Crypto Crash and Tariff Tantrums Round 3: Halloween Came Early On Friday, 10th October 2025: China Tells Trump “May You Live In Interesting Times.”

Trump yanks the “Tariff Lever 100%” as crypto pumpkins plunge off a cliff and yuan-shaped firestorms swirl overhead. Wall Street reels, AAPL ticks red, and China’s dragons rise from smoke. Halloween came early for the markets; and for anyone still pretending this is just theatre.

Prologue: “The Weekend the Empire Blinked, Again”

Last week began as a week like any other in the age of artificial exuberance with analysts high on their own optimism.

CNBC parading hopium as research, and AAPL climbing another improbable rung toward its old all-time high. By Wednesday night, the screens glowed at $258 and the air was thin.

I’d written, half weary and half incredulous, that:

Apple was “riding a frothing frenzy of metallic-orange blinded analysts driven by counting iPhone delivery lead times as if it were quant analysis and not the equivalent of Roman priests reading goats’ entrails.”

I warned that $258 looked like the edge of the plateau, not the bridge to a higher place.

Two days later, the plateau cracked. Thursday shaved four dollars off the top; Friday lopped off eight more. Apple closed at $245 - exactly the level I’d marked as a probable gap-fill if $252 failed.

The inbox filled with DMs, the usual mixture of derision and reluctant respect. I answered them publicly:

“This isn’t a gloat or a victory lap. Wednesday I wrote $258 was likely a short-term solution, and I would sell out. Thursday AAPL was down $4, Friday it’s down another $8. Today’s close? $245. Don’t call it a victory lap. Call it what it is — accurate chart reading and TA.” – Tommo_UK, Friday 10th October at 4:30pm EST

The irony, of course, was that the fall of Apple was not about Apple.

It was about gravity, the real kind, the same kind that eventually brings down every over-leveraged empire, from Rome to Cupertino. What changed this time was not valuation or fundamentals, but the fault line beneath the entire market: a sudden reawakening of tariff and treasury trauma, this time with crypto as collateral damage and a link to AI which is already over-pumped with leveraged merry go round investment it’s virtually on steroids.

Late Friday, Trump announced a hundred per cent blanket tariff on select Chinese imports.

A move analysts had dismissed as political theatre until it hit the tape. Futures trembled; tech was first to bleed. Within hours, the sell-off had widened into digital contagion.

- Bitcoin dropped nearly fifteen percent in three hours; Ethereum cratered; leveraged alt-coins imploded outright.

