Apple, F1, and Perplexity: “Engineering Fantasy.” With Tariffs On The Horizon, What Tyre Strategy Does AAPL Need for $400?

Behind Apple’s cinematic Formula One fantasy lies a more urgent narrative: markets pricing perfection, investors smoking hopium, and a company at a strategic crossroads. But what if the road to $400 isn’t paved with hype—but with the precise geometry of Apple finally showing its hand and delivering?

Introduction: When Myth Overtakes Meaning

There’s a peculiar schadenfreude (knowing you sold out at the top and saved your sanity for once) in watching a company you love, and once lauded for its precision and restraint, become a prisoner of its own legend.

Apple, for so long the high priest of design absolutism and strategic clarity—much loved by me for it—now finds itself in a curious twilight: still worshipped, still mythologised, but increasingly adrift from the realities it once shaped. If you listen closely, you can almost hear the tectonic plates of narrative and numbers grinding against each other, each trying to drown out the other’s inconvenient truths while the market doesn’t just stand aside but actively tries to straddle the fault-line with its legs growing slowly further apart, but refusing to come down on one side or the other. Sometime soon, there will have to be a reckoning with reality of either $160 or $400 but in the meantime, let’s talk about another fantastical story in denial of reality: Apple’s latest cinematic blockbuster, Formula One, which stars Brad Pitt (but unlike Disappointment O’ The Year 2024, “Wolfs,” doesn’t star George Clooney).

(”Comfort Message:” After the dressing down of the movie, I promise I paint a positive picture and a path to $400. There’s just, like reality, a bit to wade through first.)

The real comedy, if you can call it that, is that Apple’s latest existential wobble isn’t best captured in an earnings call or a product launch, but in a film. Not just any film, but a Formula One epic so drenched in Hollywood gloss and American heroics that it makes Top Gun look like a BBC4 documentary on the economics of tyre degradation. Brad Pitt, carbon fibre, slow-motion heroics, and a plot that treats the rules of F1 as mere suggestions is Apple’s latest love letter to itself. The result? A cinematic metaphor for the company’s current predicament: high on spectacle, low on authenticity, and utterly convinced that the world will buy the story, no matter how implausible.

Americans will love it, of course. Not because they understand Formula One, but because it’s a pitch-perfect blend of American Exceptionalism, mashing together Rocky, Top Gun, and a dash of Days of Thunder. In other words rather saccharine romantic nationalistic idealism. Without any insult intended, but for perspective, imagine (if you’re American), if a British studio dared put out a film with an ageing British soccer player arrogantly entering into the brutal world of American Football and showed him winning against all the odds with people half his age standing in the way, by cheating on the pitch and breaking all the rules.

Outrage would have ruled with a fever pitched chanting of “USA USA USA” and “Nuke The UK Nuke the UK Nuke the UK” for a chorus.

That’s how most non-US critics saw the film, at least, and as a viewer, I saw for myself over the weekend. Pure schlock and schtick with sugar on top with a dash of sweaty muscle and blond hair flicking shrouded in masterful photography.

Ticket sales seem just great though, so “good for Apple for managing to ship at least one blockbuster product on the last five years,” right, even though its a film release rather than its core product offering.

The Formula One Film: A Masterclass in Narrative Inflation

Apple’s foray into Formula One cinema was pitched with the solemnity of a moon landing: deeply researched, emotionally resonant, and visually revolutionary. The reality was a film that bends the laws of physics, character development, and common sense in service of a narrative where American grit always wins, even if it means ignoring every rule in the FIA handbook and cheating your way up the grid.

It’s not that the film is bad, per se. It’s that it’s so obviously a product of Apple’s current corporate psyche: obsessed with myth-making, allergic to nuance, and convinced that spectacle will always trump substance. Pitt’s character doesn’t just race, he rewrites the rulebook, triumphing by sheer force of will and a disregard for the kind of on-track behaviour that would, in reality, probably earn a lifetime ban. It’s Apple, telling itself and us a story it desperately wants to believe.

Sadly stories, like valuations, have limits. And when the narrative premium outruns the fundamentals, gravity has a habit of reasserting itself.

The F1 Film as Metaphor: Apple’s Cultural Narrative in Carbon Fibre

The Apple-backed Formula One film is more than just a glossy piece of entertainment. It’s an accidental confession. A cinematic mirror reflecting the company’s current cultural psyche. Here’s how the film operates as a metaphor for Apple’s broader narrative:

1. Spectacle Over Substance

The film, much like Apple’s recent product launches, is high on visual polish and low on authentic detail. The plot bends the laws of F1 and physics to fit an American hero’s arc, just as Apple’s messaging increasingly bends reality to fit the myth of perpetual innovation.

