Dawn rises on Apple’s iPhone 17: Is It Really a Super-Cycle, Or Super-Choreography? We (will) Look Back Six Years, and Two forward. This is just a teaser.

TEASER ALERT: $245 stock highs, queues, hype, orange phones: Apple’s iPhone 17 is already being called a super-cycle after one day! Or is it just… super-choreographed? TOMMO.FYI has crunched six years of iPhone data and what it means for AAPL in 2026. Part one and Part two to follow, next week.

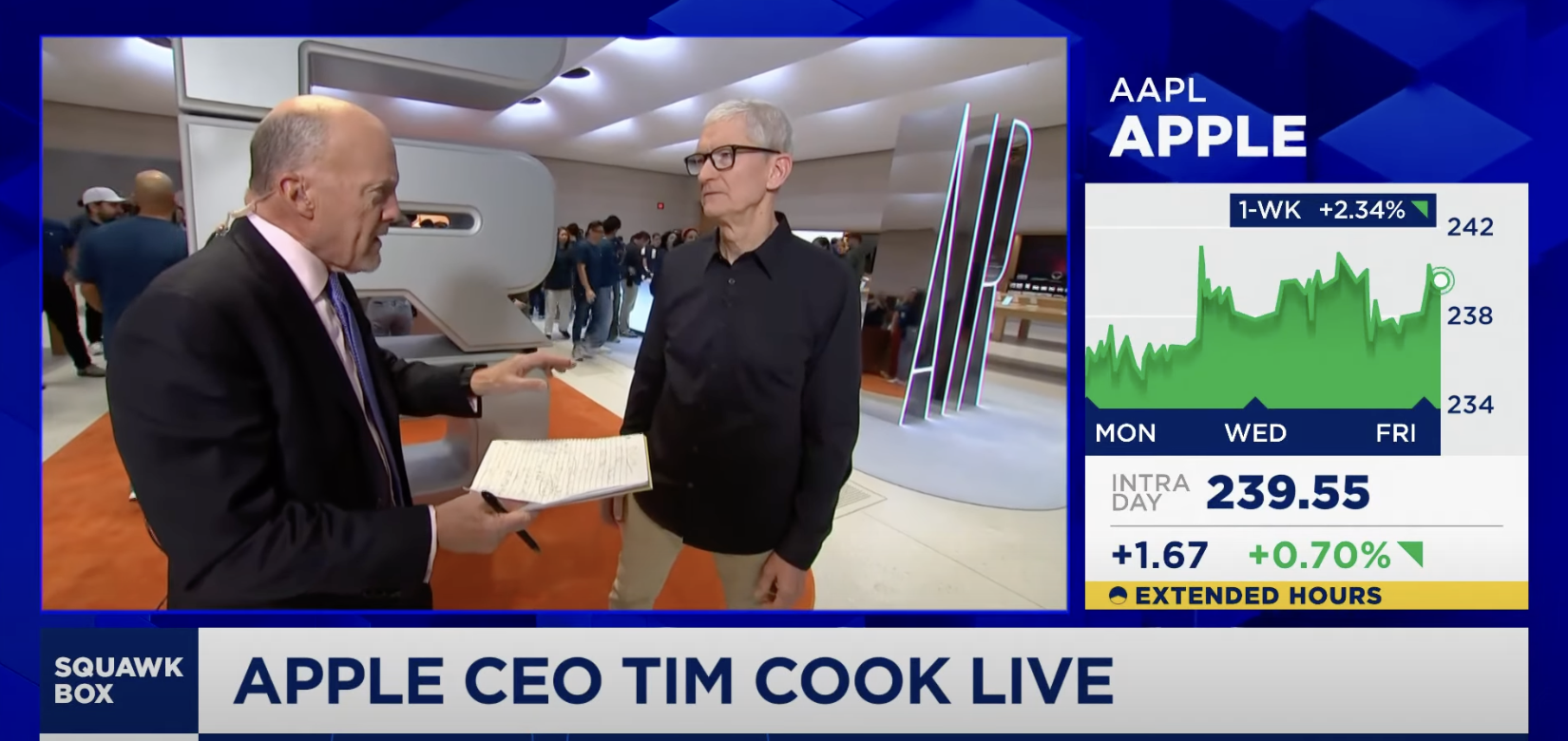

Appearing out of a veritable tornado of superlatives and Jim Cramer sycophancy, like Dorothy’s Kansas house landing on bad press in the form of the Wicked Witch of the East in The Land of Oz, Apple’s iPhone 17 launch has unleashed the usual hurricane of hot air as it dropped, catapulting the stock to $245 in the process.

