From “Insanely Great” to “Good Enough”: Apple’s AI and Foldable Story Cannot Justify AAPL at $272 - For Now.

At $272, Apple is being valued on an AI revival and a foldable that exists largely in rumour and analyst imagination. This piece explains why today’s narrative misreads Apple’s past decisions, misunderstands its current structure, and overstates what can realistically arrive next.

Tommo’s Happy Holidays, AAPL Edition

Sneak preview hint - This Isn’t 2011 again.

There’s a particular kind of magic trick that only markets and children at Christmas still believe in.

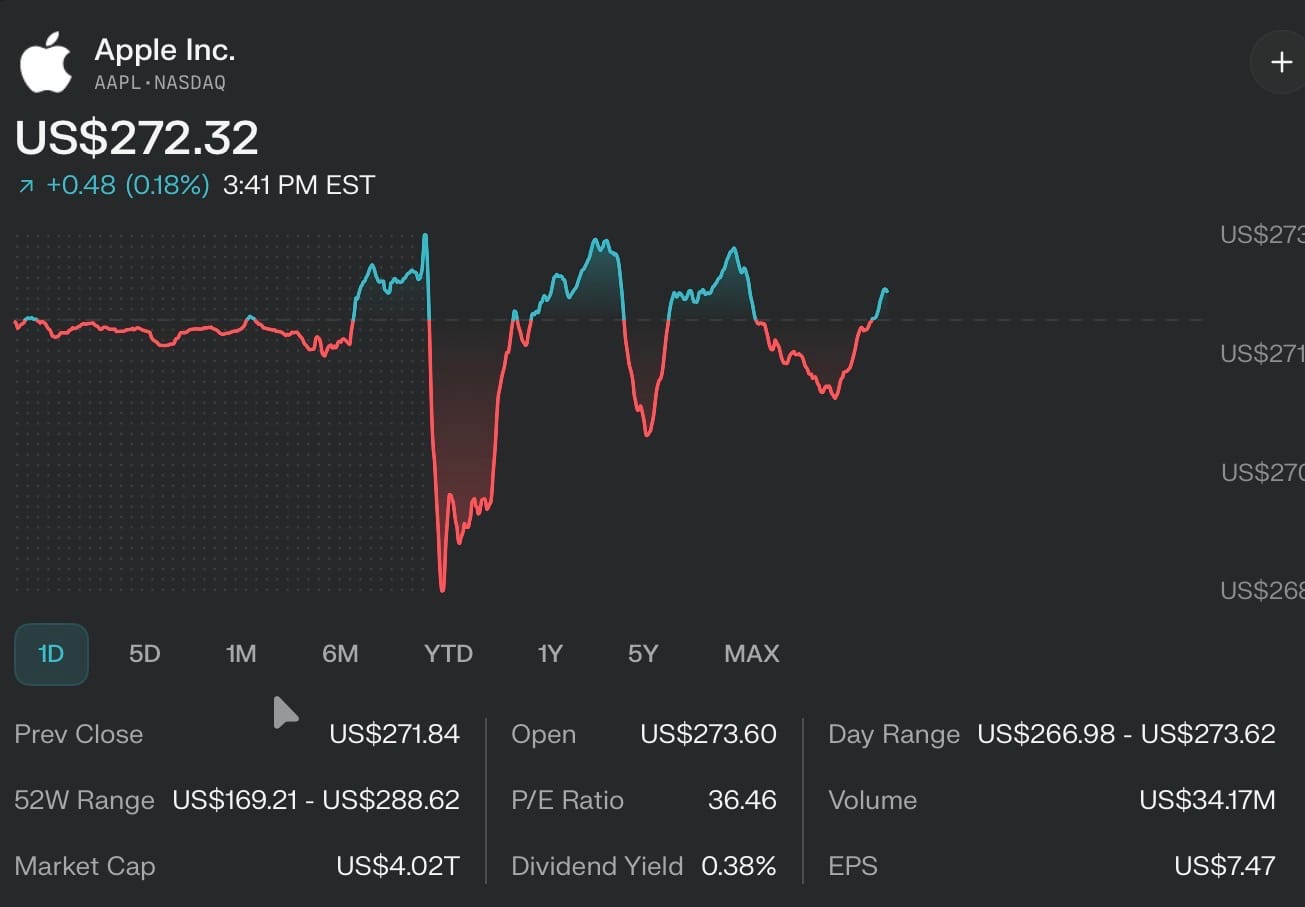

It’s the one where you already know what’s in the box, you didn’t really like last year’s model, but you convince yourself that this year, somehow, the wrapping paper has changed the contents. That’s roughly where Apple now sits at $272 , on 18 December, after briefly flirting with $288 a week or so ago, and dipping to $268 intraday today (right in Bollinger Band S/R).

Twelve days short of the anniversary of last December’s 260 intraday spike, we’re about 12 dollars higher, after a year of deafening noise. A five per cent rise year‑to‑date, if you’re feeling generous.

Call it twelve months of high‑definition hype wrapped around not very much at all.

And yet the Street is back at it, piping in the same soundtrack: “this time will be different, this time Siri will work, this time the foldable will save us, this time the AI we can’t see will justify the multiples we can.”

If Santa’s sleigh is meant to carry Apple another leg higher from here, one has to worry about poor Rudolf. There’s only so much hopium you can load onto a reindeer before the cardiovascular system complains.

