Apple’s iPhone 17: Post-Launch Hype, “Liquid Glass” Illusions, or a Q4 Comeback Story?

iPhone 17 hysteria is here - but are lead time charts and orange phones really enough to push AAPL over $260? With AVP seemingly shelved and AI stalled in 2024, Apple’s silence is golden… for analysts. But beneath the rally lies a void of vision. What if this is success by absence, not by design?

Shout out - this is a long piece.

I’d originally meant to write at about half the length, on launch-day, but as events unfolded, I decided to hold back and more and more material accumulated which was just too germane to this subject to exclude especially this close to Q4 earnings. So I’m offering the analysis, the brain dump, and all the signalling I can pick up on, to muse over, in one go, with this little table as a justification:

“If the Vision Pro was Apple’s most expensive dead-end, the iPhone 17 is its most exaggerated ‘fresh start.’ Both are different faces of the same problem: hype as strategy.”

The AVP may be dead (we don’t know, and rumour mongerers Gurman and Cybart are dissing one another over who is gaslighting who), and the iPhone 16 mercifully relegated to yesterday, but what’s really happening with the 17, whose hype has driven AAPL up by about $50 on what seems like analyst hot air and euphoria alone, because there certainly aren’t any sales figures to hang this off yet. It maybe it’s the people of a rumoured foldable (courtesy again of Mark Gurman) for October 2026, which is driving the price up? Because it certainly isn’t AI, or innovation, those two pillars supposedly key to Apple’s growth, which are anywhere but on display.

Siri Remains Boxed.

The AVP seems to have been axed for now.

AI is now dismissed by the same analysts who called it an essential to the iPhone story, as “unimportant to iPhone buyers purchasing.” Well, that’s a given isn’t it, because if it was the most important feature they wouldn’t be a buyer participating in the survey would they? Perhaps the question which should be asked is, if AI and true integrated intelligence were present in a new iPhone (in the way Gemini works automatically in the background on Samsung phones and Google), would it make you more like to buy an iPhone? But that wouldn’t fit the narrative.

Apple’s iPhone 17 launch may look like a super-cycle, but six years of iPhones (discussed in Part 1) tell a different story: subsidies, tariffs, plateaus, and theatre. From 5G highs to tariff panics, TOMMO.FYI cuts through the hype to show where Cupertino’s magic really lies — and where it doesn’t. Two weeks ago we looked at the launches of the iPhone 12 to 16 and how relatively speaking they performed, where there was friction, and where there was success, and why. Last week I took a break to look at the flop of the AVP and what it does, and doesn’t say about Cupertino.

In this Part 2 we’ll look at why the 17 may be much ado about nothing, and certainly is not the panacea it is being made out to be.

Part Two: The iPhone 17 Launch Hysteria — Continuing the Plateau Playbook or Genuine Breakthrough?

At the stroke of Apple’s oft-punctuated launch hour, 9am on the morning of Friday, 19th September 2025, the world awoke to familiar scenes: Apple stores swarmed with enthusiasts queuing for the iPhone 17. This ritual, now choreographed with the finesse of a seasoned Broadway production, raises the perennial question:

Is this really a super-cycle moment, or just another act in a well-rehearsed play, remixed for 2025?

Last year’s iPhone 16 promised the dawn of “Apple Intelligence,” an AI revolution to energise the plateau. It didn’t come. Now, against a backdrop of savvy logistics, pricing stratagems, and glossy marketing choreography, Apple courts the markets’ renewed optimism. Analysts breathlessly forecast 5–10% sales uplifts, JPMorgan hikes price targets from $255 to $290, Apple’s shares hover near $258, and Jim Cramer publicly pledges to buy ”all three models” in a love-fest with Tim Cook worthy of daytime television (which it was, on CNBC, with Cramer and Cook seemingly high on hash cookies and punching the air with orange superlatives celebrating the boundary thin-ness of Jim Cramer himself, Tim Cook’s natural physique and the iPhone Air held up by the two of them with so many superlatives it’s a surprise the entire camera crew didn’t rise of the ground with the hot air coming out of the Vapour Cooling chamber’s vents.

And then at the end of the day, someone leaked a rumour that Apple had raised its production orders for (something to do with iPhones) by 30% and the stock jumped to close at $245 that week (rising to $258 a week later, Friday 3rd October). Convenient timing – someone made a killing with that drop, but hey, this isn’t a stock market we’re talking about any more but a “West gone wild” on dopamine.

But, under the reverberating applause, what does the spine of cold data reveal?

Revisiting Part One’s Baseline: The Plateau Redux

In Part One we detailed the iPhone’s evolving tale from 12 through 16, painting an unvarnished picture of diminishing returns dressed up with peak marketing flourish. The 12 was unequivocally a super-cycle, powered by the 5G wave and a design language overhaul that triggered a leap in units, explained by Canalys with a sold 82 million units in initial quarters and revenues leaping to $192 billion.

Subsequent cycles - the 13’s “boring good,” the 14’s critical supply disruption distortion, the 15’s China-challenged premium skew, and the 16’s tariff-fueled demand pull-forward - showed less growth in volume but increasing reliance on ASP (average selling price) gains, especially driven by the Pro and Pro Max models with their camera improvements and experimental materials (one year aluminium is passé and titanium is in, and the next, as with this year, titanium is so not the done thing (because Apple couldn’t get it cool enough, not because it isn’t a better material” and Apple touted “Space Grade Aluminium” with telco-fetish advertising or “raw aluminium blocks being milled an drilled” as if each of the finger was of millions of these they’ll sell are lovingly hand braggers by gnomes in Switzerland, like Rolexes).

The unit growth across these years fluctuated within a modest range of low single-digit percentages or flat, while revenue gains were largely owed to pushing buyers toward higher-margin models and the expansion of services. The share price had already surged with the breaking out of “services” in 2018 as a separate line item, and with that including Apple Care insurance and Financial Services, this sector boomed, adding considerably to gross margins just when hardware was having a tough time doing so, and buybacks of almost $100B a year now, making up the otherwise alarming shortfall in EPS.

Bringing this forward to the 17, the touted 5–10% uptick is arguably just a continuation of the same “plateau economics” detailed rigorously in Part One: modest unit growth buoyed by pricing optimisation and supply management rather than a breakthrough leap. And yet, by Friday’s close, this was enough drive the stock up to almost $260, some $90 off its earlier April low. And people are calling AI a bubble? Good Grief, as Charlie Brown might have said.

