sign of a tone deaf ear, or desperate distraction strategy?

The Strategic Wildcard: Can Apple Tune In and "Plug and Play" Out of Trouble to reach for $400 in spite of itself?

There is, of course, a wild card: a successful, transformative AI acquisition—Perplexity, for instance—hat could be "plugged in" to Apple's new Foundation Model Framework (FMF) and deliver a step-change in AI capability, developer excitement, and user engagement. As I've argued in my own deep dive, this is Apple's "NeXT moment" for AI: a chance to leapfrog years of internal fumbling and ship something genuinely useful, immediately and put the competition in the dust.

I won't argue it again separately but refer you to the 4-part articles about how a Perplexity acquisition cold give Apple the mojo it needs; this case is already made.

So let's be clear: the $160 scenario is what happens if Apple continues to delay, dither, or merely iterate. If the company fails to execute a bold, visible move, if Siri remains a punchline until WWDC2026; if Vision products remain an EOL'd curiosity; if the tariff headwinds are met with silence or hand-waving? Then the market will do what it always does when in a vengeful mood after "its most favoured status" stocks let them down: re-rate Apple as just another hardware/utility company, with all the margin compression and multiple contraction that entails.

The Bottom Line: The Gravity of Arithmetic

Tariffs and rising production costs are not "one-offs." they are now

structural risks. The market has not even begun to price them in.

Gross margin compression of 20--30% is plausible if Apple absorbs

these costs, with a direct hit to EPS and intrinsic value.

A bad earnings call---flat growth, no guidance, big set-asides, could

trigger a sharp correction, with the stock pinned down by multiple

contraction and a loss of narrative momentum.

Only a bold, plug-and-play AI move (like acquiring Perplexity and integrating it into FMF) can unravel this scenario quickly in a manner I advocated for last month, reigniting growth and restoring premium And brining 2026 into 2025, smoothing out a calamitous 2024 in the process.

If you're not modelling for these risks, you're not preparing for reality. And if you're only looking at the upside, you're not investing, you're praying. If you're just sat watching hoping for the best but not looking at how that might happen, and ignoring the worst because life would be unimaginable if it did happen, what does that make your investment style? Probably as well thought through as a Dodo – an

exotic flightless bird, eventually hunted to extinction so other people could put its feathers in their cap.

As ever, the proof isn't in the installed base, or the demos, or the "momentum." It's in the earnings. And the next few quarters will show whether Apple can escape the gravity of $160 and mediocrity or whether it's finally time to admit that arithmetic, not narrative, is in charge because velocity has gone missing in action.

Apple's Challenge: Because WWDC25 was not a product reveal. It was more can-kicking.

(apart from, curiously, a long promo for Apple's F1 movie), but a proxy reveal of the attempt to re-claim—clumsily—Apple's post-Jobs ethos.

Which scenario do you believe is most likely—$160, $400, or just a "first among equals"? Can Apple execute beyond a CGI presentation? "If they can land a keynote, do they still have the culture to ship?" As ever, the proof isn't in the user base, or the demos, or the "momentum."

It's in the earnings, the execution, and the willingness to ask uncomfortable questions. The next cycle starts now.

Wrap-up: Drift vs Momentum vs Velocity Reflection

Apple's greatest danger is not sudden collapse, but strategic drift. It's the risk of becoming "first among equals"—the best of the incumbents, but no longer the company that defines the next act. The examples are right there in the product line: Maps, Music, Siri, Vision Pro. Each is good, some are great, but none are irreplaceable. And the market is starting to notice.

Here's a five line summary of the last 12 months. Really, it's a lot of effort to go nowhere at all.

Not a good look, and the story of the last few years: yo-yo action on no conviction, hopium raising, reality stalling, free-fall outcome. Rinse wash and repeat:

- Apr 2024 – $169: iPhone sales weak, guidance cut, PTs lowered.

- May 2024 - $180: iPad Pro M4 launched. Amazed. Hope return.

- Jun 2024 – $220: WWDC hype, AI teased, analysts upgrade.