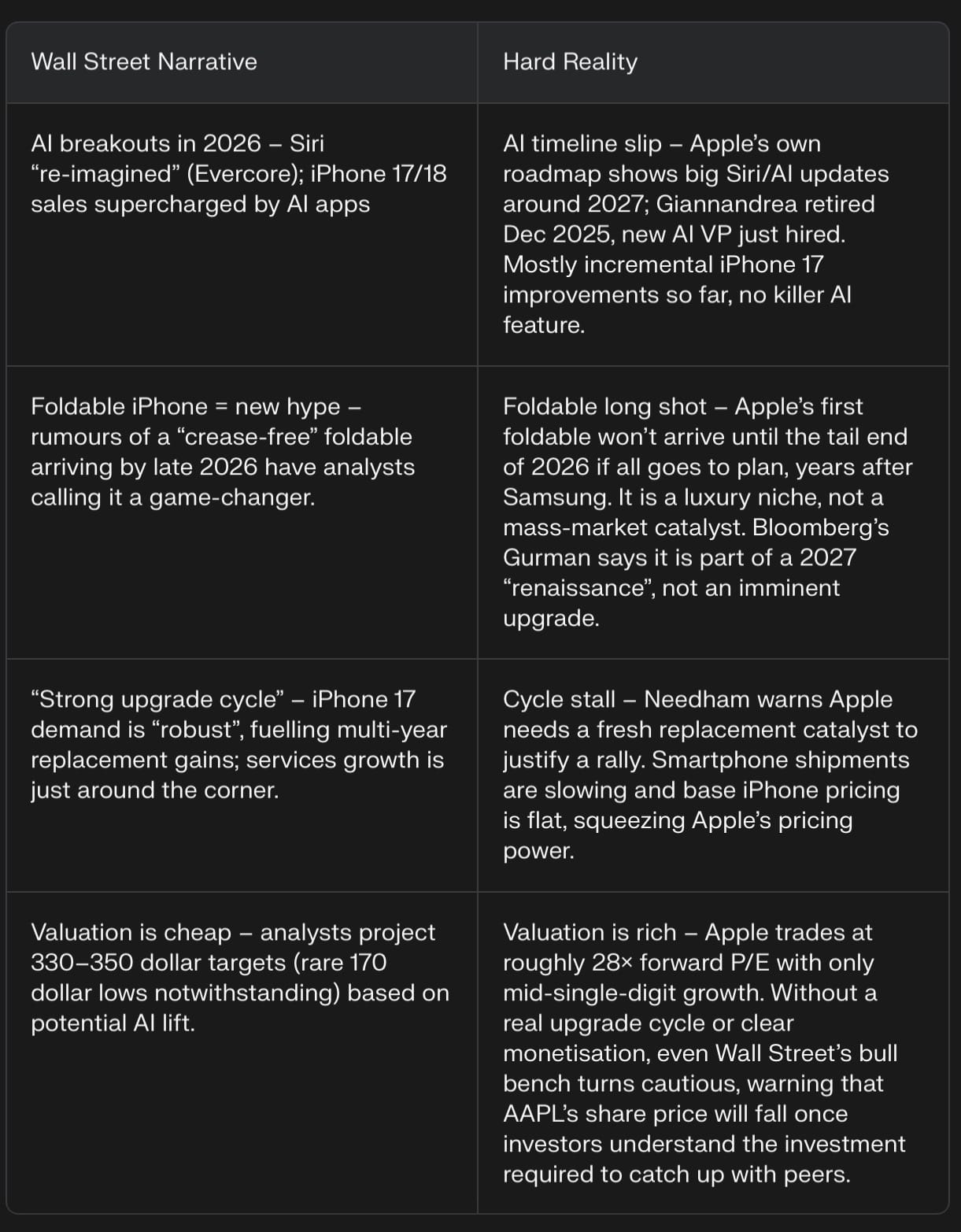

Here’s a lovely table for you. Analysts love tables.

What follows is not another seasonal wish‑list. It’s two different arguments fused into one.

- Draft A changes minds: it shows why the current Apple narrative on Wall Street is built on sand.

- Draft B stops arguments: it brings receipts from forty years of Apple’s own behaviour. You don’t need a mash‑up. You need a front strike, and a deep magazine.

This is both.

The fantasy: Apple as emotional support mega‑cap

This isn’t 2011 again. It just sounds comforting to pretend it is.

On one side you have Evercore’s Amit Daryanani, Wedbush’s Dan Ives and assorted Street luminaries busily sketching a 2026–2028 future where “Siri 2.0”, “Apple Intelligence” and a foldable iPhone ignite a new supercycle and reshape Apple’s narrative.

On the other, you have Apple’s actual track record:

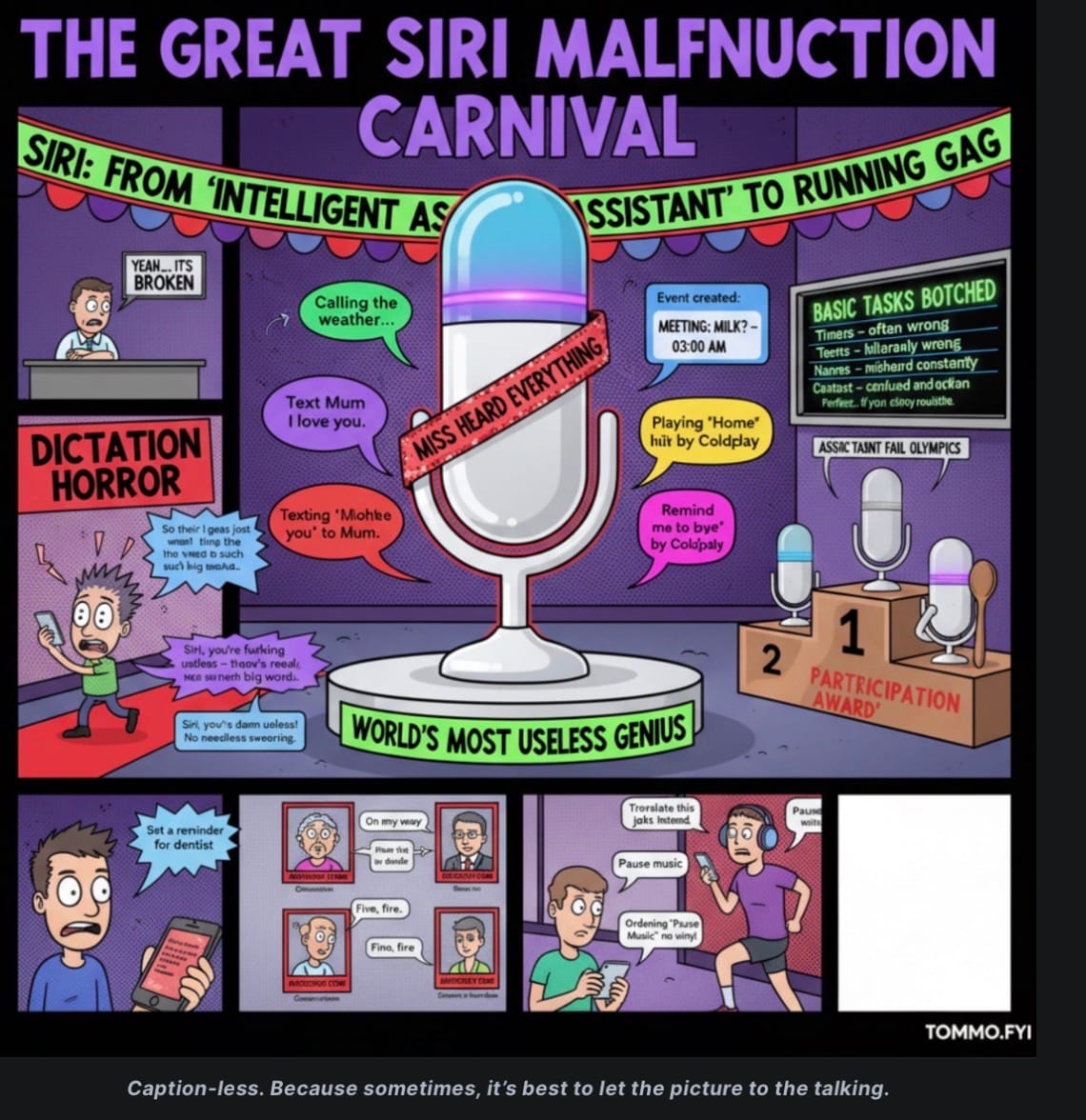

- Fifteen years of Siri underachievement

- A delayed and half‑baked AI rollout, and a leadership team that has been renting other people’s brains while talking about privacy and polish.

Between the two sits a market that desperately needs Apple to keep going up, because the rest of the AI trade has started to look a bit peaky.

The polite way to put it is that the Street is being “forward‑looking”.

The accurate way is that it has gone all‑in on Apple’s imaginary 2027 Siri and a “phabled pholdable phablet,” because the alternative is admitting that the index’s emotional support stock might have run out of actual catalysts.

The last few weeks have been a case study in this.

Daryanani has been merrily lifting targets into the low‑to‑mid 300s, on the basis that 2026 will finally deliver a “Siri 2.0” showcase – a spring event in which a reborn assistant, supercharged by Apple’s own models and with optional Gemini or ChatGPT‑flavoured brains, will “reshape Apple’s AI narrative” and unlock as‑yet‑undiscovered revenue streams.

Evercore’s Amir Overheats In Pom Pom Mode

Dan Ives, never knowingly under‑bullish, has talked up a 26 per cent rally from here on the back of an “AI revolution in 2026”, folded neatly into an iPhone 17–18 upgrade cycle that will supposedly re‑accelerate growth, particularly in China, as if the last decade of smartphone saturation and macro noise simply didn’t happen.

Dan Ives - furious to be beaten to a PT upgrade by Evercore, doubles down the very next day with extra Pom Poms!

Jim Cramer, doing his usual impression of a man trying to talk a jumbo jet into the air by shouting at it, oscillates between claiming Apple is “well‑positioned even without its own AI tech” because of its user base, and insisting that that same user base is exactly why Apple will somehow benefit disproportionately once it finally does get around to deploying proper generative AI. On Mad Dash he waves away the lack of visible progress, because in his framing, spending heavily on AI is what the other, slightly desperate firms do. Apple, by contrast, is clever enough to sit back, “not chase hallucinations”, and then pounce when the technology is bake‑ready.

If you listened only to this chorus, you’d think that somewhere in the depths of Cupertino, a file marked “Siri 2.0, 2011’s Original Vision, But This Time It Works” had been sitting for fifteen years, waiting for the perfect macro environment.

The awkward fact is that Apple has not earned this benefit of the doubt in AI. The Street isn’t extrapolating from execution; it is filling a void because it needs at least one mega‑cap that can be dressed up as an “AI laggard with optionality” to keep the S&P’s chart from looking like a ski slope.

When the chips, cloud providers and headline AI names start looking wobbly, as they have been of late, Apple becomes the emotional support stock. You tell yourself you’re being prudent and defensive by owning it, while simultaneously baking in science fiction about 2027.

The house of cards: Siri 2.0, Apple Intelligence and the phabled pholdable

Strip the notes of their breathless adjectives and you end up with four pillars holding up this structure:

- The first is Siri 2.0 as second coming.

Citi and friends talk about Siri finally “doing what it was supposed to do, the way Apple envisioned it”, with a dedicated 2026 event acting as the theatrical pivot. The analogy doing the rounds is the iPhone 4’s introduction of a front‑facing camera and FaceTime: a small‑sounding technical feature that became a social moment and drove upgrades. The implication is that Siri, long mocked, will suddenly have its FaceTime moment – fifteen years late.

- The second pillar is Apple Intelligence as delayed inevitability.

Analysts are quite open that Apple is late to the generative party; the trick is to reframe lateness as latent opportunity. Because Apple hasn’t “monetised AI” yet, they argue, the multiple contains no AI premium. Any movement on AI – from shipping a truly conversational assistant to sprinkling LLM fairy dust on services – is therefore a free upside option. The reports of Apple buying in Google’s Gemini because “Apple can’t do AI and fucked up Siri,’ shaving quietly leaked news of “testing Anthropic’s Claude,” are turned into proof that the company is “pragmatic” and “choosing the best tools”, rather than what they actually are:

signs that Apple’s years of home‑brewed Siri tinkering have left it fifteen years behind the frontier.

- Third, the foldable.

On cue, the usual rumour‑industrial complex has cranked out stories about Apple ordering in the region of twenty‑odd million OLED panels for their first‑generation foldable – enough, once yield and non‑phone uses are accounted for, to suggest something like ten million units. This is breathlessly described as a “huge bet” and a “category‑defining” move.

