Apple’s Q3 of Quiet Arithmetic: Growth Without Momentum. A “Good” Quarter. If You Ignore What Made It Good.

Apple’s Q3: solid on paper until scrutinised. iPhone strength? US tariff and China subsidy-fueled, and Services grew but without acceleration thanks to financial services. No new growth engine. Just some existing lines doing their job. Except iPads wearables: pigs, with no lipstick. Here’s why.

Introduction: “Apple’s $94B Quarter - Why the Parade Needs Rain”

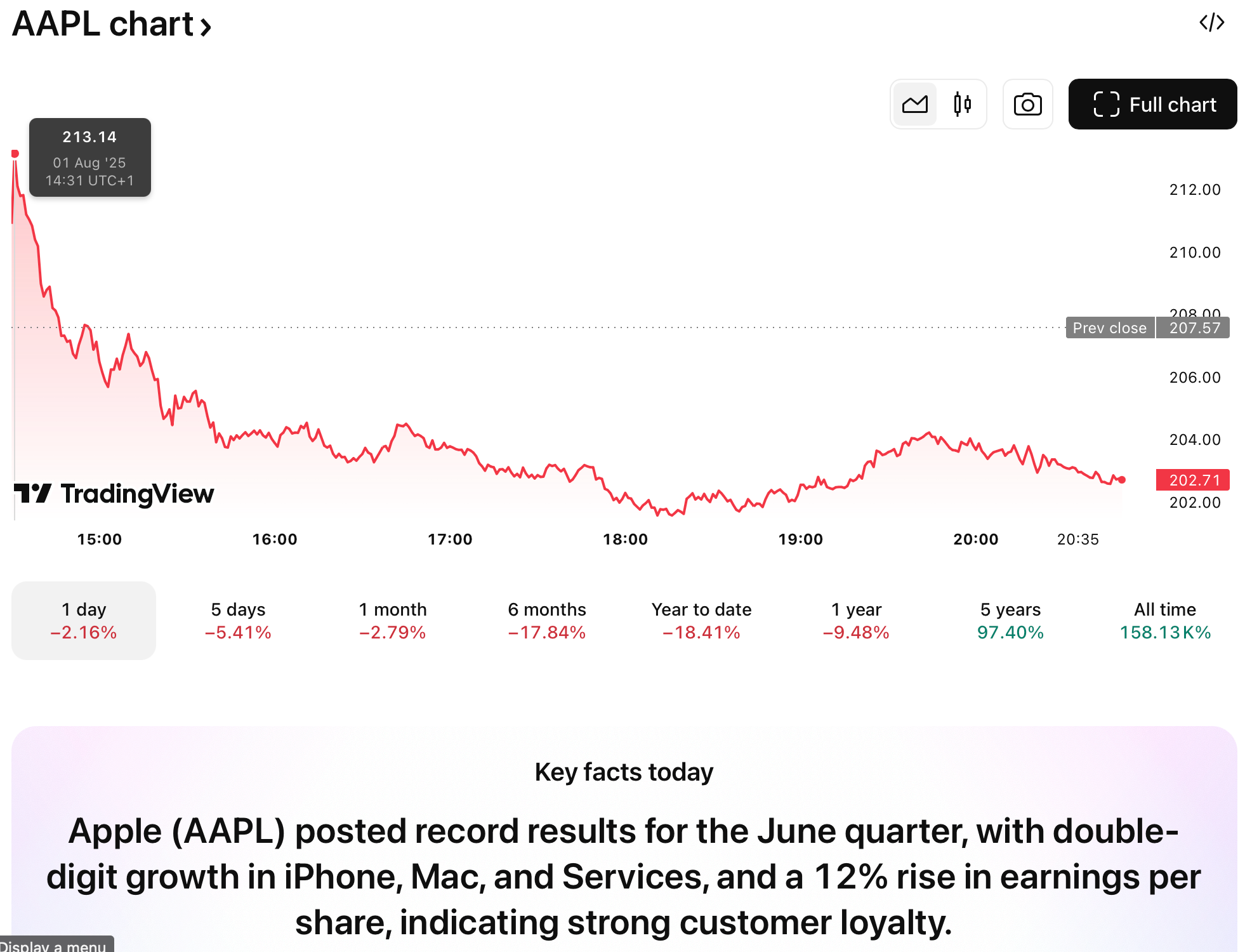

There’s a phrase I see tossed around, quarter after quarter, that could be pasted at the end of every Apple earnings report: “Apple blows past estimates, again.” Like clockwork, the headlines - Reuters, CNBC, The Verge, even the analyst horde at Seeking Alpha - bellow and echo “blowout,” “record,” “defies gravity.” The company’s Q3 2025, with its $94 billion in revenue and a 12% jump in earnings, is no exception. Once again, the “Apple can’t lose” mantra shouts down the doubters.

But as anyone following .fyi knows, I have a different habit: getting under the surface, demanding the math to show its work, and - perhaps most crucially - refusing to believe that luck, policy, and clever accounting are the same as genius or inevitability. That’s not cynicism, its skepticism, having seen my once favourite company lie its way through more quarterly reports and statements about AI in the last few years than I’d like to admit. Harsh? Sure. Valid? Yes.

This quarter - billed as “historic” by many - isn’t just déjà vu. It’s the apex of the modern Apple paradox: a quarter not built on organic product demand, but on a cocktail of paused tariffs, government subsidies, and a mushrooming services sector that increasingly looks more like an insurance/fintech play than Silicon Valley’s premier hardware innovator.

“Apple’s strength is just different now,” gushed a CNBC analyst in the post-call roundtable. “The market just doesn’t care about the risks,[so why should we?]” Well, if you’re invested for more than your next dopamine rush, you should care - a lot.

The Market Differs - it’s not “different this time (yet).”

This article is about the ten things both Wall Street and the amateur Apple blogosphere are, willfully or naively, misreading about Q3 2025 - and why those who don’t question the parade-throwers may wake up with confetti in their eyes and an ache in their portfolio. For each area, we’ll contrast hype with data, and ground every point in the transcript, the 24-hour blast radius of the latest analyst notes, and concrete numbers.

