Apple “Through the Looking Glass” PART ONE: iPhone 12 to 16, Reality Distortion, Scratch-Gate™, and the Long Silk Road to the 17

From a 5G-fuelled iPhone 12 boom to the tariff-juiced, AI-starved 16, the last six years reveal Apple’s true playbook: plateaus dressed as super-cycles and super-clever launch optics. Part One dissects subsidies, supply shocks, and pricing sleights that set the stage for as iPhone 17 super-frenzy.

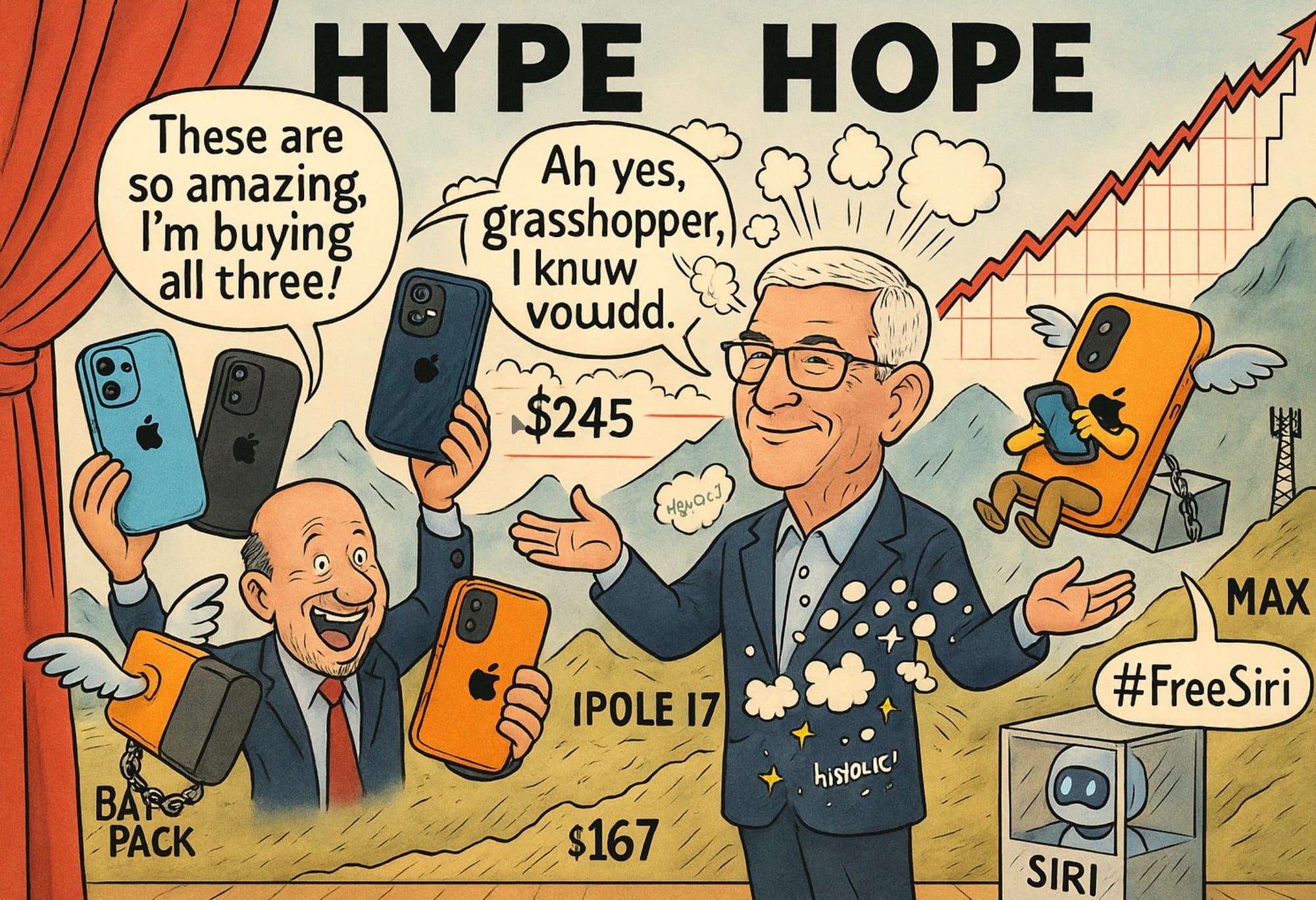

Apple’s iPhone 17 may not the “combustible AI-defying super-cycle” phenomenon Gene Munster and Jim Cramer seem to think it is. Or maybe it is. “Who cares,” you might say, “AAPL is at $254 again!”

Too right it is, and here‘s where weather fronts collide: are we up against a cold front incoming to douse the frothy too-far-too-fast-too-soon, or is this warm front an Indian Summer as we head into autumn?

The truth is, there is a lot of hot air coming out of Apple’s vapour chamber right now, and analysts - along with AAPL - are riding higher than helium - or even hopium - on it.

Prologue (and it’s a long one)

Like football (“soccer,” uniquely, in the USA) this article is a “Game of Two Halves.” In this Part I: iPhone 12 → 16: What Really Drove Each Cycle and why the iPhone 17 line-up and iPhone Air are like a three step dance – one step forwards, one step back, and one to the side.

The media and analysts have gone loco. Narratives are colliding like submarines with no sonar, and “online shipping times” vary from one note to the next.

Last weekend I teased a two parter. Here’s the drop of Part One.

Yesterday, Monday 22nd September, Jeffries says the base 17 is a selling poorly, JP Morgan say base 17 models are going through the roof. Air sales “seem” poor solely due to analysts saying there’s broad availability (perhaps Apple built too many, maybe not enough people are ordering? Nobody knows, but everyone pretends they do). The Pro Max is booming, it seems (and doesn’t it always) but, scratches. In fact “scratchgate” has now become a trending “thing” on social media, and no surprise - it’s made of aluminium after all, not titanium. The Air’s battery, supposedly lacking, apparently performs like a champ. It’s an upside down world, and nobody knows which way up is down, or where sideways eBay up changing trajectory from plateauing to ascending.

“How very odd,“ Alice might have said. If only Lewis Carrol was still alive he’d be having more fun writing about iPhone launches than Alice has ever had in imagining six impossible things before breakfast. Eat that, Queen of Heart. Well, at least it has a plateau though, or a “boob tube“ as seems a much fun and less serious term.

(A quick request, but an honest one. I write for free, to democratise insightful information, albeit rather long-form. But you’ll find more signal on TOMMO.FYI than any analysts’ notes, and a track record mostly right stretching back 25 years.

If you’re enjoying this, I’d love your help in growing our community. Just hit the “share” buttons floating on the page, or forward this email to a colleague or friend. If every reader brings just one more person on board, this space grows into something bigger, sharper, and more fun for all of us. Thank you — and welcome to everyone who’s new. Thank you!

Catching the Wave Before it Arrives for independent investors 100% accurately. Help Me Spread the word, the profits, and the opportunity, by spreading this site to a few friends.