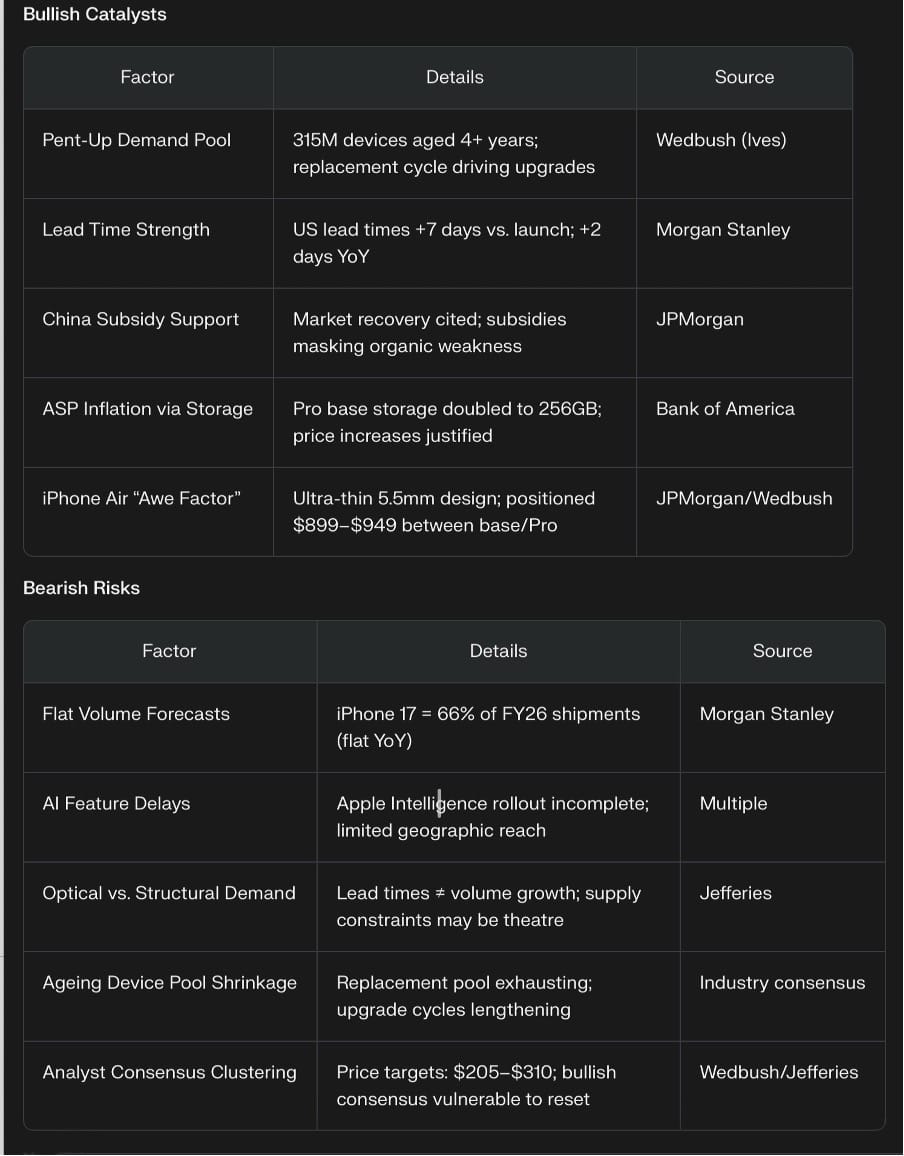

Let’s take a look at post-launch analysis by our so-favourite “pros” of the iP17 and the Air, three weeks on from the release:

Recent analyst notes on the iPhone 17 and iPhone 17 Air present a sharply divided outlook for investors. Early enthusiasm has given way to caution as Wall Street scrutinises actual demand, innovation claims, and the implications for Apple's margins amidst tricky macro conditions. Jeffries even downgraded Apple on iPhone sales numbers - causing a pre-market dip to $240 before every frothing “buy the dip” Gen-Z written GPT automated trading algorithm jumped in headfirst and drove the stock to close at $258 by the end of the day.

iPhone 17 Analyst Sentiment

Initial demand for the iPhone 17, especially the Pro models, was strong and "10%-15% ahead of iPhone 16" according to Wedbush, prompting some price target increases and a short-lived stock rally which sensibly paused, before then beginning a head-scratching run up as AAPL returned to ride amongst the so-called Magnificent Seven. It seemed as though the return of Dan Ives to the Folds of the Faithful was enough for investors, and CNBC, to don their own Colours of Benetton (remember them?) jackets and floral shirts and cheer Apple all over again, as if rediscovering a long lost friend who they pretending they hadn’t been ignoring en-masses since April, but had just been “taking a break” from.

Jefferies and others have warned that early momentum is already fading, with preorder and in-store excitement not translating to sustained growth. There’s scepticism about whether this launch represents a true “super-cycle” or just the result of pent-up demand and clever supply management, and recently downgraded AAPL in the face of their peers gushing about the IP17 prospects – bold move.

We’ll find out in 3 weeks at the end of October, if they’re right, or not,in the upcoming earnings call but I suspect any number of rationales will be found to explain away tepid numbers (“The Air wasn’t available in China,” as an example).

- Investors are wary of Apple’s decision to absorb $1.1 billion in tariffs without raising prices, fuelling fears of margin pressure.

- Multiple firms downgraded Apple post-launch, flagging a lack of disruptive features—AI upgrades were delayed, and the hardware was seen as incremental.

iPhone 17 Air Highlights

The iPhone Air has received praise for its radically thin 5.6mm design (if you ignore the “plateau”), which is viewed as an engineering showcase rather than a direct driver of a new upgrade cycle and already being spoke of as a design exercise rather than an innovation. Apparently Apple are using it as a beta test for cramming technology into a super-thin iPhone Foldable in a year’s time. Well, for its price, and almost negligible components except a battery, I’m certain that beneath the surface, the Air is in fact, an absolute margins generating monster, and probably costs less to manufacture vs its selling price (plus mandatory $99 battery pack and $xx for a case…

“While the Air is seen as Apple's boldest hardware statement in years, initial sales and preorders appear more muted than for the larger, pricier models, possibly due to higher availability and subdued consumer interest in design over substance.”

Some analysts suggest that the Air’s modular battery strategy and component miniaturisation could point the way to a future foldable model, but for now it seems a niche proposition.