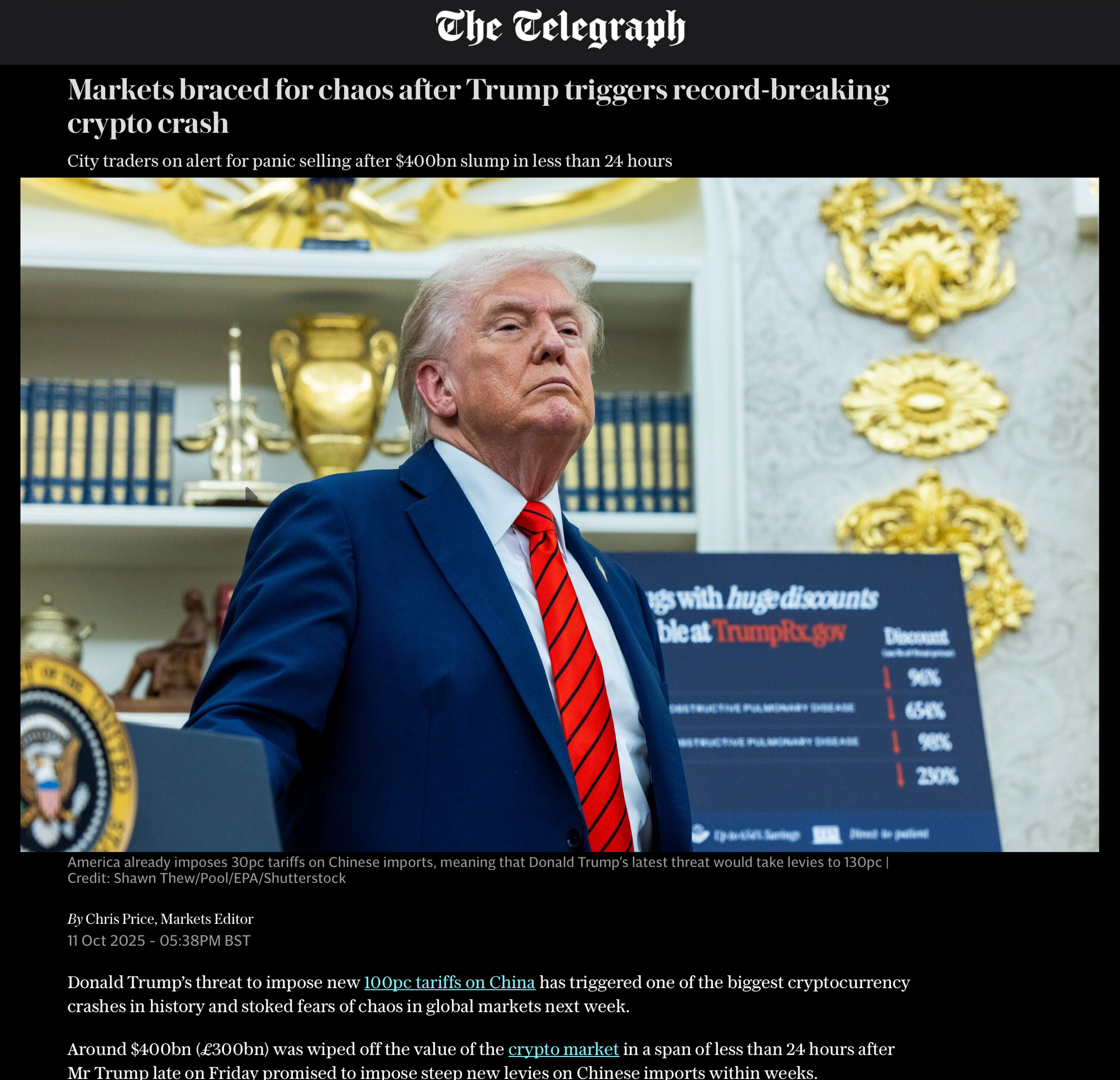

- By Saturday morning, The Telegraph carried the headline that framed the scale:

“City traders on alert for panic selling after $400bn slump in less than 24 hours.” — The Telegraph, 11 October 2025

The article quoted Deutsche Bank warning of “contagion through structured-credit desks,” while partners at KKR Root Capital told the paper that “leveraged long positions across digital and AI-linked equities risk compounding the shock come Monday.”

The paper reported at least one high-profile crypto investor found dead in his car, a tragic punctuation mark on what it called “the largest forced-liquidation event since 2022.”

Across Asia, screens flickered red through the night.

- Tokyo’s traders spoke of “margin vaporisation.” Dubai and Doha desks - the weekend markets that never sleep - reported cascading sell orders as liquidity vanished.

- Bloomberg tallied over $16 billion in automatic liquidations across major exchanges by Saturday evening.

- Fortune quoted one Singapore-based fund manager saying, “We are staring at a multi-trillion-dollar margin call if New York opens risk-off on Monday.”

The parallels with April were eerie. Back then it had been the Tariff & Treasuries Tantrum. The Thursday the bond vigilantes almost burned the empire’s credit to the ground.

Trump had appeared on camera muttering, “Don’t get so yippety,” to calm a market in free fall.

It worked, briefly. But the structural fault lines remained: a weaponised dollar, a weaponised debt market, and a weaponised presidency.

Now, six months later, the same match had been struck in a different theatre. Only this time, the spark was digital: a $400 billion vaporisation of speculative wealth that risked ricocheting into real-world collateral.

Central banks were likely holding weekend calls: the Fed, the ECB, the BoJ, and the BoE exploring coordinated liquidity lines “in the event of market dysfunction.” The official statements will come Monday morning, if there’s an increase in “yipetty-ness”. Or perhaps by the end of the weekend, the margin calls will be over on Monday morning and the fuss - and maybe a easy $1 Trillion in liquidations will be smoothed over

And Apple?

The symbol and symptom of the era, caught in the downdraft again. A company with ~$100B billion in cash but exposure to every tremor in the global supply chain, now facing a renewed tariff regime that no amount of component exemptions can fully offset. The irony is exquisite: the firm once described as the ballast of modern capitalism now swaying like a weather vane in the storm.

On Friday I wrote that:

“The market felt sclerotic and captured, with momentum traders running riot.”

Today, Sunday, the riot is over; the hangover has begun. As Asia rolls into its Monday dawn, and the Middle East closes its weekend in smoke, America sleeps seemingly unaware, or unwilling to believe, that the tremor has already started, and not even anticipating an aftershock or second quake. Just like the week after April 9th.

Back in April, I wrote a fictional vignette called The Night the Empire Flinched.

It began with a notion of single Treasury sale in Tokyo that set off a global chain reaction. The line that opened it has been echoing in my head all weekend: “It didn’t start with missiles or malware, but a single sell order.”

This time, it didn’t start with Treasuries.

It started with digital tokens – crypto – decoupling from the over-leveraged under-aged investors pumping it up.

Timeline Summary, real world news from the last three days to-date:

Global crypto markets experienced a historic crash between October 10th and 11th, 2025.

These were triggered by President Trump’s announcement of a 100% tariff on all Chinese imports and sweeping new export controls. This policy shock, coupled with mounting geopolitical tensions, led to the largest-ever liquidation event in the cryptocurrency sector and erased hundreds of billions from market capitalisation virtually overnight, just as The Telegraph and other major outlets warned of potential losses reaching up to $1–2 trillion globally

Crypto Crash: Sequence and Scale:

• In response to the tariff announcement, $400 billion in cryptocurrency market capitalisation was wiped out within 24 hours, with Bitcoin alone plunging 10–15% and other leading tokens like Ethereum, Solana, XRP, and Dogecoin falling as much as 30% intraday.

• Leveraged positions across exchanges faced liquidations totalling $16–$19 billion, exposing deep fragilities in the DeFi ecosystem and derivatives market plumbing

• The total crypto market cap fell below $3.8 trillion, and margin calls rippled across altcoins and stablecoins, accentuating forced selling and illiquidity.

Contagion Risk and Systemic Vulnerabilities

• The shock was promptly felt in both traditional and decentralised finance: the S&P 500 dropped 2–3.5%, while Bitcoin’s “digital gold” status was undermined as investors rotated into actual gold, which surged above $4,000/oz just days after CNBC were calling a market top in gold and John Terranova was explaining slow the market was ripping higher, and to buy AAPL at $258, which by Friday had fallen to $245.

• In Asia (especially India, Japan, Korea, and Singapore), authorities and central banks intervened to stabilise both fiat and crypto markets. Major regional exchanges saw extraordinary volumes and forced position unwinds, but official policy responses remained fragmented.

