“AI CapEx Is Doom!” The Great AI Tech Panic, Served with a Side of Pie Charts and Perspective.

It’s summer 2025, and the AI panic chorus is back on cue decrying data centres as the new tulip mania and CapEx as collective delusion. Michael Roberts leads the charge, warning of bubbles, GPU overload, and investor madness. But maybe the pipes being laid aren’t the problem but the point?

Introduction: Welcome to the Panic Room

It’s the summer of 2025, and as sure as England storms out of the Euros on penalties (except this year, our all-women’s team defended their Euros title for the second year running! Watch out men, they’re after your balls), the AI pessimists are once again in full voice.

Every tech blog, think-piece, and well-meaning Twitter doomscroll offers earnest warnings that the world’s gone barking mad, throwing hundreds of billions at AI, spinning out data centres like Victorian factories, and daring to invoke the ghost of railway mania in the same breath as ChatGPT.

Michael Roberts, our lead worrywart today, has deployed the full artillery: monstrous CapEx, “bubble” talk, skewed subscriber stats (with obligatory scare quotes), the “Magnificent Seven,” and a panicked concern for “who’s going to use all these GPUs?” The upshot: we’re all doomed, unless someone, somewhere, invents a spreadsheet that will save us all from ourselves.

But, newsflash! For every Roberts bemoaning the Great Technological Overspend, there’s a history lesson waiting to be learned, and a reality that, whether on the rails, the fibre, or the neural network, true dividends flow less to the pioneers and more to the mainstream who follow.

Here, then, is your .fyi rebuttal, in which the Cold War between AI CapEx “doomsters” and those quietly changing the world one workflow at a time gets the context it deserves.

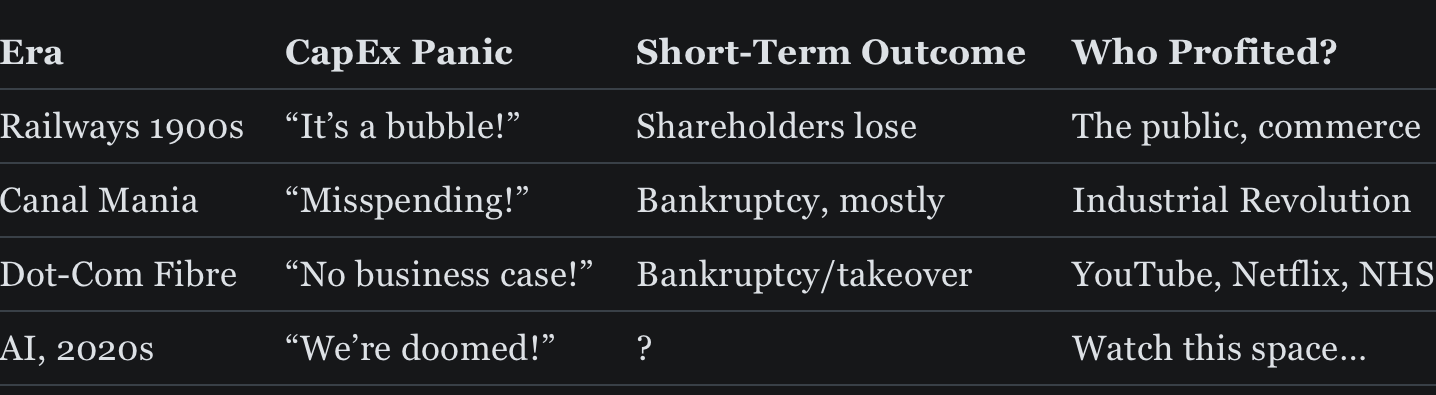

Chapter 1: The Screamers and the Steamers. Another Century of Tech Panic

Let’s start with the British tradition of technological anxiety. Our nation has always loved a good hand-wringing. From the South Sea Bubble to Canal Mania, Railway Manias, and every dot-com boom turned bust, we’ve always had a knack for composing baleful anthems to the tune of “What if it all goes horribly wrong?”

Enter: the AI era.