Market & Investment Implications

The consensus is that Apple’s iPhone 17 lineup, while solid, did not deliver the AI leap or transformative innovations hoped for by analysts and investors betting on renewed growth.cMany see pricing and demand strength propped up by increased carrier subsidies and trade-in incentives, not true underlying market pull.

- Several major analysts have set price targets below the current share price, warning of downside risk if the ongoing sales plateau isn’t shaken up by genuine product breakthroughs or clear AI leadership.

- The stock saw rollercoaster action: rallies on headline preorder strength and innovation claims, followed by retracement as the reality of incrementalism and margin pressure set in for the investor class.

Investor Summary

For investors, the clear message is to temper expectations:

The iPhone 17 launch is defined more by skilful showmanship and iterative improvement than by disruptive innovation, and continued scrutiny is warranted given the risk/reward balance now facing Apple’s stock.

iPhone 17 Analyst Summary: Risks & Catalysts

Key Takeaway

Analyst optimism centres on lead times and pent-up demand, yet volume forecasts remain flat and AI features incomplete, suggesting the iPhone 17 cycle is more about margin management and optics than genuine unit expansion

The 5–10% Magical Growth: Pricing, Miniaturisation, and Mix

The proclaimed 5–10% volume growth is tempered when viewed versus last year’s artificially propped base.

The iPhone 16 cycle closed on tariff-pulled pre-buy volatilities and generous China subsidies, casting a shadow over a true baseline for growth. Industry forecasters like Bloomberg and Reuters reported early iPhone 17 sales outperforming the 16, especially for the premium Pro models (caveat - pre-order sales waiting times, actual sales weren’t recorded, again calling this Oracle of Delphi forecasting trick pulled every year into question as a genuine forecasting methodology), citing fourfold trade-in sales growth on JD.com and lead times increasing about a week longer versus last year, suggesting stronger demand. Ming-Chi Kuo reports production targets for iPhone 17 Pro and Pro Max were set 25% higher than last year.

“That’s not much of a surprise, given this is the same guy who reported Apple had slashed iPhone 16 orders last year by 30% following lacklustre demand.”

What Ming takes away one year, he adds back in the next. The market, just sees the addition, and doesn’t net off the set-off but that’s who our CNBC-driven markets work with these days. You’ve got 20 seconds to make an impression, and these guys do it with panache.

However, much of this is likely premium mix and pricing leveraging incremental product tweaks rather than dramatic innovation.

The Air model is celebrated as a marvel of industrial miniaturisation: To riff with percentages lets call it:

- 90% battery,

- 8% components,

- 2% case composition,

… which illustrates the cost-trimming Apple engineers have painstakingly achieved. These efficiencies bolster gross margin at the cost of some component compromises that even loyal fans admit affect battery life and feature robustness.

Far from being an “outlier risk” of a product, the Air is actually the cheapest and probably highest margin iPhones Apple has released.

They could have spent a bit more CapEx to get rid of the “plateau” and squeeze a bit more out of the battery, for the price, but - since I’ve historically made a big deal about Apple’s lack of willingness to actually ship, I’ll give them a half-pass on this somewhat compromised product which I almost (but can’t) love, and wait for Gen-2. Or Gen-3. When it doesn’t have a boob tube, and everyone with a Gen-1 Air will wail with shame at having an “Air” with a “Plateau” forcing an Air Supercycle Upgrade phenomenon in, I predict, around 2027.

Apple’s pricing nimbleness shows in this

The base iPhone 17 starts at $799, widely perceived as competitive, contrasting sharply with the Pro line kicking off at elevated storage capacities and price points that push the Pro Max over $1,200 all the way up to $2500 if max’d out in the US and approximately $1,599 and almost $3000 fully spec’d in US equivalent in some European markets, especially the UK where Apple inexplicably hiked prices on MacBooks and iPhones by a whopping 15-25% after Brexit, even though the currency has since returned to its pre-Brexit level, making UK consumers milking cows for Apple’s gross margin story.

And then there’s The “Air Battery Pack,” priced at $99, which effectively forces a mandatory upsell on battery life for Air buyers and is deliberately incompatible with other models: a masterstroke in profit optimisation (and consumer frustration).

To add insult to injury, literally, Apple had valiantly shown an iPhone Pro undergoing what can only be called an assault course of scratch testing: flying through clouds of broken glass, screenfulls of keys, coins and other sharp objects, and all without a mark or scratch. “Space Grade Aluminium,” they screamed!

Of course, in real life, it isn’t like a CGI movie, so buyers increasingly screeched and squealed in despair at how easily their lovely new orange plaything actually did scratch.

Apple stayed quiet on week on. In week two, they blamed too much use of the magnetic charger pad, and then finally, last week, they just simply advised buyers to “get a case.”

Gee, thanks Apple. You launch Orange is the New Black, give us Deep Sea Blue, ostensibly because black would scratch too much and then tell people that their “unscratchable” iPhone Pro Max needs a case to survive their pockets.

Street reaction? AAPL went up anyway.

In fact, AAPL rose higher on every piece of mediocre news out of the company, as if the Street needs every stock in the so-called Mag 7 to be firing on all cylinders to justify this incredible market rally continuum, even though breadth is lousy and stinks, and there are clear signs of a rotation building.

But to return to the point, the supposedly unscratchable iPhone Pro is, actually, incredibly scratch prone, and you will need a case which makes their advertising almost as much of a mockery as advertising the iPhone Air as an “Air” monicker-worthy device, when it still has a boob tube camera plateau on its chin. Poor show guys.

Upgrade choices are another critical margin engine.

Flash storage adds are gargantuan profits in Apple’s pocket: a 500GB increment, roughly $50 in components, can tack $500 to final consumer cost. Discerning buyers may baulk, but many comply for prestige and perceived longevity.

Or just because for them, size matters, even though they also subscribe to Apple One with two Terabytes of cloud storage.

Clever services revenues and margins, again proving a neat trick for Apple along with people senselessly kitting out their iPhones with two terabytes of storage when many are happy with just and ⅛ or a a ¼ of that on the MacBook’s internal 256 or 512 GB SSD drives. I would love to re real world statistics showing how many MacBook buyers need 2TB of storage when the base model comes with 512GB, and yet are happy to spring an extra $1500 to upgrade their iPhone 17 Pro Max to a 2TB version. Are they downloading content from the Vestager Hot Tub up to run locally? The public need to know. It rather, they couldn’t care less, they just need to come something, and have been convinced bigger is between except when it’s called an Air, in which case thin—ness is a virtue and the camera becomes “is that just a plateau in your pocket or can I assume you’re pleased to see me,” sly comment.