The focus on slow-motion glory and cinematic grandeur mirrors Apple’s current tendency to favour narrative and branding over genuine, disruptive progress.

2. Myth-Making vs. Authenticity

Apple promised a film steeped in reverence for F1, but delivered spectacle and myth instead. This mirrors the company’s shift from authentic, category-defining products to a reliance on brand mythology and storytelling.

The film’s disregard for the sport’s realities is a stand-in for Apple’s own drift from its roots—where once it was about precision and restraint, now it’s about maintaining the legend at all costs.

3. Rule-Breaking as Virtue

The protagonist’s disregard for F1’s rules, triumphing by sheer force of will, is a cinematic echo of Apple’s self-image: the company that plays by its own rules, convinced its narrative will always win out.

In reality, both the film and Apple face the limits of this approach. There comes a point where ignoring the fundamentals—be it in racing or in business—results in consequences that can’t be spun away.

This is evident in the way the film ends, not with Brad Pitt staying in the sport, but instead fading off into the sand dunes down a metaphorical Sunset Boulevard to find his niche and final resting home in some dirt-track low profile race where it’s all about the grit, not the money. Word.

4. Insulation from Critique

The defensive reaction to criticism of the film in American forums mirrors the tribalism around Apple itself. To question the authenticity of the film is to question the brand, and the response is often reflexive, not reasoned.

This is emblematic of Apple’s status as a psychological totem: immune to critique, insulated from reality, and defended more as identity than as company.

5. Narrative Fatigue and the Limits of Storytelling

The film’s reliance on familiar tropes and narrative shortcuts is a metaphor for Apple’s current strategy: leaning on the “Storytelling Premium” rather than substantive innovation.

Just as the film’s spectacle can’t compensate for its lack of authenticity, Apple’s market narrative cannot indefinitely outrun the gravity of fundamentals: flat revenues, strategic drift, and looming external risks.

6. The Global Disconnect

The film’s American-centric narrative, pitched as universal, fails to resonate with the global F1 audience (at least with the critics, so far, cinemas themselves seem busy, though there’s nothing else to choose from at the moment - exquisite release timing to be fair) much as Apple’s myth-making is increasingly out of step with a global market instead of a US-centric one, that demands substance over spectacle.

The cultural tone-deafness of the film is a warning sign for Apple: what plays well in the echo chamber of The Directors Suite and cutting room may not survive contact with reality. This isn’t Rocky. This is realpolitik. Craig Federeghi might be able to drive around the roof of the Apple Spaceship during his WWDC’25 CGI spectacular, but CGI is as as close to reality as he got, just like Brad Pitt’s character could only possible resonate this much with an American audience even if the film’s production techniques are spectacular. The only real meat is in the spectacular cinematography, not the script, and not Brad Pitt.

In summary, the F1 film is Apple’s contemporary story in miniature: a high-gloss, meticulously branded, emotionally manipulative production that reveals rather than conceals the company’s growing reliance on narrative over numbers, spectacle over substance, and myth over meaning. It’s a metaphor (or rather, I’m making it one) not just for where Apple is, but for where it risks staying if it continues to believe its own legend at the expense of reality. Bluntly, a come-back kid with one more race left, and then, if it doesn’t find the fountain of youth (ie vibing with Gen-Z, finally), fading into boring corporate competency.

Of course, this is just one amateur critic’s opinion but where’s the fun in being a critic, if you can’t offer a dry and self-opinionated critique?

Backlash: Tribalism in the Age of Investsor Brand Worship

When I dared to critique the film, not for its visuals, but for its cultural tone-deafness, the response was swift and revealing. The debate wasn’t about script integrity or F1 realism, but about loyalty.

“You Europeans just don’t get it.” “If you don’t like it, make your own movie.” “Stop being such a purist. It’s entertainment!”

The point, of course (I must insert ”in my opinion” here apparently, lest I offend someone) was never about entertainment. It was about authenticity. Apple promised reverence and delivered spectacle. It claimed to honour the sport and instead served up a corporate myth. The reaction from the faithful? A reflexive defence of Apple as both brand and identity, as if to criticise the company was to commit some sort of cultural heresy. Cor blimey guvnor, excuse me for being English!

This is the real risk: when a company becomes a psychological totem, immune to critique and insulated from reality. If you can’t question the myth, you’ll never see the cracks until your portfolio is sitting in one.