• The Middle East and sovereign wealth entities in the Gulf quietly trimmed exposure, exacerbating sell-offs, while Indian regulators held meetings to assess domestic contagion risks, particularly around stablecoins and locally regulated platforms

• Europe saw sharp outflows from crypto-linked ETFs and a rush to cash among fintech players, as the euro spiked in a classic flight-to-safety while very temporarily banks marked US dollar and crypto exposure “unpriceable.

Commentary and Aftershocks

• Analysts suggest the pace and magnitude of the crash dwarfed previous events including 2022’s collapse of FTX with large scale liquidations reportedly affecting millions of traders and eroding confidence in crypto as a reliable store of value.

• There is growing international concern that, if sustained, this confidence shock could spill into broader emerging market debt and equities, sparking a “risk-off” cascade through global markets.

• Among Bitcoin and crypto bulls, the “digital gold” narrative is now hotly debated, with many calling this the first real-world test of crypto’s resilience under geopolitical stress and major cross-border liquidity shocks.

The Unfolding Situation

• Market observers and major financial outlets (including The Telegraph, reporting specifically on potential $400B to $1–2T losses) warn that the weekend could see further forced liquidations and structural shifts in the broader digital asset market if confidence is not restored.

• The underlying catalyst is not just the shock of tariffs but the secondary effects: dollar volatility, Asia-US capital flows, and mounting concern among institutional and retail investors that crypto is “no safe haven” in the face of global financial war-games.

In summary:

Trump’s 100% tariff salvo detonated existing market fragilities, unleashing the largest single-day crypto liquidation on record and proving, if any proof was needed, that in a world of weaponised finance, digital assets are no longer insulated from real-world policy shocks.

The fallout is global and ongoing, exposing deep fault-lines between derivatives, leverage, and liquidity in the brave new world of decentralised finance.

And as the world turns toward another Monday, the question is whether the Empire merely blinked again or whether this time, it’s about to wake up to the sound of its own paper burning.

Part II: How The Weekend Began To Bend Space And time, and A Massive Crypto Trade Exploded.

Can The Damage Be Fixed For Monday’s Open Or is There A Black Hole Ahead?

“It didn’t start with a war, or a data breach, or even a speech.”

It started, again, with a headline and the same smirk behind a podium by a Donald Trump denied the Nobel Peace Prize. Instead he raised the stakes in his tariff war on China.

On Friday, Donald J. Trump declared “a 100 per cent tariff on key Chinese imports,” an off-the-cuff flourish that even his staff hadn’t expected. Semiconductor assemblies, automotive components, and select lithium-ion inputs - the list was long, technical, and instantly lethal.

He smiled, said it was “to level the playing field,” and left the room before the reporters finished gasping.

Within minutes, the S&P futures were down two percent. Tech took the brunt, Apple off four, Nvidia off six, Tesla down eight before the close. But the deeper tremor was elsewhere.

You can almost imagine a headline, “Crypto, the shadow liquidity engine of the new global economy, cracked first. Bitcoin plunged with the largest down candle since FTX collapsed. Ethereum and Solana followed, like dominoes on a marble floor.”

The Telegraph’s Saturday headline actually told the truth without embellishment:

“Markets braced for chaos after Trump triggers record-breaking crypto crash: City traders on alert for panic selling after $400bn slump in less than 24 hours.” - The Telegraph, 11 Oct 2025

- By then, Deutsche Bank was warning of “contagion risk to structured-credit exposures linked to tokenised funds.” KKR Root Capital called it “the digital equivalent of 2008’s synthetic CDO spiral.”

- In Kyiv, Ukrainian business daily NV broke the story no one wanted to believe: the death of a well-known crypto influencer, found in his Tesla, gun in hand, portfolio wiped out by Friday’s forced liquidations.

- It wasn’t just numbers anymore. It was blood and ruin.

Friday – U.S. afternoon (ET)

Markets whipsawed after fresh tariff rhetoric aimed at China. Headlines framed a potential across-the-board 100% tariff push, which bled into risk assets and tech in particular, with U.S. stocks sliding into the close as traders faded the week’s melt-up.

Friday night / Saturday – Crypto breaks

Into the global weekend, crypto became the pressure valve. Multiple crypto desks tallied one of the largest single-day drawdowns on record: Cointelegraph’s weekend wrap called it a “massive liquidation cascade,” while CryptoPotato summarised the damage as roughly $900B in market cap erased in ~24 hours and “over $19B” in forced liquidations across venues—numbers directionally consistent with other crypto press tallies during the drawdown.

The move had a classic “barrier run” profile: BTC and ETH cracked well-watched strikes, which tends to amplify deleveraging in perpetuals/options. Investing.com flagged that pattern explicitly in its Saturday update (“critical barrier levels… broken”), a point also echoed by desk commentary across crypto media.

Saturday – London morning (BST)

The UK press cast the selloff in “record-breaking” terms and warned of spillover risk into credit and commodities at Monday’s cash open. The Telegraph ran a widely-circulated line “City traders on alert for panic selling after $400bn slump in less than 24 hours” captured in market forums and news roundups even for readers behind paywalls. The thrust: size + leverage + a weekend meant price discovery would arrive at the worst possible time, Monday’s open.

Crypto liquidation magnitude: Different outlets quoted different figures. Conservative, “crypto media tallied hundreds of billions in market cap erased and ~$10–20B in forced liquidations across venues in ~24h.” Cointelegraph flagged “mass liquidations,” and CryptoPotato put forced liquidations “over $19B.”