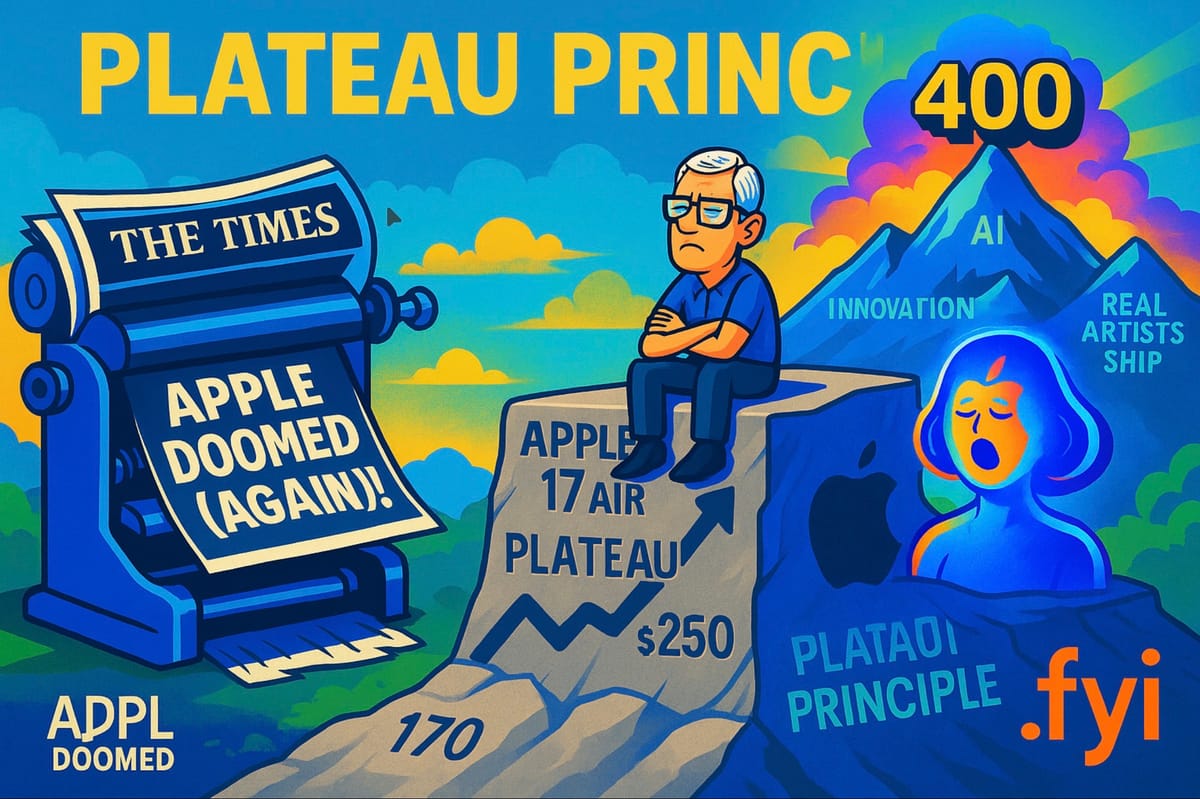

Last week the Times of London called the iPhone 17 Apple’s End of Times. Yes, really, the media is chasing its own tale. Rarely have I had so many laughs, at other writers’ expense, than sitting back and waiting a few days for some real news to unfold that slaughtering a goat and reading its entrails to proclaim “Apple is doomed,” as The Times seems to passively suggest.

So the financial media are all now Apple Silicon Supremos (ASSes) instead of Apple Intelligence Proponents (AIPs, more colloquially known as APEs), having suddenly, for the first time you’d think from their non-stop coverage of it, talking knowledgably about the N1 chip, the C1X and the M series as if they were talking golf handicaps.

Thus is born The AAPL Supercycle 2025 Edition Rebound, with everyone, even Dan Ives who abandoned Apple for dead last month, now back on the gravy train, showing just how fickle men in Hawaiian shirts and brightly coloured jackets can be. Fair weather friends indeed, and Ives is never one to run away from ole spotlight, and has now dismissed AI as being as irrelevant as he declared AAPL to be just 45 days ago. Goldfish market, anyone? Fifteen minutes of fame seems to have devolved into the 20 second memory of a goldfish in this mad money market - kudos to Cramer for nailing that monicker well before its time.

This, even though the launch event itself was generally not so much “Awe Dropping,” as Yawn Dropping.

The iPhone 17 has barely been in customers’ hands a few days, and Wall Street is already back to declaring a “super-cycle.” Gene Munster calls it “combustible.” Jim Cramer claims Apple has “defied the AI gravity well.” J.P. Morgan’s Chatterjee is publishing notes about shipping delays suggesting a tsunami of orders is overwhelming Apple’s iPhone assembly plants (luckily those sweat-shop factories have “vapour cooling,” even if not air conditioned, it’s rumoured) as if iPhone wait times were to be taken as gospel for demand as if as holier than the Dead Sea Scrolls.

And Krantowitz, never one to miss a headline, argues that demand for the iPhone 17 proves Apple doesn’t need AI, that its buyers are immune to the AI arms race, and it’s a bloody good thing Apple is sticking to its knitting and producing “excellent phones, as they’ve always done,” while leaving a “still maturing AI market to develop” before they focus on it. In news for Krantowitz, Apple has been “sitting on AI” since it bought Siri in 2011 and totally squandered their opportunity to define what consumer AI really is, and have now reduced themselves To following the crowd instead of being 10 years ahead of it.

This isn’t really so much analysis as it is performance art, contemporary style, chiefly regurgitated from previous notes of a similar ilk re-imagined for the modern era (ie more than 12 months old). And like most performance art, the lighting and CGI is better than the script and choreography.

Let’s be clear: the iPhone 17 is not some epoch-shattering AI-defying miracle.

It’s an iteration of sixteen previous iPhones, dressed up as revolution with more in common than a retro iPhone 6s which had barely a camera protruding at all, than any of its modern day peers (and isn’t much thinner either). The new Air is the Mounjaro version of a modern base iPhone but on steroids and priced for a gross margins bonanza.

The ultra-thin “Air” is a marvel of industrial design compromised by physics: a battery that can’t last a day without a power pack, and a camera bump so awkward it’s a design crime in Jony Ive’s old court. The Pro Max is the same badge-status story as ever, only this time Apple tested how high the price ceiling could go. (Answer: £2,500 - that’s about $3250 - in the UK, if you’re brave enough to max it out.)

And the standard 17?

A safe iteration to keep the upgrade treadmill moving, apparently selling badly if you listen to Jeffries but doing a Buzz Lightyear “To Infinity and Beyond” if you read Bank of America’s Wamsi Mohan’s Report today in which he predicted Apple’s margins would rise over 50%, at which point some people - especially Europeans tired of price gouging - might start calling for a revolution, rather than being told “let them eat cake,” or pay up the Apple Tax.

Is it a wonder Europe, as a developed market ex-UK, is a mediocre market for Apple with its sensitivities and pricing culture maybe ignored by Apple in what could be an easy extra 20 million iPhones shipped if Apple didn’t cut off its nose to spite the EU’s face by punishing European consumers with simply appalling pricing and carrier deals, compared to China and the US?

None of that stops Apple’s PR machine from spinning a new chapter in design purity, delivered in carefully modulated British tones. Gone is the over-promising of “Apple Intelligence.” In its place: a change of subject. More talk of “plateaus” than any of AI. A studied effort to frame thinner aluminium as the second coming of design innovation (even though titanium is lauded as the material of must-need, for the iPhone Air to survive and thrive in many “bendgate” attempts to get it to snap like a cracker. Apple has always been good at misdirection, this time telling you AI is pointless, space grade aluminium is the best (after telling us titanium is just the sickest metal ever for years and using it to ensure the Air is unbendable); let nobody say Apple still isn’t capable of redefining reality.

“Can’t Create An Illusion, my Ass,” as a certain senior Apple C-Suite member might have said.