The Doom Narrative, in Their Own Words

- “AI investment is grotesquely oversized ($332B CapEx vs. under $30B in revenue for 2025).” shrieks of horror!

- “It mirrors railway mania, the dot-com bubble, the Dutch tulip craze.” capitalism will collapse under its own greed! This time! Really!

- “The S&P is too top-heavy. Nvidia and friends make up 8% of the market.” [see above]

- “Not enough paying users. ChatGPT is ‘alleged’ to have 500M users—few of whom, Roberts suggests, pay for the privilege.” I think Roberts shows his ingrained bias here and is also using 2024 figures. More later.

Never mind context; just wheel out the inflation-adjusted panic and serve with a side of exponential curves, right! What did capitalism ever do for us after all?

Chapter 2: Who Profits? Not the Man Who Laid the Rails

History, however, has a nasty habit of making the doomsayers look faintly silly in hindsight. Take steam railways. Legions of hopeful tycoons poured capital into tracks stretching from the Pennines to Penzance. Most lost their shirts and sometimes along with their family estates and a foolhardy son or two in Parliament. But here’s the twist: the real value came not from those who built the railways, but from those who used them.

“He who builds the railway rarely profits. It is the commuter, the merchant, and the ticket-holder who reaps the harvest.”

In modern terms: Google, Amazon, Netflix, even the NHS booking system; none of these parties paid for the dark fibre that telecoms companies once “wasted” billions laying beneath British streets. The value accrued to those who made the journey easier - once the rails were built.

If you squint, you can see the same pattern emerging in the AI gold rush: some will lose their shirts, but it’s the rest of us, our schools, GPs, supermarket deliveries, and government services who’ll reap the benefit. You can almost hear the Roberts of the Victorian era moaning from the grave about “under-utilised viaducts,” just before catching a train to Brighton for the weekend.

Chapter 3: The Productivity Payoff and Why It Doesn’t Have to Start With Profits

A favourite trope among the anti-AI crowd: “Where’s the productivity?” The answer: In transition, as ever. Ask any economist with tenure and they’ll explain sometimes at excruciating length that revolutions rarely arrive on schedule. The buildout phase comes first, and rarely to immediate effect.

What They Get Wrong

- Overweighting investment risk: Yes, many investors will lose money. That’s always been the deal. But the gains such as better healthcare, faster public admin, lower corporate admin costs, ultra-personalised services land downstream.

- Underestimating non-linear returns: History teems with infrastructure that looked bonkers at the time. Canal networks dug up all over the countryside, fibre cables, zig-zagging telecom masts yet delivered immense value to future generations. AI is on the same curve: “boring” automation, “low-church” enterprise AI, the digitisation of grotty expense reports. Hardly moonshots, but invaluable, all the same.

- Blurring the “AI Market”: Not all bets are on AGI or world-dominating LLMs. Incremental enterprise gains, document search, recommendation engines, workflow bots... All of these drive value far beyond the headlines.