The coverage was ... “Awe Dropping,” (unlike the launch event itself)

Jim Cramer pledges to “buy all three models.” - Apple 3.0

No

Gene Munster calls it a “super-cycle.” - Apple 3.0

hard feelings

JPMorgan hikes its price target to $280 on the back of longer online order lead times. - Apple 3.0

between friends.

And Apple stock obligingly soared to $245 by Friday’s close on rumours of a 30% increase in factory orders - conveniently leaked just in time for traders to cover their shorts, who conveniently forgot that orders for the iPhone 16 were rumoured to have been slashed by an equal amount in just February gone. Goldfish.

Even Alex Kantrowitz said the choreographed lines, a result of pre-booked online orders with a timed collection slot, rather than the frenzied campers of old winging iot hoping to buy an iPhone before they ran out of stock, said this proves AI doesn’t matter any more. Until Apple says it does. Alex says, ”they make bloody good phones.” As if being a phone was even much of a highly used function of the iPhone these days.

“It’s not about Intelligence. It’s just about being a bloody good old-fashioned phone” - AK

Me? I say this is a damn good use of creating visible demand by packing 100 people into a collection point all at once on launch morning using pre-booked closely packed “pick-up times.” Clever, but not an allegory to the past frenzies, more like a theatrical production carefully choreographed. Theatre.

If this hyperbole and commentary all feels familiar, it’s because it is. Every September, Apple choreographs a spectacle designed to look like unstoppable momentum: queues, scarcity, hype, and a this time a return of the gloss of British-accented calm from Tim Cook’s CGI spectacular. Every year, analysts rush to outdo one another with bigger price targets. And every year, the hard numbers units, revenues, ASPs tell a more prosaic story, often in hindsight.

Except this year TOMMO.FYI has done the hard work up front To lead ahead of the analysts by six months and give you the comps you need, right now, to understand what this launch means now, rather than further down the tracks, and the result is a two-part epoch being released over the next few days to approach the good, the bad, and the ugly from all angle leaving no stone unturned in a quest to provide transparency for investors and penetrate the Apple’s “Reality Distortion Field,” somewhat absent of late but now cranked back up again as Cupertino brings its new power grid online to power it up, just in time.

That’s what my upcoming two-part deep dive will cover:

Part 1 looks back across the iPhone 12 through 16 cycles — the pandemic-era super-cycle, the supply-choked 14, the China-discounted 15, and the tariff-juiced 16 — to establish a baseline.

Part 2 then dissects the 17 launch itself: what’s real, what’s manufactured, and what it means for Apple investors staring down 2026 with a peak into 2027.