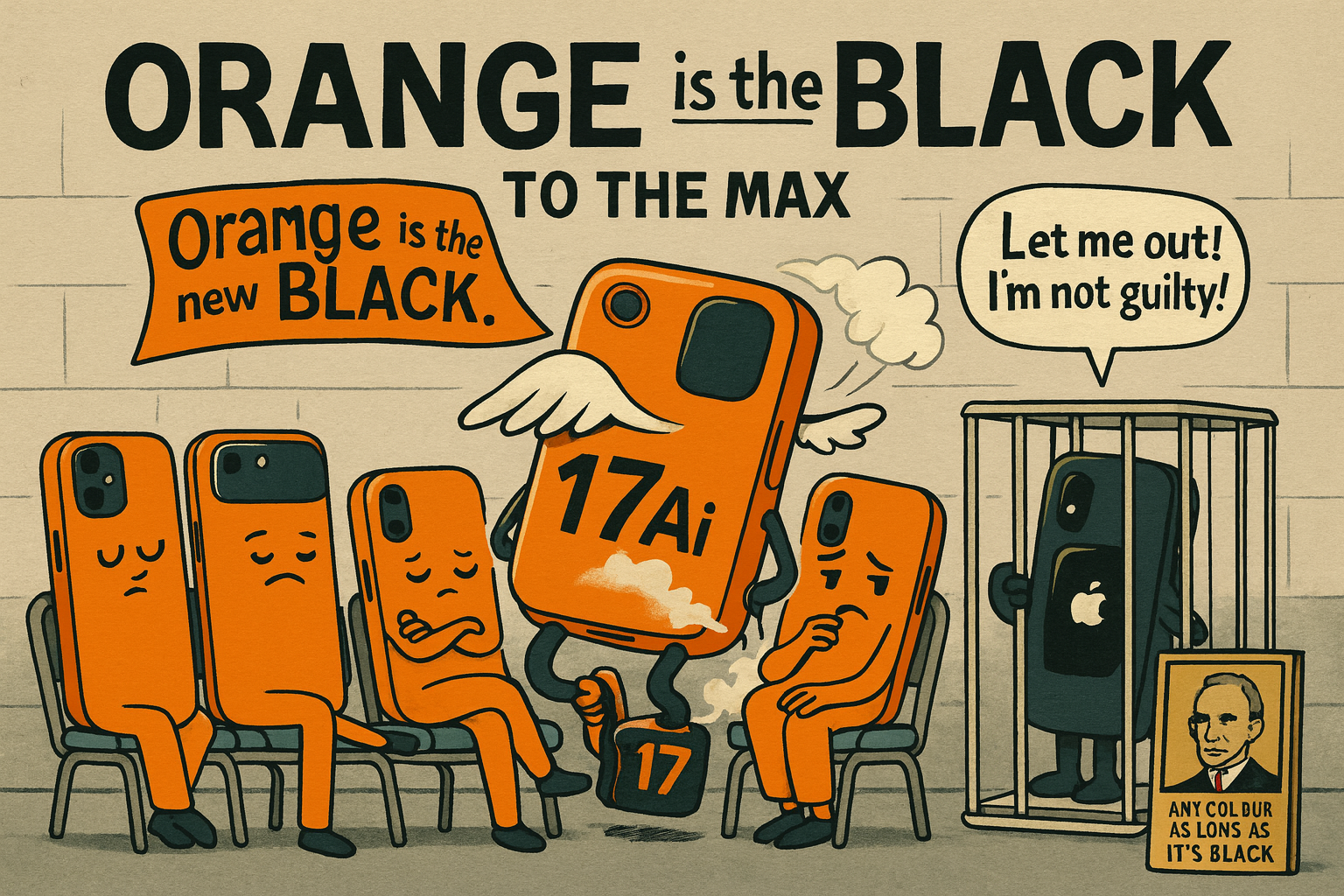

And yet there is one area where the company seems to have miscalculated: colour.

The star of the iPhone 17 lineup, if you read the headlines, is the “hero colour”: a shade of high-gloss orange, so bright it looks like it wandered off the set of hit series Orange Is the New Black.

Which is fitting, because in a choice both curious and telling, Apple dropped the traditional Space Black option for the Pro models this year. No black, just orange. The blue version – in fact all of them – are already gaining notoriety for “scratching easily” in spite of Apple’s advertising showing them surviving an assault course of assaulting key chains and broken glass thrown at them in an endurance test, blemish free. Not so much if you check out X or Instagram, and Tik Tok moaners whining that batting their case-less aluminium iPhone 17 .. scratched it! Well spank me and call me Shirley, who would have guessed a big cunClass action lawsuit probably coming your way soon. That’s the price you pay for shifting from titanium to aluminium for the apparent requirements of overheating internals of the Pro and Pro Max, in spite of its much-touted “vapour cooling,” the design “feature” requiring – we’re told – the shift from titanium to “space grade aluminium.”

Anyone who has seen the persons of the International Space Station will realise immediately that “space grade” anything is absolutely no guarantee an object will not survive multiple hits and small impacts without scratches, damage and the occasional piercing or cracking.

Orange, in Chinese and Asian markets, is auspicious: a symbol of prosperity, luck, and optimism. For buyers there, it works. For buyers in the West, it looks like a hi-vis vest, or worse, a prison jumpsuit. A Vogue editor would probably spin this as prescience: the Apple team, like the show-runners of Orange Is the New Black, channeling trends years before they land. Sadly for Cupertino, orange is a colour on the dusk of fashion in Europe and America. And on London’s streets, an orange iPhone is not a badge of fortune but a beacon for moped thieves.

That Apple of all companies, obsessed with detail, with the semiotics of colour, with what Jony Ive once called “the whisper of a shade,” could omit black, the timeless neutral, is astonishing. Everyone needs a stylish but understated black outfit in their wardrobe and an iPhone is by default these days, part of your daily ensemble, but not, for you, this year, Apple says.

“Unless you buy an Air. In which case you can have black.”

But perhaps that’s the point:

In a product cycle starved of true innovation other than marvellously shrinking internals and astonishing achievements with Apple Silicon, yet again saving the day, colour is the upgrade. When you have little to show, you show it in bright orange, Hermés style.

This, more than anything, captures the problem with the iPhone 17 hype.

The “astonishing” 5–10% year-on-year unit increase Wall Street is now hailing doesn’t come from a breakthrough in intelligence, nor a quantum leap in hardware. It comes from optics: colour, pricing skew, and the natural rebound after a year in which the iPhone 16 stumbled badly.

The iPhone 16 Launch: How Apple Fell On Its Face But Missed The Ground.

That stumble matters. The iPhone 16 cycle was a catalogue of self-inflicted wounds:

- Apple promised the dawn of its “Apple Intelligence” platform in 2024 and delivered a delay instead. Siri remained a punchline. China, once a bulwark of iPhone demand, slowed sharply after the initial launch rush.

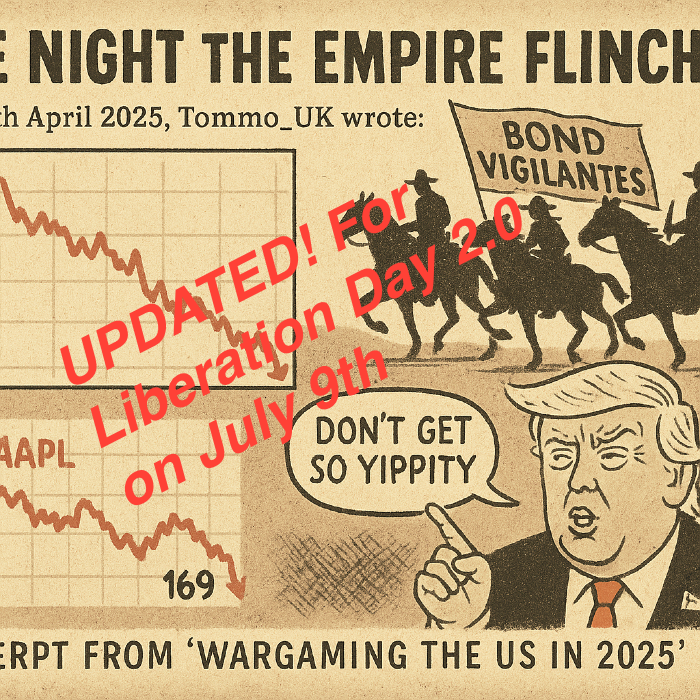

- The “Tariffs and Treasuries Tantrum” in the U.S. pulled forward demand artificially, as buyers rushed to beat potential price hikes.

- Then, late in the cycle, Beijing stepped in with a massive subsidy. $250–300 per device! That goosed sales just enough to make Q3 2025 look respectable.

Strip away those distortions, and the 16 was an under-performer.

“Which makes the 17’s “super-cycle” look less like liftoff and more like base effects.”

Comparing mediocre against bad and call it remarkable.

Now that’s hubris. With the 17 offering a 256GB version across the range, there’s a subsidised version for all Chinese citizens, so comrades can bag a 25% discount off an iPhone on China, goosing sales of otherwise more expensive Pro and Pro Max model (especially in the absence of the Air in China, thank to eSIM related regulatory problems) and making up for the lack of that Air model but pushing buyers into higher margin Pro Max models. Smart move Apple, no criticism from me on that front, but lauding taking advantage of government subsidies as a substitute for a genuine revolution in design when you do more than ceding the guidance with a key and find it’s about as tough as Liquid Glass would be, were glass really liquid, and the shine comes off the achievements, undoubtedly remarkable though they are on a internal technical level (Plateau camera bumps aside).