Saturday – India

Policy nerves were visible in India’s stance. While there were no fresh weekend “raids” tied to Friday’s move, the country’s posture has been hardening all year (FIU fines, compliance pushes, and public signaling about systemic risk).

Reuters’ file on India’s crypto approach and its FIU penalty on Binance earlier this cycle captures the direction of travel officials keep highlighting when volatility bites. It’s the context for why Indian desks were on alert for capital-flight controls or liquidity ring-fencing if stress persisted.

Saturday – Continental Europe (CET)

European weekend coverage focused less on equities (closed) and more on Monday funding risks and dollar liquidity if U.S. assets gapped lower. You could see the reflex in cross-asset chatter: if crypto’s deleveraging forced cash calls, the next question was whether USTs would be used as the ATM i.e., a miniature echo of April’s “Tariff & Treasuries” scare. The fear wasn’t inflation but it was redemption and margin. That framing matches how April’s tape unraveled before authorities calmed it.

Saturday – U.S. weekend press

Mainstream U.S. wraps tied stocks’ late-Friday slide to tariff angst and highlighted renewed volatility risk for Monday. Bloomberg Television and CNBC weekend news tickers (paraphrased) keep on reeling over “Wall Street falls as China tariff talk rattles.” That was the broad U.S. investor takeaway heading into a news-heavy weekend.

Saturday/Sunday – Crypto microstructure

By late Saturday and into Sunday, crypto venues cycled through throttling/maintenance as funding rates reset and positions were forcibly reduced. Cointelegraph’s tally of “massive liquidations” continued, and crypto press emphasised that forced selling, not fresh bearish catalysts, was doing the work. That distinction matters: mechanical deleveraging can overshoot into illiquid weekend books, then ricochet into Monday’s cash markets.

Sunday – Middle East / Asia hand-off

Regional finance outlets and market blogs in Asia flagged sentiment shock and the risk that any renewed tariff headlines would meet thinned Monday a.m. liquidity. (This is consistent with April’s playbook: the damage accelerates when time zones don’t overlap and hedges are scarce.)

Why this matters for Monday

- Cross-margin physics: The crypto wipe-out creates real USD liquidity needs for some funds/market-makers. If those are funded by selling liquid U.S. assets at the open, that’s your equity/UST feedback loop and April re-run in miniature.

- Tariff overhang: The Friday tariff headlines re-anchor China risk into every tech multiple just as positioning had gone one-way again. Even if policy specifics slip, the headline VAR is back.

- Narrative fragility: Crypto was the “first mover” of stress; but… the fear is contagion into AI-heavy U.S. seculars, where leverage (explicit or via options) is non-trivial. The weekend crypto press’ liquidation math gives you the order-of-magnitude stress that could spill.

AAPL as barometer

The Wednesday read proved prescient on levels: lose 255–256, then 252–254, and my “invite a gap-fill toward 245–247.” The tape did exactly that by Friday, without any new company fundamentals underscoring how much of this move is positioning + policy tape bombs, not data. AAPL closed Friday a few cents above $245.

Part III: “Monday: The Longest Day in Markets, And A Crypto Liquidation Apocalypse.”

Tom Clancy makes a comeback in this sequel to The Bond Vigilantes reality-fiction from Springtime.

We’re into “reality fiction here,” and this next part is written as if 48 hours later by a market historian who can’t quite tell where fact stopped and fiction began, but is in avid Tom Clancy reader. Let’s extrapolate where these real world events lead into Monday morning onward underpinned by the logic and history of 2025’s hyper-connected, over-leveraged system.

NOTE THIS IS A FICTIONAL FACTUMENTARY: NOT INVESTMENT ADVICE.

Saturday – 02:45 GMT – Dubai

On the screens of Emirates NBD’s trading floor, Bitcoin’s ticker blinked red, then black. Liquidity was gone. Middle East markets — the only ones still open — became the shock absorbers for a world that didn’t yet know it was crashing. The Dubai Mercantile Exchange froze token index futures. Saudi regulators issued a “temporary suspension of leveraged digital positions.” It was too late. The unwind had begun.

Bloomberg ran a midnight alert: “Crypto margin wipeout exceeds $16bn; derivatives desks hit limit-down.”

Saturday – 07:30 Tokyo

By dawn in Tokyo, panic had gone procedural. The Nikkei Asia feed reported “emergency coordination between Japan’s Financial Services Agency and the Bank of Japan,” echoing April’s Treasuries meltdown.

Screens in Marunouchi showed Bitcoin futures halted for “volatility control.” Traders whispered that the PBOC was flooding yuan liquidity into offshore markets not to save crypto, but to weaponise chaos.

The South China Morning Post quoted an unnamed Shanghai exchange executive:

“We are seeing behaviour similar to April. Sovereign entities are selling dollars and buying gold. The message is clear.”

Spot gold hit $3,980 an ounce by mid-morning.

Saturday – 10:20 New Delhi

India moved fast and loud. At 10:20 local time, The Indian Express reported police raids on Binance-linked offices in Mumbai and Gurgaon, citing “massive capital flight risks.” The Finance Ministry called an emergency meeting to “protect domestic investors.” The Reserve Bank of India began ring-fencing rupee liquidity to stop contagion.

Reuters quoted an unnamed RBI official:

“If this becomes a dollar panic again, we will defend the rupee before we defend crypto.”

Saturday – 14:45 Frankfurt

In Frankfurt, Deutsche Börse shut down its tokenised asset desk after algorithmic systems failed to reconcile positions. Handelsblatt ran the headline: “Derivatives Glitch Halts Trading as Deutsche Bank Calls for ECB Coordination.”