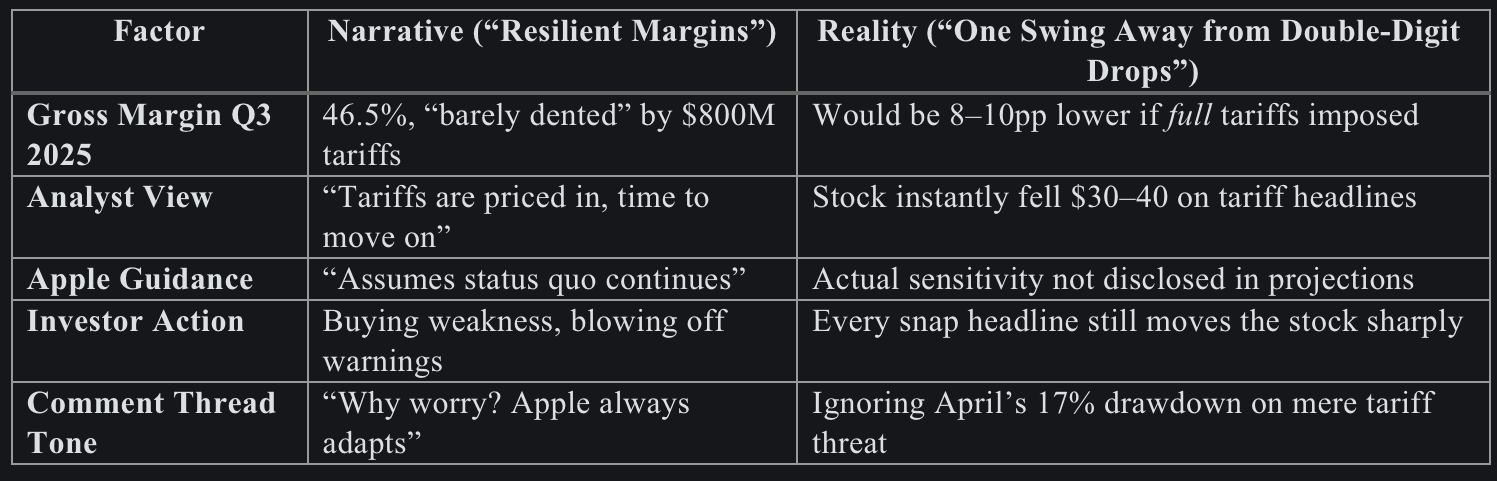

Key Area 1: The Tariff Mirage - Margin “Resilience” Built on Deferred Reality

For the last 9 months, Apple’s core North American profit engine has operated with a Sword of Damocles hanging overhead: the threat of 20-140% or greater tariffs on Chinese imports. Each quarter, the company’s guidance and Street estimates have swayed to the tune of whether those tariffs would strike. In Q3 2025, they didn’t - at least not in full. Instead, Apple was walloped for just $800 million in new tariff costs, shrugged, and boasted a 46.5% gross margin anyway.

But let’s check the record:

Apple's call, July 2025:

“We estimate the impact to next quarter, should tariffs go ahead as planned, would approach $1.1 billion… Guidance assumes the tariff regime holds as is.” (CFO Parekh, Q3 2025 call)

Compare this with Q2 2025, where an analyst on the conference call asked:

“Suppose those tariffs are put in place - how much is Apple planning to absorb, and how much gets passed on?” (Q2 2025 call, paraphrased transcript)

Tim Cook’s answer [paraphrased]: “We’ll watch and adapt. Right now, we're optimistic no dramatic change is imminent.”

Fast-forward back to the future: in April 2025, AAPL shares plummeted intraday to $167 - almost exactly the “technical” price predicted by a mechanical margin compression model when 20% tariffs hit the news cycle. And when it looked likely those tariffs would be deferred? A few weeks earlier with AAPL at $220 I’d predicted a plunge to $150-170 which wasn’t very popular. Popularity doesn’t win investor returns though, so sadly I was lynched and mistrusted ever since, for the cardinal sin of ... being right. The righteous just don’t like reality.

Then, after Trump kicked tariffs down the road, AAPL slow regained $30–40 in market cap over a weekend, to around $195 - roughly where a company with no tariff risk but execution risk, and a PE multiple of 30, would sit. As I write post Q3 Apple is back at $201, a $14 plunge from its post earnings high in the morning,

Cut to this quarter:

- Management estimates just $1.1B in cost for Q4 if nothing else changes.

- Analyst notes from August 1 (Morgan Stanley): “The tariff story is just noise now. Apple is showing gross margin resilience that should put short-sellers in their place.”

But here’s the reality:

If 20% tariffs on Chinese hardware imports hit, and Apple absorbs them to defend U.S. pricing, gross margins could collapse by 8–10 percentage points, EPS would likely be cut by a third or more, and the stock - as proven by the April swoon - would compress to mid- to low-$160s or lower based on historical P/E multiples.

Yet, the Bloomberg terminal glows with commentary like,

“Apple shrugged off regulatory risks - again - surely it’s time to upgrade our price target, not downgrade risk.” (Analyst, Jefferies, August 1)

The Street and Apple-faithful ignore the risk because it didn’t hit - this time.

Table 1: Tariff Fairy-Tale vs. Reality

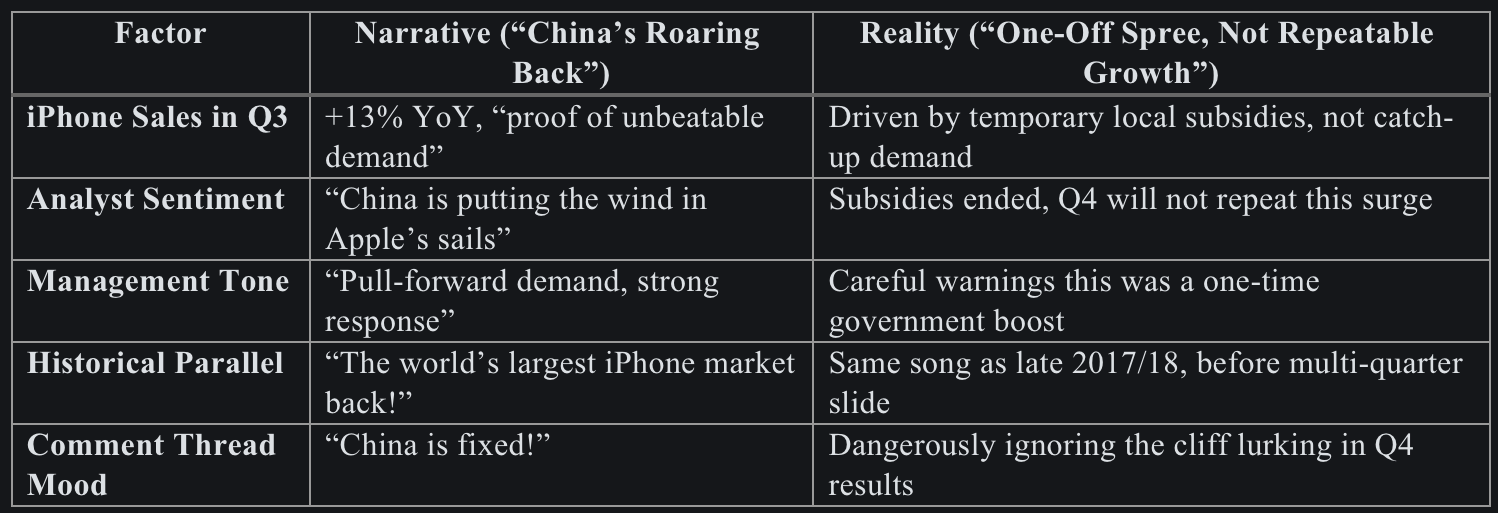

Key Area 2: The China Syndrome - Subsidies, Pull-Forwards, and the Mirage of Enduring Demand

Much of the “wow” in Apple’s Q3 numbers came from China - a market that, over the last two years, has bounced from villain to saviour in the analyst roundtables. This quarter, China delivered again, and no sooner had the spreadsheet-wielders glimpsed that 13% jump in iPhone revenues than the “China’s back!” narrative took over the headlines.

Except, it’s all just a bit convenient, isn’t it?

Let’s look at what really happened:

- Apple’s iPhone growth in China for the quarter was driven by one-off government subsidies, aggressive carrier push, and what one analyst this week called “the greatest hardware promotional fire-sale since the 2014 iPhone 6 launch.”