That, for all its length, was the foreword, and pretty much all this Part One of the article covers when it comes to the iPhone 17.

Because this article’s real purpose, beyond providing me with an opportunity to poke fun at the analyst and media commentariat (personally I quite like metallic orange and I’d likely buy an Air if it wasn’t for the battery pack must-have an the plateau, which I consider a design faux pas and unforgivable carbuncle on the fancy of beauty), is to ground you with some rear view mirror recalibration.

We’re going to before looking at the iPhone 17 in a brighter light of day in the next part, and in context of this Part One which will examine the iPhone 12-16 launches and explain why they matter, not surrounded the iPhone 17 noise with the confusion from a bunch of clueless analysts and commentators still, years on, trying to read tea leaves and goats entrails for signs of how causation and correlation are not equal, and “shipping times” and “availability” are a completely false allegory for comparing actual order volumes.

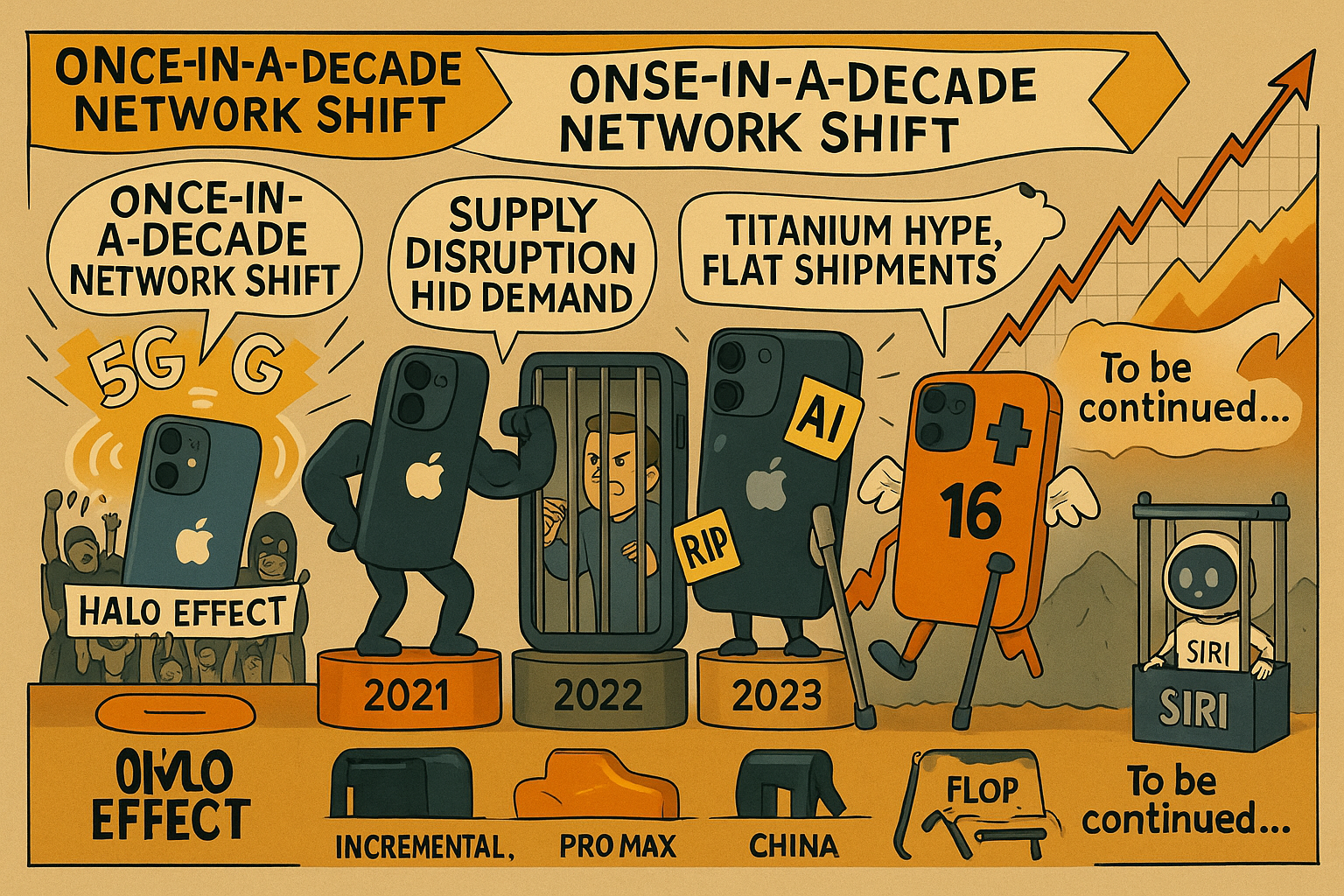

Because if you want to understand the hype, you need the baseline. Before the 17, there were five cycles before it. Let’s have a look. The truth is that since the iPhone 12 in 2020, the story has been one of broadly diminishing returns with occasional blips up and quite a lot of plateauing:

- iPhone 12 (2020): the 5G halo effect, with demand pulled forward by a once-in-a-decade network shift.

- iPhone 13 (2021): incrementalism, the Mini quietly euthanised, the Pro Max finding its stride.

- iPhone 14 (2022): the China lockdown year, where supply disruption hid slowing demand.

- iPhone 15 (2023): titanium hype masking flat shipments; Pro Max skew saving revenue.

- iPhone 16 (2024/25): flop territory, AI fiasco, tariff panic, Chinese subsidies propping up the line. Great lowered baseline for iPhone 17 comps though, probably its major achievement.

Each cycle has its own flavour of distortion.

Each was dressed up by Apple’s marketing machine as if it were revolutionary. But each in practice showed the same trend: unit growth in the low single digits, revenue growth increasingly reliant on upselling to higher-end models, and mid-range experiments (Mini, Plus, now Air) that fizzled out almost as soon as they arrived.

Which brings us back to orange.

When a company once lauded for colour discipline (remember the careful reintroduction of gold, the slow palette refinement of blue and green) turns to high-viz orange as its flagship shade, it tells you something. It tells you that design theatre has become the upgrade and the same people who made Liquid Glass WWDC’s primary event-feature have seemingly captured the iPhone 17 Launch with the same clever trick: optics.

And that Wall Street, mistaking theatre for transformation, is once again writing upgrade notes against a story that doesn’t yet have the cash behind it, but is certainly an eye-catcher for fast moving scooter-using phone snatchers in the street, and has every analyst intern wetting their pants in excitement at being able to finally upgrade AAPL again instead of mourning it being the wagon train straggler of “Magnificent Six plus one.”.

So yes, the iPhone 17 may sell “5–10% more units than the 16”

Or even more, but don’t confuse a fashion quirk and a rebound from a flop of a launch in the form of the iPhone 16 + Apple “Intelligence”, with a combustion engine for Apple’s future. Because less, in the case of the iPhone Air, certainly isn’t always more, and orange is definitely not the new black, for many Pro buyers, who likely won’t enjoy being forced to buy a quite-scratchable dark blue iPhone Pro instead of their preferred “Space Black” or “Silver Surfer Grey” or whatever a more “DL” colour might be called (to use some dating app slang).

That’s the difference between reality and theatre. And in this piece, starting with the iPhone 12 through to the iPhone 16, we’ll strip away the theatre and look at what really happened, before turning back to the hysteria around the launch of the 17 we saw last week.