Apple’s is a dab hand and knowing how to squeeze every last drop out of its fan base. While shareholders are gratefully watching their dividends, it can’t be denied these come at what is, by any metric, enormously over-charged upgraded specification fees with absolutely no rationale reason logic or fairness to them.

Pricing Strategy: Not Just Numbers, But Geographic Realities

Europe offers Apple both a challenge and a paradox.

The UK market, often described as the most Apple-penetrated in Europe, bucks the trend with solid volume and revenue growth. By contrast, continental Europe remains a mystery of steady but uninspiring shipments. VAT, import duties, and less rapid currency adjustments add 20–30% price premiums compared to the US, limiting volume expansion.

Meanwhile, emerging and less saturated markets remain a hinterland of untapped opportunity. Platforms like IDC India report Apple climbing (from a tiny base) rapidly - a 35% shipment growth underscored by iPhone 16 and bolstered by iPhone 17’s launch - but Apple’s pricing strategy has yet to truly embrace volume acceleration over margin maximisation, as the company chooses a cautious route, pushing premium pricing and preserving exclusivity.

Nothing Phone Looms In the Rear View Mirror

Taking a quick detour, the Nothing phone, a UK startup gone viral with Gen-Z and manufactured in India, has surged to capture 2% of India’s entire cellphone market from, well, nowhere, so Apple is likely going to face strong overseas competition even in markets where it build as well as sells, like India, thanks to innovation from companies such as Nothing.

With it’s recent inward investment, Nothing, which offers a conjure ecosystem of products (Nothing‘s watch sells f is now more than a unicorn, and rapidly becoming a trend-setting disruptor (I wrote about this extensively in my article about Gen-Z and their buying preferences on my TOMMO.FYI site if you drop by).

The contrast is stark: conduct the same analysis in the US or Japan, and one finds saturated but premium-hungry segments; in Europe, an uneasy truce of brand loyalty mixed with price sensitivity leads to the “tick over” behaviour detailed in Part One.

A recap of what the real story has been behind the iPhone from 12-16, prior to this article

Expansion would require Apple's willingness to jettison premium pricing in favour of unit growth, a strategic pivot not yet evident and one which requires a new global strategy and more complex set of metrics to overlay, something Apple’s tightly knit and Sino-US focus seems unwilling or unable to re-imagine even though this low hanging fruit might yield and extra 20% in iPhone sales alone and pave the way for another domain for geographical dominance.

NOTHING just completed a round of fundraising, promising their new imminently to be released OS 4 will feature the entire OS based around agentic AI, linking – at will – all apps, data and sensors you give it access too, including shared “playgrounds” where you can interact in a sandboxed environment with other (ie friends, colleagues, and family).

This is something so way beyond anything Apple has even discussed, let alone demonstrated, that it shows how far back the company is in its thinking, yet alone its ability to articulate the benefits, of AI, is. That it has dismissed AI for now is not as sign of lack of demand, but a lack of Apple’s passion and vision for telling its consumers how and why AI can be used for their benefit, and demonstrating the use-case in what Steve Jobs by now would have turned into a “one more thing,“ of earth-shattering impact.

So the future, right now, is Nothing with its minimalist interface, and groundbreaking approach to UI and UX design, and core OS philosophy and that company is focusing on functionality and accessibility, not “Liquid Glass.”

It is truly something Jobs himself would have embraced in its embodiment of defining the use case for AI at an OS level to deliver just a better life for users, not “a Veritas Question Answering Machine” if you believe the rumours, which sounds like something designed by Q from an unreleased James Bond movie, or rumours that Apple is about re-activate Siri as a “question answering machine” are true and to be called “Veritas.”

Sounds more like a truth serum from Harry Potter than anything Apple should be using. Did Meta buy their marketing department too, as well as all their AI talent?

The Service and Peripheral Ecosystem: Small But Tactical

Amid hardware plateaus, the ecosystem including AirPods Pro 3 and Apple Watch Series 11, while individually contributing modest revenue slices (~5% for AirPods), create soft locks and retention ladders critical to future upgrade paths.

These add-ons and services form a veritable shadow economy inside Apple’s financials, subtly supporting ASPs despite unit softness and offering a way to ensure people are lured into the ecosystem by additional devices (often offered as part of a carrier airtime contract) and designed to keep consumers within the Apple Ecosystem Walled Garden forever after.

AI’s Great Vanishing Act

The elephant once thought to halt the plateau was AI: the transformative, the game-changer Apple itself heralded in 2024’s product teasers. Now, AI's conspicuous absence in iPhone 17, especially a Siri assistant that remains a punchline, smacks of strategic retreat.

Executives have seen their AI talent raided by OpenAI and Meta, which promise less brass and more collaboration. Meanwhile, GPT and related AI tools balloon globally, nearing a billion installs by Christmas as forecast by me in June, dwarfing Apple’s muted efforts.

From Part One, we know Apple’s AI saga is marred by multiple attempts to rebuild Siri, all ending in failure or delay. The company’s failure to integrate AI convincingly removes a key upgrade incentive, pushing pressure back onto hardware innovation and pricing to sustain growth.

I covered this extensively once long article cataloguing 15 years of abject failure to capitalise on Apple’s acquisition of Siri in 2011.

If you really can’t accept Apple bought and then gave away an AI lead as far back as 2011, just read this article I beg you, and stop making excuses for the company “getting it right in the end.” They’ve had 15 years, and about as many flops! When is enough, enough?

Distortion Fields and Manufactured Scarcity

The Reality Distortion Field, long a comedic foil, is alive and well and on the return. Apple’s logistical choreography is a masterclass: controlling stretch in supply chains, limiting inventory access, and drip-feeding product availability to sustain hype and pricing. This is Apple’s tour-de-force when it comes to managing optics on iPhone launches, as it controls both the supply, the the narrative, and the actual delivery times. Including “faked” delivery lead and wait times.

This “manufactured scarcity” nudges buyers up the price ladder and keeps analyst narratives positive despite the underlying unit sales growing at a tame pace.

Recent weeks’ wild lines at the doors of Apple Stores (manufactured by collection slots pre-booked for on-line buyers, not by campers-of-old-days buyers who lined up overnight, not knowing if they’d get to the sales counter in time before supply ran out) were interpreted as wild demand by analysts who almost a seemed to lose their minds at the sight of people seemingly-queuing up to buy an iPhone.