- On Apple’s own call, the phrase “pull-forward demand” was used again and again though they hesitatingly tried to suggest it only accounted for 2% of additional sales. I wasn’t aware buyers filled out a “tariff survey” form before purchasing an iPhone so I can only assume this is a “POOYA” number (work it out). Senior management carefully tiptoed around the fact that this quarter benefitted from Chinese local government stimulus - subsidies of up to 30% on headline models, now rescinded.

- As one seasoned Hong Kong analyst put it in a note on August 1st: “Apple’s June quarter was the closest thing to government stimulus you’ll ever see in their hardware sales. It worked this time, but it’s a sugar rush, not protein for the next lap.”

- For those with a memory spanning more than the last headline, remember Q1 2024: Apple spent most of the quarter excusing flat, even declining, China revenues due to “macroeconomic headwinds.” Yet here we are now, cheering a single quarter made not by a new iPhone, but by Communist Party fiscal policy.

The retail investor chorus is even more simplistic: “Apple’s still growing in China!” But that isn’t true underneath the numbers. The underlying Chinese consumer remains under pressure, and there’s scant evidence that absent the government’s largesse, the number would be positive. What’s more, aggressive Q3 pricing merely dragged demand forward into June, not created new, lasting users.

Analysts and bloggers who should know better - those who (to borrow a phrase) “would paint a car boot sale as a royal gala if it meant another up day on the ticker” - ignore that the party’s over for this bit of the story. Apple themselves warned: no more subsidies, no more one-off deals in Q4. Yet, the stock still gently floats on the breeze of “maybe next time will be the same.”

Table 2: The China Demand Illusion

Key Area 3: Financial Alchemy - The Ascent of The Bank of Cupertino

If you ask the average Apple bull what’s driving the company’s “blowout” quarters, you’ll hear the usual refrain: iPhones, Macs, Apple’s design magic. But look past the headlines and you’ll find that the real action isn’t in hardware anymore - it’s in the swelling belly of Apple’s services business, and specifically, in insurance, finance, and what I call the ‘Bank of Cupertino’.

I actually wrote about Apple’s missed Apple Pay trick in June here, but Apple had a trick up their sleeve all along: become a re-insurance company!

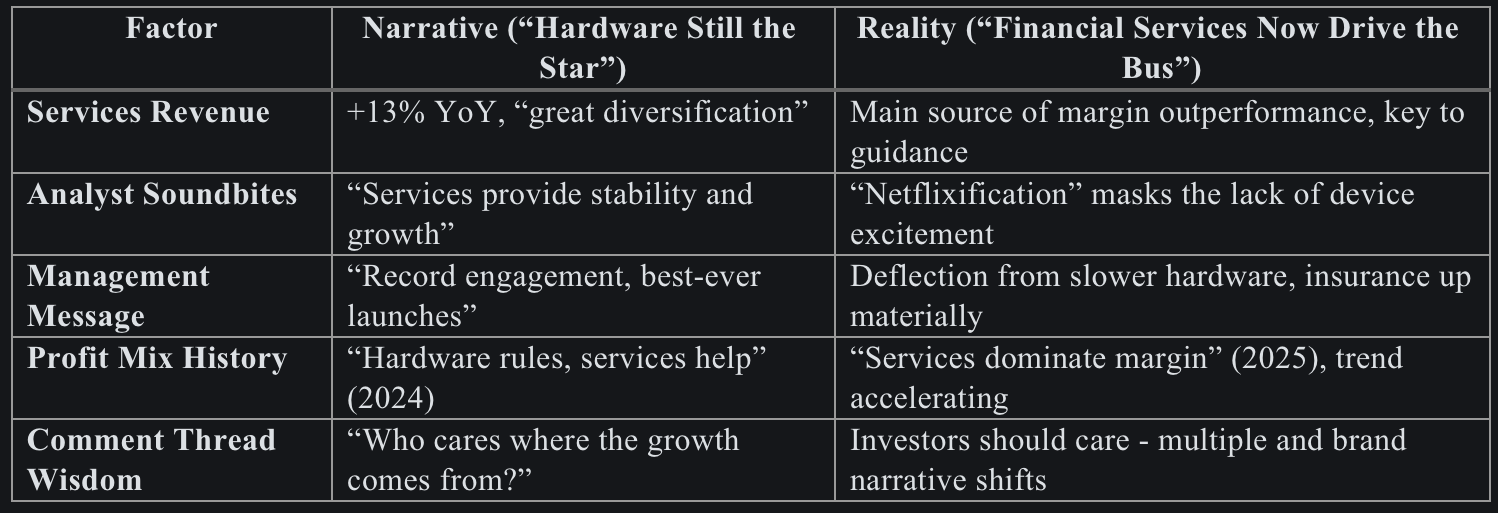

Here’s the uncomfortable truth: in Q3 2025, Apple’s services sector :

AppleCare, Apple Card, Apple Pay, App Store fees, and a growing suite of financial and insurance products - contributed the bulk of the margin growth that allowed them to post record profits, even as hardware costs ticked upwards.

Let’s look at the evidence:

- Services revenue hit $27.4 billion, up 13% year-on-year, to a new record (hint: every year is a new record). Financial services (Apple Pay, credit, device financing) and insurance (AppleCare, extended warranties) formed a rapidly increasing share of that total.

- The actual contribution to Apple’s net profit margin from hardware, once you normalise for tariffs, promotions, and supply chain woes, is at its lowest point in nearly a decade. It’s kept buoyant not by gadget innovation, but by recurring monthly payments - what one analyst this week dubbed, not entirely as a compliment, “the Netflixification of Apple.”

- Analysts love this pivot: “Recurring revenue stabilises the story,” they chant endlessly, as if financial predictability trumps the disappointment of lacklustre product cycles. And for now, perhaps it does. But the character of Apple’s business has fundamentally changed.

Compare with last year, and the contrast is stark:

- Q3 2024 saw AppleCare and services as “a great side dish.” This quarter, they’re over a quarter of Apple’s total revenue and an even higher share of operating profit.

- Bloggers and analysts in the amateur sphere mostly parrot the line that “services are additive.” The more insightful should note what’s been gained and what’s lost:

Apple is now as much a bank and insurer as a creator of shiny things.

While Tim Cook and CFO Parekh highlight “record levels of engagement, high customer satisfaction, and new services launches,” they stop short of confronting the implication: what happens to Apple’s multiple - and the myths of Cupertino - when the glow of hardware excellence fades behind insurance and interest revenue?