Table: Infrastructure Mania—A British Tradition

Chapter 4: 80 Million New Passengers a Month. The Understated GPT Explosion

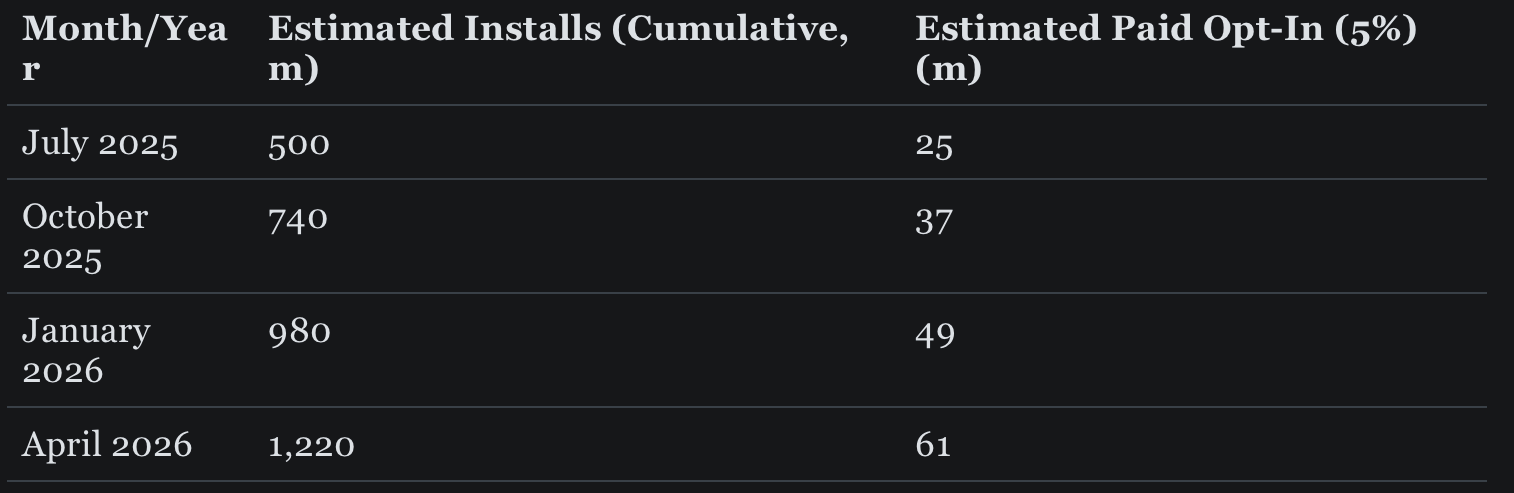

Roberts attempts a sleight of hand: pointing to a “mere” 500M “alleged” users of ChatGPT, suggesting the trajectory for paid services isn’t credible, and therefore discounting the utility of all that CapEx. But hold the phone.

App Store Data GPT/Perplexity Downloads: Top of the Iceberg

- Apple App Store (June/July 2025): ~30M downloads/month.

- Google Play (same period): ~50M downloads/month.

- Combined: ~80M new GPT app installations per month. A figure still rising.

Do the back-of-envelope maths, and we’re heading rapidly toward 1 billion active users of GPT-powered tools by early 2026. And not through marketing hype, but via plain old user adoption curves.

If less than 5% of new installs become paid subscribers within a year, we’re looking at a paid user base rivalling Spotify, Netflix, or Disney+ within 24 months.

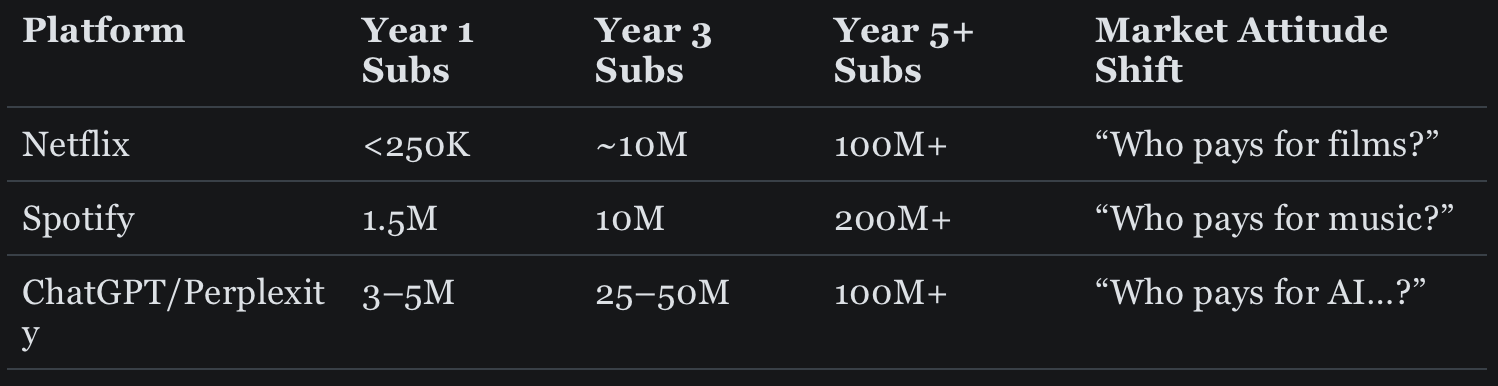

Table: Projected GPT User Growth

And this without clear communication of the benefits, like:

- Agentic browsing: ChatGPT, Perplexity’s Comet, and other tools can automate, triage, summarise, and act on user instructions far beyond basic Q&A.