Commentators talk about a crease‑free, titanium‑framed marvel turning up at the “tail end of 2026”, setting the stage for a broader 2027 product renaissance. Bloomberg’s Mark Gurman is duly cited.

The phrase “game‑changer” has already had a busy year.

- The fourth pillar is the oldest and laziest: the user base as permanent optionality.

Every time the AI story gets awkward, analysts clamber back up onto this familiar ledge. Apple’s allegedly “under‑monetised” one‑plus‑billion “active devices,” and 1.5 billion iPhones, are rolled out as proof that whatever happens, however long Apple tarries, it holds the keys to the kingdom. Whoever ends up providing the cleverness – Apple’s own model (not stuck in the dunce class), Gemini, Claude, some future start‑up – will, so the story goes, have no choice but to come through Cupertino for distribution, and to leave an attractive toll behind on the way out.

Underneath all of this is a single, unexamined assumption: that Apple, having missed the early generative wave, will suddenly execute a flawless pivot, integrate third‑party cognition without losing face, ship a genuinely competitive assistant, and somehow conjure a hardware supercycle out of a saturated market, on roughly the same timeline it took OpenAI to go from GPT‑3 to GPT‑4.1. That took them about 15 months. Apple? It’s already had 15 years.

Out here in the real world, that’s not how Apple behaves.

The history: what Apple actually did with Siri and AI

To see why, you have to go back to the last time Apple genuinely was first.

In 2010, Apple bought Siri, then an independent start‑up spun out of DARPA‑funded work at SRI.

This was not a toy voice front‑end. In its pre‑acquisition life, Siri was an API‑first, multi‑service agent layer.

It could, in 2011:

- book restaurant tables through OpenTable,

- call cars through Uber‑like services,

- buy cinema tickets,

- check flights,

- juggle calendars

- … and orchestrate a messy web of third‑party APIs

All through a conversational UI. A bit like... LLM Agentic AI’s are only now starting to be able to do fifteen years later.

- It was designed to live on multiple platforms.

- It was, bluntly, a decade ahead of its time.

If you squint at OpenAI’s Model Context Protocol or Perplexity’s agentic browser today, you’re looking at something Siri’s original team were already doing in 2010.

Apple launches Siri as a headline feature of the iPhone 4S in 2011. The marketing writes itself:

“understands what you say, knows what you mean.”

The press dutifully gushes. For a brief moment, it looks as if Apple has not only fulfilled the 1987 Knowledge Navigator fantasy, but weaponised it as an iPhone‑only lock‑in mechanism.

Then the knifework begins. Not from outside skeptics, but within Apple’s rotten culture.

Almost immediately, Apple starts trimming the bits of Siri that offend its sensibilities. The promiscuous pre‑acquisition integrations are corralled into a narrow, whitelisted, Apple‑blessed set of partners.

Capabilities that might generate awkward headlines in the current political environment – Siri finding abortion clinics or escort agencies, for example – are quietly disabled. Siri is recast as a cautious concierge, not a street‑wise fixer.

Internally, Siri becomes a hot potato.

Different executives champion different visions and then move on. Plans to give Siri a proper “brain” – combining cloud‑based and on‑device models under codenames like Mighty Mouse and Mini Mouse – are floated, half‑implemented, then scrapped. The AI and machine‑learning group is so directionless that staff dub it “AIMLes.” Engineers complain about chronic under‑investment in cloud infrastructure. Training modern‑scale models in an organisation that still thinks in iPhone release cycles becomes a bureaucratic slalom.

At the cultural level, Apple doubles down on a particular brand of privacy and polish that makes modern AI extremely hard.

Where Google and Amazon quietly hoover up user data and interactions to make their assistants better, Apple decides that Siri must not learn from you very much at all. The company even vetoes a simple mechanism for users to flag Siri’s mistakes, on the basis that the assistant must never admit error. Better a smooth imbecile than a slightly messy genius.

The outcome is predictable.

By the middle of the last decade, Alexa and Google Assistant are clearly ahead, not because they’re especially well‑designed, but because they’re allowed to learn.

Siri, by contrast, has become the voice interface you tolerate when your hands are full, and the butt of jokes when you’re not.

And yet, for most of that time, the orthodoxy – in Apple blogs, forums, and, conveniently, in certain corners of the analyst community – is that this is all part of a deeper plan. Apple’s silence is evidence of hidden depth. Siri’s lack of visible progress is proof that something much bigger is being incubated behind the curtain. Criticism is treated as heresy. Point out that Apple is being out‑innovated by the very companies it used to mock, and you are accused of not understanding how Apple works.

We now know how Apple works. Like this:

When the AI party breaks out elsewhere, Apple eventually turns up six to eight quarters late, having spent the intervening period convincing itself that it was terribly wise not to come sooner, and then claims that incremental improvements are tantamount to a revolution.

That’s Apple “Intelligence.”

Apple Intelligence: the sequel nobody ordered

When Apple finally said “AI” on stage at WWDC 2024, it did so wrapped in stand‑up and skydive footage. Craig Federighi jumped out of planes, mugged for the camera, and cracked jokes about on‑device intelligence. The demos themselves were modest. Slightly better email summarisation. Auto‑generated replies that oscillated between anodyne and eerie. Image and photo clean‑up tools that brought Apple somewhere closer to where Adobe has been for a while. System‑level tweaks to search and suggestions. Oh and let’s not forget Tim Cook’s favourite feature of “Apple Intelligence” - Genmoji. Gee.

What it did not show was a competent general‑purpose assistant to rival ChatGPT, Claude, Gemini, or even what Alexa and Google Assistant have been doing for years.

- There was no Siri renaissance.

- No sign that the company had found a way to square privacy with learning.

- No sign, frankly, that there was a coherent, user‑facing AI strategy at all.

A year later, at WWDC 2025, Apple had to stand up and admit – in its own coded way – that bits of what it had teased were not happening on schedule. Federighi told developers that certain highly anticipated Siri/AI capabilities “needed more time to reach our high quality bar”, and would therefore ship in “May 2026,” But they had “excellent and world class ’Foundational Model’ and “Private Cloud Compute” amongst so many other acronyms they almost TSMC out of the alphabet.