The Coming Reckoning: Tariffs, Earnings, and the Return of Gravity

While people are busy dissecting Brad Pitt’s helmet cam, (after paying $100 for two tickets and some stale popcorn) or his abs, the real world is quietly preparing to intervene. Trump’s “Big Beautiful Tariffs” narrative, launched with full fanfare on April 2nd, comes due on July 9th. The 90-day deferral expires, and with it, the threat of sweeping tariffs on foreign goods - China, Vietnam, India -looms large. For Apple, whose supply chain remains uniquely exposed, this isn’t a footnote but a potential earnings shock of the first order. Today was full of tariff announcements of 25% on Japan and South Korea at the time of writing, with more Trumpian Proclamations being drip-fed by the hour.

And yet: silence. From analysts. From Wall Street. From Apple itself. From everyone who seemed to thing that Terminator: Tariff Judgement Day Re-make, would never actually happen.

Except, of course, Navarro and Bessent—who somehow manage to portray the April promise of 200 trade deals by July, and delivered exactly one (the UK) as of today, painting this über-underachievment as a triumph of Trumpist Exceptionalism in a mammoth exercise of deplyoung a “reality distortion field” of Jobsian proportions.

There’s certainly something exceptional about the hyperbole. But as of July 7th, that’s the scoreboard: one formal deal. A second, with Vietnam, was more a unilateral imposition than a negotiation. Vietnam, having already dropped its average tariff on US imports to under 1%, is now rewarded with a Trump-imposed 20–25% rate. At least the marines weren’t sent so we may be spared a full 1970s reboot. Just the stagflation part. Just saying.

Meanwhile, the market, exhausted by reality, has chosen to pay a Storytelling Premium instead. A bet that Apple will somehow finesse the blow, despite having shipped no consequential AI product, failed to follow up on Vision Pro, and left Siri languishing in mediocrity for over a decade.

Narratives, like credit, have their limits. July 10th – the day after the night before - may well be the day when fantasy collides with reality, and the market is forced to remember that numbers, not stories, pay the bills and the market wakes up with a hangover.

The Psychology of the Apple Investor: A Rorschach Test

If the film and discussion reveal anything, it’s that Apple is no longer just a stock. It’s a relationship—one defined less and less by rational analysis than by nostalgia and faith. The responses to my critique of AAPL (even framed against a subtext of a path to $400) has been about as enthusiastic as a bowl of cold sick, and a masterclass in psychological defence mechanisms:

- Portfolio Nostalgia: “Apple has done great for me.” True, if you bought before 2020. But that’s gratitude for the past, not analysis of the present.

- Vision Pro as Vibe: Defended not as a commercial success, but as an “interesting first step.” A £3,500 beta test, apparently.

- AI Denial: Some claim LLMs are overhyped, others insist Apple is ahead because it’s focused on privacy. Contradictory, but emotionally insulating.

- Valuation Faith: Buybacks lift EPS, revenue is flat, but the PE is justified because… Apple always wins?

- Strategic Paralysis: “Keeping its powder dry.” “Playing the long game.” Fine, but where’s the output? Where’s the clarity?

What no one wanted to discuss, of course, was the elephant in the room: tariffs. Because complexity is exhausting, and after 18 months of inflation, war, AI hype, and rate confusion, investors want to believe the worst is behind us. “Perplexing” and “befuddling” are the words du jour to describe Apple’s decisions amongst the professional and retail AAPL commentariat - all, somehow, unable to articulate a narrative of their own for once.

The Anatomy of Denial: How Narrative Became Sedative

Apple’s current predicament is not collapse, but drift. A slow slide from strategy to sentiment, from $260 to $167 and now dawdling around $200 mirroring its run from execution to expectation, from meaning to messaging.

The company that once shipped disruptive products now sells a fictional F1 film that glorifies rule-breaking, while real-world innovation happens elsewhere, often in the rain at Silverstone, far from the Dolby Atmos.

The silence around tariffs, the evasions about AI, the reframing of Vision Pro as a “vibe” are not signs of confidence. They’re symptoms of narrative fatigue. The market is tired, and so it clings to the story, hoping that magic will return, that Tim will wink instead of resort to Genmoji talk, and all will be well.

But narratives, like markets, are cyclical. And when the music stops, it’s the numbers that matter.

The Numbers Behind the Narrative: A Brief Reality Check

Let’s dispense with the myth for a moment and look at the facts:

- Flat Revenue: Apple’s top line has stagnated, even as the company commands a 30x trailing earnings multiple.

- Buybacks as Strategy: EPS is up, but only because Apple is buying back its own shares. Organic growth is conspicuously absent.

- Services Slowdown: The much-vaunted Services segment is losing momentum, with App Store revenue growth under pressure globally.

- Hardware Stagnation: New categories—Vision Pro, Watch, HomePod—have failed to deliver meaningful growth.

- AI Parity, Not Leadership: Apple’s AI efforts lag behind competitors who are already shipping products and capturing user engagement.