- Personalised, contextual AI: Save histories, retrain assistants, pick up private tasks just as you left them.

- Enterprise-scale value: AI-powered research, admin, and automation currently being piloted or deployed throughout the public and private sector.

The vast majority of consumers have yet to grasp what “paying for AI” genuinely delivers. Anyone who lived through Spotify’s first subscription push will remember the refrain: “Who pays for music?” Today, millions do, because value follows familiarity, and understanding always lags capability.

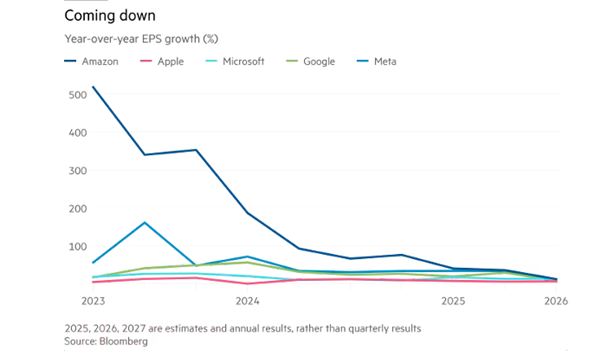

Chapter 5: The Meta and Microsoft Revenue Machine. It’s Already Working

If doomsters are correct, Meta and Microsoft should be posting quarterly shrieks of pain, their shareholders combing through job sites for a fresh gig at Pret. Instead:

Meta’s AI, DoD, and MoD Play, Q2 2025

- Revenue: $47.5B, up 22% YoY.

- Net Income: Up 36%.

- Stock: Surged 10–11% in after-hours.

- Defence Contracts: US DoD and UK MoD, plus wins with UK public sector and NHS. Money already flowing.

Microsoft Azure Blows It Out of the Water

- Azure Revenue: +39% YoY, Q4 2025.

- Cloud Revenue: $46.7B in Q4 alone.

- AI Services: The core driver of business growth across sectors, as confirmed by CEO Nadella in post-earnings calls.

If this is the apocalypse, one wonders if the Four Horsemen aren’t just delivering quarterly reports.

Chapter 6: The Government Jackpot and Why Bloat Is a Feature, Not a Bug

The “prize” for all this CapEx? The gigantic, slow-moving, labyrinthine world of public sector and government services. Roberts, and those of similar stripes, spend lifetimes bemoaning inefficiency in the NHS, HMRC, the DoD, and every town hall from Aberdeen to Amersham. Yet the stampede of AI into these domains—via Meta, Microsoft, and others—is fiscally transformative.

- Cost Control: AI-driven bloat-busting fosters savings, rationalises staffing, automates form-filling and claims processing, powers digital triage.

- Productivity: Fewer hours on admin, more on delivery (be it healthcare, benefits, or security).

- Scale: The only way public-sector bloat shrinks without slashing public-facing service is via productivity dividend—not just budget cuts.

Meta and Microsoft’s government credentials aren’t PR window-dressing; they’re chocolate-box proof that the CapEx gamble is beginning to deliver.

Chapter 7: The Rear-View Mirror Doesn’t Drive the Car

Nostalgia is a terrible investment adviser. The doomsters’ entire thesis is backwards-looking: measuring cost in the present, ignoring dividends in the future. Railway mania left broken investors and paved the way—literally—for a century of growth. Dot-com burst, but its fibre underpins everything from Netflix to NHS e-referrals. AI CapEx will follow suit.

In every era, legacy infrastructure—often built out at seemingly insane cost—enables new waves of innovation and prosperity. Your own gripes with Siri, Apple’s “innovation” lull, and the echo chamber of tepid “new” features stand in contrast to the creative destruction happening at scale in the AI sector right now. The British have a name for this: “The wrong end of the stick.”