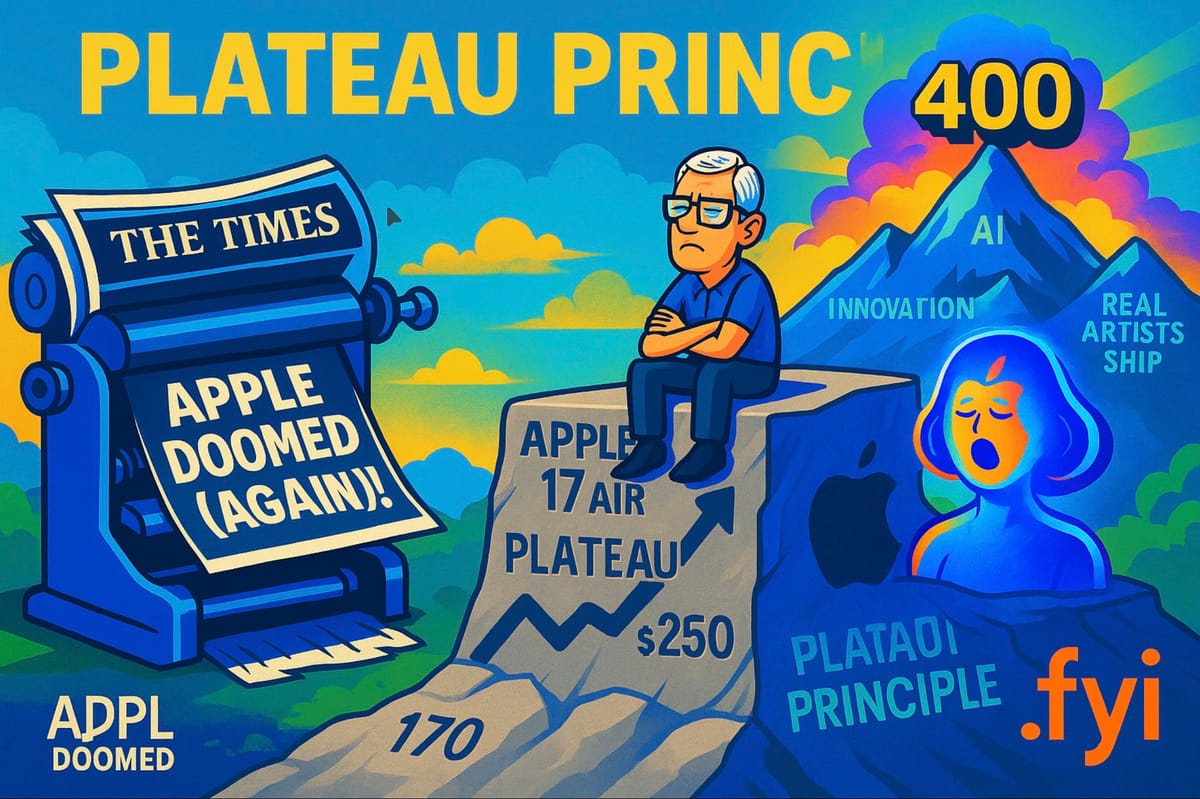

Recall I was the first to write about a plunge possible to $160 (AAPL hit $167), a mediocrity result of around $250 in the result of a competent but AI-less launch (AAPL is at $245 as of Friday’s close) and touted in many articles how I saw and did the math for a rise to $400 by Q4 2027 - given the right circumstances for the Golden Path to become visible. Right now were stood at that crossroads.

You may wish to refresh yourselves with a couple of articles I wrote recently, about these paths, and also Apple’s Q3 report:

TOMMO.FYI’s AAPL Q3 coverage and deconstruction: more trumpets than blowout quarter

Part 1 and 2 drop Monday through Wednesday. In the meantime, Below is a “Cheat Sheet” to Whet Your Appetite:

For those who want the punchlines up front. But the full pieces go much deeper, with numbers, history, and a fair bit of dry humour. It seems “Orange is the New Black” is no longer simply the title of a well-liked TV Series, but a global strategy.

Preview of the Two-Parter to Follow:

The key points to be covered in a 10,000 word two-part drop.

This upcoming two-part article and the 17's market reception will included deep signal analysis and history of launches and the significance of iPhone 12-16 and then, all about the iP17 and the Air in Part 2, but here’s a taster of what’s to drop:

- The iPhone 17 launch has generated significant hype, with Wall Street analysts and media personalities calling it a "super-cycle," fueled by enthusiastic commentary from figures like Gene Munster and Jim Cramer. However, this hype is considered more performance art than grounded analysis.

- Early sales and demand signals for the iPhone 17 show strong uptake especially for the Pro and Pro Max models, with production targets reportedly rumoured to be 25% higher than last year for these premium units. The standard iPhone 17 is viewed as a safe, incremental update maintaining the upgrade treadmill. The United of slashed iPhone 16 numbers last year, from the same store, should be taken into account, and its these sounds of inconsistencies we’ll be highlighting when trying to do a comp of this launch against the previous ones.

- The iPhone 17 Air model is praised for its industrial design and miniaturisation but criticised for compromised battery life and the controversial "plateau" camera bump, representing a design misstep in Apple's traditionally precise aesthetic.There are reasons, trade-offs, a deliberate pay-offs though.

- Pricing has been pushed higher, particularly on the Pro Max, which can reach prices up to $2,500 in the US and the local equivalent of $3000 in other countries when maxed out, a significant premium that tests the ceiling for consumer willingness to pay.

- Black is not back. The traditional Space Black colour option for the Pro was removed in favour of a high-visibility orange, a choice that resonates positively in Chinese markets but is poorly received and even mocked in Western markets like London except by armchair mountain climbers, possibly symbolising a misalignment of cultural preferences.