Table 3: The Services Shift Revealed

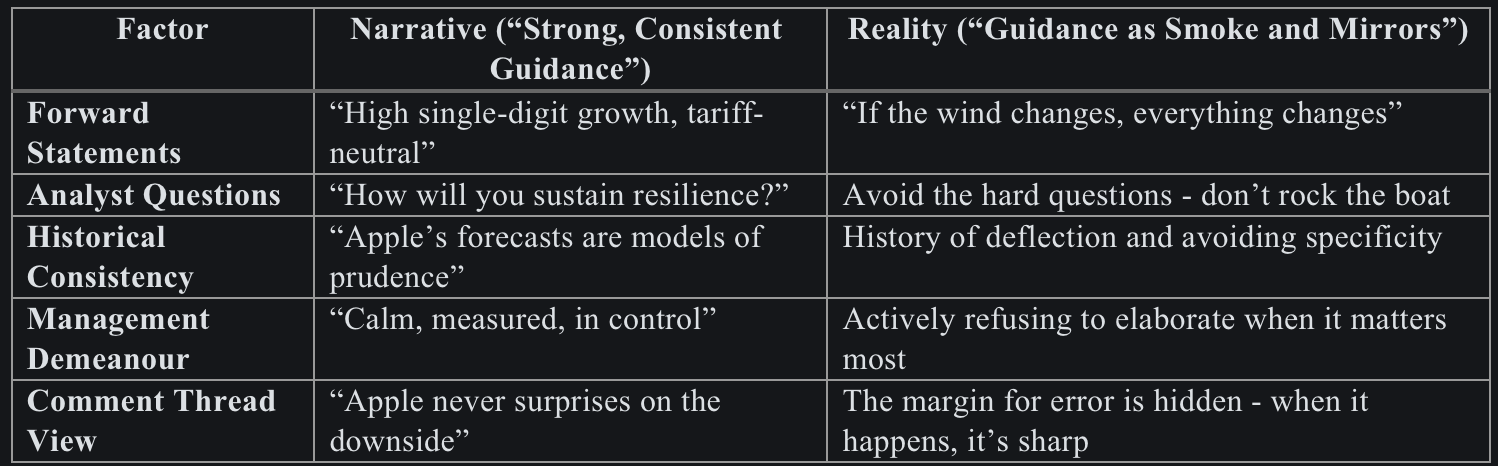

Key Area 4: Guidance Games - Apple’s Masterclass in Obfuscation

Every Apple earnings call serves up a masterclass in the artful dodge. This is not unique to Cupertino, but few companies make such a ritual of stating what they won’t state, guiding without guiding, and relying on the analyst herd to ask everything except the right questions.

Q3 2025 was a case study in murky forward-looking language. Here’s how:

- Apple’s forward guidance skirted the real drivers of last quarter’s “success”. Instead, we got phrases like “high single-digit growth,” always “assuming tariffs remain as they are today.” When pressed, CFO Parekh repeated the caveat: all guidance is “predicated on the absence of material change in policy or market environment.”

- Questions - even by experienced analysts - avoided the underlying structure of the boom. No one directly challenged: “How do we normalise this quarter’s numbers with the rollback of Chinese subsidies you know cannot repeat?” Instead, we got softballs about “resilience” and “customer satisfaction.”

- This hedging is nothing new. Scroll back to the Q4 2023 call, when market turmoil in China shaved a full percentage point off gross margin. Apple management then invoked “transitory geopolitical factors” and failed to provide any guidance for China at all. The Street let it slide.

- In recent analyst notes, the phrase “Apple keeps guidance tight, but visibility improving” has made the rounds. In reality, “visibility” is conditional optimism: if the variables line up, the outcome is fine. If not, you’re on your own.

Amateur commentators frequently mistake Apple’s non-specificity for quiet confidence - “They must have strong numbers coming, otherwise why would they be so calm?” The truth is simpler: Apple reserves the right to rewrite the narrative next quarter, no matter what’s happening this quarter.

For professional investors, the takeaway is unmistakable: treat Apple’s guidance as a PR exercise, not a roadmap. They reveal only what doesn’t threaten to shake the share price. The rest is left delicately unsaid, ensuring the certainty you crave remains just out of reach.

Table 4: The Earnings Guidance Illusion

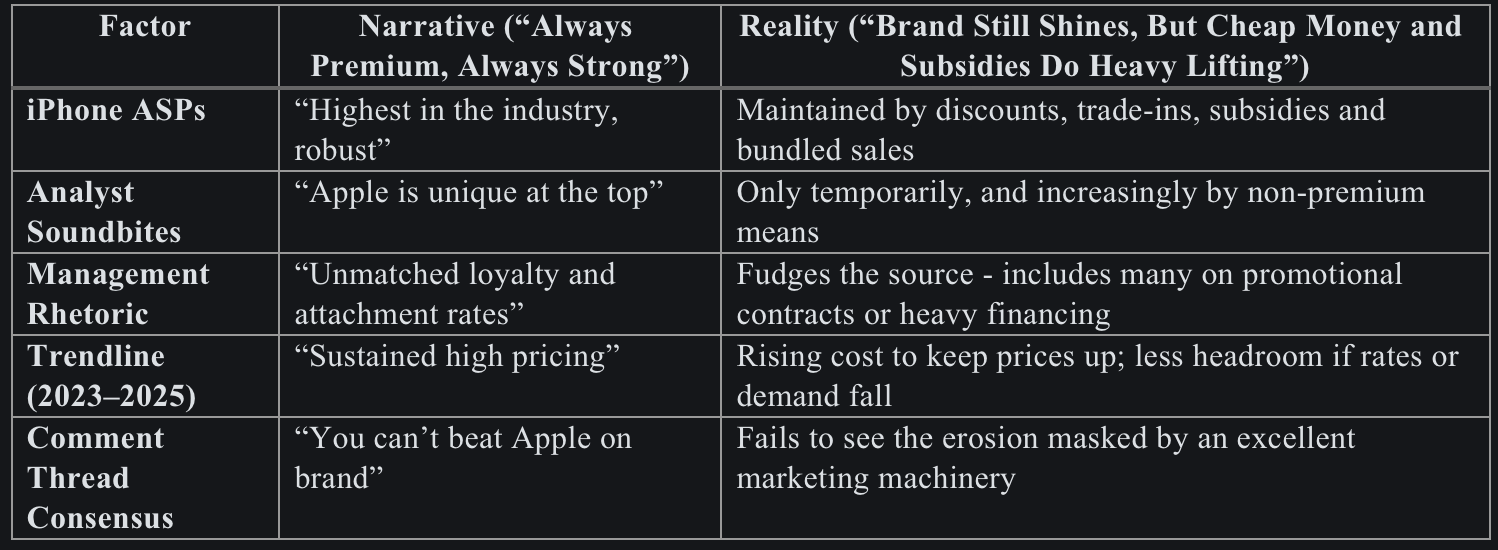

Key Area 5: The Myth of Perpetual Premium - Brand Vitality or the Long Slow Fade?

A recurring refrain from both Apple’s marketing and its bullish online faithful is that “people will always pay more for the best.” The premium branding story is gospel - so deeply rooted that even seasoned investors forget to check whether it’s still true.

On the surface, Q3 2025 did little to trouble this belief. iPhone ASPs (average selling prices) remained robust. North American and European sales defied macro headlines. Commentators in earnings post-mortems - both professional and amateur - hailed, “Apple is the last brand standing at the top end.”

Scratch that surface, though, and the paint starts to peel:

- China’s iPhone growth this quarter was driven almost entirely by extraordinary discounts and subsidy schemes orchestrated by provincial governments, not by consumer willingness to pay premium rates. This is the antithesis of brand strength - it’s a demand spike from a Chinese State firework display.

- Long-term trendlines show that in core markets, ASP growth is slowing, and trade-in promotions are increasing. The company is relying ever more heavily on deferred revenue and generous swaps not to grow, but simply to maintain headline price points.

- During the call, one analyst pressed on how Apple would maintain premium positioning if economic weakness spread. Tim Cook’s answer, diplomatic but non-committal: “We believe our unmatched customer loyalty and attachment rates will serve us well.”

But those “attachment rates” now include many customers on aggressive finance or service bundles, not necessarily buyers for whom price is no object.

