Apple’s “Installed User Base” as Hopium or Substance? Well, it depends what you mean by “installed.”

Apple’s “installed user base” isn’t the growth engine investors think. It’s a device count, not a user count. With iPhone sales flat for a decade and services growth stalling, Apple’s narrative leans on smoke-and-mirrors metrics while AI-native rivals like OpenAI and Perplexity surge ahead.

A poster elsewhere wrote:

“Apple’s Installed Base Hits All-Time High As Their Dominance Grows!”

“Apple’s active device install base has reached new heights, showcasing the company’s ongoing dominance in the tech industry. Recent reports indicate that Apple now has over 2.35 billion active devices worldwide, marking a substantial increase from previous years.”

Let’s talk “installed user bases.” He continued with pointing out with fervour:

[That]“Apple sold the same number of iPhones in 2024 as it did in 2015” is of interest, because in spite of that, Apple’s installed base has continued growing.”

But wait…

iPhone sales have been stagnant for 10 years? Yet the stock’s up a myriad-fold, mainly because Apple broke out services revenue separately from about 2018 onwards, sending the PE multiple up from about 17 to almost 30 overnight on the then-assumption iPhone sales would carry on growing between 2015-2025 the same way they had from its launch in 2007 to 2015 and services would “obviously” boom in direct correlation with this growth.

But they didn’t. Services have indeed been a big driver (together with the smoke and mirrors trick of almost $100B in share buybacks a year reducing the sharecount) but there’s a blind spot, even as the poster goes on excitedly that:

This is the blind spot that so many analysts founder on, focusing on market share rather than installed base. They literally miss the growing forest by focusing on the trees being planted.