The market is pricing Apple as if it’s still 2010, as if Steve Jobs is about to walk on stage and unveil the next iPhone. But it’s not 2010. It’s 2025. And the story now requires actual numbers.

The Tariff Sword of Damocles

The 90-day extension on tariffs is about to expire. If new duties are imposed on Apple’s Asian-assembled supply chain, the impact on earnings could be severe. Guidance will have to be revised, supply chains reconfigured, and the Storytelling Premium may evaporate overnight.

Yet, the market remains sedated. Analysts are mute. Investors are distracted by Brad Pitt’s lap times and sweaty abs. The cognitive dissonance is almost impressive, except the script is off real, a bit like Brad Pitt’s driving for most of the film.

How Trade Tensions Threaten Apple’s Narrative of Resilience

Apple has long styled itself as a Teflon titan of global commerce: nimble, diversified, and immune to the geopolitical squalls that buffet lesser companies. But as the latest round of trade tensions and tariffs looms, the company’s carefully curated narrative of resilience is about to meet a rather less forgiving reality.

The Tariff Sledgehammer: No Longer a Rhetorical Threat

- The US administration’s new tariffs—25% minimum on all Apple products not made in the US and perhaps as high as 70% are not just sabre-rattling. They are already inflicting real, quantifiable pain. Apple’s last quarterly results include a $900 million tariff hit, with projections of up to $1.4 billion in additional costs if current policies persist. We’ll know more in a few days.

- Even Apple’s much-trumpeted supply chain diversification - shifting iPhone production from China to India and Vietnam like musical chairs, offers only partial protection. The new tariffs are sweeping enough to catch even Indian-assembled iPhones in their net, exposing the limits of Apple’s “China Plus One(or Two)” strategy.

Margin Compression and the Spectre of Higher Prices

- Apple’s legendary margins are under siege. The company faces a stark choice: absorb the tariff costs and watch profitability erode, or pass them on to consumers and risk dampening demand. Early signs suggest both are happening: margins are slipping due to the baking in of some tariff costs, and analysts warn of iPhone prices and other devices potentially breaching eye-watering new highs in key markets.

- The company’s recent $30 billion reduction in its share buybacks ceiling is a telltale sign, a signal that cash may be being conserved for rougher seas ahead, not showered on investors as in rosier times and a means of distracting investors from what appears like earnings growth without top line growth, but a case of reducing the share count at an extraordinary pace.

Supply Chain: Diversification or Distraction?

- Apple’s pivot to India and Vietnam is a logistical ballet, but not a panacea. China still accounts for the lion’s share of Apple’s device assembly and component sourcing. Replicating China’s scale and efficiency in new markets is a multi-year, multi-billion-dollar project and one that brings its own risks, from infrastructure gaps in India to the threat of reciprocal tariffs. Navarro today had an argument with Cramer on CNBC, and said the tariffs due would be Apple’s own fault, for not re-locating its assembly lines from China to the US “as they promised during Trump’s first term,” Navarro scolded. Ouch! Tim just got a spanking from Trump, via Navarro. Talk about asking from grace as “most favoured organisation,” and on live CNBC. That one hurt.

- The US administration’s insistence on “Made in America” iPhones is, for now, a fantasy. Analysts estimate that full reshoring would require $30 billion in capital expenditure and would triple the retail price of an iPhone—a commercial non-starter. Personally I believe that given time and innovation, using modular roboticised assembly techniques, US re-shoring its feasible, but not for at least five years.

The Narrative Frays: From Invincibility to Vulnerability

- For years, Apple’s mythos has been that of the unflappable innovator, always one step ahead of macro risk. But the current trade environment exposes cracks: the company is suddenly reactive, not proactive, scrambling to pull forward inventory and re-route supply lines in a bid to stay ahead of policy whiplash.

- The market is noticing. Apple’s share price has wobbled, and analysts are openly questioning whether the “Storytelling Premium” can withstand a sustained assault on earnings and margins.

Investor Psychology: From Faith to Fatigue

- The risk is not just financial, but psychological. Apple’s retail investor base has been lulled by years of narrative comfort—buybacks, brand loyalty, and the myth of supply chain mastery. Trade tensions force a reckoning with the reality that even Apple is not immune to the laws of economics and geopolitics.

- As tariffs bite and the company’s responses grow more improvisational, the old narrative of resilience risks giving way to something altogether less flattering: that of a company caught between a rock (Washington) and a hard place (Shenzhen), with no easy escape.

In sum: Upcoming trade tensions threaten to puncture Apple’s aura of resilience by exposing its dependence on global supply chains, compressing margins, and forcing strategic pivots that are neither quick nor painless. The real test is not whether Apple can weather this storm, but whether the market will still buy the story when the numbers start to bite.