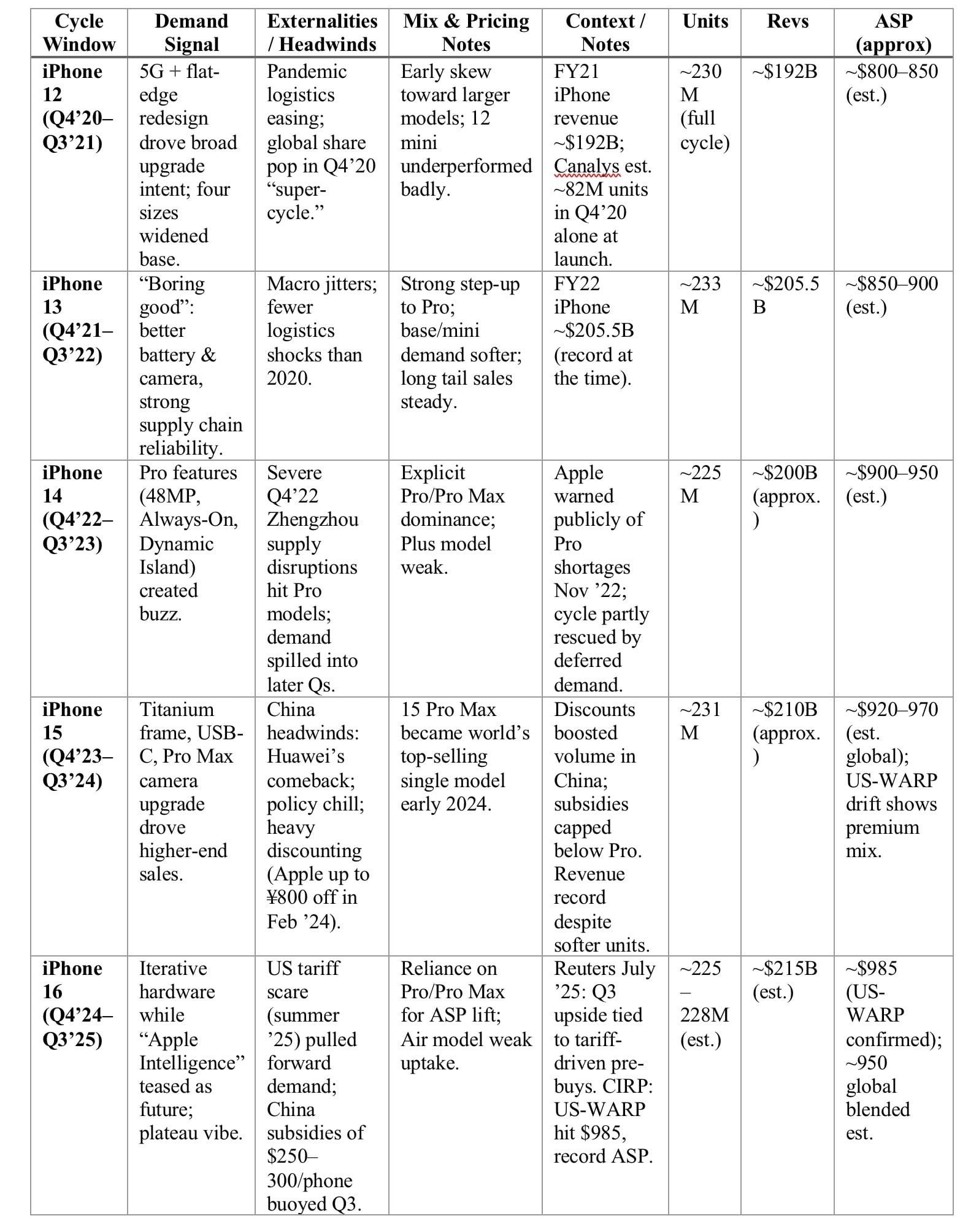

The Truth Behind The Numbers: Using Apple’s Time Machine Backup To Step Back In Time, Through .FYI’s Archive Material

If you want to understand the truth about iPhone 17, let’s start by clearing the fog around its predecessors. Apple reports in fiscal years (Oct–Sep), but iPhones launch in September. So measuring “a year of iPhone [x]” off Apple’s FY distorts the picture. The clean way is launch-to-launch: Q4 (launch year) through Q3 (the following year). That’s the window I use below because if we’re going to deconstruct this year’s “mammoth” narrative, we need a baseline that isn’t built on shifting sands.

A quick reminder about a data desert which deliberately tries to obfuscate the numbers: Apple stopped disclosing unit shipments in 2018. Since then, we triangulate from Apple’s product-line revenue, channel checks, and independent trackers (Counterpoint, Canalys, IDC, etc), plus the company’s own disclosures and preannouncements when it breaks the usual silence (e.g., the iPhone 14 Pro supply warnings, or statements on earnings calls when they’re needed to reassure analysts). Treat unit “estimates” as directional, not gospel; the qualitative drivers matter more than the false precision of back-filled spreadsheets.

iPhone 12 (Launch: Sep 2020 → Window: Q4’20–Q3’21): The 5G Super-Cycle That Really Happened

If there was ever a cycle worthy of the overused word “super,” it was the iPhone 12.

Launched hot on the heels of the previous year’s arguably best-ever iPhone and the first with proper nightvision and video, the iPhone 11 – also the year, 2018 – when Apple broke out services revenue separately in its earnings, causing the PE multiple to rocket from a then-pedestrian 18 to about 25 as the Street finally realised what a “big deal” services revenues were going to be (something individual investors, including yours truly, had been talking about for years as a hidden in plain view reason to buy hand over fist waiting for this breakout to happen. That period paid of many mortgages.

Moving onto the following year

The iPhone 12, Apple rode the first mainstream 5G wave (even though 5G was hardly available anywhere and where it was, it was usually crippled by too many concurrent connections) and, crucially, hit the holidays with four form factors (including the “mini,” which generated a lot more heat in blogs than it did in checkout baskets, a bit like this years 17 line-up).

Canalys called it:

Apple shipped ~82M iPhones in Q4’20, briefly retaking the global crown from Samsung on the back of iPhone 12. The setup: a major radio upgrade plus a fresh design language, which put wind in the sails all the way through Q3’21.

Financially, it shows.

Apple’s FY21 iPhone net sales jumped to ~$192B (from ~$142B in FY20), with the heart of that lift landing inside the 12-cycle window. That’s the tell that matters: the combination of new radio + form factor mattered to real buyers, not just to reviewers.

Two nuance points that set up later years: (1) buyers showed early preference for larger, pricier variants; (2) the 12 mini underperformed (CIRP and others pegged its share in low double digits at best), a pattern Apple would quietly acknowledge by shifting the small-phone experiment to “Plus” the following year and notably, has dropped altogether now..

iPhone 13 (Launch: Sep 2021 → Window: Q4’21–Q3’22): Refinement + Supply Normalisation = Long Tail

The 13s were “boring good”: better battery life, camera refinements, and the A15’s efficiency gains.

In a world still digesting pandemic supply frictions, Apple kept shelves stocked and leaned into the skew that had become obvious: bigger, nicer, pricier. The pattern paid off: FY22 iPhone net sales rose again to ~$205.5B, a new high. In other words, 13 wasn’t a super-cycle; it was the super-cycle’s compounding in a world short of components and an unreliable pandemic supply chain to struggle with.

Corona-panic delivered Apple a restorative tonic thanks to their marvel of supply chain and manufacturing management unparalleled by any other manufacture – and that includes everything from autos, to washing machines, and all other consumer electronics manufacturers. Apple buyers were able to shop with fervour and impunity while less companies’ production ones had long-since ground to a halt due to lack of components.

This matters for how we judge 15/16/17:

You don’t need fireworks to build a strong iPhone year.

You need dependable supply, steady ASP uplift, and a reason to step up the ladder to a new model, which doesn’t involve features like “Apple Intelligence” which Apple hasn’t even shipped at the time of launch. And then neglected to for the following two years. The iPhone 13 delivered that, quietly and competently: a modest upgrade for a pandemic stricken world shipping reliably and into the hands of housebound-weary consumers as a new, if familiar toy, they could at least upgrade to on contract easily and unlike rivals, Apple had lined up its supply chain as efficiently as you’d expect of Tim Cook, with new glitch in shipments despite lockdowns.

iPhone 14 (Launch: Sep 2022 → Window: Q4’22–Q3’23): When “Pro” Carried the Line (and Supply Bit Back)

This is the first cycle where “Pro carried the family” became impossible to ignore.