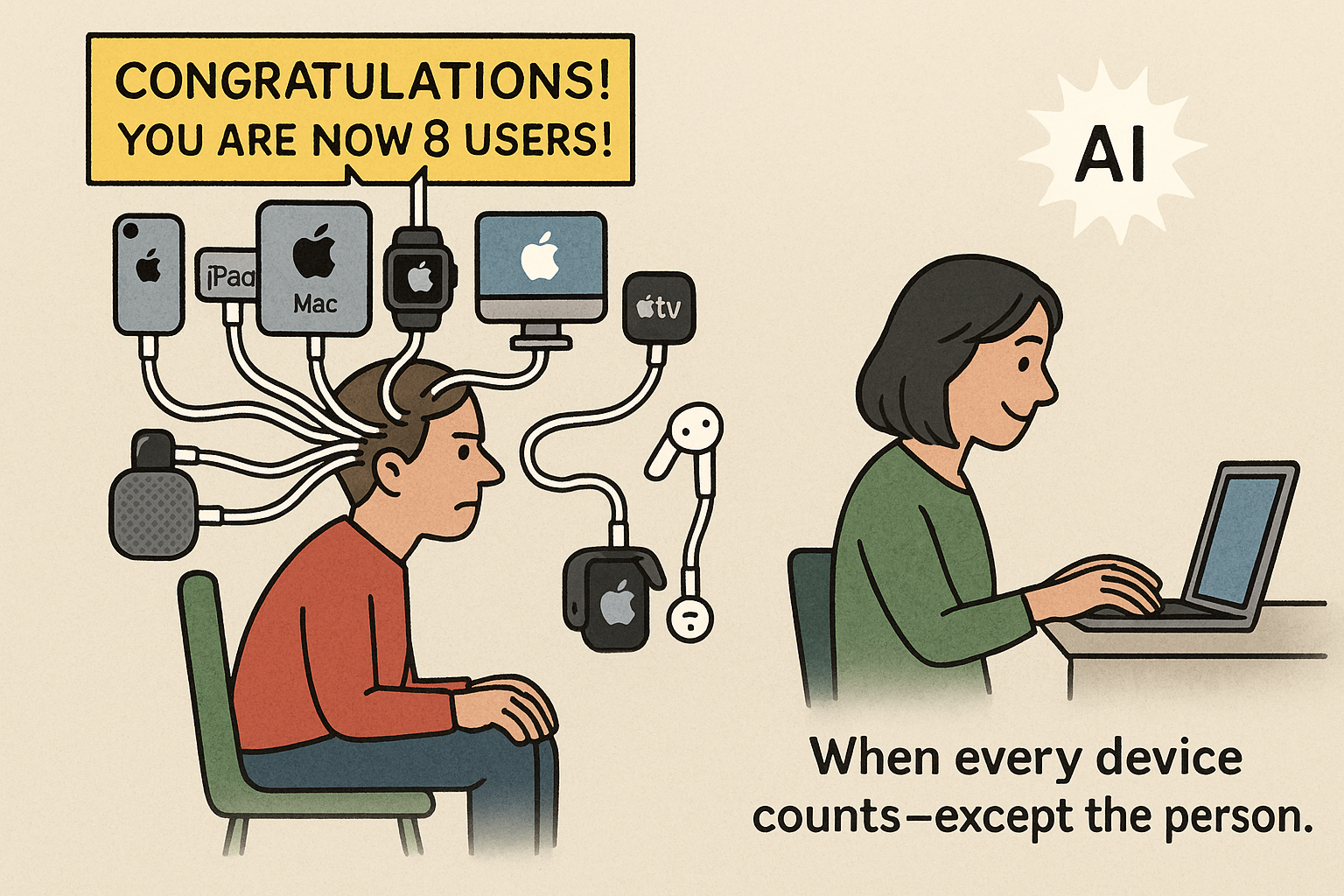

Apple’s magical “installed users base” metric is not a per-user account but a device count. In other words, if someone has a MacBook and an iPhone and an iPad and a Watch (and few HomePod Minis and a few AppleTVs) that magically becomes say, eight “installed devices” as if that implies a corresponding growth of the possibility to sell services to, not just an expansion of the number of devices per AppleID. It’s a bit of a smoke and mirrors metric really but sounds great on an earnings call.

The fabled Installed DEVICE Base is :

- Macs

- iPads

- iPhones

- HomePods

- AppleTVs

- AirPods (just kidding)

The clue is in the phrase “Installed Device Base” not “Installed User Base.”

This is why Services Growth has tailed off because iPhone sales have not gone anywhere but flatlined, and the great hope, services, is now levelling off fast, partly because Apple’s reliance on new services it had planned to offer have had to be largely delayed due to product cancellations (car), delayed (vision products) or #epicfailures (Apple AI and #freeSIRI), while it tries to get its AI efforts on which much of its new services revenue and new hardware products, depend on for launch and are running over 24 months late. Meanwhile there’s only so many AppleOne and Apple Music and Apple TV subscriptions and Apple Care you can book as “sales” from carrier-related mobile plan fees before saturation point begins.

Meanwhile let’s look at a real phenomenon: perhaps that fastest growing phenomenon in the history of tech adoption, ever.

ChatGPT / OpenAI

As of July 2025, ChatGPT has approximately 800 million weekly active users. OpenAI receives 2.5 billion prompts per day globally, with about 330 million from the U.S. alone (so much for them just being “early adopters”).

In March 2025, ChatGPT was the most downloaded non‑game app globally, with approximately 46 million downloads total (13 million on iOS and 33 million on Android).

Recent reports confirm the iOS app alone achieved nearly 29.6 million downloads in a single month, implying Android adoption being perhaps 3x that now, with adoption growing at an almost-exponential rate.

This tallies with the GPT Downloads totalling 70M downloads/month across platforms.

This shows GPT is truly cross platform, cutting across all demographics and crucially is not US-centric unlike Apple, which has almost half of its market locked up in the US because of its truly abysmal pricing promotions and marketing activities outside of the US, UK Japan and China.

