AAPL Tries to Touch Its ATH: CNBC’s Terranova Blows Trumpets, and the Vapour Chamber Blows Smokium.

AAPL has climbed back to the top of the Plateau, peeking over $258 today. But what happens when the air gets this thin? The view’s great unless the bridge turns out to be hot air created by a Vapour Chamber generated mirage.

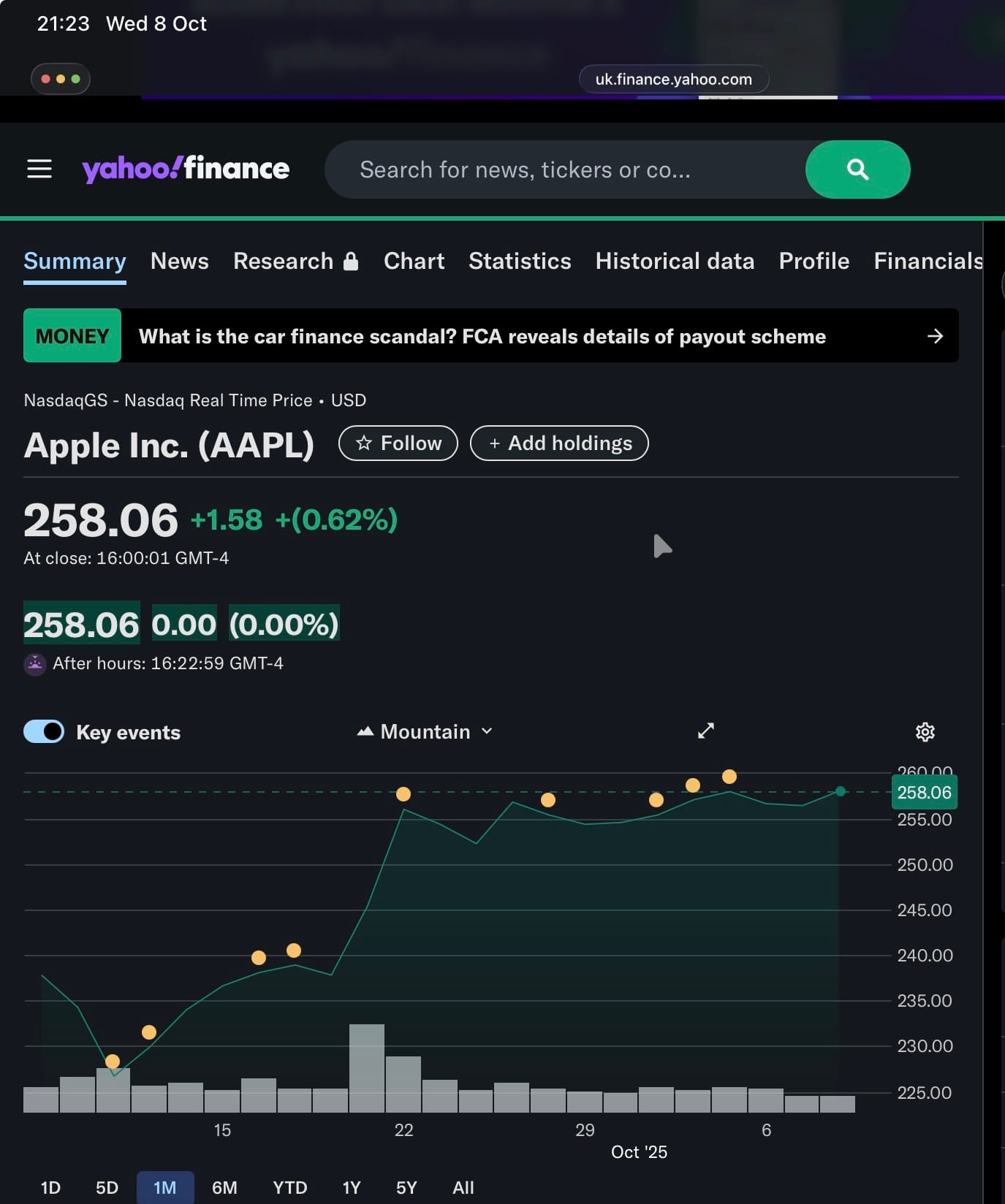

Here’s a one month look at Apple, from the moment it surged on “news” that “Apple Store Delivery Lead Times” showed strong 5-10% demand over the iPhone 16 according to a bunch of analysts who seem to think delivery lead teams on launch day really signifiy anything fundamental at all (for reasons I’ve described in past posts, explaining why this metric is always a false tell and should be ignored, whether positive or negative).