The 14/14 Plus were fine phones, but it was 14 Pro and Pro Max with Always-On display, 48MP sensor, Dynamic Island that drove the narrative and the mix. Then came the punch: in November 2022, Apple publicly warned of “significantly reduced capacity” for 14 Pro/Pro Max due to Covid-related disruptions (even Apple, couldn’t avoid a sneeze this year, catching a tail-end whiplash from Covid after all) at Foxconn’s Zhengzhou “iPhone City,” an unusually explicit heads-up admission that holiday supply wouldn’t meet demand, unlike the carefully managed launch of the 13 the year earlier.

That’s not blog gossip; it’s from Apple itself, but to it’s credit, Apple managed remarkably well in a year when even German car producers like Mercedes needed to shut down production lines for months on end because of chip supply shortages. Apple managed probably better than anyone else did. Kudos to Tim Cook, the original and only pre-eminent supply chain and operations guru the world has likely ever seen, even if he’s a few other issues with the “product” thing.

More importantly though, two consequences rolled into the 14 window:

- (1) a portion of holiday demand slipped into later quarters; as a result of the supply chain issues, and

- (2) the Pro/Pro Max pricing power (and scarcity) elevated the ASP even as volumes were pinched.

That “Pro skew” would become the profit engine Apple leaned on again in 15 and 16, and now – again as we’ll see later, it’s leveraging it into the 17 Pro and Pro Max, especially on up-spec’s models where the profiteering off RAM upgrades is daylight robbery, even if very shareholder friendly.

iPhone 15 (Launch: Sep 2023 → Window: Q4’23–Q3’24): The China Check + Pro Max Takes the Crown

USB-C across the range, Titanium on Pro, and a $100 higher starting price for Pro Max. In the West

That was enough to keep the upgrade games of Snakes and Ladders intact; globally, another story emerged: Huawei’s comeback (eg. Mate 60 Pro), tighter device policies in parts of China’s public sector, and price-led Android competition added real headwinds. Yet the mix skew did more heavy lifting:

The iPhone 15 Pro Max became the world’s best-selling single smartphone model in early 2024, i.e., the top of the range did what the base couldn’t.

- There was discounting in China, but you needed to read the fine print to see through that data point.

- Apple and channels ran promotions (Apple’s own site cut up to 800 yuan in Feb 2024), while some state/local subsidy programs didn’t even cover phones priced above 6,000 yuan (which excludes most Pro/Pro Max configurations).

- The “China discount saves iPhone” headline was tidier than the reality: promotions helped, but didn’t rewrite the 15 story.

The 15 was a rare animal, a hit in spite of the headwinds, and enough of a design and performance upgrade to make it probably the best iPhone at launch, since the iPhone 11.

Especially the Pro Max version, whose Neural Engine enables it to still run what is called “Apple Intelligence,” something lesser models are disappointingly barred from (despite technically capable of doing so). Not that you need neural engines for what’s masquerading for “Apple Intelligence” for now, but Apple insist you have one of their newer phones to run what’s a project in reverse anyway, just, well because.

iPhone 16 (Launch: Sep 2024 → Window: Q4’24–Q3’25): A Year of Misfires… and a Weird Tailwind

This is the cycle the current hype machine hopes you forget.

The iPhone 16 launched into a muddled narrative: Apple Intelligence was previewed at WWDC 2024 and framed as a 2025–2026 roll-out of biblical promise and proportions, while the practical, here-and-now changes to the phone line were simply iterative.

That created a subtle but important incentive to wait especially for buyers who internalised “AI” as the next must-have feature, but wanting to see what the has was about before committing (newsflash – Apple “Intelligence” – AI as Apple tagged it with hubris – amounted to a shelved project instead and gave rise to a class action lawsuit instead, rather an own goal).

Apple’s own 2023-2024 filings talk about R&D concentration on “Apple Intelligence,” underscoring that the sizzle sat ahead of the steak, and the steak was off the menu before it was even served by January 2025.

It’s no wonder starving iPhone upgraders are jumping on the 17 without AI having moved in over a year, having had their upgrade dopamine receptors denied access for far to long not to get antsy.

AI post WWDC-2025 has been downplayed to the point of dismissal by this point, with analysts and tech pundits arguing that somehow, because “Apple ships bloody good phones,” apparently it doesn’t need AI, even though as recently as July and August Tim Cook et all were furiously insisting they were heavily focusing on getting AI right and were “exploring acquisitions and partnerships,” which made the Street showed with pleasure and was the unreal on-ramp for AAPL’s resuming its ascent.

With unintended irony, and with AI now being trash talked by Apple (by its absence from a narrative) and with analysts and the media saying Apple doesn’t need it anyway, really, because - well - they make bloody good phones, that AI-driven jump up from the $200s to $220-230 didn’t drop off.

Instead, building on more hot air than the whoosh coming out of an iPhone Pro’s vapour cooling chamber, AAPL built up to a close today of at All Time High for 2025 of $254 (close to eclipsing the closing day of 2024’s $259 in December).

Apparently Apple are still exploring AI (lost in the jungle along with Dr Livingstone, one presumes), but if you believe Mark Gurman, at least, they’ve allegedly given up on their own “foundation models” which Gurman calls “commoditised“ (but could have been Apple’s if they’d moved 5 years ago, he Doesn’t go on to add) for now and are considering tying up with Anthropic for agentic AI using other people’s services.

Which was my whole argument in June and July that Apple should have just bought Perplexity while it had the chance and just plugged it in, to me they’re they hope to be next summer, a couple of months back.

That would have been “intelligence” in action, but “iterative dithering” made that move too late in the offering, and Perplexity with its agentic “Comet” browser is now rocketing in use and value, to the point it made a cheeky offer to buy the Chrome browser from Google for $100B a month ago, prior to the anti-trust suit conclusion. Meanwhile OpenAI just received a $100B investment ton NVIDIA and everyone but everyone seems to be working with everyone else in the AI world.

Except, Cupertino, who whispery about doing something with Anthropic, sometime, involving using AI agents to help users, and exchange Siri, to track to-dos and intelligently accrue and store data across devices and apps, allowing API access to outside developers and SaaS systems.

This follows precisely, the framework I outlined in my SenseOS concept in early June 2025, and then discussed as being the preeminent benefit of adding Perplexity into Apple’s DNA in July and August. Apple seem to have come to the same conclusion, but squandered 6 months and probably now paying twice as much for any partnership they enter into.

While Tim Cook and Hairforce One showcased their pet baby, F1: The Movie for WWDC 2025 in June to the detriment of almost anything else of any importance (with a mention to “Liquid Glass,” a love/hate UI/UX design paradigm still in mid-development really, the AI capex boom continued, and shot so hard past Apple the general consensus now is that it is impossible for Apple to catch up on its own, without partnering.

So as I said at the time, while Apple could have owned this space the way it owned MP3 players and music downloads ahead of the crowd and destroying the competition by getting in early with the iPod and then iTunes, capturing the world when it went cross-platform, now Apple is reduced to playing also-ran with AI, and not setting the agenda or the consumers expectations by leading them but instead they will be following in others’ footsteps, making whatever they do in AI more akin to iPhoto than iTunes.

Back to the half-decade of iPhone saga though – I digress.

To add insult to injury and following the scandalous and public cancellation of Apple’s AI launch and the re-boxing of Siri for 18 months in February 2025, late in the 16 window, something unexpected (at least, unexpected by analysts; I wrote about an upcoming tariff and treasuries tantrum on March 7th – it broke on April 9th of course) happened in the U.S.: a tariff scare.

I did a Tom Clancy riff off this in a prediction on March 7th which came horribly true on April 9th, and brought some gallows humour to the web about it in an imaginary scenario which almost came true when US treasuries really were on the edge of a global dump by the Bond Vigilantes hunting them to extinction before Trump came out and it’s everyone to “stop being so yippety.” Has any POTUS ever been able to control the entire US stock and bond market, with just four words?