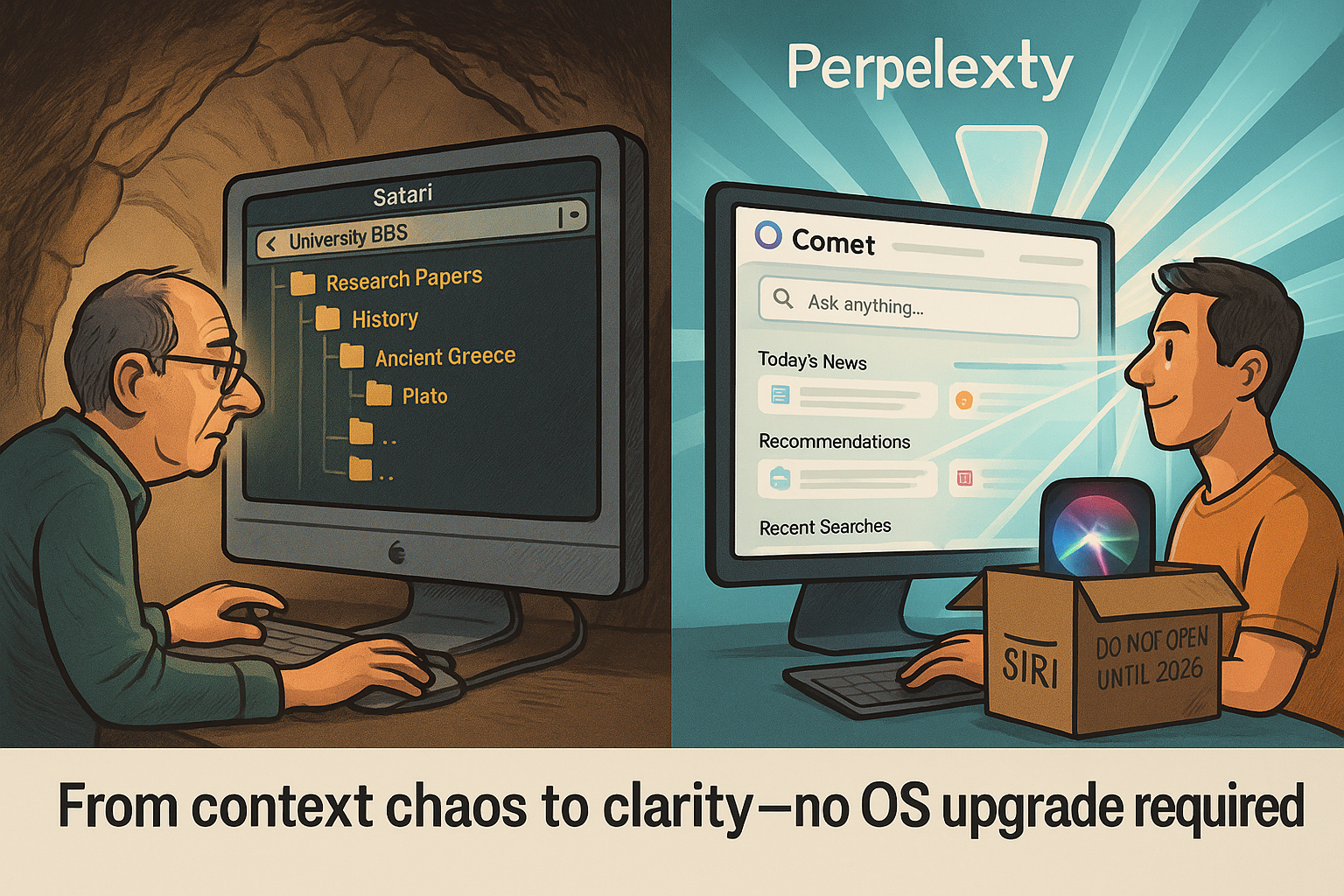

Perplexity is currently rising fast but stands at about 14% of OpenAI’s adoption. When its Agentic OS Comet Browser is released outside of Max subscriptions and early access devs like me, it’ll be available for free subscribers though, and is likely to instantly become the default browser for many users, as it ties in directly with cloud productivity email and calendar apps, and keeps your in-Perplexity browsing and session and context history in one platform - running on top of any other OS.

All I can say about Comet is that it makes using Safari or any legacy browser seem as tedious as trying to look up old research papers on an old online university BBS system and using nested menus lining to files by subject to try and find what you’re after.

In other words, the rise in so the so-called “installed base” does not necessarily equate to anywhere close to the rise in services growth investors are assuming, which is why the multiple expansion which kicked in around 2018 and sent the stock soaring, has now levelled off and contracted again as the “magic” didn’t follow the expected trajectory. This is a bit of a surgical takedown of Apple’s “installed base” smoke show while reinforcing OpenAI’s and Perplexity’s cross-platform scale and direct relevance of their “active users.” Not active installed devices.”

So what’s the point?

The size of an “installed base” means very little if it doesn’t drive services growth or reflect real user expansion.

That’s why the multiple expansion that began in 2018 fuelled by the narrative of Apple-as-services-growth-engine has now plateaued, and in some respects, contracted.

Because guess what does count towards the “installed base?” HomePods and Apple Watches. Last time I checked, there wasn’t a HomePod App Store, and any services solely for the Apple Watch which would move the overall needle.

So - the magic didn’t materialise. It’s not about how many devices are switched on. It’s about who’s actually using the future and who’s just selling more “connect widgets.”