- Dec 2024 – $260 ATH: Holiday optimism, AI supercycle noise

- Feb 2025 - $all over the place. AI doom! Siri boxed. Tim asked to

commit ritual suicide. Sacks AI team instead. - Apr 2025 – $167: Tariff costs bite, analysts panic.

- Jun 2025 – 190: It's all about WWDC. Which was all about Formula 1,

and AI - coming in 2026. - Jul 2025 – $212: Vietnam tariffs rise, guidance fears loom. 3 weeks until Q3.

The next 6-12 months will decide whether Apple can reclaim its velocity and hitch its skirts to run up to $400 by 2027, settle for being merely present, rather than relevant, or enter a death spiral of irrelevance and iteration.

The Courage to Look Both Ways

It's not offensive to ask hard questions.

There was an interesting reaction to analyst Richard Windsor's comments about Apple's need to make a move, fast, over on my favorout Apple blog ($) at

This Comment Stream Became Fiery But Sparked A Good Exchange Of Opinions ($)

It's not bearish to model risk.

The case for $160 is real.

The case for Apple becoming a luxury but utility company is real.

The case for $400 is real.

Three contradictory truths can exist at once, without being a feline quantum physics conundrum (apart from poor Siri, now boxed, and apparently dead and alive, at the same time).

The refusal to engage with any of these, and the preacher-like denial that pervades the commentariat and even analysts (Laura Martin aside) is the real story now, with Dan Ives now off his hopium dance of "$325 or bust," reduced to saying he is "befuddled" in last week's note about Apple and its dilly-dallying with AI.

If this article discomforts you, ask yourself why.

Because the most dangerous place to be is not in the bear camp or the bull camp, but in the middle, staring into headlights in the middle of the road, refusing to move, refusing to choose, and mistaking inertia for confidence, deciding "it'll be OK, it always IS with Apple."

Except it hasn't been ok at all, for the last five years at least, and the last three in particular being failures of epic proportions.

As Alice would say, "curiouser and curiouser." The next few months will likely

show which path Apple chooses and which narrative the market finally decides to believe. My take on WWDC’25 raised a number of observations and led to a flurry of articles, about subjects which we may get a view behind the curtain of in 3 weeks time. This could be one of the most important ERs in years, given the fork in the road the market, the economy, Apple, and politics are at. The intersections, straight after WWDC 25 are primed to lead down any number of paths. You might want to have a look at a recap of thoughts around WWDC’25 to put the present in context.

.fyi's Five Questions for Scenario Builders. Have you got what it takes to answer these?

- If you can see a path to $400 by 2027 as I can, what must

Apple tangibly ship in the next 6, 12 and 18 months to justify that

trajectory? - If you dismiss the $160 scenario, what assumptions are you

making about future growth, margins, and market positioning, and are

you watching for cracks, or just not daring to look? - What part of your AAPL thesis, if invalidated, would actually

change your position? Are you watching for that, or just hoping it

never happens? - Does privacy still matter to Apple's core user base, or is it

a legacy advantage that's fading with each new generation? - Is Apple's current premium justified by innovation or is it a

relic of past execution, now at risk of reversion? Why or why not?

If you have an opinion, it's time to stop bickering, get off your

armchair, and actually get your hands dirty with some critical thinking.

Don't you think?

This is the end of your Apple Mid-Year Strategic Audit. The next cycle

starts now.

- tommo_uk, London, July 3rd 2025

@tommo_uk

NB. Happy Independence Day from London, with just a quick factoid you may not know: 99% of the world's fireworks are made in China. As you light yours, or watch the fireworks displays over New York City, just remember; those are Chinese rockets you’re lighting, and paying extraordinary tariffs on. As they explode, just think of what a bad Chinese trade deal is going to do to not just AAPL but the entire US economy. Enjoy the holidays!

Please pass this to your friends, colleagues, investors, liquidators, families, or anyone you think might be interested in real time thought leadership commentary written in real time on the news, about the news, and looking into the future.