- Compare this to the Q2 2023 commentary, when Apple sales in Japan and Europe actually dropped year-on-year, and management’s only answer was to point to undiminished “brand survey scores.” But “NPS” doesn’t keep the lights on if pricing power erodes at the margin.

- Retail chatter this quarter, both on tech forums and in the analyst calls, is peppered with anecdotes of hardware being bundled or cut-price alongside expanded AppleCare contracts or financing. For the first time, Apple’s flagship position is being secured by the same tricks as every other OEM: make it easier to buy, and cheaper to hold. Sell warranties.

Professional analysts still frame Apple’s premium as untouchable; hobbyist commentators simply parrot, “Everyone wants the best.” The data tells a subtler, more precarious story: the strength at the top is more about engineering deals than true blue-chip pricing power. That doesn’t spell instant collapse, but it’s the opposite of the “untouchable premium” myth that fills the press release boilerplate.

Table 5: The Perpetual Premium Problem

Key Area 6: Guided by the Algorithm - Apple’s Poker Tell on Siri, AI, Partnerships, and the Race for Relevance. Tim Cook issues smoke signals.

“At Apple, we remain open to any acquisition or partnership, regardless of scale, if it helps us further our long-term AI ambitions. We’ve always believed in building where it counts and partnering where it accelerates, and that’s especially true right now. While I cannot comment on our specific plans - because obviously that would give away our plans - I want investors to know we are actively looking.” - Tim Cook, during the conference call for Q3 2025

This is an astonishing admission from a company famous for saying nothing until a product is in the customer’s hand.

And… read his lips: he didn’t mention the “GenMoji”.

If there’s one phrase echoing through every analyst note this quarter - sometimes louder than “record revenue” - it’s “AI.” Artificial intelligence is the market’s latest Golden Goose, and here, for once, Apple’s chief risk isn’t that they will miss a sales target, but that they have already missed a paradigm shift they themselves started by acquiring Siri in 2011.

For years now, Apple’s story around machine learning and Siri has been defensive: they have “long experience in the field,” “billions of on-device inference cycles,” and a “core ethos of privacy.”

But with every quarter, and especially in the past 12 months, the pressure has ratcheted up. Samsung, Amazon, Google, Meta, Nvidia, even Nothing - everyone is making more noise and showing more technical bravado on AI than Apple. Even Samsung has managed to position its Galaxy AI features as cutting edge, and Google’s Pixel? It’s already running Gemini on-edge on device, prompting reviewers and Wall Street types alike to ask, “Where’s Apple’s move?”

The first big push was in 2019, called Blackbird:

Apple’s Siri “Blackbird” Project was an internal Apple initiative from 2019, aiming to rebuild Siri from scratch to make it faster, lighter, modular, and capable of running on-device. The goal was to allow third-party developers to create their own Siri features (just as planned originally in 2011 for Siri), opening Apple’s closed ecosystem. There were impressive demos, and the project was considered very advanced in comparison to the stagnant state of Siri at the time.

Sadly, Blackbird was shelved owing to internal politics and Apple’s tendency to race towards more incremental privacy-led improvements with “Siri X”.

Details of the Blackbird Project

• Started: 2019

• Goal: Complete overhaul of Siri for speed, modularity, on-device performance

• Features: More flexible; would enable third-party plug-ins/extensions for Siri

• Internal Reception: Created excitement among demo audiences for its perceived leap over legacy Siri

• Fate: Axed in favour of “Siri X,” a more conservative project moving only existing Siri capabilities on-device

• Outcome: Apple missed an opportunity to match or leapfrog big AI moves from Google and Amazon at the time; true LLM (“Apple Intelligence”) work started much later, unrelated to Blackbird

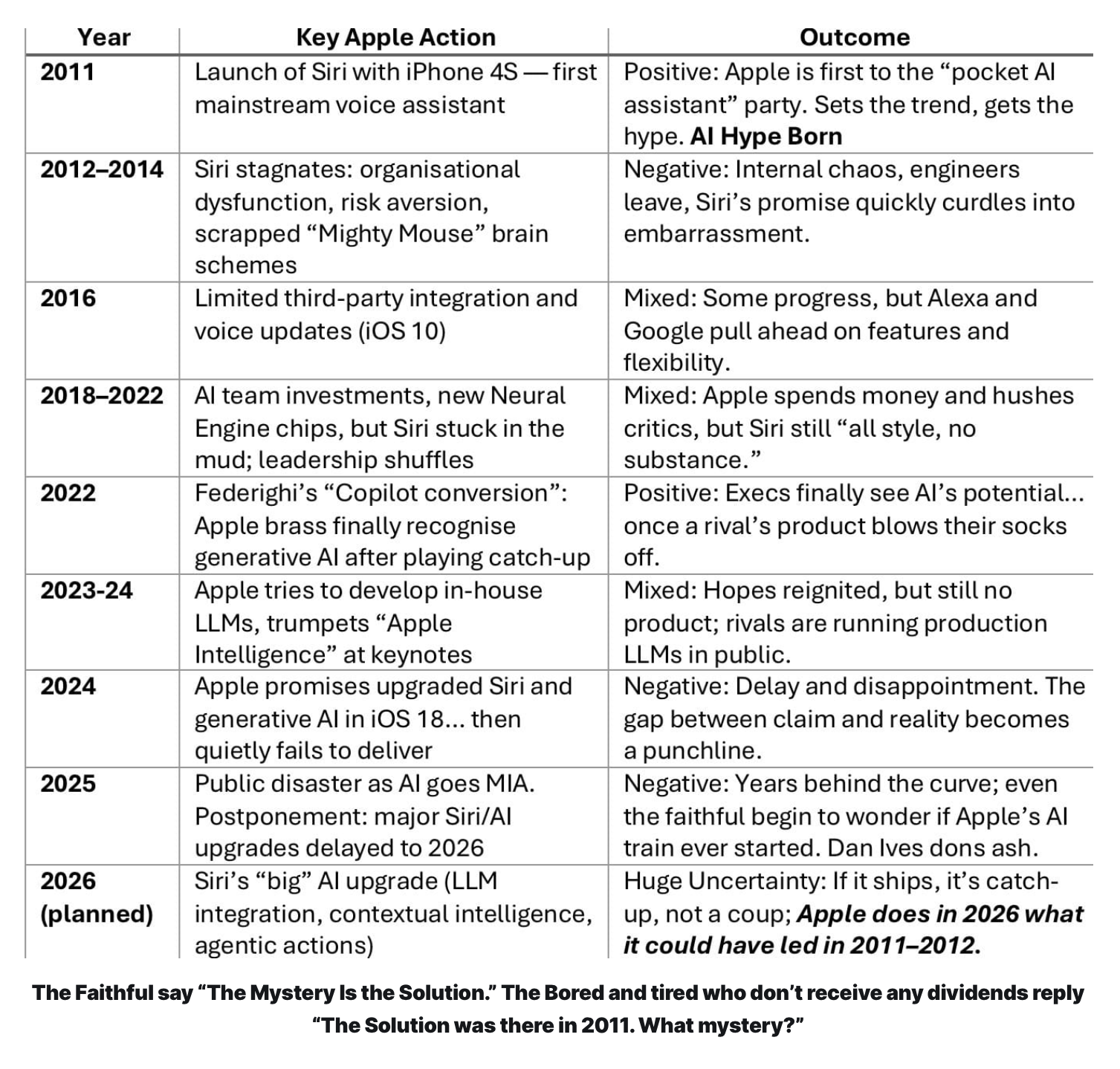

The real truth behind Apple’s AI misery has been its own hubris and errors: they flunked it by boxing Siri in 2011 and have been trying ever since to cover up their failure - here’s the bitter truth in one chart, summarising 15 years of wasted time, investment, customer loyalty and investor faith.