So when Tim Cook takes to the earnings call podium and rolls out the now ritual incantation—“our installed base is at an all-time high”—pause before you applaud. What exactly are we celebrating? A stat that includes HomePods that can’t download apps, Watches that piggyback off phones, and Apple TVs that haven’t been central to anyone’s digital life since Netflix went platform-agnostic? It’s a cumulative count of devices switched on in the past 90 days, not a measure of unique users, nor of expanding demand, nor even necessarily of commercial opportunity. It’s a headline metric—useful for optics, meaningless for forecasting.

And key to this: Apple iPhone sales have flatlined for a decade.

If anything, the “installed base” figure has become a proxy for what Apple wants the future to look like: a self-contained, vertically integrated ecosystem where owning more Apple hardware correlates with spending more on Apple services. But the underlying assumption - user engagement per device is expanding - isn’t bearing out. Services revenue growth has visibly slowed. Attach rates aren’t rising meaningfully. And unlike iPhones, many of these “installed” devices don’t offer Apple much in the way of monetisation paths, beyond showcasing how good the supply chain still is.

That’s the fundamental problem with this framing: it mistakes saturation for expansion, and inventory for influence. Apple isn’t onboarding new users at scale—it’s increasing the number of devices per existing user. That’s not platform growth, that’s accessory proliferation.

Now contrast that with the only platform on the planet today that is actually experiencing exponential user base expansion: AI. Not “AI” as a marketing flourish slapped on top of features, but actual interface-level AI.

ChatGPT hit 800 million weekly active users as of July 2025, and does so across iOS, Android, Mac, Windows, and increasingly, dedicated LLM-native browsers like Perplexity’s Comet.

These aren’t “devices sold”—they’re users engaged, prompts served, and sessions generated. It’s raw, unfiltered behavioural data tied to real-time task execution—exactly the kind of usage Apple has long failed to generate through its own services layer and illustrating clear real time user trends and usage patterns.

AI-native usage doesn’t rely on hardware cycles. It isn’t tied to App Store lock-ins. It spreads virally through need, context, and convenience. It is, in short, the first interface evolution since multitouch that genuinely resets user expectations and it’s not coming out of Cupertino, even though they’ve been putting to squeeze it out arguably since 2023.

So let’s not confuse “installed base” with relevance. If anything, it’s a trailing indicator—a museum exhibit of Apple’s past dominance, not a signpost to future growth. Meanwhile, LLM-native platforms are redefining what software feels like, how queries become actions, how workflows consolidate, and how operating systems might dissolve entirely into the background. That’s not a forecast - it’s a trend already happening and as I predicted now a metric being increasingly recognised by analysts.

And no, growth in China or India hasn’t reversed this.

Yes, Apple’s India sales are growing—but off a low base, and mostly in older iPhone models sold as “new” to a rising middle class. It’s not a land grab—it’s a salvage operation.The real growth story isn’t in how many widgets Apple can sell. It’s in how many minds are now wired into daily, agentic interaction with AI. And by that measure, Apple’s most recent milestone isn’t dominance but distance

China? Ironically got an iPhone sales boost this quarter thanks to a Chinese subsidy boost! Maybe Trump should charge Apple a punitive tariff for accepting Chinese government subsidies?

Why The “Installed Base” metric bandied about matters

This isn’t semantics—it’s narrative framing:

- Device count inflates ecosystem size.

- It’s often used to justify future Services revenue growth assumptions, despite flat iPhone replacement cycles.

- It masks the reality that existing users own more devices, not that Apple is onboarding new users at scale.

- It makes a mockery of projected services growths charts oft used by both professional and amateur AAPL analysts alike by conflation A with B and getting Z.

The installed-device metric may still be useful to understand hardware footprint. But conflating it with user-base growth is misleading and not remotely what Apple presents.

So a quiet step back, while the world moved forward. Because last time I checked, HomePods, Apple Watches, and AppleTVs didn’t generate much in the way of services revenues, even if the plan five years ago were that they would be.

And if you hear Tim Cook start to talk about GenMoji when analysts start to ask him why Apple lost another key AI engineer to Meta just say the time of writing, hit the panic button.

With 2 days to go, have a look at my Q3 Preview from a 4 weeks ago.

And don’t forget:

#FREESIRI

And How Apple could still hit $400 for Q4 2027 (if it can stop losing its top AI talent to Meta)

— Tommo, London, 29h July 2025 | X: @tommo_uk | Linkedin: Tommo UK

See the share buttons to LinkedIn, social media and email, please, use them and help keep .fyi free at the point of readership.