Delivery lead times, although a signal of sorts of renewed interest, are complicated by this dance of supply-side constraints and market regulation that enforces delivery timetable reporting. The “lead time gospel” is just that: it’s a fuzzy rollercoaster driven more by shipping slots and regulatory and consumer protection requisites deadlines for online purchases than precise real-time customer demand, but given analysts can just tell their interns to keep on seeing what “delivery times” are online by just constantly logging onto the Apple Store or Carrier’s stores all day long, they’ve got something they can use to provide some form of metric to use as a quote machine and ticker tape - but haven’t we seen enough of these charades to know these initial “virtue signals” actually end up signifying absolutely nothing whether positive or negative, after the logistics chain settles down by the end of October?

Apple keeps the real data for itself.

If you dig into it behind the scenes, every cell phone carrier exec will vent with frustration at the darkness Apple keep them in during pre and post-launch, ensuring Apple can control not just the shipping roll out and logistics, but also the headlines and narrative, and crucially, access to its own products for its own store, as it deems necessary.

Carriers often just wait, hoping and praying, for a shipment to arrive so they can fulfil customer orders sometimes stretching into months, even when you can buy the same phone in an Apple Store over the counter the same day.

The Market’s Dance: Hype, Reality, and the Road Ahead

This year’s market capitalisation swing, from mid-$160 lows in spring to $258 peaking on “Liberation Day: iPhone 17 edition”, is testament both to optimism and forgetfulness: a market eager to believe a “growth story” when fundamentals show little more than a slow grind upwards from a low base.

JPMorgan’s bullishness is founded on a largely mix-driven revenue lift and a 2% unit sales increase forecast, really, the “bare minimum” to maintain valuation multiples, with cautious eyes on a potential foldable iPhone in 2026 to reignite excitement.

A 2% uplift in unit sales permits a $50 increase in their AAPL price target? Someone’s been smoking a lot of hopium, but let’s not forget these price target increases mirror exactly what happened during the iPhone 16 launch, and AAPL’s price movement and fervent upgrade notes again mirror this launch, which fell to pieces just a month or two later And saw the stock plunge from $240 to $200, up to an ear piercing $259 at the end of December 2024 and then crashing to disasppointment to $167 in April 2025. So colour me a fence sitter, having watching these events live, for 18 years now, until the real numbers come out not this quarter, but the following one which will truly capture the holiday sale.

So, caution rules: When it’s all baked in, be careful of burning your fingers when you reach in the oven for more apple pie: it might be overcooked, and burn your fingers.

Having said all this, Apple’s engineering brilliance cannot be overstated.

Its biggest success in about a decade, Apple Silicon, is almost solely responsible for the rest of the company even managing to stay relevant.

This is the same Apple Silicon department which delivers the revolutionary M1 chip in 2020, and which years prior to that Apple Financial head honcho Lucca questioned the wisdom of the need to fund, asking “can’t they design their chips with less money,” with the same tone deaf ear as Gil Amelio in the pre-return of Steve Jobs days. The company dodged a bullet by Tim Cook personally advocating the need for Apple’s own chip team, and the company has benefitted from that one, enlightened choice ever since – even though it has squandered so much more opportunity on vanity projects such as cars, goggles, and dead end AI attempts costing tens of billions in wasted CapEx, wasted even more precious engineering time, and destroying integrated teams of excellence each time one of these iPhones had to be terminated and remaining talent reorganised – or as we’ve see recently, simply poached by Sam Altman and Mark Zuckerberg.

So the mandated thinness of iPhones was only possible thanks to the the integration of Apple Silicon, and efficiency gains are feats of industrial art riding on the back of this. Apple’s ability to create luxurious-feeling phones while evening out cost structures is a marvel, and and engineering feat in a category all of its own.

But, I would argue, this approach to smoothing out the wrinkles in what should, after 49 years, be a slick and smooth operation, is no substitute for a coherent, well planned, properly funded and perfectly executed vision, and in this area, Apple has proven itself extremely lacking: product design even with astonishing internals, has been simply appallingly slow, lacklustre, iterative and unimaginative.

Where, for example, is the resurrection of a wallet-friendly low priced MacBook?

With the departure of the iBook arguably, and then the departure of the white plastic-shelled MacBook, a new low-cost version powered with an iPhone A19Pro processor with a built in Apple C1X modem for example, could be sold alongside and airtime contract by carriers on contract, extending the ecosystem even further – in the same way other laptop and Chromebook OEMs have been doing for years.

Again, this low hanging fruit, low investment but enormous ROI and expansion of Apple’s precious “installed user base metric,” has been there for the taking for a decade. But hubris over wanting their own modem in their own laptops instead of using Qualcomm’s – as the’ve been using in iPhones and iPads for years – stopped them. And stopped MacBook sales exploding in the process.

It is the lack of movement on high yiel high ROI ultra-low investment and engineering requirement which are making me increasingly question Tim Cook’s label as the genius “for Apple’s next 50 years,” as one of my comment he’s made out to be? Sure he’s a logistics genius and diplomat, but the guy flops as a product man, with a track record to prove it, in spite of all his genius and focus.

It’s just not in his blood, and that’s no insult to the man or his competence, but a tell-tale path visible going back a good 15 years now and which there is no excuse for. The man is a genius, but he’s not the right man to be the “product go-to.”

But returning to the meat of this piece

iPhones through the ages, as Part One illustrated, Apple’s approach to their annual iPhone SKU rollout strategy bears the cost of accessibility and broader market reach.

Over-pricing and “planned upgrades” via battery packs and storage boosts, ever more attractive AppleCare Plus packages and services work in select markets but stall unit growth elsewhere, and over-pricing in markets where Apple could tack on an immediate 20% increase in market share – such as Europe – remain largely muted and on the backcountry as priorities. Perhaps Apple needs to expand its board and stop the standard EMEA grouping of nations recognising the world has moved on from this 1990s approach to geographical map carving? Or maybe it sees a big opportunity in the Middle East where money flows like oil, if Trump - against all the odds - manages, after the “Hamas negotiations” ongoing this weekend, to pull out a peaced deal allowing an “iPhones For Gaza” programme to roll out and boost sales, subsidised by the profits from UK iPhone buyers.

Hope Amid the Haze

There is a muted hope for 2026 and beyond. After three years of AI hiccups, a bungled Apple Car project, and a shelved AVP launch, perhaps Apple, ever the master of measured reinvention, has recognised the perils of hubris.