The shiny new LLM – years in the making, if leaks are to be believed – got under a minute. I timed it - I believe it was 45 seconds, and featured Craig “Hair Force” Federighi stating, no less, that “this is going to be the best LLM ever. More acronyms like were wheeled out ad developer conferences to give the impression of progress.

For actual users, the delta between what was implied in 2024 and what was delivered in 2025 amounted to “slightly more of the same, but later”.

Needless to say, class action lawsuits for falsely selling the iPhone 16 as a necessary upgrade to run an “Apple Intelligence“ which simply didn’t exist, began.

Behind the curtains, things were messier still.

Siri was quietly moved out of John Giannandrea’s direct oversight and handed to Mike Rockwell, fresh from presiding over the Vision Pro’s expensive stumble And Dan Riccio’s exit. Rockwell, to his credit, did the obvious thing and ran a bake‑off between Apple’s in‑house models and those from OpenAI and Anthropic.

Reports suggest that Anthropic’s Claude won on quality for Siri’s specific needs. In parallel, Apple began exploring deals with Google for Gemini integration in certain contexts. There were discussions about how, or whether, any of this could be explained without admitting that the company’s own models weren’t up to scratch. They even discussed Perplexity - actually the best solution to their problem, and the most easily integrated but typically Apple, it was deemed too dangerous, to.. un-Apple-like. In other words, it was with dynamic and fearless, a bit like Apple in 1984 - a pirate ship sailing the high seas, than the octogenarian cruise liner Apple had become.

If you are Apple, steeped in a quarter century of vertical integration mythology, this is the opposite of where you wanted to be.

At exactly the moment when the world starts to see AI systems as the new substrate – the layer everything else will sit on – you find yourself quietly renting cognition from the very firms you once out‑designed and out‑engineered, because you insisted on keeping Siri in a box for fifteen years while they were experimenting in public.

The Bible About Siri - My Seminal Work (taking a bow) on what Siri was, how it died the death of 1000 bad decision, and why Apple killed its own future by being too afraid to embrace it.

You would think that might give Wall Street pause. Instead, it’s been rebranded as nimbleness.

Licensing Gemini stops being a humiliation, and becomes proof that Apple is now platform‑agnostic and “picking the right partner”. Testing Claude is reframed as evidence that Apple is “leaving no stone unturned”. The fifteen‑year failure to move Siri past “set a timer” is glossed as admirable restraint. Apple didn’t miss the AI train, we are told, it was simply waiting until the technology matured.

My thoughts, need no caption, but the article is worth a read. Realy.

And this is the context in which the current “Siri 2.0 in 2026” narrative is being sold.

The same leadership team that spent a decade and a half lobotomising, under‑resourcing and then belatedly scrambling to replace Siri’s brain is now being given full credit, in advance, for a reboot that does not exist.

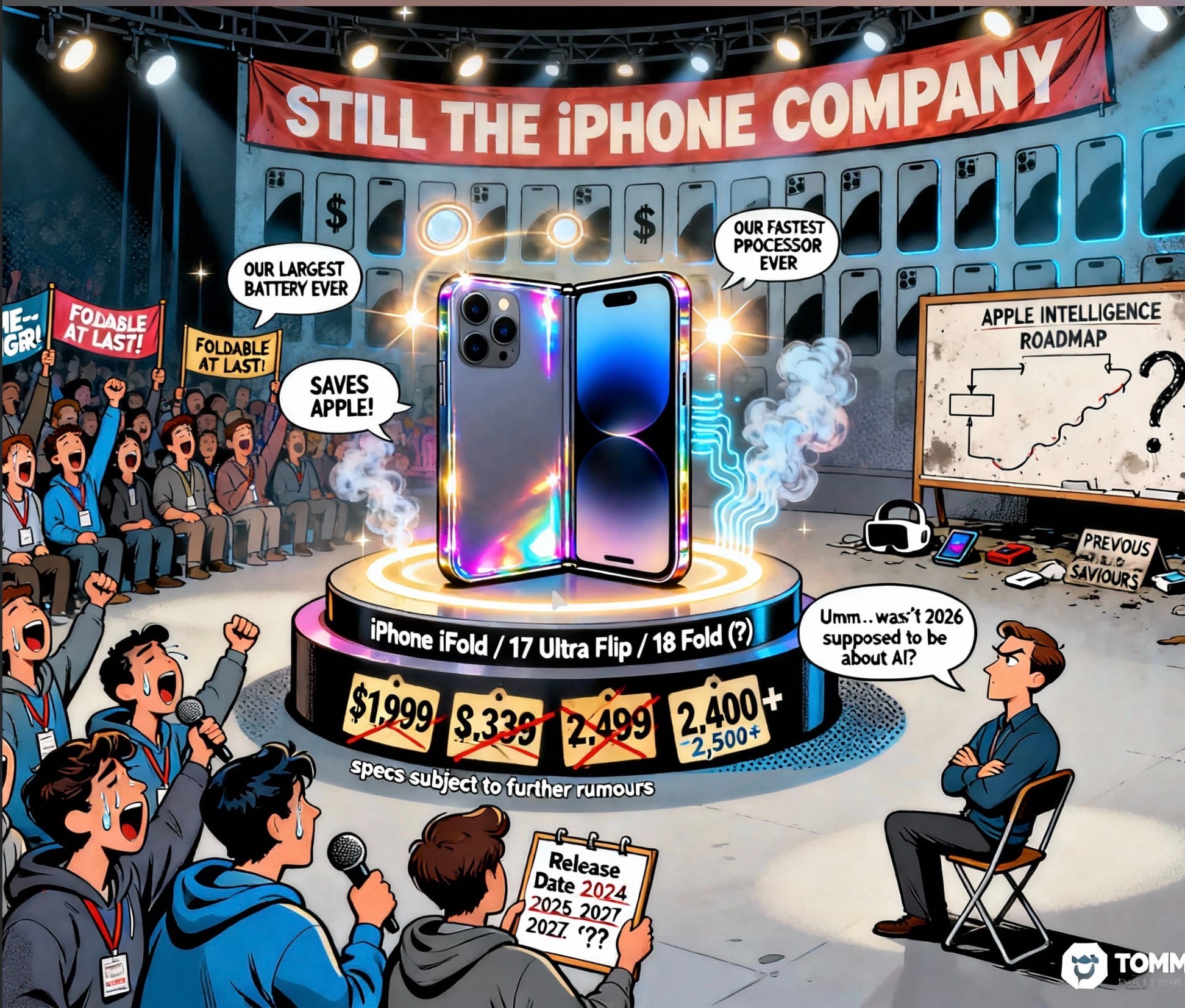

The phabled pholdable phablet

If the AI story is thin, the foldable one is almost homeopathic.