Regulatory and Judicial Hurdles

- Apple has been playing hardball with regulators and the judiciary worldwide for years, losing case after case but persisting with what many are calling vexatious litigation tactics.

- As a result, distraction by key execs has been high and the company’s inner workings have been made as plain as day during disclosures painting an odd picture of Apple and its use of “Apple Legal” as a ‘“profit centre.”

What the Forums Don’t Say: The Power of Silence

Perhaps the most telling aspect of the recent comment exchanges I’ve read all over the place was what wasn’t said. Beyond a few passing mentions, no one wanted to grapple with the potential impact of tariffs. No one wanted to ask whether Apple’s AI strategy is a decade late. No one wanted to consider that Vision Pro’s pivot to lightweight glasses is less iteration and more evasion.

Silence, in this context, is not serenity. It’s sedation. The market is tired of complexity and has chosen to believe in the myth, even as the foundations begin to crack.

Conclusion: Waiting for the Puck

Apple is no longer skating ahead of the puck. It’s waiting for the puck to come back to it, hoping that brand loyalty and narrative inertia will see it through the next few quarters. Retail investors, lulled by media narratives, and their own brand of faith (I say “they,” for now, because I sold out in December and March) are pricing that wait as risk-free.

It isn’t.

The next few quarters will hopefully prove my worst fears wrong. Perhaps Apple will ship something truly disruptive. Perhaps the myth will hold a little longer. But if not, we may look back at this period from AVP to AI (aborted) to Siri 3.0 (aborted) to July 31st 2025 (Q3 Earnings) - as the moment the story stopped working, when the rubber hit the road. Will Apple go into a spin like Brad Pitt, or recover the narrative and seize victory from the jaws of defeat?

Because the real question is no longer: Will Apple ship something great? At this rate, with Gen-Z’s increasing “meh,” it’s: Will anyone still care when they do?

For those who still believe numbers tell the story, not the marketing, keep asking the hard questions. Investing isn’t a religion, and the only heresy is refusing to reassess the risk/reward balance when the facts change.

And if you missed the comment section, you didn’t miss answers. You missed reasons to keep asking.

Enough! Let’s Toss The $400 Pancake Instead.

Now for those thinking I’m just a harbinger of doom, remember that AAPL to $400 call I keep on talking about (but curiously, nobody EVER acknowledges or seems to dare discuss, because to discus it would seem to also demand an acknowledgment of the mess the company has gotten itself into)?

Here’s a deeper dive on how it could get there. Don’t say I don’t see the upside. I’m just honest about the $160 downside story I could see playing out, and have described both with equal passion and detail, which is a damn sight more than I’ve read from anyone else, and put their thoughts under public scrutiny instead of yelling “buy,” “sell,” or “how dare you – AAPL is sacred!”

Apple’s AI Renaissance: How a Perplexity or other AI Acquisition Could Redefine the Narrative and Deliver $400 AAPL

Introduction: From Drift to Drive

Let’s imagine a world where Apple, instead of tiptoeing around the AI revolution, seizes the moment with both hands – and say, acquired Perplexity, integrating its advanced LLM capabilities, and finally delivering on the promise of an intelligent, interconnected Apple ecosystem. With immediate effect, not in Summer 2026. Not just another “me too” move, but a strategic leap that could transform Apple from a narrative laggard into the undisputed leader of consumer AI. This is not hopium; it’s a roadmap for tangible, compounding value. One that could send AAPL to $400 by Q4 2027, and for once, have the numbers to back it up. I’m using Perplexity as an example as I’ve written about the case for it repeatedly, so I’m trying to be consistent.

A Strategic Case: Perplexity as Apple’s Missing Piece

- Best-in-Class LLMs: Perplexity’s models are nimble, context-aware, and built for real-world querying - precisely the sort of intelligence and routing capabilities Apple’s digital experiences have lacked.

- Plug-and-Play AI Plumbing: Integrating Perplexity’s engine into Apple’s FMF (Foundation Model Frameworks) and PCC (Private Cloud Compute) would turbocharge Apple’s ability to deliver seamless, privacy-respecting intelligence across Macs, iPhones, iPads, and iCloud.

- API Access—A Paradigm Shift: For the first time, Apple could open its walled garden to outside developers, allowing secure, privacy-first API access into its AI stack and able to reach iCloud users directly, mirroring Microsoft’s Internet Explorer-era dominance, but with 21st-century safeguards and become the de-facto standard to plumb into.

The Playbook: How Apple Could Leapfrog the Competition

1. Early, Full-Stack AI Launch

- Immediate Integration: Apple wastes no time. Perplexity’s LLMs are woven into Siri, Spotlight, iMessage, and every corner of the OS.