At the risk of making an ass of myself, because I haven’t felt there’s been any genuine visibility on AAPL since March 2025 for me, when I forecast the drop to the $160s and a US market collapse, at this point, on the “Plateau Principle” along with the slowly rising price on distinctly lower volume at touching the ATH on the day Terranova shrieked in the pre-market that ”AAPL will probably take out its all-time high,” followed by AAPL’s reaction from low volume momentum traders to do just that, I would be out of it right now.

If I hadn’t publicly sold out in December at the last ~$260 high, and then in two trades in March 2025 around $240, swearing I would (and did) exit US markets and Dollar denominated assets in a prophetic move at the time, which foreshadowed the huge market plunge and AAPL in particular in April, I would be out now. Because:

Since then the markets have been sclerotic and captured, with no sense anywhere and momo/meme traders running riot.

Personally, if I had ridden this ride up from $200 just a few months ago, and made 30% here, I would be out given AAPL has no visible drivers other than a frothing frenzy of metallic orange blinded analysts driven by counting iPhone delivery lead times as if it was quant analysis and not the equivalent of Roman priests reading goats entrails.

- Will there be an “October Launch Event?”

- Will MacBooks and iPads get a refresh sometime?

Well, yes of course, but will they drive growth? Not on their own, so any October event at this level is, on fundamentals, irrelevant.

But then who am I to suggest buying or selling - I’ve only been “doing” AAPL in public for 25 years after, and I’ve been a self-confessed (and stress free) fence sitter for the last 6 months now, so take my musings with a pinch of salt if you’re all-in.

I simply sighed with weariness at Terranova and CNBC actually faith-walking AAPL up first thing in the morning today, declaring he’s in the stock and believes it’s good to take out its ATH. I just wonder how the FCC and SEC combined can allow such blatant hopium and book-talking to be allowed without sanction. This isn’t financial insight, this is talking up your book to individual investors, in the middle of a feeding frenzy of momo trading. It’s a bit vile, from a distance, but then I’m English so perhaps even after 30 years of watching this TV craptastic channel, something in me still gets offended at the sheer chutzpah of these self-serving cheering and snearing CNBC talking heads,

For the first time in a long time, here’s a bit of chart analysis for you. The 1-day (rather “Plateau-like if you ask me), and the 1-month (distinctly illustrating the Plateau Effect I mentioned earlier).

The One Day Chart - ”The Terranova Effect,” Wednesday 8th October

Bull or bear, these moves are pure momentum and anyone who isn’t in this for the next few years, needs to consider the risk reward, short term, right now given we’re at the ATH within spitting distance, and the hot air which has led here, and earning just a few weeks away.

The One Month Chart: Also called the “iPhone Shipment Lead Times” Chart.

The tape has all the hallmarks of a sentiment-driven squeeze into earnings, not a fundamentals-led grind.

The one-day chart I shared shows a TV-headline pop at/after the open, a vertical push, then tight, low-range consolidation near the highs into the close. That’s classic “chase + reluctant profit-taking,” not new information being discounted.

What the tape is shouting

- Extension: Price is ~20%% above its September levels and riding the top of its recent range. It’s visibly stretched vs short MAs; that’s where squeezes stall or blow off. AAPL analysts’ vapour chambers seems to be producing a lot of hot air at the moment, and there may be many people wishing to cool their heels and take profits after a rise like this.

- Fuel: The ramp coincides with narrative catalysts (lead-time chatter; on-air cheerleading) rather than hard numbers. Shallow intraday dips being bought = shorts covering + momentum funds pressing.

- Volume/texture: Up-days with shrinking net progress and intraday spikes that fade to sideways = exhaustion risk. You can see several “higher highs / smaller candles” into today: another squeeze tell.