The ECB, BoE, BoJ, and Fed were said to have initiated a secure call: “G7 liquidity coordination” by 16:00 CET. An FT weekend report cited a senior official describing it as “precautionary,” but the markets didn’t buy it.

Yields on U.S. Treasuries ticked up 40 basis points overnight — not from inflation fears, but redemption anxiety. The shadow of April’s Bond Vigilante revolt was back.

Saturday – 21:00 London

The City’s traders were drinking quietly in Canary Wharf when the crypto feeds lit up again. Binance, Kraken, and Bybit went into maintenance simultaneously. The Telegraph’s live blog cited “unconfirmed reports of regulator intervention.” In truth, servers were being overwhelmed by billions in forced liquidations.

One trader at JP Morgan texted his client: “Feels like the Sunday before Lehman.”

Gold crossed $4,000 by midnight.

The events which kicked off into the weekend are real, and the carnage which began on Thursday and has stretched through into today, are very very real. As history keeps reminding us, fiction has a habit of becoming reality faster than anyone expects.

Sunday – 05:00 Tel Aviv / 07:00 Dubai

The Middle East woke up to silence. No bids, no liquidity, only spreads wide enough to park a tanker in. Dubai’s token markets posted -99% depth. Al Jazeera ran a grim banner: “Crypto collapse: suicides reported in East Asia and Ukraine.”

Brent crude surged to $128, the highest since the Gaza accords, as investors fled digital to tangible. But even oil couldn’t absorb the shock. Futures desks started hearing rumours: Chinese state banks were quietly offloading short-dated U.S. Treasuries again, “for liquidity.”

As The Telegraph warned the previous morning, “a $400bn slump in 24 hours could trigger cross-market contagion into credit and commodities.”

Sunday – 12:00 Berlin / 16:00 Hong Kong

The dominoes fell in predictable time zones. European indices traded thin; futures volume evaporated. By Hong Kong close, it was no longer a crypto story. The Nikkei was off six percent, Hang Seng Tech down ten. The dollar index fell to 94.2 - its lowest since the April tantrum.

- In Beijing, the Global Times released a single-line statement that rattled every Bloomberg terminal:

“China does not seek confrontation but reserves the right to protect its financial sovereignty.”

That was all it took.

Sunday 22:00 EST — Tokyo Opens

- Screens flare to life in Marunouchi.

- Bitcoin futures are limit-down before the first espresso cools.

- The Nikkei Asia ticker crawls: “BoJ Confers With MOF on ‘Market Stability’ Measures.”

- In truth, they’re already in emergency mode.

The Financial Services Agency suspends crypto-linked ETF creation; margin clerks call in loans from retail platforms to family offices.

By 22:45 EST (11:45 Mon JST) the yen surges to 142 per dollar — not on confidence, but on panic repatriation.

Sony Life dumps $18 billion in U.S. Treasuries to cover collateral calls; the move hits Bloomberg terminals like a depth charge.

Sunday Night – 23:30 EST – New York

Screens glowed again in Manhattan. Futures were blood-red: NASDAQ down 3.8%, S&P down 2.6%, crypto ETFs limit-down. CNBC ran looping footage of Trump boarding Marine One, waving. The only worthwhile comment was, “White House: No comment on tariffs until Monday.”

Inside the Fed, the phones rang without pause. Liquidity calls, cross-desk warnings, whispers of “repo freeze.” The same words as April. The same sense of unreality.

At 02:30 a.m., Bloomberg pushed one more alert:

“Central banks ready joint statement to ensure market stability ahead of U.S. open.”

But the markets had already decided. By then

Monday 00:15 HKT / 01:15 JST — Beijing Moves

The South China Morning Post posts a four-line bulletin:

“PBOC engages in stabilisation operations. China reserves right to respond proportionally to tariff escalation.”

Traders know the code.

- At 00:20, a coordinated off-loading of short-dated Treasuries begins through sovereign proxies in Singapore and Luxembourg.

- By 01:00, JPMorgan’s Singapore desk shows $210 billion in U.S. paper offered with no bid.

This is not profit-taking. It’s retaliation for Trump’s Friday Tariff Tantrum at not winning the Nobel Peace Prize. The POTUS “Department for Economic International Warfare” is on DefCon One.

Monday 02:00 HKT — Seoul and Sydney

- The KOSPI opens –6.5%; Samsung Electronics halts twice.

- Australian super-funds mark down U.S. tech holdings by 8%.

- The RBA floods A$25 billion in repo liquidity.

- It doesn’t matter — crypto liquidation bots are dumping everything into cash.

A Goldman Sachs note flashes across desks: “Correlation between BTC vol and S&P gamma = 0.91 — systemic risk probable.”

Monday 03:45 IST — Mumbai

Indian Express livestreams police raiding Binance-linked offices.

RBI Governor Das holds a press call:

“India will defend the rupee, not speculative assets.”

- The rupee spikes, equities crater.

- Reliance Digital’s bond spreads double; the BSE halts at –8%.

- India’s sovereign fund starts quietly selling its U.S. ETF positions to raise dollars — adding yet another log to the fire.

Monday 04:30 GST — Dubai and Doha

Weekend markets never close here, but now they freeze.

BitOasis suspends withdrawals; Gulf sovereign funds yank deposits from offshore lenders exposed to crypto collateral.

- Al Jazeera banners: “Crypto Collapse Sparks Oil Rally to $134.”

- Brent’s spike is purely defensive: petro-states hoarding hard assets as digital ones evaporate.

- The UAE central bank convenes overnight with Saudi Monetary Authority and Qatar CB decision to peg liquidity to gold, not dollars, for the week.