Angry? If not, then maybe like Siri, you’ve been lobotomised?

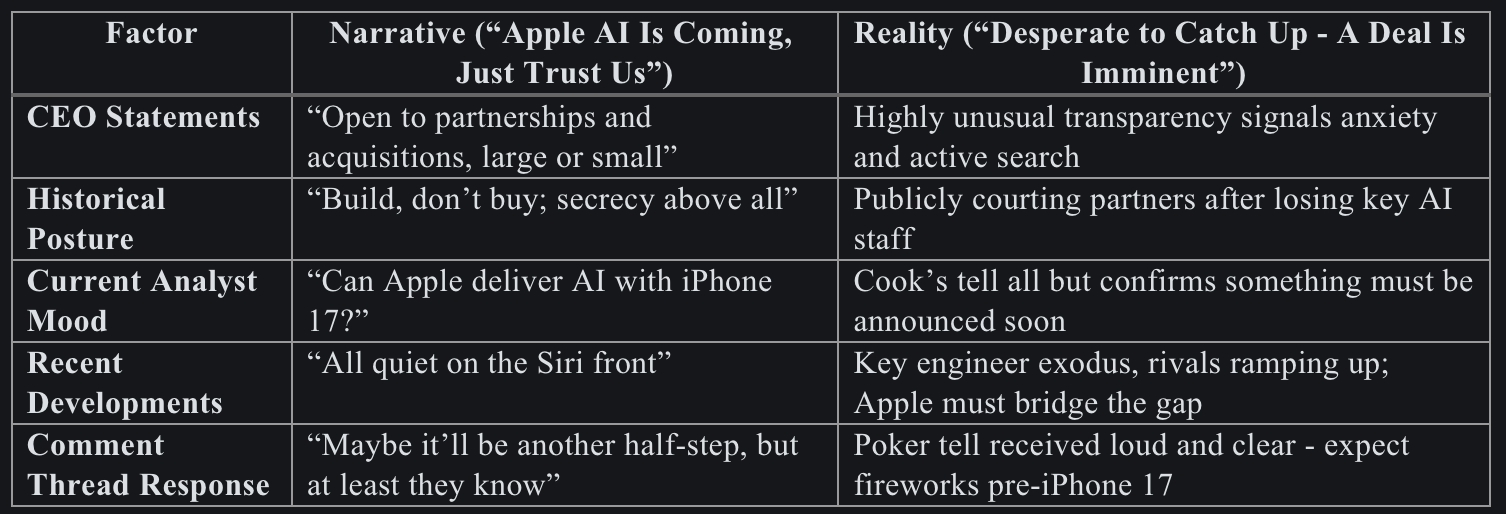

That’s why this quarter’s earnings call delivered an extraordinary, Apple-unlike moment of transparency: Tim Cook, always the script-perfect operator, veered directly into the subject of AI - and went so far as to talk openly about Apple’s sudden appetite for partnerships and dealmaking of any and every size:

Yet context is everything: in just the past month, Apple lost its four chief chief language-model engineers to Meta and, most alarmingly, its Director of AI Data Centres to OpenAI - brain-drain that industry insiders described as “the most significant at Apple since the Intel Mac exit.”

What Cook Gave Away In His Scripted Delivery About AI On The Q3 Call

In that same breath, competitors have upped their game, and the analyst class has begun wondering if Apple can deliver an AI-infused iPhone 17, or once again miss the moment and try to spin catch-up as “measured strategy.”

Cook’s remarks were a classic giveaway for the old school Apple-watcher: when the CEO says, with circus-trainer calm, “We’re open to anything,” it usually means there’s already something in the pipeline.

They want to calm the market (and, let’s be honest, goose the stock price before iPhone launch season), but also need to pre-empt panic that Apple’s slipping on the most important battleground in tech since the smartphone itself.

- There’s a real chance that, between now and the iPhone 17 launch in September, we’ll see a major AI partnership - or the absorption of a breakthrough LLM shop.

- The timing is far too coincidental.

- Apple knows it cannot afford another “wait and see” position come autumn. The poker tell is as clear as it’s ever been.

And if there isn’t? After a verbal drop like that, AAPL is toast.

For investors, this frankness should be read as both an admission of urgency and a bid for patience. Apple is signalling they know they’ve fallen behind. More importantly, they’re threading this into the launch window, teeing up an AI reveal that could - to borrow Cook’s line - “accelerate” their way out of this awkward, uncharacteristic vulnerability.

Table 6: Apple and AI - Candour as a Tell

Key Area 7: Borrowed Time - The Unrepeatability of Apple’s Luck

In every business, luck is welcome. In investing, it’s usually treated with caution: treat a one-off as recurring and you’re signing up for disappointment. Yet when it comes to Apple, there’s a strange exception: both Wall Street and the Apple blogosphere routinely mistake “one-time” boosts for new normals, convinced that luck follows Apple like a loyal pet.

Q3 2025 is a masterclass in the art of luck and the market’s willingness to misread it. This was a quarter where every lightning bolt struck the right tree:

- Deferred tariffs that could have wiped billions off the bottom line - avoided.

- Chinese regional subsidies fuelling dramatic iPhone sell-through - gone in Q4.

- A surprising currency tailwind after a year of punishing forex headwinds - one that reversed historical patterns.

- Major competitor stumbles (notably, a significant production issue with Samsung’s flagship Galaxy line in April, which temporarily dented their Asian momentum).

Each development is, in isolation, good fortune. Strung together, they created Apple’s “blowout” performance.

But luck, by its nature, resists repeatability. This time next quarter, tariffs may land. Subsidies are already discontinued. Currency could turn the other way. Samsung and others are patching their processes as you read this. Apple will, or will have not, shown it has an AI ace up it sleeve.

Yet, the bulk of analyst commentary, both professional and amateur, is to annualise the good fortune: “Apple has momentum. These margins are the new floor. The market is playing catch-up with Apple’s reality.” A typical note from Barclays on 1 August: “Our new models take Q3 margins as a baseline for FY26.” No mention that half the factors leading to those margins simply won’t exist beyond Labour Day.

Retail fans are equally optimistic: “If Apple can do this in a bad quarter, imagine what happens when things go right!” The peril, of course, is that things did go “right” by the purest chance - and extrapolating luck is how bubbles form (and burst).

For the diligent investor, or even a mildly sceptical Apple observer, the lesson is not to be a doom-monger but to treat “luck” and “one-offs” as what they are:

Pleasant surprises, not foundations for a new model. Apple’s true test comes when the wind changes - and the company, and its fans, must navigate without a perfect storm in their favour.

Table 7: One-Offs vs. Real Strength

Key Area 8: Margin Mirage - How Reported Profit Masks the Real Story

Every Apple quarter, you’ll hear the bulls tout margins as evidence of Apple’s infallibility. “Look at those gross margins! Where else in hardware do you see this kind of profitability?” It’s a refrain so familiar it’s become dogma in both analyst circles and the Apple-watching public.