Chapter 8: Who Will Pay for AI And Why Subscription Opt-In Will Take Off

Roberts and his ilk dwell on subscriber inertia (“3% conversion isn’t impressive!”), blissfully ignoring how such technologies always lag adoption before delighting investors and users alike. As the benefits of modern AI—agentic tools, personalised context, workflow continuity—become clear, the numbers will snowball.

Spotify and Netflix began with minuscule paid user bases. Once the value was obvious (all the music, all the films, on-demand, everywhere), uptake leapt. So with AI: when the public finally sees what opting in unlocks—personal knowledge graphs, automated research, life admin on autopilot—the pond will ripple into a tarpon feeding bonanza.

Table: Paid AI Subscription Curve—A Familiar Pattern

People moan, then join in. Always have, always will.

Chapter 9: Why “AI CapEx = Doom” Is Just a Trope… and a Tired One at That

You can recycle every panic from the past century and get the same tired conclusion: money spent on infrastructure is “wasted.” Until it isn’t.” The AI naysayer’s mistake is to see risk, and call it recklessness; to spot short-term losses, and assume there’s no long-term gain. The dividend - the kind that ennobles governments, delights commuters, enriches shops, and transforms daily life, accrues to those content to invest first, panic later.

An Invitation to the Sceptics

By all means, wring your hands. Publish your bubble pieces. Gaze at the CapEx tickers like Bob Cratchit gazing at Tiny Tim’s crutch, and mutter about AGI failures and S&P concentration ‘til your tea stews. The rest of us will be busy, building, using, and eventually subscribing, not because the world is doomed, but because it’s the way progress has always been funded, built, and enjoyed.

Closing .fyi note: “The Disaster Is in the Rear-View; The Dividend’s in the Dashboard”

To the doom-mongers: take comfort. Your moment always seems prescient, for a year or two. But history is a better teacher than headlines. Many will lose money on AI, but the public, business, and even government will ride the rails, surf the fibre, and even train their own AI agents on infrastructure built in this very “panic.” And that, for all the hand-wringing, is where the real value has always accrued: not in the first-failed investor, but in the many millions who benefit from the dreamers’ mistakes. If you’re a Marxist, who knows - maybe like so many failed left wing governments before, AI datacentres will be deemed “too big to fail,” and bailed out to becoming nationalised industries providing infrastructure to the world, before being sold off again to Blackrock.

See the share buttons to LinkedIn, social media and email? Please, use them and help keep .fyi free at the point of readership.

So don’t buy the trope, buy the ticket, take the ride, and when you see doom around every corner, remember: the train may be late, but it always arrives in the end. Especially in the UK, which whilst the home of the invention of the locomotive and exported it to the world, now has probably the most unreliable public transport system in the Western World. That doesn’t make it any less necessary or valuable though, which is surely the point.

Critics will say this is just another bubble and they’ll be partly right. Every major tech cycle has its froth. But bubbles leave behind infrastructure: the railways didn’t all pay off, but they reshaped economies; the dot-com crash still left us with fibre-optic highways. AI is laying the next layer of an “intelligence infrastructure” that outlives investor memory. If Big Tech’s CapEx looks inflated, it’s because they’re building blueprints, not just balance sheets. And if you’re worried about the social cost such as jobs, emissions, displacement, ask instead what the ROI of delay looks like.

Still, if we’re laying tracks to nowhere, at least we’ve got Roberts manning the signal box waving a red flag with conviction, and occasionally, with cause. If it all goes tits-up, we can’t say we weren’t warned.

.fyi take: “AI CapEx is not doom. It’s the prelude. Passengers welcome. No doom subscription required, but you might want to opt in for context and a comfy seat, and watch out for environmental protestors supergluing themselves to the track.”

— Tommo, London, 31st July 2025 | X: @tommo_uk | Linkedin: Tommo UK

© 2025 Tommo_UK | tommo.fyi