In early 2025, with talk of across-the-board 100-140% import tariffs and a political “buy American” push rising, U.S. consumers pulled forward purchases in July 2025 concurrent with the market tanking and bond vigilantes almost wiping out the USD. Apple’s fiscal Q3 (reported July 30, 2025) came in hotter than expected, and Reuters explicitly linked the upside to tariff-driven pre-buys, an exogenous tailwind that flatters the 16 window’s finish. If you’re comparing 17’s first inning against 16’s full game, remember: some of the 17 crowd already bought early because Washington rattled sabers, and they’re not going to be selling up to get a 17 yet. These are the people waiting for the 18. Or the 19. Perhaps.

Meanwhile, China remained complicated.

Yes, Chinese online channels discounted iPhones at various points in 2024 and 2025; yes, some provinces ran electronics subsidies; but many programs capped eligibility below mainstream iPhone price points, limiting the effect on the Pro/Pro Max mix that actually moves Apple’s margin needle.

Translation: headline “subsidy” stories were noisier than their net impact on Apple’s highest-value units, but they still added demonstrably to the push behind China sales enough to warrant strong discussion and recognition on the Q3 conference call.

With this subsidy remaining and Apple ensuring their base 256GB models across the range remain eligible for a government subsidised iPhone in China.

Don’t you wish you lived under an authoritarian regime like China which stomps on free speech and hands out iPhone Discounts?

Poor Americans just have free speech stomped on, or assassinated – RIP Charlie Kirk – but add to your iPhone costs by imposing tariffs on US imports and components, and Trump will definitely not be giving you a government handout for your next iPhone.

In fact, whatever happened to the his much-vaunted Trump Corporation “Trump Phone,” to be “Made in the USA, In China”?

What a story that would have been - and is it still happening or did the Trump Phone get lost on the road to Bessent and Trumps tub-thumping World War Tariff campaign?

Back to iPhones: Why this framing matters for 17

Across the iPhone 12 thru 16, the real drivers repeat:

- Major inflection beats “nice year.” 12 (5G + design) and, to a lesser extent, 13 rode clear consumer value props.

- Pro is the margin engine. From 14 onward, the top variant increasingly carried the series: ASPs pulled more weight than units.

- Exogenous shocks distort comps. Supply shock (14), policy shock (15) tariff pull-forward and AI-cancelled truncated enthusiasm (16), and region-specific dynamics (China’s discount quirks) can make a meh cycle look solid or a strong cycle look merely okay.

So, when you hear “5–10% iPhone growth is remarkable” for the 17, ask: “remarkable vs what, exactly,” - versus a 16 window boosted at the end by panic-buying? Or versus a 12/13 baseline that actually reflects underlying product pull?

Numbers without a sold bottom line narrative are props.

Narrative without numbers is theatre. We’ll need both for 17, and so far Apple is delivering CGI and colour coded grooming and “skinny is the new good” in spades.

Street analysts just lapping it up and counting using metrics which literally rely on watching an online store generate totally made up shipping time lead times, because Apple doesn’t actually tell most of its carrier partners when they’re going to receive shipments.

Nor, though a highly acclaimed discounting and bait-and-switch tactic in the US, does the rest of the world get the incredible trade-in deals being offered in the US, if any at all. US analysts seem oblivious this, even though only 33% of iPhone sales by unit are in the US.

But similarly to smoke and mirrors, we have to ask if this is a case of aesthetics over achievement and whether this might bite the narrative in the derrière after Christmas, depending when or if some real magic rolls out.

My Real Hope to Drive AAPL, absent of AI

- “A wireless MacBook sold through carriers on contract”

or a relaunched and actually functional version of “Apple Intelligence.”

You can leave a “HomePad” at the door, thanks. I don’t need another screen in my bedroom or living room, and if I do, I’ll use my old iPad for that. A hybrid speaker with an arm and a screen on it to control bits of overpriced home automation kit which only work with Apple’s squandered HomeKit opportunity? Thanks, but no thanks - I’ve lived HomeKit since it launched. It does a fantastic job with my Philips Hue lighting and gates control but is pretty lousy at anything else. Thanks to a very dumb and lobotomised Siri. #freesiri.

Launch-to-Launch Snapshot: iPhone 12–16 (Q4 → Q3 Windows)

Here’s a summary table for the following tabling asking of the iPhone, “What have you done for me lately,” covering the last six years, focusing on the following key metrics.

- Cycle Window

- Core Demand Signal

- Externalities / Headwinds

- Mix & Pricing Notes

- Financial Context / Notes

- Units (approx.)

- Revenue (iPhone net sales)

- ASP (estimates / confirmed where possible.

Launch-to-Launch Snapshot: iPhone 12–16 (Q4 → Q3 Windows)

So in a summary digest of this meandering article (which I thank you, if you read this far, for allowing me to indulge in some pet rants) you should skim before we talk about the iPhone 17 & Air (note, it’s “Air,” not “17 Air.”) in the Part Two to follow:

By the time you step back from the iPhone 12 through 16 cycles, a pattern is unmistakable.

1) The 12 was the last genuine super-cycle:

(Super-cycle): The last unambiguous “step-function” year—new radio + new look + wide range - visible in both share and iPhone net sales. 5G, a new flat-edged chassis, four distinct sizes - Apple hadn’t delivered that much obvious “step-function” novelty in years. Unit volumes spiked, revenues followed, and even the most cynical analysts grudgingly called it a true upgrade year.

2) The 13 looked dull on keynote day but turned out to be a masterclass in “boring good.”

(Follow-through): Proof that a well-executed “boring” year can be financially excellent. Better batteries, steadier supply chains, and incremental camera gains with the competition struggling to even ship anything with supply chain issues, were enough to lock in follow-through demand. Apple’s financials broke records without a single new design headline.

3) The 14 was where the range split decisively.

(Pro or bust): Base models were ballast; Pro features created scarcity-fueled desire, then supply capped it – ‘cos Apple said so. The Pro and Pro Max - with Dynamic Island and 48MP cameras - were the only models that mattered. The base and Plus served purely as as ballast. Then Zhengzhou’s lockdowns throttled Pro supply, turning manufactured scarcity into its own form of desire. Apple admitted as much in its own investor note, and hasn’t made the same mistake since.

4) The 15 was billed as a China test and a titanium showcase.

(China reality + mix math): China was harder than headlines, but the mix, especially Pro Max, kept the line’s economics intact. In reality, it was a story of Huawei’s return, government sensitivities, and heavy discounting. The Pro Max carried the line, climbing to the world’s top-selling smartphone slot in early ’24. Apple protected revenue by leaning on mix ensuring the top end did the heavy lifting, even flat flat units.

5) The 16 showed what happens when the narrative drifts too far ahead of the product.

(Narrative mismatch + AI failure, policy shock): AI sizzle largely dated forward; a U.S. policy scare juiced the final quarter. Great for Q2 and Q3’25 optics; lousy as a clean comp for the 17. “Apple Intelligence” was announced but not delivered; AI sizzle was dated forward. U.S. tariff fears pulled demand into Q3, while Chinese subsidies propped up volumes by $250–300 a unit. Great optics for the July 2025 quarter; lousy material if you’re trying to claim a clean baseline for the 17. The promise and need for an upgrade to an iPhone 16” to cope with the the-then much vaunted “Apple Intelligence” even sparked a few class storm lawsuits, still ongoing.

Call it the “Plateau Principle (version 0.9beta)”:

When Apple doesn’t give customers a clear, present-tense reason to upgrade, iPhone economics default to the top of the range (ASPs) and to timing quirks, supply shocks, discounts, or policy incentives.

- That’s been true since the 14.

- It was survivable in the 15.

- It became conspicuous in the 16.

And the 17, although being offered what seem some great trade-in offers on the surface, neglects to mention the exceptions in the small print and actually comes with a price hike, especially on up-spec’d orders.

Which means if you want to argue that “5–10% growth for the 17 is extraordinary” and upgrade AAPL to $290 (or $315 at the top end, adjusted for the date of publication a day later than planned) on the basis of that, and some so-far rumour of a Samsung-style foldable iPhone in 2026, which Samsung have been selling since 2022, you have to be capable of holding several contradictory truths in space and time in your mind all at once.