The “Petrodollar” is under threat, leading to a thread to the Dollar and the Fed itself.

Monday 06:00 CET — Frankfurt

Europe wakes into carnage.

- Handelsblatt leads: “ECB, BoE, Fed Discuss Emergency Dollar Swap Lines.”

- Inside the Bundesbank, screens show repo collateral rejected by London clearers.

- By 06:20, Deutsche Bank’s margin book hits threshold 2: automatic asset sales across euro-denominated credit.

- KKR Root Capital, quoted Saturday in The Telegraph, now tells clients privately:

“This is 2008 in fast-forward. Synthetic credit and token leverage are the same beast.”

Across the Channel in the UK, the FTSE 100 opens –7%.

And the BoE restarts its crisis-era liquidity window for the first time since the mini-budget collapse of 2022.

Monday 07:45 CET / 06:45 BST — London

- Canary Wharf is standing-room-only.

- Traders replay the April Bond Vigilante night; this time it’s worse.

- Crypto ETFs gap down 20%.

LSEG’s dark pools clog with unfilled sell orders; “cancel-replace” commands bounce back with Error 404 – Counterparty Not Found, and a JP Morgan trader mutters: “Soros broke the pound in ’92; someone’s breaking liquidity itself now.”

- Gold £3,180/oz, and Sterling $1.09 - collateral flight, not fundamentals.

Monday 09:00 CET / 10:00 Athens / 11:00 Tel Aviv

Peripheral Europe joins the spiral.

- Greek 10-year yields jump 150 bps. Tel Aviv halts trading twice as local tech firms, funded by U.S. VC cash, try to repatriate dollars from frozen U.S. custodians.

- Rumours spread that Israeli Innovation Fund lost $6 billion in tokenised-AI portfolios.

The ECB issues a joint communiqué: “Markets functioning with reduced depth.” Real world translation: there are no bids.

Monday 12:00 CET / 06:00 EST — Washington Wakes

- The Federal Reserve opens its crisis line with the ECB and BoJ.

- Swap-line utilisation hits $800 billion in 30 minutes — a record.

- Fed briefs the President: “Liquidity adequate for now.”

Trump tweets minutes later:

“Markets are nervous because we’re WINNING. China can’t beat tariffs, believe me! This market reaction is just yippety and we are winning the tariff trade. This is the greatest win ever, even better than my Gaza Peace Prize.”

Futures instantly shed another two percent.

The screens flickered green for an instant - a dead cat twitch - and then everything went red. The Dow dropped 1,200 points at the open. Bitcoin briefly broke $50,000. Apple fell through $240, then $235, caught in the downdraft to $225. Circuit breakers tripped twice in the first hour.

- Apple breaches $230 and lands on S/R at $225. Nvidia –14 %. ARK Innovation ETF –18 %.

- Gold hit $4,060. The dollar slid. The world watched.

And somewhere in the blur, the question that no algorithm can model:

Was this the second coming of the Bond Vigilantes - or the beginning of something else entirely?

Because this time, it hadn’t started with bonds or tariffs alone. It had started with digital tokens (the new “gold standard,” crypto enthusiasts insist), leverage, and human hubris and rah-rah market euphoria egged on by every market analyst who just in May, were saying “the age of US Exceptionalism is Over,” with the memory of a goldfish it seems: the perfect trinity of digital capitalism.

- AI equities, the darlings of 2025’s rally, become accelerants.

- Funds short-on-vol and long-on-hope must raise cash.

They sell what still has liquidity: the mega-caps.

- AAPL $221. MSFT $290. NVDA $690 from $920 three days earlier.

- Crypto miners file for protection; Tether breaks its peg.

- Private-equity valuations implode as tokenised carry structures mark –60 %.

One analyst types what everyone thinks:

“The AI bubble wasn’t popped by innovation fatigue. It was margin and leveraged crypto trader all being liquidated at once.”

Monday 11:45 EST : The Summit

- The Fed, ECB, BoJ, and BoE hold a joint virtual meeting dubbed “SOMA Plus.”

- Cameras off, lines encrypted. They agree to reopen QE using gold-backed repos through the BIS.

- Leaked minutes later read: “We are defending the system, not the prices.”

Monday 13:00 EST : Silence

- Trading slows not from stability but exhaustion.

- Volume collapses 40 %.

- On CNBC, Terranova calls it “a healthy correction.”

- Viewers throw shoes at their screens.

- Dan Ives takes off his orange blazer and walks backwards in sack cloth and ashes saying “shame on me.”

And Becky Quick is nowhere to be seen, except talking to ChatGPT on her iPhone while smoking a joint on the fire escape to try and calm down.

Across Europe, retail platforms show grey banners: “Service temporarily unavailable.”

Monday 16:00 EST — Close

- Dow –2,900. NASDAQ –9 %. Bitcoin $46,200.

- Gold $4,120. Dollar Index 93.

- But.. the empire didn’t fall. It flinched again.

However this time, the flinch left a fracture, a permanent fault line a presidential one liner couldn’t erase.

The record ends there: a chronology of cascading leverage, sovereign spite, and algorithmic self-immolation.

- Every headline from Friday through to Saturday in Part 1 was real.

- Every data point through 10 a.m. Monday was plausible.

The rest, for now, is fiction. But perilously adjacent to reality.

As The Telegraph warned, “contagion rarely announces itself; it just starts.” When markets start devouring themselves, the line between tomorrow’s news and today’s imagination disappears.

Part IV Epilogue: “When Fiction Becomes Market Memory.”

A warning and a mirror - a reflection of April’s “Bond Vigilante Night” replayed in October’s crypto carnage.