- Unified Experience: Whether on a MacBook or iPhone, users access the same intelligent assistant, contextually aware and always learning.

- iCloud as AI Backbone: Personal data remains encrypted, but AI models are trained on-device and in the cloud, ensuring privacy without sacrificing intelligence.

2. Opening the Garden—On Apple’s Terms

- API Access for External Developers: By allowing vetted, privacy-compliant third-party apps to tap into Apple’s AI, the company creates a new platform moment akin to the App Store launch, but for the age of intelligence.

- Cross-Platform Reach: Apple’s AI becomes the default for not just Apple devices, but for any service or device that values privacy and seamless integration; think smart homes, cars, and even enterprise tools.

3. FMF and PCC: The Secret Sauce

- Apple’s FMF ensures routing is determined locally, with only anonymised insights shared via its PCC plumbing. No mass data slurping, no creepy surveillance.

- The PCC framework guarantees that every interaction is encrypted, every request is sandboxed, and user trust is never compromised.

The Market Impact: Why This (or a variation) Delivers $400 AAPL

1. Multiple Expansion—With Justification

- Restored Growth Narrative: Investors no longer have to squint at buybacks and “vibes.” Real, recurring AI-driven revenue streams emerge from subscriptions, developer fees, and new hardware categories.

- Default Industry Standard: As Apple’s AI becomes the “plumbing” for the consumer internet, the company enjoys a platform premium reminiscent of Microsoft’s browser dominance only this time, it’s opt-in, secure, and beloved by regulators.

2. Shareholder Optimism—With Substance

- Earnings Acceleration: AI integration drives higher ARPU (average revenue per user), reduces churn, and opens up entirely new markets (health, education, creative tools) along with AI subscription revenue from both Apple and non-Apple device user.

- Sustainable Moat: The combination of privacy, integration, and developer access is nearly impossible to replicate at scale—Google and Microsoft can compete, but not on Apple’s terms.

3. Growth Expectations—Finally Met

- Vision Pro Becomes Useful: With real AI, spatial computing finally delivers on its promise—context-aware, hands-free productivity and creativity.

- Services Supercharged: App Store, Music, TV+, and iCloud all become smarter, more personalised, and more indispensable.

The Competitive Parallel: Microsoft’s Internet Explorer Playbook—But Better

- A Decade of Dominance: Microsoft’s browser strategy made it the default gateway to the web, until regulators forced it open. Apple could repeat the trick, but with privacy and interoperability as selling points, not legal liabilities.

- API Access as Growth Flywheel: By letting the outside world plug into Apple’s AI, the company becomes the default “intelligence layer” for the consumer internet—setting standards, shaping user experience, and capturing value at every turn.

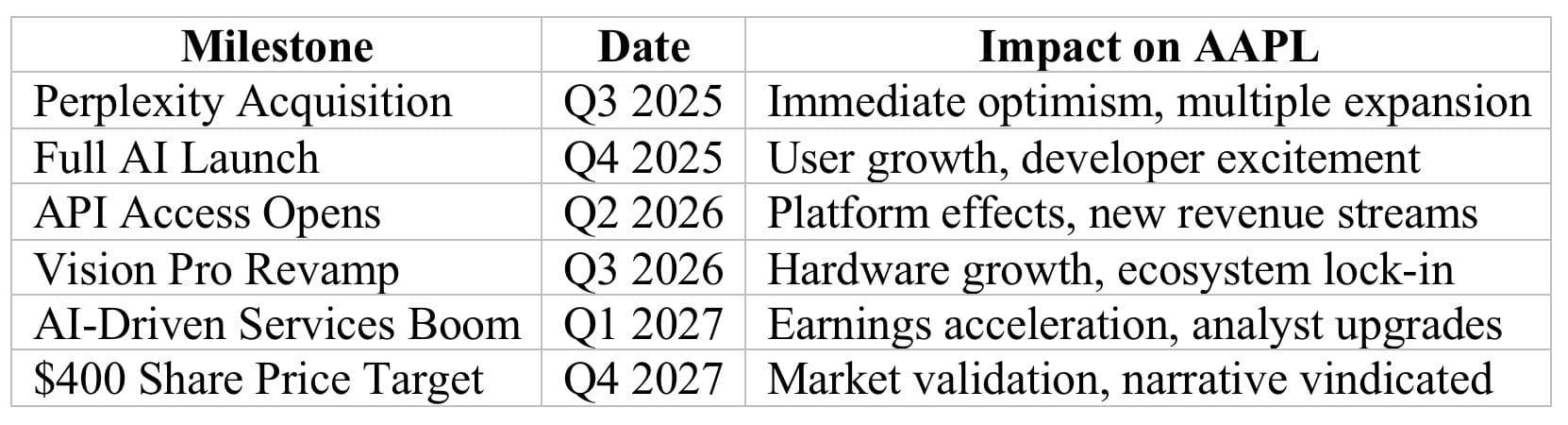

The Path to $400: A Timeline Example

Conclusion: From Walled Garden to Intelligent Ecosystem

Handled with care, an early and decisive AI play—anchored by a Perplexity acquisition and a bold embrace of openness—could transform Apple’s narrative from one of drift and denial to one of leadership and innovation. By making its AI the secure, privacy-respecting plumbing for the digital world, Apple wouldn’t just catch up; it would leapfrog the competition, set the new standard, and finally give investors something more than faith and nostalgia to cheer about.

