AAPL S/R @ ~$272 Today, Where Hope Goes To Die Again, While China Props Up the CNBC Narrative.

AAPL’s five-day chart is a stumble down a staircase with no handrail. $272 has become the market’s favourite rejection zone where every bounce goes to die. Meanwhile CNBC cheers China’s ‘33% surge,’ quietly omitting that Beijing’s subsidies are doing most of the lifting.

An “Exec Summary,” if you can’t be be bothered with the narrative:

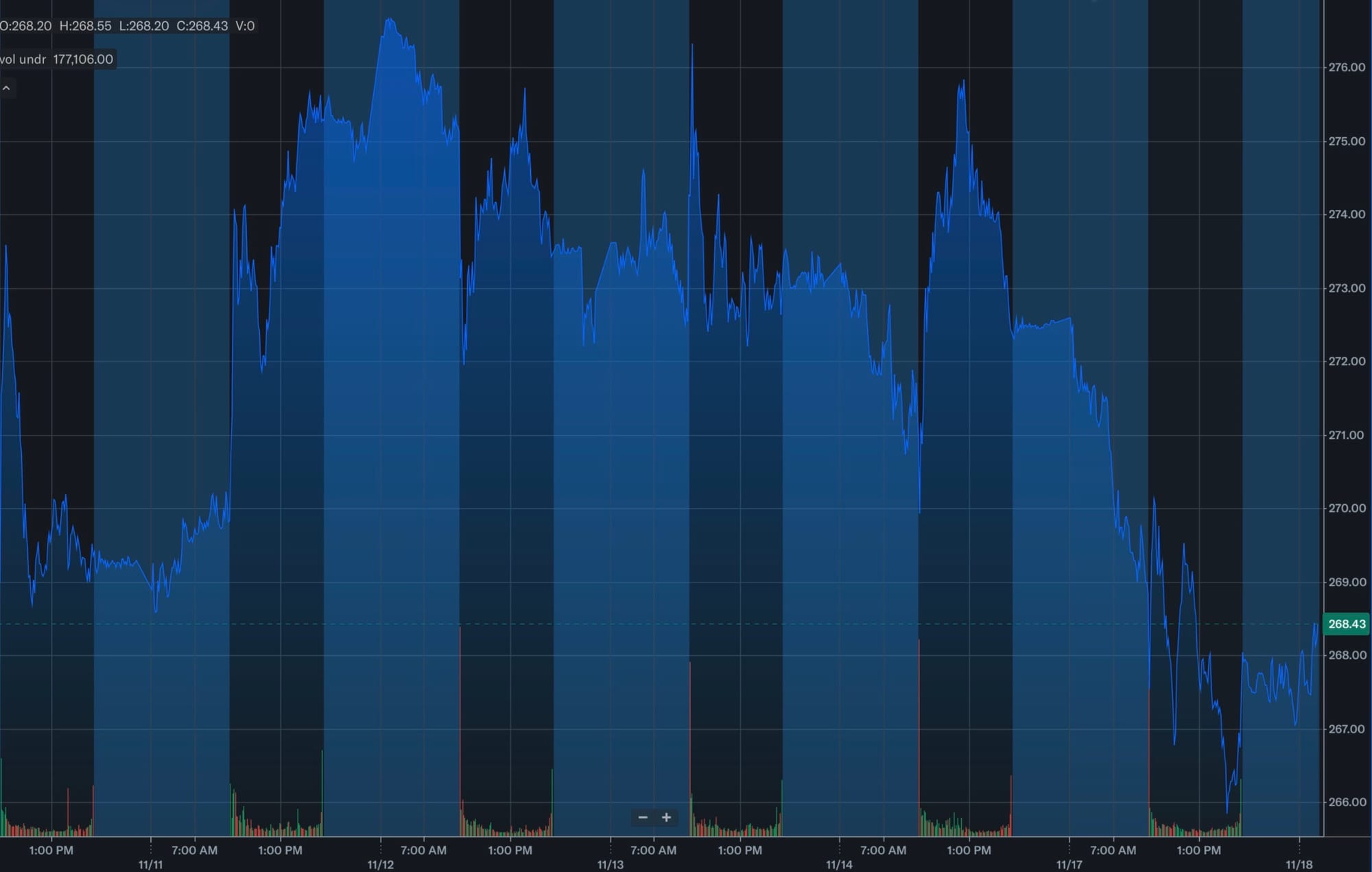

AAPL starts the morning exactly where it left off — in the ditch. Yesterday’s close at $267.46 followed a fairly brutal late-day fade, and pre-market hasn’t improved matters, stuck wandering around $268–$269 with very little conviction.