This is something only “Q” from Star Trek has ever really managed to pull off (and even then, Patrick Stewart as Jean-Luc Picard regularly used to outsmart him) and Kathryn Janeway in Star Trek Voyager used to get the better of this omnipotent being (the allegory of a modern day analyst like JP Morgan’s Chaterjee)

So, back to “funny-mentals” and analysts: you first have to strip out the tariff pull-forward and China’s discount noise from the 16. Otherwise, you’re not applauding a super-cycle based on comparables rather than absolutes. You’re applauding a mirage. First AI didn’t matter, according to Apple, until and including 2023. Siri was kept boxed for 15 years. Suddenly AI mattered, and it was the centre piece of Apple’s entire 2024 raison d’etre. Suddenly, again, the wind changed when they couldn’t make it work, it was kicked into the long grass in March 2025. By WWDC 2025, it was all about “Liquid Glass” and Apple’s F1: The Movie, followed by a lot of promises about “AI and Siri by May 2026, maybe.”

Now, it’s all about:

- “Orange is the new black.”

- ”Vapour cooling” as a marketable feature (not to be confused by Gen-Z’s enthusiasm for vaping – a feature which had Apple though to include (“Vaping Chamber,” anyone?), Gen-Z and many Millenials would be throwing their new Nothing phones in the trash to embrace.

- The re-naming of Apple’s “camera bump” as a “Plateau” feature.

- An iPhone Air so skinny it looks like it belongs in a 1990s size-zero fashion show; hardly the kind of design ethic to brag about in 2025., and that’s in spite of having a boob tube at the top ruining it’s mockery and form factor in the process.

“Nothing tastes as good as skinny feels,” Kate Moss, supermodel, once said but in these days of big is beautiful, adoring skinny is usually seen as a hate crime, so Apple are arguable off-trend on this (although their boob tube addition is certainly a nod to the trans community, arguably).

Diversity Rules (as a noun, and a verb)

The iPhone Air is credible in its ED&I credential, beyond a shadow of a doubt, but whilst it has something for everyone, it leaves everything something short of being 100% finished.

I’ll wait for Gen 2 or 3, when they’ll likely have “levelled the plateau” and charm us with the amazing form factor of “look mum, no bump” narrative, making all legacy iPhone Air owners red with embarrassment at their now-declared ugly models, and forced into an “iPhone Supermodel Edition Supercycle Upgrade™,” thereby making every analyst declare the dawn of the 18th coming of the mythical supercycle (oddly when I type that, iPadOS autocorrect tried to substitute the word with “hyperbole.”)

Because, by 2029, a “Plataeu” will just be seen as so “passé” and the world, healed from obesity by Mounjaro and Ozempic by then, will once again applaud “skinny is good: without feeling condemned for being body fascists.

In the meantime, in 2025, your new Air is likely to run out of battery just as you’ve left work and you’re on the way to the pub with your mates, in time to miss that call from your partner asking why the hell you’re not home already. Better order that $99 battery pack. Or just order a Pro Max.

Finally, the “rabbit back in the hat” trick which only Apple would dare try and conjure up, revealing the AI “magic” in 2024, with the promise of “the best artificial intelligence ever and a real Siri assistant,” only to pretend nothing happened in 2025.

And that it won’t matter until 2026 again, at the earliest, at which point, no doubt, people will say “Apple always bide their time but get it right when they do.”

Which isn’t an excuse for strategic failure, but simply the end of a long walk of shame.

If you didn’t read my summary of fifteen years of Siri and AI failure last month, here’s news for you: Apple ruined Siri post-acquisition in 2011, ruined it again in 2018 when they ditched the new version named “Project Blackbird” internally, ruined it again in 2024 when they tried to recode it and found it was an impossible task with developers internally naming it unsalvageable due to its spaghetti junction coding and legacy flaws, and again in 2025 when LLMs received 45 seconds of attention this year as attention was put on the back burner by Craig “Hair Force One” Federeghi, who seemed to have more fun driving a mock-up CGI F1 car around the rooftop of the Apple Campus than he agreed show in any enthusiasm for AI.

Honestly, Read This: It’s The unvarnished truth of Apple’s squandered 15-year lead in agentic task fulfilment and AI, written up with no gloss and 100% true. SIri isn’t just late, she’s died of old aged, buried, and whatever re-appears will be a new re-write, not a reboot.

So approaching 2026, AI doesn’t matter anymore, to iPhone users, apparently. Even Krantowitz says so, so it must be true. This, even though GPT is now approaching the installed used base I predicted in June, by Christmas, of 1 Billion users, and Perplexity has now launched an agentic browser, attracting investment valuing it in the tens of Billions.

But no matter, we’re told we can “just use the GPT app” to access AI.

Well, sure, but without that integrated into the OS at OS and App level, that’s a bit like tell someone who needs to use the WC that it’s outside in the cold, in the hut at the end of the garden.

Certainly, it’s there, but it isn’t “present.”

And it is no longer the essential feature touted by Apple two years’ ago, but of course – will be, once they’ve managed to fix their plumbing and tout it from the rooftops as the “Second coming of Siri” (although by historical standards, it should really like “Siri’s Resurrection Story, post-AfIB #5).

That, for now is the backstory to this year’s iPhone launch.

In the context of how the previous five years of launches unfolded and translated into English in case, some readers just don’t do French memes, “the more things change, the more they stay the same” and why the analyst hype and hyperbole is more theatrical and a sign of the gasping despair for any good news which isn’t tainted by the toxicity of 3 years of abject failure to launch anything, of any consequence.

Closing Price of $254 - a 2025 All Time High

And why in an incredible relief rally and humongous FOMO buying of AAPL as the market again soars to new levels, ironically much of which is driven by AI hype and CapEX which the great and the worthy are saying Apple is wise to have avoided, perhaps, and is instead focusing on “building bloody good phones,” even as less people use a phone as a phone than ever before in history. Far from being “doomed,” as I wrote in this article when people were scoffing at AI CapEx, we’re only in the first innings and the rail track and roads are only just being built.

AI is not doomed. CapEx is not “Out of Control.” NVIDIA just invested $100B in OpenAI, and Apple? Shelving its “FMF and PCC and PCP” and other AI acronyms for now, once celebrated as its future as recently as August, and going for broke by turning its signature iPhone into Agent Orange to spread like wildfire, it hopes, amongst anodised space-grade aluminium loving armchair mountain climbers everywhere.

Try getting anyone under 25 to answer their phone without them experiencing a wave of performance terror at the though of holding a conversation instead of saying hru and brb and wbu when you ask them how their day’s been and what they’ve been up to. If they’re had a bad day, just a single emoji follows, not a conversation, usually a 💀 if it’s been a bad one, or just a 💅 if they’re bored. Fun? Gen-Z rarely admit to having fun. 82% of 12-17yr old Americans are too busy talking to GPT for personal therapy (fact not fiction).

Summary: A lot of All Ado About Nothing?

You don’t need Genmoji or AI or even an iPhone 17 to ride the wave of AAPL hysteria and iPhone 17 vapour chamber analysis . Just a lack of critical thinking and conversational skills, something which even the Street, and broadcast media especially CNBC, seem to have fully embraced these days.

Just ask Cramer, who said he was buying one of each of the three iPhone models after working himself up into a frenzy having hung out with Tim Cook for a day. I mean, how did serious financial commentary end up in this state?

Because when you can afford it, who wants just one iPhone to carry, when you can have three?

God bless American consumers, and God bless the Chinese government for subsidising their “comrade citizens” with iPhone subsidies.

Where would Apple’s fabled growing installed base be without them?

(Comments in the comments please, I’d really like to hear subscribers’ thoughts on these matters, and for cues for finishing off Part 2.)

- Tommo_UK, London, 23rd September 2025 | Connect with me on socials : X @tommo_uk | Linkedin Tommo UK | Threads and Instagram tommo.fyi

Connect with me on socials : X @tommo_uk | Linkedin Tommo UK

Coming next in Part 2: The Real Story behind the iPhone 17 numbers, and what they mean for Apple investors: $250 mediocrity, or my $400 for Q3 2027 target?