AAPL at $400 by Q4 2027? For once, that’s not just a story. It’s a strategy.

Now, let’s return to Formula One.

Using the F1 Film Metaphor to Cut Through Apple’s Myth-Making

In case you forgot my summary of my review of Apple’s F1 movie, and my critique of the commentators defending it, let’s put the safety car back out to slow down the down the narrative, allow readers to catch up, and remind them that Brad Pitt is not a race car driver nor the embodiment of Rocky – American Exceptionalism Edition – that is, unless like the character he plays, you think America is a washed up grey-haired man on his last legs with a broken spine and good for one last shout for glory before heading off into obscurity into the desert. If that means nothing to you, go and see the film – but I can’t recommend paying for the tickets. On second thoughts, just read the US and European reviews, familiarise yourself with the plot, then go and watch a re-run of the British F1 Grand Prix at Silverstone on July 6th 2025, for a real controversy and seat of the pants drama – no $100 on tickets and popcorn necessary.

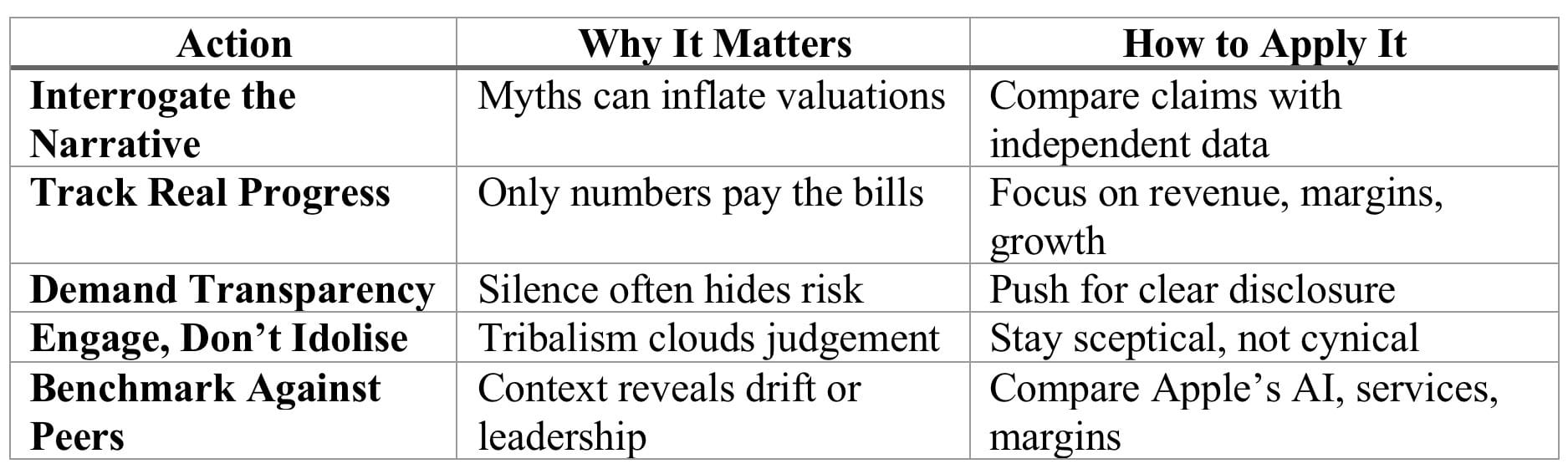

The Formula One film is not just a cinematic side project; it’s a near-perfect metaphor for Apple’s current corporate psyche. High-gloss spectacle, narrative over substance, and a stubborn belief that the story will always sell. For investors, this metaphor is more than a clever literary device but a practical tool for seeing through the fog of myth-making and demanding actual progress. Here’s a summary of my coverage earlier on, but set off against what investors could learn about Apple from its production, and how you could interpret and take action based off it. Has a film review ever tried to show you how to make an investment work? (Don’t invest on in my opinionated speculation by the way, caveat made, it goes without saying as a boilerplate cover-all).