- The 2024 promised AI enhancements and Siri improvements have failed to materialise in the iPhone 17 launch, with AI features quietly deferred to 2026, contributing to skepticism around claims of product revolution. AI has been airbrushed out of this launch, on the whole, and many questions stand about whether, truly, it’s the 18 which will deliver the promise

- Apple’s narrative relies heavily on supply chain management, orchestrated scarcity, and pricing mix rather than unit growth, propping up revenues through margin optimisation and ecosystem sales (like AirPods and Apple Watch), which are significant in narrative but minor in revenue. The impact on gross margins of AppleCare (insurance re-selling) and Apple Financial Services (money lending) have been the chief drivers behind Apple’s “successful “ recent Q3 report, and are much under-identified as being the driver for this. Financial engineering products are remarkable in their profitability, but not where incurred ideally want to see profits rise, in preference to genuinely innovative new products.

- The US tariff scare in mid-2025 artificially pulled forward demand for the iPhone 16, creating a challenging baseline that inflates comparisons and makes iPhone 17 growth appear stronger by contrast.

- China subsidies for the iPhone 16 distorted sales performance, and the iPhone Air model is still not approved for sale there due to regulatory hurdles, limiting the potential for volume growth in Apple’s crucial premium market. This may distort Q4 and Q1 2026 sales.

Last but not least we’ll focus on analysing identifying and deconstructing Apple’s "Plateau Principle," as I’ve termed it.

The tactics deployed since the genuine super-cycle of the iPhone 12 launch and morphing into the the pattern since the iPhone 14’s release: absent a compelling innovation or clear upgrade driver, Apple defaults to upselling the top models and exploiting external timing quirks and policy incentives to maintain revenue growth.

The Times covered the launch last Saturday, 13th September. FYI had a different take.

This launch is a mashup between financial engineering, excellent consumer psychology, but lazy tactics to replace a lack of a product release strategy, and not one, in my opinion, sustainable. Does this year mark the return to innovation across the map, instead of Apple psychologically herding buyers towards a particular product line up and mix to maximise ROI? Or is it just a blip ”Proof-Of-Life” on an otherwise rather flatlining plateau?

The iPhone 17 and Air - Dazzling in Pro Max Orange, Black is not Back, and the Air - an Emperor with no clothes - but battery pack?

Overall, the iPhone 17 is seen less as a game-changing revolution and more as a well-executed, price-mix-driven iteration on previous cycles, underscored by spectacular marketing and operational prowess, which continues to buy Apple time ahead of expected AI-driven breakthroughs in 2026.

The first instalment of this two-parter will go live Monday or Tuesday, laying down the six-year record of how Apple has really managed iPhone growth.

The follow-up:

Part Two focuses squarely on the iPhone 17 launch and what it means for investors, will follow on Tuesday or Wednesday, respectively, depending on what up-to-date news-flow deserves to be included.

The “Yawn Dropping” truth behind the iPhone launch, before analysts cranked up the hype machine to begin talking up their books, and Cramer went full-on fanboy.

Between the hype and the history lies the truth. And in markets, as in Apple launches, truth is where the money gets made, by “doing our own research“ just like we did int 2008 to beat the Street to understand Apple’s first year of iPhone sales in a community of independent analysts working together. Disagreements should lead to debates, not arguments, because out of this will flow the truth.

There are still three paths AAPL could take:

Which one it sticks to, we’ll look at in the next two parts, and project forwards to find some visibility. This CGI might help goose the launch hyperbole, but unlike Apple’s F1: The Movie, there’s no room in real life for Brad Pitt to break the laws of financials and physics to win the race. This isn’t about ripping up the rulebook, but sticking to a strategy. Recent tactics look promising, but all it takes is a rainshower to throw the tyre strategy off course, and it’s anyone’s game to win. Even OpenAI is getting it’s act together now, and the world of AI, far from reversing, now with almost 1B GPT registered users and growing, is going to dominate more than ever as the months tick forward.

More in the week. Until then, feel free to comment, or ask for any specific coverage you’d like and if I’ve time, I’ll adapt the two-parter to include your questions.

— Tommo_UK, London, 21st September 2025

Connect with me on socials : X @tommo_uk | Linkedin Tommo UK