Let’s accept, for a moment, the supply‑chain rumours.

The mockups. The Gurman regurgitations of rumour to Bloomberg attribution to slavish analyst commentary to The Information reports back and down to 9to5 Mac, Mac Rumours, and every other Apple site starved of anything else to report about because, well, there isn’t anything to write about.

Apple orders enough foldable‑class OLED panels to suggest perhaps ten million finished units in the first year. The device in question rounds up every trope the rumoursphere can muster: crease‑free display, titanium frame, “iPhold” price tag in the two‑and‑a‑half thousand dollar range, and somehow – this is the clever bit – just enough newness to persuade the world that folding your phone in half is a sign of progress, not a hinge failure waiting to happen. A foldable iPad? I’m so buying one - that makes sense.

But a foldable iPhone. Seriously? Why? It’s like a “Zune” - a solution to a problem that didn’t exist and nobody wanted.

On its own terms, ten million units is not trivial. For any normal OEM, it would be an ambitious launch. For Apple, it is a side quest.

There are north of 1.5 billion active iPhones out there. Even if every one of those foldables goes to someone who would otherwise have sat on their hands, we are talking about less than one per cent of the base. The global foldable market today is still small, price‑sensitive, and reliability‑constrained. Samsung has been at it since 2019 and still hasn’t turned the category into anything more than a well‑marketed niche.

And yet, in analyst notes and blog posts, this hypothetical device – not yet announced, not yet seen, shipping in the “tail end of 2026” if the stars align – is treated as if it is the missing keystone in a grand architectural plan. It gets bundled into the same “Apple renaissance” package as Siri 2.0 and Apple Intelligence. Suddenly, this as‑yet‑imaginary phablet‑that‑folds is proof that Apple has “plenty of levers to pull” and “multiple ways to win the back half of the decade”.

Analysts are upgrading the stock on outrageous proposed sales numbers for a device still in the rumour mill, still unpriced, with a foldable market track record of failure, not success (just like the “thin” phone movement - a failure, which Apple finally attempted, and also spectacularly failed at).

At that point you are no longer reading research.

You are reading a brochure for a holiday resort that hasn’t been built, written by people who’ve skimmed the planning permission and decided it will definitely have an infinity pool and a helipad, because otherwise how will the brochure sell anything meaningful excerpt deposits (in this case premature investments).

- A bendy screen does not make Siri any smarter.

- An eight‑inch display that closes like a book does not turn incremental Apple Intelligence features into an “AI‑as‑a‑Service” juggernaut.

- But it does give the notes another noun to sprinkle between “AI”, “narrative”, and “ecosystem” when the spreadsheets look a bit light.

That’s not enough for a $100 PT upgrade though.

The echo chamber: rumours in, hopium out

None of this could sustain itself without a supporting ecosystem of rumour sites, tech blogs and financial media who have forgotten what primary sources look like.

The pipeline runs like this.

A supply‑chain whisper about panels, a Mark Gurman newsletter hinting at a 2027 “product renaissance”, an off‑hand line in an Apple press release about “continuing to enhance Siri over the coming year” – any of those will do as a starter. That gets written up by a technology news‑site into a headline that treats “could” as “will”. Analysts then drop that headline into a note as if it were a footnoted fact. Financial portals rewrite the note as “Wall Street says”. By the time it comes out of the far end,

an entirely speculative 2027 roadmap has become “what Apple IS going to do in 2026”.

The more of these loops you put through the system, the more the whole thing starts to resemble a pyramid Ponzi scheme of commentary: rumour at the bottom, notes in the middle, headlines on top – everyone riffing off everyone else, while the underlying reality quietly diverges and Dan Ives and Amir are trying to knock eachother off Maslows’ Hierarchy of Needs to reach the ”Transcedental” level at the apex.

Look at the December 2025 coverage.

One outlet tallies up the chorus:

- Dan Ives calling 2026 “Apple’s true AI year”,

- Daryanani banging the drum for a March Siri relaunch, Citi and CLSA sticking mid‑300s targets on Apple on the back of a “coming AI‑driven services re‑acceleration”.

The same summary notes, almost as an aside, that most of the underlying AI launches are not slated until 2026 and beyond, and that Apple’s own roadmap puts the more ambitious Siri work closer to 2027. This absurdity – assigning today’s valuation to tomorrow’s collateral, and hoping nobody reads the dates – is simply accepted as the way of things. It might be acceptable if AAPL hadn’t already wafted up on hopium against lousy iPhone 16 sales comparable juicing iPhone 17 sales from $200 to $280, but at a fPE of 30, in other words assigning each $1 of AAPL as being worth $30 “sometime in the future” - is, well, rather rich to put it mildly.

Meanwhile, Needham, almost alone among the usual suspects, pointed out the obvious back in June and then October, although recently, Laura Martin seems to have competition internal from another AAPL bull taking over coverage and “doing an Evercore.” Martin hasn’t commented.

Apple, Needham had rightly stated, has no cloud business to speak of. Every dollar it spends on AI infrastructure is cost, not revenue. Its current AI work is aimed at shoring up its own platform – making iOS less embarrassing next to Android – not at selling cognition to the rest of the world. In other words, while the rest of the world views and treats AI as the future, Apple just views it as a feature.

If you look at AWS or Google Cloud, and in fact, and company’s customer service process chain and command structure, you see entire industrial supply chains being rewired by AI demand. If you look at Apple, you see devices, services, and a slowly‑evolving operating system, with no obvious path to turning generative AI into a margin‑expanding engine.