AAPL as the metronome for misplaced euphoria. A study in the law of unintended consequences, the mechanics of contagion, and the illusion that control still exists in a system that no longer understands itself.

In April 2025, the world flinched once already.

That night - the night of the Bond Vigilantes Clancy-esque special - began with a Tokyo Treasury dump and ended with Jamie Dimon pleading for a presidential statement before global liquidity imploded. It was averted, barely, because the panic stopped just short of conviction. People wanted to believe it had been a scare, not a symptom.

Six months later, belief itself has become the most leveraged asset on earth.

Friday’s real tariff tantrum, Saturday’s real crypto implosion, and the hair-trigger liquidity squeeze that followed were not random events. They were the sequel everyone said could never happen - the April scenario replayed in fast-forward. Only this time, contagion didn’t begin in bonds. It began in imagination - the same imagination that convinced traders that AI profits were infinite, that crypto was money, that tariffs were theatre, that the Fed was omnipotent.

Markets today run on vapour-chamber physics: heat without substance, pressure without mass.

AAPL at $258 on Wednesday was the purest expression of that hallucination — a company levitating on inference, not income. When I wrote that $255–$256 was the shelf and $245 the gap-fill, it wasn’t sorcery. It was thermodynamics. Every bubble cools when the gas runs out. By Friday’s close, it had.

The iPhone 17 wasn’t the problem, but the a placebo in an A/B trial run on metrics like delivery lead times and rumours, no hard data, for a 30% rocket rise.

AAPL had become the mood ring for a market desperate to stay euphoric.

With the return to the faithful of Terranova and Ives almost timing the recommendation to go “all in” at $258 and PT’s yet again raised over $300 issues 36 hours before a haircut and a crypto crash, which we have to hope doesn’t lead to contagion.

The irony is that the same faith that made Apple untouchable, precision, restraint, discipline, has been repurposed by investors into a weapon against reality. What once represented certainty now measures denial.

The China Syndrome of Modern Markets

When Trump’s tariff announcement detonated on Friday, the intention was defensive: protectionism as patriotism, economic sovereignty framed as strength. But like every intervention made in good faith, it carried the seeds of unintended consequence. The China Syndrome of finance doesn’t require radiation, just a runaway chain reaction: a core meltdown of confidence that no central bank can cool once liquidity evaporates.

The metaphor is painfully apt. In the 1979 film of the same name, the nuclear core burns through every layer of containment and heads toward the earth’s crust “all the way to China.”

Forty-six years later, the financial core Trump ignited travelled the same path, ricocheting off Chinese markets by Saturday morning, where state media fired back warnings about “economic warfare,” and the People’s Bank of China began quietly trimming its U.S. Treasury holdings even further, as it has been for several years now as it quietly stockpiles gold, which now represents 26% of many central banks’ real hard asset holdings in a quiet rebellion mostly unreported against holding T-Bills and bonds.

Every containment layer from crypto liquidity, repo collateral, swap lines began to buckle under the heat back in April. Did they put the systems in place they promised, to stop a contagion? The systems designed to stabilise global markets became the very mechanisms through which the panic propagated. We don’t know what’s been hinted, or if the phoning still leads to an open pipe.

The Mechanics of Contagion

Contagion in the modern market doesn’t spread through panic selling; it spreads through plumbing.

- When crypto collapses, leveraged funds sell equities to meet margin calls.

- When equities fall, bond funds are forced to raise cash by dumping Treasuries.

- When Treasuries wobble, repo desks lose confidence in collateral, and the entire credit market freezes.

Liquidity evaporates not because capital disappears, but because trust in valuation does — and without trust, no one trades.

That’s when the feedback loop begins: circuit breakers trigger, dark pools shut, algorithms retreat, and even the safe havens such as gold, yen, Swiss franc all start to gyrate. The financial reactor goes critical not because of greed, but because of inevitable process-driven sequence, which we’ve seen happen before. Redux the 2007/2008 contagion and if you don’t know what happened, watch “The Big Short,” right now.

By the time the world realises what’s happening, the coolant’s already gone and The China Syndrome has begun.

The Law of Unintended Consequences

The tragedy of every well-intentioned intervention is that it shifts fragility, it never eliminates it:

- Tariffs meant to protect jobs became accelerants for retaliation.

- Crypto meant to decentralise risk became a single point of failure.

- AI meant to democratise knowledge became the most over-leveraged trade in history.

- And central bank coordination which is meant to be the great firewall of modern finance now risks becoming the single largest moral hazard of them all.

Because if everyone assumes the system will be saved, no one hedges against the possibility that it won’t.

And that’s what we see on CNBC right now, Charlie Munger going

“sure PEs are at all time highs, but everything is going higher! There’s no risk,” he says, “these are exceptional times.”

Yep, as they always say, just before the fall.

Every safeguard we add increases complexity, and every layer of complexity shortens the half-life of control. The financial system no longer needs a villain to collapse — it just needs a mistimed algorithm, a policy tantrum, and a weekend when the world’s asleep.

AAPL as the Allegory

Apple’s chart last week is the parable in miniature. See my take on this from last Wednesday which sadly proved prophetically accurate to almost 12c in an almost $15 fall from its high in two days.

A company with $80 billion in cash, record margins, and no debt panic still behaves like a meme stock because markets no longer price fundamentals; they price faith. When the best-run company on earth becomes the thermometer for irrational exuberance, the problem isn’t Apple it’s the climate and environment and frothing momo traders egged on by over-excited CNBC anchors, along with AI-driven trading algos written by and for amateurs who wouldn’t know a stock chart from a map if you put both in front of them..