The five-day chart

has the familiar look of a stock losing altitude: each bounce weaker, each attempt at a higher high rejected almost on contact.

The after-hours low at $266

held just above the short-term support at $265.75, and if that level gives way, $263 is the next obvious target.

On the technicals, the picture isn’t complicated.

$268 is now the first real intraday resistance — yesterday’s faint rebound levels and overnight highs both cluster there, along with AAPL’s pre-market jump on “China News” (which isn’t comparable news, or actually news at all - see narrative below).

A brief attempt at $270.49 was sold immediately,

reinforcing the idea that the market isn’t interested in entertaining higher prices without a catalyst.

Above that sits the more meaningful barrier at $271.50-272,

a level the stock has tested and failed at repeatedly. Every approach has been met with selling, and unless genuine buying shows up (not headline-driven enthusiasm), the pattern is unlikely to change today. See narrative for further discussion.

VWAP for the last 24 hours sits near $270

With AH action unable to reclaim it for more than minutes at a time. Momentum isn’t helping: RSI drifting in the low 50s and MACD still tilted bearish. Put simply, this is not a setup that rewards optimism. I’m sure you have your own charts to check this out without me having to do a cut and paste job, don’t you? If not, you probably shouldn’t be reading this.

Support remains $265.75, then $263 if weakness continues.

Below that, the market will start paying attention to the 50-day at $255.92. Nothing in the current profile hints at a reversal. China chatter will generate noise, but not the sort of buying that alters short-term structure.

Summary:

resistance stacked at $268 and $271.50, support at $265.75 then $263, and nothing in the tape suggesting a change in trend. Trade the levels, not the headlines.