The promise of future breakthroughs whether that be true AI integration, flawless battery life in a new Air, or the mythic $2,500 foldable, hangs over the horizon as a beacon. Having failed to deliver anything of consequence for several year in spite of its promises, and being punished by investors, suddenly, the love seems to be back thanks to rumours from Bloomberg about Apple products to be released in 2026 (the subject of rumours in 2024, about products to be released in 2025 regurgitated on the whole) and investors deciding they’re bored of punishing Apple and want to love the stock again.

The rumour sites are already bored of the 17, and are now spinning up the hype wheel on the “coming in [autumn] 2026” foldable iPhone, which they “guess” will be base on the progress arising from the thin-ness of the iPhone Air.

I’m just wondering, does a two-panel iPhold mean two plateaus and two boob tubes? Pass me the smelling salts, I’m dumbstruck with anticipation, given this foldable has had me on-edge since 2022 when Samsung launched theirs. Apple will only be running four years behind, yet already it is being called the salvation of the “new form factor of the iPhone,” as if the foldable will be the mainstay, and not the niche luxury priced to infinity and beyond profit it is bound to be earmarked as.

Meanwhile the launch of the iPhone 17 seems to have hit the Zeitgeist for that need and analysts are now frenzied with newly-rediscovered enthusiasm for a stock they’d pretty much all written off by June.

And who can blame them? There’s only so many times you can upgrade NVDIA and TSLA before you run out of things to talk about, so AAPL is the 7th of the Magnificent Seven to be lovingly brought back into the fold as an analyst darling. All’s good for now, on the Street, as tariff and treasuries threats take a back seat to Fed cuts and partying like inflation wasn’t a risk on the horizon and a market so resilient that you’d think it was 1996 with “flying high, miles to go” the mantra, not an allegory for 1999 when the hangover ruined what was otherwise looking to be a pretty good decade!

In the meantime, the vapour cooling theatrics and milled spacecraft grade aluminium tattoos may be superficial gloss over a maturing company, still quick with theatre but mindful of realities. Apple’s Reality Distortion Field, for all its legendary power, is not impervious. As numbers and narratives unravel, insiders and investors alike watch closely: this company is poised between inertia and innovation, masterpiece and mirage, but the curtain will reveal the truth in the end. What’a behind it? Pomp and Pageantry, or Progress?

Strip the Pageantry, Count the Plateaus, Watch Out For New Superlatives

Strip away the pageantry, bikini lines and “plateaus”, and what’s left is a cleaner ledger of what the last five iPhone cycles actually tell us - and how that context should colour the iPhone 17 frenzy.

Part One of this article set the baseline (iPhone 12–16 launches as a long glide with ASP gymnastics).

Part Two (this one) peeled the theatre off 17 (queues, lead-time gospels, the AI that never quite arrives). This close stitches the two together and offers you:

8 checks you should run before you call anything a super-cycle, let alone jump into a buy-programme with earnings just 3 weeks away and the stock back at $258, lliterally on hopium and faithium, beause there are no numbers out yet, unlike the fairy tale of 2024, which drove the stock up to $259 on Ch.

1) China subsidy distortion (Q3 ’25) - Beijing, not Cupertino, juiced the optics.

Q3 ’25’s “resilience” leaned heavily on $250–300 per unit subsidies in China. That doesn’t prove demand; it proves policy. Remove that scaffolding and the iPhone 16 base looks more wobble than strength, which means the 17’s vaunted 5–10% “beat” is starting from a mirage. Add the kicker: iPhone Air still isn’t approved for China (eSIM hurdles). That pushes the prettiest marketing story out of the window for Apple’s most important premium market - or perversely shunts buyers up to Pro/Pro Max, inflating ASPs while units stay ordinary. “May you live in interesting times” was never meant as a comfort.

2) Tariff-scare pull-forward - a one-off fluke, not a flywheel.

Q3 ’25 in the U.S. was juiced by panic buys ahead of threatened tariffs. That’s not a cycle; that’s a calendar trick. It flatters iPhone 16’s exit run and hands iPhone 17 an easy comp. If you’re applauding 5–10% against that base, you’re cheering timing, not traction.

3) Orange vs Black - colour as signal, not garnish.

Omitting Space Black on Pro while splashing a high-vis orange is not a trivial palette choice. In China, orange = auspicious; in London, it reads hi-vis vest meets inmate jumpsuit - an invitation to moped thieves and Vogue’s “last season” file. When genuine novelty is thin, colour theatre fills the vacuum and headlines follow. Semiotics aren’t screensavers; they steer sentiment - and sales - by region.

Let’s just look at this particular choice in a little more detail though, because it speaks more about Apple’s choice of communication strategy than it does, arguably, about offering consumer choice.

- Luxury precedent: Hermès orange is iconic, not accidental. It is aspirational in fashion and luxury. Even Lamborghini leans on bold orange as an extroverted statement. Apple is not blind to those associations. But, frankly, the iPhone Pro Max is meant to be aimed at high-vis professional photographers, not fashionistas. There’s a lesson in there, of aspiration, and vanity which arguably as a one off colour, Apple have managed to monetise, so let’s allow them some kudos for this bold, if brash, decision.

- Mass-market baggage: On the street, especially in UK/Europe, orange can also signal hi-vis jackets, construction gear, and in the US, prison jumpsuits and echoes of Guantanamo Bay. That’s where the satire lands.

- Provocation factor: Controversy by colour choice. Or rather, a lack of choice.. Apple wants people to talk about the colours. Dropping black is deliberate provocation to a “Pro” market deeply in love with variations of “Space Black” or whatever superlative they come up with to define a new shade of black but it is a conversation generator. Orange isn’t chosen because it’s universally loved; it’s chosen because it forces a reaction. It’s “earned media coverage” through debate.

- Regional signalling: In China and much of Asia, orange carries prosperity and good fortune. Combine that with the Hermès halo and you get something that appeals to wealthy Asian consumers, where the Pro/Pro Max skew is already strongest.

- Orange – Replacing The Old Black: So, the right take is probably not: “orange is a mistake” but “orange is a gamble.” It’s divisive by design, a dual-coded colour: in Asia it’s auspicious, in the West it’s provocative, bordering on brash. And Apple, historically, thrives on that tension think Bondi Blue, Jony Ive’s candy iMacs, or even the old iPod mini palette.

The Simple Truth Behind “Orange is the New Black” (unless you’re buying an Air, which does come in black): The real critique, then, isn’t orange itself: it’s the absence of black.