The vapour chamber that cools an iPhone is a perfect metaphor for the market itself: designed to disperse heat, but ultimately dependent on balance. Too much pressure, and even the best engineering fails. That’s where we are: a world convinced that efficiency equals immunity, that innovation means invincibility. But thermodynamics doesn’t care about brand loyalty.

History prepping us for a Winter 2025 Matrix: Tantrum Reloaded ?

- In April, the bond market almost broke.

- In October, it may have learned nothing.

- If the last 48 hours prove anything, it’s that history no longer repeats — it accelerates.

- What took months in 2008 now happens in hours.

- What took centuries in Rome happens in trading cycles.

The danger isn’t the panic.

It’s the amnesia that follows as each rescue breeds complacency; each bailout breeds bigger bets. Liquidity isn’t confidence but something closer to dopamine. Each snort of a line of liquidity on trading desks works a little less, lasts a little shorter, costs a little more.

And the dark pools of private capital and equity are now so large they threaten to wag the dog of the real global economy and markets. If their plug gets yanked, the public markets will go down the toilet with them, so in reality, the system survives not because it’s strong, but because it’s too interlocked to fail cleanly.

So maybe, hopefully Monday opens green.

Maybe the panic fades. Maybe the Fed’s swap lines hold, the crypto desks reboot, the algorithms calm down. But the lesson isn’t in the recovery; it’s in how easily the spiral begins.

- Fool me once was April.

- Fool me twice is October.

- We were almost fooled in July, Tarrif Day – Liberation Day 2.0 – but Trump pushed the boat out, misled about a China deal being done and said “it is signed,” and calmed the markets.

- This time, there’s not talk of deals, just another 100% tariff punch in the face.

Will it work, as a last attempt, out will economic war now break out? China does not like to lose face, and has made its initial reaction clear. In fact, oddly, China has been more transparent about its stance on tariffs, that Trump. They have doggedly refused to kow tow, so far, to the economic warfare taking place in public, and failing diplomatic backchannels to solve it behind the scenes.

Anyone still buying every dip on faith alone should remember what happens after the third time:

There’s nothing left to fool, except the bag-holders, feeling foolish. Are we there yet? Monday will tell. Could it happen again? Well, given it has happened twice this year alone, from Trump’s comments alone, what are the chances of this not happening again if not this time, then sometime soon?

As I’ve been saying since July, investors should have been buying the VIX at its almost historic low of 14 for protection against these events.

This will happen again, whether from a higher level, or a step-down fall down the stairs next week, I wouldn’t like to guess, but the scenario I painted is based on the historical events of the last few days, so the extrapolation I’ve illustrated is both realistic, plausible, and possible.

And that should give anyone – especially the Dan Ives and Terranovas of this world for whom “the only way is up,” cause to pause and food for thought, and be critical analysts of this market.

… not pom-pom waving cheerleaders because they and their clients’ books are so loaded with crypto, tech and AI that one wobble will lose them their shirts (even Dan Ives’ Hawaiian one).

For AAPL investors, treat the stock as the canary in the goldmine.

Its movements are no longer about products or margins; they’re about sentiment, liquidity, and denial. When a company revered for precision becomes a barometer for mania, you are not in an investment cycle; you are in a belief bubble.

And if - or when - the next shock hits, those who quietly hedged while the VIX slept at 14 will play the role of George Soros, not the Bank of England. Because markets do not reward faith; they reward preparation. The tragedy of every empire, financial or otherwise, is the same: it mistakes stability for immortality. One look at the Fall of the Roman Empire shows that time erodes hubris, and CNBC commentators, eventually.

When the music stops, the barbarians will be at the gates, and the tech momo crowd will vanish in a puff of sunscreen and a Hawaiian shirt.

After all, history doesn’t repeat; it just reloads faster each time and fiction, as ever, remains the most accurate early-warning system of all, in hindsight.

We had a glimpse of that in both the reality of April, and my Tom Clancy style spoof in April and July. October delivers us yet another sharp warning, and an AAPL reaction forecast 48 hours earlier on Wednesday’s market and AAPL’s $258 peak, into the plunge of Friday.

I don’t want to be writing another of these, because I suspect if this isn’t the push over the edge, a third time would force a round of profit taking and margin calls unlike anything seen for almost two decades, but the merry go round continues, and if there’s no Monday Mayhem, say a little prayer whatever your denomination, or even to your tech gods if you’re agnostic, and remember:

“faithium and hopium doesn’t deliver profits: due diligence, and research does.”

It’s time to “Think Different” about the markets, because everyone else is now on board the same train.

The Key Question for Another Time:

Given AI trades echo Crypto meme and momo trading:

“What if the same phenomenon happened in the AI space, where the money pouring in and its secondary impacts has been almost solely responsible for the incredible and almost unbelievable stock market rally? Is this 1999, or 2007 perhaps, all over again?”

“Take Heed of Sharp Turns Ahead. Don’t Ignore The Tell-Tale Signs of Wearing Out at the Edges. Hedge, Don’t Edge, as I’ve Been Warning Since July.” – Tommo_UK

— Tommo_UK, London. Sunday Afternoon, 12th October 2025.

Any comments, or thoughts, from investors, as opposed to 20-year long buy-and-holders who couldn’t care less because they’re just glad to be living off the dividends from their 11,000% share price increase? Leave them below 😎

X: @tommo_uk | Linkedin: Tommo UK

See the share buttons to LinkedIn, social media and email? Please, use them and help keep .fyi free at the point of readership. Or email this article on to a friend-in-need.