Needham also had the temerity to say the quiet part out loud: Apple is behind.

A year or two behind, in generative terms, and further behind in the infrastructure and culture required to catch up. It warned that Apple’s share price may fall even if it rises, once investors grasp the magnitude of the investments required and just how far behind Apple remains, even renting brains from somewhere else. Uniquely, they also identified a lack of appeal to Gen-Z (a conclusion I also came to in my own research especially outside of the USA) as being a core flaw in Apple’s strategy which is uniquely and arrogantly US and China centric.

It noted, rather drily, that “holding the line” on base iPhone pricing since 2019, while component costs and customer expectations have risen, has already cost investors measurable upside, even before you factor in AI capex.

For this, of course, Needham and others were mocked by MacDailyNews and the usual perma‑bull outlets as “bad news beggars”. The groupthink holds. Dissent is for YouTube commenters and short‑sellers, not for the respectable analyst community, which has long ago replaced genuine stress‑testing with “what are my peers saying”.

Don’t Disagree with The Preachers, or Ye Shall Be Cast Out

Tommo’s Happy Holidays: where hope goes to die

This brings us back to where we started: price, time, and that seasonal illusion that December is somehow special.

On 20 November, with Apple pressing up into the $272 area for the first time since the Plateau Principle took over earlier in the year, the working title was “AAPL at 272 – where hope goes to die”. Not because the company is dying, but because that price, on those fundamentals, with this story, leaves very little air in the lungs if anything goes wrong.

From $245 to $288 and back to $272 again: A Hobbit’s Tale

Since then, we’ve had the usual twelve‑day advent calendar of narratives.

- A brief spike to 288 – right on cue after a new round of target hikes and “Apple poised to explode 26 per cent higher” headlines.

- Another run of whisper‑based AI stories.

- Foldable rumours

- A fresh round of iPhone 17 (and even iPhone 18 and even 19)lead‑time tea‑leaf reading.

And now, as we approach the anniversary of last December’s $260 intraday high (with AAPL at $270 as I write on Thursday 18th December intraday), we’re back where we started, more or less, with Apple at $272, the Street out of new metaphors, and retail investors clutching at the faint hope of a Santa Claus rally.

It’s worth remembering what happened last time.

December 2024’s $260 led to April 2025’s $167. Father Christmas (Santa to Americans) did his usual trick of showing up in the rear‑view mirror. Anyone who bought the December optimism and ignored the structural issues spent the first half of this year explaining to themselves why a company that “just works” had left them with a chart that very much didn’t.

This year, the stakes are slightly different.

The rumours have become larger and less falsifiable. The timelines have stretched further into the fog.

- The AI story has metastasised from “Apple doesn’t talk about it but probably has a plan” to “Apple is years behind, but that’s actually good, because it means the AI upside isn’t priced in yet.”

- The foldable story has gone from “they might be exploring it” to “this is the cornerstone of 2027’s renaissance.”

- The echo chamber has become aware of itself, and has decided to double down rather than step back.

At the same time, the market has got noticeably less impressed. Each new “upbeat rumour” now tends to coincide with Apple selling off, not spiking. You can feel the ennui creeping in. People have heard the “renovation” story one too many times without seeing the scaffolding go up.

And yet… and yet.. you just know that once “Siri 2.0” is released thanks to renting brains and head of AI from Google, it will be Jesus 2.0, and Tim Cook will walk AAPL across water. Right? That’s what you’re banking on, right?

Hasn’t that been baked in yet, after all $75 rid in just 4 months?

In seriousness, analysts with pom-poms aside, We’re no longer in “tell me a nice story and I’ll buy it” territory. We’re in “show me the money, or at least the working prototype” season. And in that environment, treating an imaginary Siri 2.0 and a hypothetical pholdable phablet as the pillars of a $350 dollar stock is not just optimistic, it’s reckless. And that’s coming from me - the guy who originally painted a pathway for AAPL to $400 by Q4 2027 while everyone else was still trying to work out how it might hit $265.

One of five articles I wrote about how, and using what strategy, AAPL could hit $400

The clean formulation

If this all feels a little binary, it’s because it is.

Draft A – the part of this argument that lives in the near‑term data, the notes, the price action – is designed to change minds.

It says: look at what they are actually saying, when, and on what basis. Recognise the house of cards. Accept that you are not being given a forecast so much as a script.

Draft B – the part that lives in the 40‑year timeline, from Knowledge Navigator to Newton to NeXT to Siri to Blackbird to Apple Intelligence – is designed to stop arguments.

It says: whatever you think of Apple as a company, here is how it behaves, consistently, when confronted with platform shifts. Here are the org charts, the executive moves, the roadmaps it published and then quietly abandoned. Here is the evidence that the current AI narrative sits on top of fifteen years of missed opportunities and deliberate amnesia.

You don’t need a mash‑up. You need both. You need my book, on the way, explaining Apple and 40 years of success to failure, thanks to disastroCus management and a betrayal of the foundational principles and ethos of the company and its founders. Coming soon.

The real story is a full frontal strike and “shock and awe“ tale that makes it impossible to unsee the absurdity of assigning today’s price targets to tomorrow’s hypothetical Siri, and a deep magazine of history that means the next time someone tells you “this time it’s different”, you can quietly point to forty‑plus years of Apple managing to be exactly the same.

The fork in the snow

None of this is an argument that Apple is doomed, or that the share price must crash on New Year’s Day. It is, however, an argument that the current narrative – Apple as sleeping AI giant, 2026 as coronation, 2027 as renaissance, foldable as saviour – is a fantasy built on a foundation of rumours, circular references and a studied refusal to look at the company’s own history.

If you are happy to hold Apple as what it actually is – a slow‑growth, high‑margin, buyback‑happy quasi‑utility with a remarkable ecosystem and a fascinating, if often infuriating, culture – then carry on. Price it as that. Expect it to behave like that. Stop pretending it is a hyper‑growth AI platform stock just because the notes are bored of writing “plateau.”