- Black has been a mainstay, especially for “serious” buyers, for decades. Its omission does feel like a misstep but, more likely, is a calculated stunt to force narrative churn: everyone from Vogue editors to CNBC anchors is now talking about Apple’s colours instead of its missing AI.

The real reason Apple didn’t launch a black 17 Pro? It would scratch too easily.

4) Services oxygen - small revenue, big story.

AirPods and Watch hover near ~5% of revenue, yet supply ~50% of the narrative oxygen. They keep the ecosystem sticky and ensure that even when handsets plateau, the brand feels in motion. Fold in AppleCare, finance and the insurance blob and you get margin perfume that flatters consolidated results. It’s clever, it’s legal, it’s good business. Just don’t mistake it for handset demand re-accelerating. It’s just an old fashioned financial services and high margin re-insurance stunt (no less an achievement for that, but, not what Apple enthusiast ideally want to get excited about).

5) Analyst incentives - the hype has a P&L.

The loudest boosters aren’t naïve; they’re incentivised. Price targets, flows, bookings and airtime feed on hopium. Bumping targets because online lead times stretch five days is show business, not science. The cycle repeats: promise super-cycle, bank the multiple, revise later. We’re not just reading research; we’re watching theatre we’ve all seen before.

6) Cultural signalling - what sells in Beijing can flop in Berlin.

Orange sings in Asia; black still rules the Continent. Apple’s global design decisions are never apolitical or costless. If the colourway and finish skew push marginal buyers off the fence in Europe while doing the opposite in China, that’s a strategic trade, not a neutral flourish. Market nuance is a P&L line item. Apple’s choice of this particular type of aluminium for the iPhone Pro, thanks to its need for “vapour cooling” - a feature to keep the handset cool and thereby ruling out better and more durable titanium. This arguably occured chiefly because of the extra power needs of useless features such as Liquid Glass. Apple, you should have stuck with titanium. What’s the point in having unscratchable “ceramic glass” if the rest of the phone is totally scratchable boring old aluminium.

If you don’t believe me, go into Settings, Accessibility, turn of Motion effect, Increase Contrast, and watch your buttons suddenly reappear like magic, the screen stop giving you motion sickness n, and best of all your iPhone will run cooler, for longer, and without causing visual impairments and migraines.

7) ASP creep - the unlovely truth under “growth.”

Three years ago the iPhone ASP lived around ~$880; today it grazes ~$980. That ~$100 lift - storage laddering, premium materials, accessory lock-ins (hello, $99 Air-only battery pack) does as much heavy lifting as units do.

- Flash memory that costs ~$50 to Apple often sells at ~$500 to you.

- Revenues up, units flat: that’s not a super-cycle; that’s mix discipline, and good product design, but its so egregious even as a long term AAPL holder and enthusiast, I can’t help but call it pure price gouging, even though, Apple’s lack of price rises not tracking inflation could be viewed as either:

a) Lacking pricing power with consumers or,

b) Happy with keeping pricing very competitive in spite of the feature-adds.

Of course, you could argue that Apple should be able to both command a premium and at least track inflation or above on the pro max models, and maintain competitive pricing where it matters and really leverage their brand and products – if they could – and maybe there’s a hidden message for investors to absorb in there:

is it actually a good thing Apple don’t feel they have pricing power, or does it show strength, that they feel they can afford to – relatively speaking- make their iPhones cheaper with inflation baked in, for higher feature phones at relatively-speaking lower prices?

I’ll leave that one to Laura Martin of Needham to argue, who said something similar in a note she issued on Monday 29th September, and Jefferies, who downgraded Apple on overheated iPhone 17 sales expectation to fight out come-earnings at the end of October when “the truth will find its way out there.’”

8) The Plateau Principle (v2.0) - when novelty slips, Apple defaults to the top

Since the iPhone 14, when there isn’t a clear, present-tense reason to upgrade, iPhone economics lean on the high end (Pro/Pro Max), timing quirks (supply shocks, policy sugar) and semantic varnish (“Plateau”, “Liquid Glass”, “Vapour Cooling”) to keep the story buoyant.

It was survivable in 15, conspicuous in 16, and - unless AI finally lands - remains the shape of 17.

What that “Plateau Principle” means for 17 (and $290+ price targets)

Once you strip out China’s subsidy halo and America’s tariff pull-forward, the 17’s “base” looks less like ignition and more like late to the party re-calibration. Yes, early signals show stronger Pro/Pro Max uptake; of course they do, that’s where Apple’s pricing staircase nudges you.

The Air? A gorgeously flawed, slightly ascetic design object with an appetite for battery packs and a “plateau” that makes case designers cry.

It will have its devotees (and Instagram moments), but it’s not an economic engine yet especially not in China, where it’s still waiting at the regulatory door and will likely miss its launch frenzy window, and demand pushed into Q1 2026 instead of this upcoming Q4.

AI? In 2024 it was the raison d’être; in 2025 it quietly left the stage while “Liquid Glass” and an F1 cameo took the bow. In fact, Apple’s “F1: The Movie” was Apple’s only singular success worth mentioning in what was otherwise a squalid year of dismal failure, AVP boxing, AI locking down, and departmental sackings.

Siri’s next-gen resurrection is pencilled for spring 2026. That’s a long way to pin $290 on “nearly there.” If the bull case for 17 is “look, five to ten percent,” be honest about why (if there is one): pricing, mix and a friendlier comp thanks to the poor performance of the iPhone 16 relatively speaking, not a sudden mass conversion to orange-tinted enlightenment.

None of this denies Apple’s craft. The logistics choreography is still world-class. The British-accented calm still sells even though Ive long left the building.

Tim Cook’s hands-on selling has rarely been more visible and he seems to have a CNBC anchor tethered to him like a battery pack. The aluminium is alluring (the way titanium was called tactile before it went out of vogue this order). Vapour cooling keeps the nerds happy. The queues make great B-roll. The marketing machine, at least, “just works” and the rest of the world hopes and prays the rest of the company soon will, once more, too. Last week, he popped up in Japan. The man is a veritable globe trotter these days, and was promoting a tie-in with Pokemon, a close relative to his other virtual favourite collectables, Genmoji. His determination to be seen as the ultimate traveling salesman, peddling iPhones, to insurance and financial services products, would make Avon proud.

But back to the technology:

- Machines can hum without sprinting or going anywhere.

- And plateaus can be profitable without being profound.

- Apple is after all, the ultimate free cash flow machine.