But the Q3 2025 results reveal the mask: those much-vaunted margins are less about operational excellence and more about careful choreography, financial alchemy, and the shield provided by non-hardware businesses.

Break down the real story:

- Yes, gross margin clocked in at 46.5% - heads turned and price targets lurched upwards. But Apple’s own disclosures revealed over $800 million in tariff expenses, absorbed by “other offsets.” Without services, the margin would have looked pedestrian. And without deferral of new tariffs, it could have been catastrophic.

- Dive into segment analysis and it becomes clear: hardware margins are trending flat-to-down, rescued only by the booming contribution of services and (more quietly) cost accounting gains.

- In Q2 2024 (and prior), Apple was celebrated for “making margins sing” in a rising cost environment. But the big change is the source: last year, they squeezed hardware COGS and supply chain discounts; this year, they’re relying on deferred costs, one-off external lifts, and recurring finance/insurance profits.

What’s more, if you simulate the margin impact of all “potential” costs falling at once - tariffs arriving, currency flipping, subsidies disappearing - the margin would plummet into the mid-thirties, territory unseen since the iPhone’s early days.

You can say this seems unlikely now given Trump’s TACOs, but its by no means certain and any exemptions are sat the whim of His Royal Orangeness Executive Order when he gets up in the morning and plonks himself on his golden commode.

- The analyst echo chamber, however, rarely teases this out. A recent Oppenheimer note: “Apple’s margin management is the envy of the sector, proof of execution.” The “how” is conveniently left to the imagination.

- For the investor, the safest position is caution. Margins depend on where you stand in the P&L - and at least in Apple’s case, standing at the intersection of luck and services profit.

In the comment streams, the amateur crowd sees high margins as a warm reassurance that “Apple’s business is just that good.” But the wall separating margin protection and vulnerability is thinner than ever.

The real story is not how high margins are, but why - and how fragile the scaffolding may be the next time external winds blow.

Table 8: The Margin Illusion

|

Factor |

Narrative (“Margins Prove Apple’s Superpower”) |

Reality (“Margins Are a Patchwork - Much Cash, Little Core Growth”) |

|

Q3 2025 Gross Margin |

46.5%, lauded as “industry-leading” |

Only this high because of deferred pain and services profits |

|

Hardware Margins |

“Proof of scale and efficiency” |

Flat/down without help, not the source of profit strength |

|

Services Contribution |

“Nice supplement” |

The actual driver of profit and margin buoyancy |

|

Tariff/Subsidy Impact |

“Managed expertly” |

Only avoided, not neutralised - next quarter risk is obvious |

|

Analyst/Comment Mood |

“Best in class, set to improve” |

Only if the best luck continues - otherwise exposed and under-hedged |

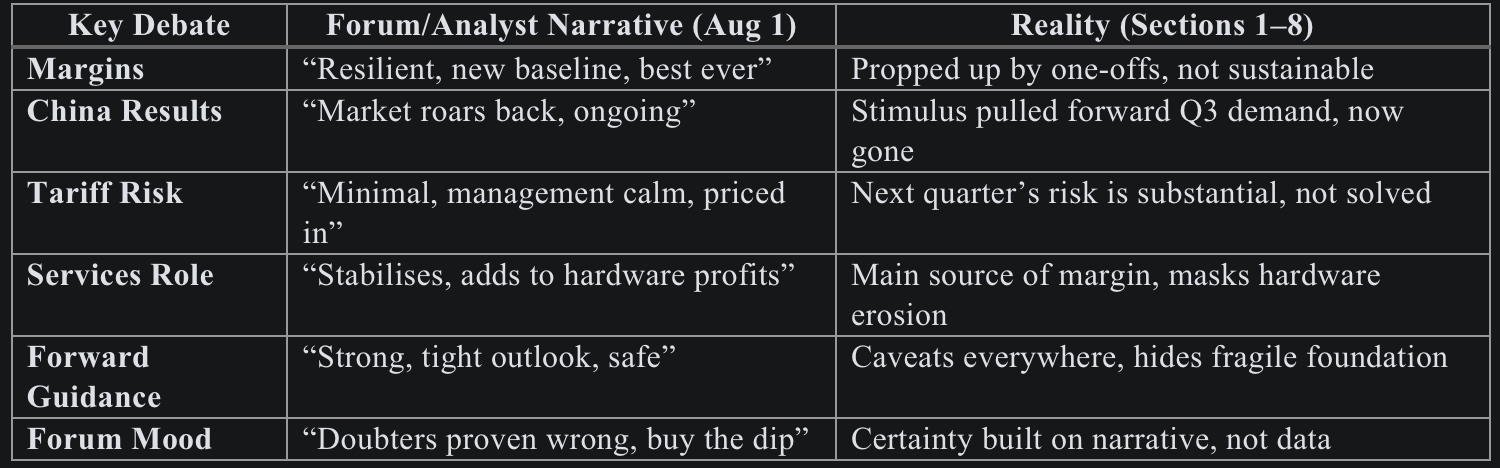

Section 9: Narrative Capture - How the Analyst and Fan Chorus Reinforce Each Other’s Delusions

It’s the day after Apple’s Q3 earnings, and the air across financial forums, Bloomberg terminals, Reddit threads, and “professional” analyst calls is thick with a single, blaring contradiction: so few are willing - even now - to see the parade for anything but a victory march and just take not a negative, but simply dispassionate view. The commentariat are hunting level headed thinkers down with pitchforks.

- “Margin resilience is the whole story. The naysayers have been wrong for years.” - Popular Apple forum, 1 August

- “Guidance on tariffs? Not worried - Apple always overdelivers.” - Analyst live chat, 1 August“

- Is anyone actually concerned about next quarter? It’s Apple.” - Large tech Discord

For every warning bell rung in the cold language of Apple’s own disclosures (see Sections 1–8) - tariffs deferred but not gone, China’s one-off “sugar rush,” margin dependency on increasingly high cost high margin financial services - there were a dozen forum posts and analyst notes waving the triumph flag, eager to extrapolate a quarter built on luck and accounting manoeuvers into an unshakeable new baseline.

Core Themes from the Comment/Analyst Streams:

- Immediate Afterglow and Amnesia:

Despite explicit caution from Apple management and a transcript littered with hedges, most reactionary commentary on the evening of the call ignored these “ifs” and “unlesses.” Instead, forums filled with cheerleading on the headline numbers, with only the rare post pausing for nuance. - Wall Street’s Institutional Memory Loss:

Real-time analyst notes from the likes of Barclays, Oppenheimer, and Morgan Stanley on August 1 showed the same playbook: take the margin as evidence of unassailable execution, not as the consequence of exceptional (and temporary) externalities. - Fan Forum Echo Chamber:

Reddit, Discord, and smaller blogs rapidly coalesced around the idea that this quarter “proves” Apple’s permanent return to form. Threads labeled every voice of caution as “anti-Apple FUD,” and legitimate questions about future risk were typically down-voted or ignored, replaced by memes celebrating “eternal iPhone dominance.” - Analyst and Amateur Convergence:

The most telling pattern isn’t who said what, but how quickly the language and narratives harmonized. Analyst reports (who were broadly beaten by independent “amateur“ AAPL investors) referenced the same “margin resilience” lauded by forum threads, while retail posts cited analyst soundbites about “historic quarter” and “irreplaceable brand.”