1. Spotting Spectacle Over Substance

- Film Parallel: The movie dazzles with visuals but bends reality to suit its narrative, much like Apple’s recent product launches that prioritise branding over genuine innovation.

- Investor Action: Scrutinise announcements and launches for real, measurable advancements. Ask: Is this a meaningful leap, or just another “cinematic” reveal with little under the bonnet?

2. Questioning the Myth, Not the Marketing

- Film Parallel: Apple promised an authentic homage to F1 but delivered a myth-laden spectacle. Similarly, the company’s communications increasingly trade on nostalgia and legend.

- Investor Action: Challenge the narrative. When Apple frames a product or strategy as “game-changing,” interrogate the underlying data. Is the claim supported by numbers, adoption rates, or independent reviews—or is it just another chapter in the brand’s mythology?

3. Demanding Authenticity, Not Just Loyalty

- Film Parallel: The tribal defence of the film in forums mirrors the reflexive loyalty of Apple investors.

- Investor Action: Resist the urge to defend the brand out of habit. Healthy scepticism is not heresy—it’s essential. Insist on transparency about challenges (e.g., tariffs, AI delays) rather than accepting vague reassurances.

4. Insisting on Fundamentals Over Fantasy

- Film Parallel: The film’s protagonist (Brad Pitt) wins by ignoring the rules and cheats his way to the top, but in the real world -both F1 and investing - there are consequences for ignoring fundamentals.

- Investor Action: Focus on the numbers. Flat revenue, slowing services growth, and strategic drift are not just footnotes. Hold management accountable for real, quantifiable progress, not just narrative sizzle.

5. Turning Narrative Fatigue into Analytical Clarity

- Film Parallel: The film’s reliance on tropes signals creative exhaustion; Apple’s similar reliance on “storytelling premium” is a warning sign.

- Investor Action: When the company leans on familiar tropes (“privacy,” “ecosystem,” “innovation”), dig deeper. Is there evidence of renewed momentum, or is it just the same story on rinse, wash and repeat?

6. Refusing to Be Sedated by Silence

- Film Parallel: The most telling aspect is what isn’t said eg. Tariffs, AI delays, and strategic paralysis are glossed over.

- Investor Action: Don’t let silence be mistaken for serenity. If management isn’t addressing looming risks, demand answers. Attend AGMs, submit questions, and engage in shareholder activism if necessary. Throw Genmoji stories back at them.

Practical Steps for Investors: Open Mind

The Bottom Line: Open Your Eyes, Not Just Your Wallet

The F1 film is Apple’s story in miniature: a glossy, myth-driven production that reveals the company’s growing reliance on narrative over numbers. Investors who leverage this metaphor can avoid being lulled by spectacle, demand real progress, and—most importantly—keep their portfolios grounded in reality, not just faith.

In short: stop bickering about the cinematography, and start asking about the earnings. The story is only as good as the numbers that back it up.

Roll on July 10th – The Day After Tariff Expiry, which should be more exciting for investors than a Triple Witching Expiration and July 31st, Apple’s Q3 ER, followed – dramatically as if by design – by August 1st: “The Day” (Trump has promised, this time, for real) “For Tariffs To Actually Take Effect” (delayed release from April 2nd, which caused AAPL to tank to $167). $160 or $400? Place your bets.

“Ooo errr missus,” as an old Elstree Studios production might have scripted, could July 2025 get any more exciting?

Better buy your soft drinks + popcorn, before prices go up.

— Tommo_UK, London, 7th July 2025

This article follows on from my Q3 Earnings Preview from July 3rd

NOTE: a few hours after publication, Bloomberg reports hearing of critical news affecting Apple’s AI rollout:

BREAKING: Apple’s top executive and distinguished engineer in charge of its AI models, Ruoming Pang, has been poached by Meta for its new AI Superintelligence division.

Ruoming and his team did really great work. The problem at Apple is cultural and structural (around GPUs, data access, privacy/secrecy, and fast launches to iterate on software). The only way to fix it is to buy Anthropic or Mistral+Perplexity and make big changes to the culture the team can operate in. Apple still has time, but the window is closing. It’s unlikely they move with the boldness of Zuck.

(Spotted + X commentary found by Dan Scropos and posted on Apple 3.0)

I’ve been writing for a month, that Apple needs Perplexity to ensure it is on-track. The urgency has never been greater, unless this is natural churn. Here was a thought piece from 20th June 2025, when I laid out the logic for it, and the context. I suppose we’ll hear something soon, or if nothing at all, an uneasy silence while we approach Q3 which is starting to look like a date with destiny.

Please pass this to your friends, colleagues, investors, liquidators, families, or anyone you think might be interested in real time thought leadership commentary written in real time on the news, about the news, and looking into the future.