- No other company has ever managed to produce this much cash, but also consume so much of its own earnings in buybacks (approaching $700B now) just to keep its stock above water.

- Again, as observed earlier, Apple’s financial engineering really is a marvel to behold, for as long as it can keep the illusion going that its products are actually moving anywhere at anything other than a competent, iterative but snail’s pace.

“Hopium” and “Hoptimism”

In recognition of the Tweedledee & Tweedledumb of AAPL Analysis, and also how Apple – like Alice in Wonderland – can think of six impossible things before breakfast – , the real question is, has it recaptured its ability to make any of them actually happen and ship, or simply remain, ultimately, a Mission Impossible: Cupertino Edition movie?

Here’s the close: Apple has bought itself time through design discipline, supply precision, and narrative control. If spring 2026 delivers AI that is native (OS-deep, app-present, not “there’s an app for that”); if the next Air drops the boob-tube bump and lasts a day without a battery purse; if colours sell across cultures rather than in spite of them; then today’s plateau can, genuinely, become a ramp.

Until then, it’s best to separate optics from outcomes. Enjoy the theatre, count the numbers, and remember the rule that’s explained the last five years better than any queue shot: when there’s no immediate reason to upgrade, Apple monetises the top and massages the timing.

That’s the “Plateau Principle” I’ve coined to term it.

- It’s held since the 14.

- It survived the 15.

- It defined 16.

- And unless reality, not CGI, changes, it’s the frame for 17’s future.

- The Air, is, well up in the air. Let’s call it a wet finger in the wind, nor something you necessarily want to hold yourself but a useful tool for the company to test the waters with and refine for Gen 2 or 3. After all, as the saying goes, never buy a Gen 1 Apple product, as most (but not all)Apple Vision Pro purchases will tacitly admit.

The mood music is encouraging. The pudding is due in 2026.

Between now and then, don’t confuse British voice-overs, carefully-curated-by-collection-time-slots queues at Apple Stores, and orange lacquer, with a super-cycle though, especially when viewed through a longer term lens and not just as a comp against the iPhone 16 + AI fiasco.

Lead times aren’t demand. Queues aren’t frenzy. Subsidies aren’t growth. They’re props. Props in a play that’s been running since the iPhone 14: The Plateau Principle is in action and holding full sway.

A Quick Analyst Conundrum recap:

Bank of America and Jeffries: Mixed Signals

Bank of America raised its price target to $270 (from $260), crediting the Pro model’s storage bump and modest revenue estimate increases (FY26 revenue: $448 billion, up from $446 billion; EPS: $8.05, up from $8.03). Jefferies, however, maintained a Hold rating with a $205.82 price target, reflecting scepticism about the upgrade cycle’s sustainability.

iPhone Air: The Wildcard

The iPhone Air, Apple’s ultra-thin 5.5mm replacement for the Plus, has generated interest but also questions. JPMorgan and others suggest it could be a “bigger hit than expected,” particularly if priced at $899 rather than $949. However, trade-offs in camera capabilities and battery life may limit its appeal to anything beyond design enthusiasts, and there’s little concrete volume data to justify the hype.

China and Pent-Up Demand: The Real Story?

Analysts repeatedly cite China subsidies and pent-up upgrade demand (the 315 million ageing devices) as key drivers, with Wedbush claiming “iPhone’s worst period in China has passed”.

Yet this optimism sits awkwardly against Morgan Stanley’s flat shipment forecasts and the reality that much of the “demand” may simply be cyclical pull-forward rather than genuine expansion. Jeffries downgrade seems to support a selection of historically competent analysts casting questions, even if ignored by a market en fuego at the moment.

The Consensus: Theatre Over Substance

Across the board, analysts lean bullish on lead times, supply constraints, and production adjustments - classic indicators of launch momentum even though they bear no relation to actual supply and demand - but volume forecasts remain stubbornly flat or only marginally up.

The disconnect between “better-than-expected demand” and unchanged shipment estimates suggests the iPhone 17 cycle is more about optics, pricing discipline, and margin management than genuine unit growth, much as I wrote about in Part One of this a week ago, where I discussed how the 17 launch should be judged in contrast to the launches of the iP12-16, rather than against almost-absurd comps simply with the iP16 in 2024.

For investors, the message should be clear: watch ASP inflation (or rather, the lack of it and how that impacts earning), services attachment, and geographic subsidy distortions, not the breathless headlines about lead times and “magical formulas”

And watch out for the enormous impact of Apple Care One, enormously high volume re-insurance product, boosting gross margins rather artificially when on the top line, it should, for a company like Apple, really be their hardware and their products, not financial services and selling insurance, which one would hope was keeping margins and earnings en fuego.

It isn’t. It’s chiefly – literally – financial services and insurance re-selling solely responsible for goosing the bottom line up, and for someone like me who’s been tracking the stock for 25 years, this isn’t the company I recall innovating its way to market domination and certainly not a store to store (as opposed to door-to-door) FinServ and insurance sales.

Peering Through Liquid Glass, Opaquely

Perhaps if they had not bothered with the battery sapping virus which is “Liquid Glass” (and is so liquid, that sometimes you can’t see the button or the banner for the “Liquid” - on the new CarPlay for example, the Liquid Glass interface totally obscures the the ETA and Distance to Destination pop-out in some use cases - making it a rather poor feature and unforgivable for a launch product ), they wouldn’t have needed to shift from titanium to scratchable aluminium , introduced “Vapour Cooling” as a “must have” feature at god knows what cost, and have offered a longer battery life, a better UI/UX, a better case material, and… an iPhone Pro in black.

- Was Liquid Glass really worth the software engineering resources which went into creating a slower, hotter-running, battery-shortening, and more scratchable phone?

- And especially at the expense of all those resources which could have been deployed in Siri’s and AI’s reboots?

- Or should Apple have been doing what they’re releasing now, in 2023, leaving this to be the year which should, as I’ve been writing about now for some time, have laid the path to $400 by Q4 2027?

Time’s running out, but one thing is for sure: the rumoured launching of an AI product called “Veritas” as a half-baked return of Siri on life support prior to its May-dated return (when we last heard, in July after WWDC 25), is not the answer to the truth we’re looking for.

Or is it?

I’ll leave you to answer, or disagree, in the comments.

— Tommo, London, Sunday 5th October, 2025

X: @tommo_uk | Linkedin: Tommo UK

See the share buttons to LinkedIn, social media and email? Please, use them and help keep .fyi free at the point of readership. Or email this article on to a friend-in-need.