- Overhang: Prior ATH/round-number supply sits just overhead; the market tends to “tag it, zag it” into events unless there’s fresh data.

Near-term levels (from the charts)

- Resistance: 259–261 (ATH zone/round number).

- Supports to watch: 255–256 (today’s VWAP-ish shelf), then 252–254 (recent breakout shelf).

- Lose 252 and you invite a gap-fill toward ~245–247.

- A test of old S/R around $225 would be unsurprising, especially given any sign of a market wobble given how fast and far the broader rally has been, but how narrow breadth has been and how isolated around AI re-re-investment many of these moves have been, dragging momentum and meme traders in, all-in, and that’s often when people lose their shirts.

Risk / reward into earnings (next ~2–3 weeks)

- Bull case (less likely without news): Squeeze continues, tags 260–267, then either consolidates or mean-reverts. Chasing here offers poor R/R unless you’re scalping.

- Euphoria is rife running into Q4 earnings. A whiff of discord, and you could see a 10-15% haircut overnight, and a trickle down lower into Q1 (Christmas Rallies aside - last year’s hit the $259 ATH. By April the stock was at $169).

- Dan Ives is back with a PT of $310 - again, trying his luck for a second year. Considering for all his sartorial style he’s never ever been even close to nailing AAPL, take his return to the fold with a big pinch of salt. Two months ago, he’d written AAPL off. Nice chap, fair-weather friend though.

- Base case: Chop between ~254–261 while implied vol rises.

- Bear case: Narrative fades; quick air-pocket to 252–254, with risk of a full gap-fill to high-240s or even a re-retest of $225 if $238 breaks.

- BASIC BULL CASE: $264 on HOPIUM into earnings

- BASIC BEAR CASE: “Fair Value” re-test of $225 on any strong profit taking.

Positioning ideas (defined-risk only)

- Already long? Consider trailing stops just under 255–256, or collars (sell Oct OTM calls 265–270, buy protective puts 250–252).

- Want downside without timing perfection: Put spread (e.g., Oct/Nov 255–245) or calendar put (short near-term 255, long post-earnings 255) to let IV do some work.

- Want protection against a momentum air pocket? Consider buying VIX protection against volatility spiking.

- Fading the squeeze tactically: Small call credit spread 265/270 keeps risk bounded if it spikes through 260.

Redux On “lead-time” Chatter

Using launch-week delivery lags as a demand proxy has a long history of false positives (mix, supply allocation, and regional skew muddy it). Until we see orders, activations, or revenue, a multiple of 39 “priced on vibes” is brittle. I believe my read - “violently overbought, story-driven, no hard sales yet” is fair, and in my view, AAPL is over-priced-to-perfection this far before earnings, with no evidence of any sales news, yet, to draw on. Maybe that will leak out before earnings or maybe they just won’t be quite good enough, or guidance will not quite hit the mark. Who knows, but a rally of this magnitude usually needs firm underlying fundamental support, not hot air and lead time chatter, to keep it there.

Just my two cents. In my opinion, the entire market is now as off its rocker as it was when it plunged during the Treasuries & Tariff Tantrum in April.

Worth Noting:

- Upper Bollinger Band is ~$265

- Middle Bollinger Band ~ $249

- Lower Bollinger Band ~ $230 (close to my “fair value” of $225 absent news)

I’d be selling all-out at this peak:

“You may get another $5-6 upside short-term, but the downside is $20-30. For me, that’s a risk/reward balance which wouldn’t be acceptable, unless I had a very long-term horizon, after this fast a run-up.”

I view the extraordinary rally on sheer hopium, especially today. But then, I‘m not a holder, so good luck to you ;)

Any comments, or thoughts, from investors, as opposed to 20-year long buy-and-holders who couldn’t care less because they’re just glad to be living off the dividends from their 11,000% share price increase? Leave them below 😎

— Tommo, London, Wednesday 8th October at the market close, 2025

X: @tommo_uk | Linkedin: Tommo UK

See the share buttons to LinkedIn, social media and email? Please, use them and help keep .fyi free at the point of readership. Or email this article on to a friend-in-need.