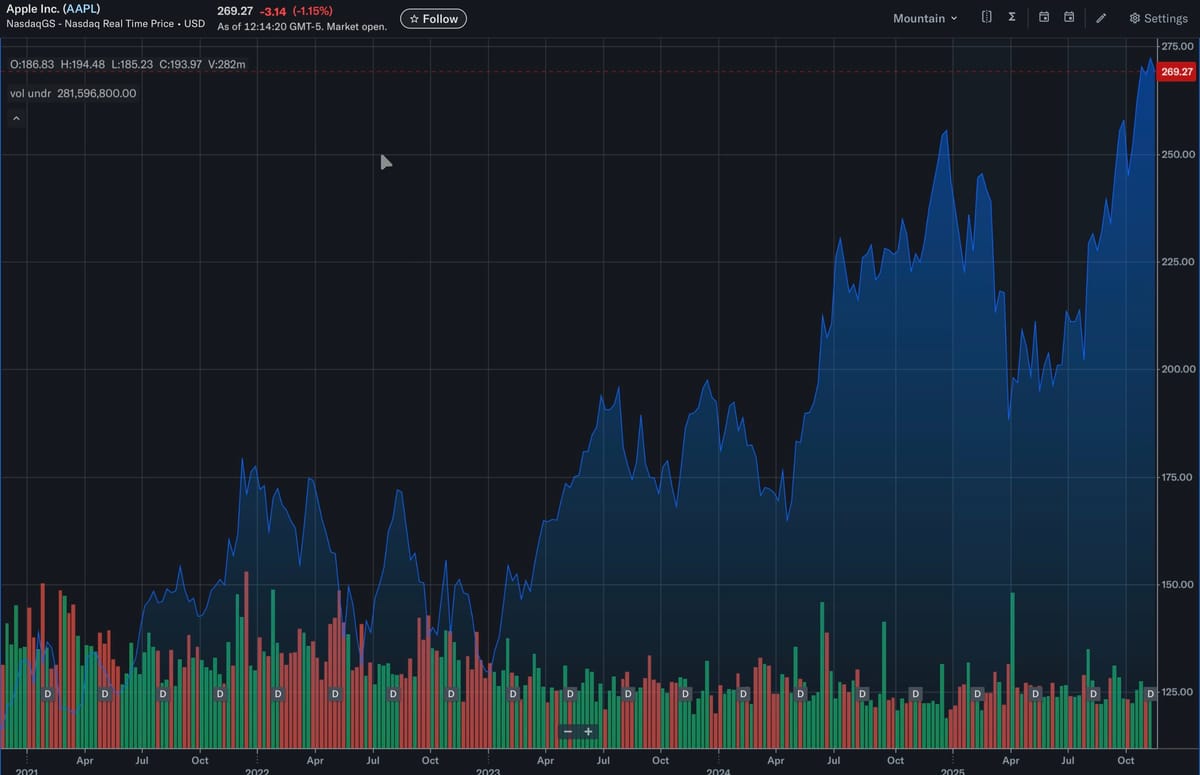

$225 remains a possible retest on a sharp pullback

Narrative (bitchy) version

AAPL’s five-day chart is about as reassuring as Tim Cook’s product roadmap: a walk down the staircase with broken handrails, unable to keep its footing above any level that would inspire confidence for anyone who doesn’t collect Apple memorabilia “just in case it’s the next iPod Hi-Fi”.

After plumbing the depths near $266 AH yesterday, today’s most obvious resistance isn’t subtle: it’s the $271.50 zone, that faint glimmer where prior rebounds have been methodically sold into by anyone with the cognitive function of a goldfish and a memory longer than five minutes.

If you’re peering at the daily chart (this is just a 5-day to show the sell-off, inc. AH action) and squinting, you’ll spot those repeated failed bounces right in that area – it’s where hope goes to die this week, as the stock tries to forget it’s shed nearly 10 bucks in a handful of trading sessions.

The China Syndrome

Pre-market chatter is busily trying to whip up excitement about “news” of a 33% YoY sales boost in China, conveniently ignoring that this was trumpeted (with little trumpet) last week, and is less a feat than a footnote.

Yes, the numbers look rosy versus last year – but comparing to last year’s utter iPhone 16 launch flop is hardly news, considering there were no iPhone subsidies at launch last year, unless you also put up bunting when you remember to tie your shoelaces. Seeing as Siri can’t multi-task, it’s a bit much to ask investors to, I suppose?

Chinese Whispers

Left conveniently unmentioned by most is how this year’s iPhone 17 numbers are buoyed not by any actual rebound in demand, but by the latest round of Chinese government subsidies, slicing nearly $300 off the price for local buyers. Who wouldn’t want to splash out on a new slab of glass and silicon when nearly a quarter of it’s on the house, paid for by Beijing’s love of keeping factories humming and headlines upbeat?

So what does this mean for the intraday moves today?

From an AH low of $266 to a China numb in the PM to $269 on, basically, no news at all, expect $271.50 to loom large: it’s the level that’ll trigger either an avalanche of programmatic selling – if tried and rejected yet again – or, should the lemmings get a sniff of momentum and enough “BREAKING: CHINA SALES UP!!!” headlines, perhaps a frantic, short-lived squeeze up to $273 again.

Don’t bet the rent money on the latter.

Unless Apple has a Christmas hat-trick hidden away or Tim Cook fancies channelling Steve Jobs finally rather than just using a faux British accent for gravitas in a keynote, don’t expect more than a perfunctory rally.

The only thing getting truly subsidised here is investors’ patience.

— Tommo_UK, London. Wednesday pre-market, 11th November 2025.

Boilerplate disclaimer: Any trades taken on the basis of this update are your own lookout: consult your emotional support animal or GPT before diving in.

Any comments, or thoughts, from investors, as opposed to 20-year long buy-and-holders who couldn’t care less because they’re just glad to be living off the dividends from their 11,000% share price increase? Leave them below 😎

X: @tommo_uk | Linkedin: Tommo UK