How Reality Deviates:

- None of this narrative stands up to the evidence amassed in the previous sections:

- Tariffs: As Section 1 established, deferred pain is not defeated pain.

- China’s Demand: Section 2 showed that government stimulus, now rescinded, underpins the growth, not repeatable demand.

- Margin and Services: Sections 3 and 8 highlight how reported margins are as fragile as the scaffolding of temporary boosts and finance/insurance profits now holding up the edifice.

- The dangerous feedback loop:

Analyst upgrades encourage retail euphoria, which in turn gets cited by analysts as “confirmation” of sustained strength. Instead of asking hard questions or referencing underlying risks (clearly named throughout Sections 1–8), both camps chase the high of confirmation and narrative closure.

Table 9: Reality vs. Forum/Analyst Narrative

Section 9: The Close

The story of Apple’s Q3 2025 isn’t just about revenue or margin - it’s about how narratives are built and reinforced. The echo chamber - where analysts and fans cheer on each other’s confidence, discounting or outright ignoring the facts shown in Apple’s own disclosures - creates a bubble of certainty that feels good until reality intervenes.

For disciplined observers, it’s essential to keep the receipts: the sections above prove that triumphal commentary is built more on inertia, hope, and selective memory than on a sober reading of risk, context, and consequence.

The Wrap: “Liberation Day 2.0, the End of the Anomaly - and Apple’s Real Test”

If there is a single, unvarnished truth to draw from the drama of Apple’s Q3 2025 earnings cycle, it’s this: narrative can only outrun numbers for so long.

For the better part of the last two years, the market, analysts, and Apple’s own myth-making machinery have colluded (sometimes wittingly, often not) to frame every anomaly as resilience and every stroke of luck as basic law. As I’ve chronicled again and again - through pre-warnings, “what ifs,” and post-mortems - the parade has always come with a payload of rainclouds.

Today August 1st, on what the market now sardonically dubs “Liberation Day 2.0,” all the deferred risks and secular shifts have begun to manifest in daylight - no longer masked by tariff holidays, sugar-rush Chinese demand, or the temporary scaffolding of services margin expansion. The markets took a predictable plunge. The DOW is down 550 points as a write and AAPL is still around $202 from its opening $214 high. In other words, fairly valued at a multiple of 30x PE, but that’s ”fantastic enough” for some long term investors, who think Apple should be back at $260 even while it lags its own product release schedule by several years. The dissonance is about as strong as I can remember in about 25 years of covering this stock, and tempers are short. Investors should recall, the market can stay “irrational” longer than you can stay on your anti-depressants.

The forums are suddenly sober and angry.

Analyst calls now sound more equivocal.

Even Tim Cook’s famed imperturbability on the Q&A was replaced by a candour that barely disguised the urgent reality: Apple is not only out of runway on its old tricks - it is now under the harshest operational and strategic spotlight since the “beige box” era.

The era of excuses is over. What matters after this quarter is not the preservation of a story, but the delivery of genuine results on tangible, strategically vital axes and “shipping new stuff, and shipping and shipping and shipping again“ like it’s 1984.

The Three Non-Negotiables: What Apple MUST Deliver on by September’s End

1. Real Strategic Clarity on Global Supply Chain and Tariff Mitigation - Backed by Action, Not Slogans

The days of skating by on partial offshoring, vague allusions to Indian and Vietnamese manufacturing, and the hope that geopolitics will always cut Apple a break, are over.

With the “Liberation Day” tariff reset, the financial impact is no longer theoretical - it is imminent and potentially brutal. Investors, partners, and observers need real, detailed evidence that Apple has a coherent, credible plan to absorb, mitigate, or sidestep tariff drag without simply compressing margins into oblivion or creating new supply headaches or just hoping , hoping, Trump will wave his pen and permanently waive Apple et al from the impact of tarrifs.

This means clear capex, clear timelines, and measurable milestones - not just a blizzard of “commitment to resilience” or “diversification” platitudes. If Apple cannot show, with receipts, that it can maintain product velocity and profitability in a newly tariffed world, Q4 and beyond will deliver a hard, mechanical reckoning.

2. An Unambiguous AI and Product Roadmap - Demonstrable Before iPhone 17 Launch Season

This quarter’s results have vapourised whatever cover Apple had left on its lagging AI posture. The world, and Wall Street, is no longer content to “wait and see,” let alone accept another round of promises with the thinnest of technical showcases.

The competitive window is now, and the “AI moment” is already barreling through every major sector and interface. Apple has lost 15 years of a clear head start and screwed up every single opportunity to make up on this (see Siri delays earlier).

Apple must both articulate and demonstrate (not merely preview) its plans for device-integrated AI, ecosystem-wide intelligence, and developer-enabling APIs before the iPhone 17 cycle closes. No more skating on reputation, or leaning on legacy moats like “privacy.” The TikTok and Gen-Z generations are hungry for tangible, differentiated benefit - not just security rhetoric. If Apple can’t provide a must-have, integrated AI leap, it won’t just lose upgrade cycles - it could cede cultural and commercial relevance at speed.

3. A Fundamental Rethink of Its Value Proposition and Brand Narrative - With New, Quantifiable Proof

Perhaps most urgently, Apple must confront and reinvent the narrative that has protected its valuation for so long. Q3 2025 has destroyed the illusion that “installed [ambiguous] base” is equivalent to perpetual pricing power, or that “premium” status guarantees margins and loyalty in the age of agentic AI and maturing alternatives.

Apple needs to put forward a new, data-driven story about why its ecosystem, devices, and experiences remain both essential and worth a premium. This means fresh benchmarks for user retention, new metrics for stickiness, and above all, hard evidence (not just platitudes) that the company can attract and keep the next hundred million customers - not just coast on the inertia of the past. Gen-Z and their successors will not be won by nostalgia or middle-aged notions of status; they need proof, utility, and engagement at the pace of their own shifting expectations. They won’t. Don’t believe me? Here’s 16,000 words why I’m right.

A Final Charge to Apple (and the Market):

What happens next is not merely about earnings-per-share, but about narrative, ambition, and execution. The “anomalies” of Q3 can no longer be repackaged as the baseline.

On “Liberation Day 2.0,” Apple has been, in effect, set free from the last quarter’s illusions by the return of risk and reality. That freedom is terrifying and enabling in equal measure: now comes the test of whether the world’s most mythic company can do what made it great - face the facts, adapt, and reinvent not only its products, but the way it tells and delivers its story.

Apple must deliver clarity, capability, and conviction on these three fronts - or risk becoming a textbook case of the perils of believing your own legend, long after the credits have rolled.

So ends the era of the anomaly. September will reveal whether Apple is still the company that shapes the era to come - or merely a casualty of its own narrative momentum. In the meantime, make my TACO the full chilli beef with jalapeños and cheese sauce all over it please – and make sure it’s all-American! I want generically modified beef y’all hear, and processed cheese that tastes as badly as it pours. Pure Americana and dose of Tim Cook making a comeback story like Brad Pitt.

— Tommo, London, 1st August 2025 | X: @tommo_uk | Linkedin: Tommo UK

And don’t forget:

#FREESIRI … because it’s not Siri’s fault Apple’s done more U-turns than Brad Pitt in Apple’s Formula One: The Movie.