Until there’s genuine culture change at Apple, the company will never get out of its own way, no matter how thin they try to make a phone and invent nomenclatures like “plateaus” and misuse “Air“ as if a boob tube makes an iPhone flat chested.

Apple cannot control the narrative any more - its lack of design competency has website than and its managerial incontinence guaranteeing that for now, iteration is its only way forward.

If, on the other hand, you find yourself tempted to pay a mid‑30s multiple on the basis of a 2027 Siri you have never seen, a pholdable phone that does not yet exist, and an AI strategy that currently involves renting other people’s models, then at least go in with your eyes open.

Back to the Future:

Back in 2011, Apple genuinely did have the future in its hands. It had NeXT’s OS running on Intel, the iPod’s distribution moat, the iPhone’s momentum, the App Store’s captive audience, and Siri’s agentic layer ready to go. It chose, for a mixture of cultural and strategic reasons, to box and then bury a large chunk of that potential.

In 2025, it has a spreadsheet, a remarkable buyback programme, and an analyst community who have convinced themselves that if they say “Siri 2.0” and “AI revolution” enough times, reality will comply.

Closing the Remaining Exits

By this point, the reader has been walked through three decades of decisions, trade-offs, cultural shifts, and institutional incentives. The outline of Apple’s present condition should no longer feel mysterious. And yet, even after all of that, one last set of intellectual escape routes often remains open, and not because the evidence is weak but because it has not yet been framed in a way that makes retreat logically impossible.

This final section exists to close those exits, calmly and without accusation.

What “Early” Would Actually Look Like

The most common counter-position that especially among technically literate readers is not outright disagreement, but a softer form of deferral usually takes the form of a single sentence:

“This is compelling - but perhaps Apple is simply early.”

It is an understandable instinct. Apple has earned the benefit of that doubt before. But the claim is not unfalsifiable, and it does not survive contact with observable behaviour.

If Apple were merely early, early to a genuine agentic transition, early to a new computing paradigm then we would expect to see a specific and recognisable set of signals.

- We would see internal systems being re-architected in advance of public delivery, even if the output were incomplete.

- We would see developer tooling evolving to accommodate delegation, persistence, and context, not just surface-level API extensions.

- We would see tolerance for visible imperfection in exchange for learning velocity.

- We would see controlled exposure to real users, with scope deliberately left open rather than tightly bounded.

Above all, we would see evidence of organisational commitment to a direction whose risks were already being absorbed internally.

We do not see these things.

Instead, we see the opposite pattern:

- We see capabilities announced as abstractions rather than systems.

- We see functionality framed in marketing language long before it appears in developer primitives.

- We see “intelligence” described as a layer applied to existing products rather than a reconfiguration of how those products operate.

- We see public commitments repeatedly qualified by privacy caveats, safety caveats, and scope caveats, each one narrowing the surface area further.

This is not what being early looks like. This is what organisational dysfunction looks like after fifteen years of excuses and a revolving door of senior executives.

Being early is noisy. It is uneven. It leaves a mess behind. It creates partial tools, awkward workflows, and unfinished affordances that nevertheless point in a clear direction. What Apple is doing instead is preserving coherence while deferring capability which is a fundamentally different posture, more colloquially known as “kicking the can down the road”

The distinction matters, because it moves the discussion out of the realm of patience and into the realm of incompatibility and the behaviours Apple is exhibiting are not the precursors of agentic systems: they are the stabilising responses of an organisation optimised to avoid decisions as thought they are toxic, which to Apple’s current Cook/Federighi management, they are.

How Decisions Now Get Made and Why That Matters

Up to now, the analysis has focused largely on outcomes: what shipped, what didn’t, and what stalled. To fully close the loop, it is necessary to say something more explicit about mechanism; not so much individuals, but process.

Apple today is not directionless. It is highly directed. But the direction is set by a decision architecture that privileges certain kinds of projects and quietly excludes others.

At a high level, the organisation now operates through a model that can be summarised as follows:

- Strategic intent is surfaced through operations, not vision.

- Risk is identified early, but resolved late.

- Success is measured by integration quality, not learning rate.

- Public failure is treated as reputational debt rather than informational gain.

This is not a criticism in the abstract. For a mature hardware-software company optimising global supply chains, it is an entirely rational configuration. It produces stability, predictability, and extraordinary margins but it is also structurally disfavours agentic systems. It is just not in Apple’s DNA having lobotomised Siri 15 years ago and reprogramming Apple’s genetics to be risk averse and not risk hungry.

Agentic computing requires early exposure to ambiguity. It requires tolerating partial autonomy before full control. It requires systems that can act, fail, and adapt in ways that are difficult to fully script in advance. Most importantly, it requires internal permission to let capability outrun polish, even briefly. Everything Siri offered, 15 years ago, and other agentic systems are only now beginning to offer. Everything Apple surgically removed.

In Apple’s current decision architecture, those conditions cannot survive escalation.

Projects that introduce open-ended behaviour encounter friction not because they are poorly conceived, but because they do not align cleanly with the organisation’s risk-containment pathways. By the time they surface at an executive level, they are evaluated not on what they could become, but on how they would behave under the most conservative interpretation of their future misuse.

The result is predictable. Risk is neutralised not by engineering solutions, but by scope reduction. Autonomy becomes assistance. Delegation becomes suggestion. Learning systems become deterministic flows with probabilistic labels. At this point, the question is no longer “Why hasn’t Apple delivered an agentic assistant?” The answer is already embedded in the system. The more precise question is whether an organisation structured this way can deliver one at all without first changing how decisions propagate through it.

Naming the Present Phase

Much of the current commentary fails not because it is poorly informed, but because it misidentifies the moment.

This is not 2011.

- It is not the dawn of a new category waiting to be unveiled.

- Nor is it 2007, with a latent platform breakthrough about to reset expectations.

- And it is not 1997, where existential crisis created permission for radical internal change.

The present phase is better described as post-platform consolidation.

In this phase, the dominant products are already in place. Margins are protected. Ecosystems are mature. The organisation’s primary strategic imperative is not expansion, but preservation of trust, of reliability, of narrative coherence and Wall Street safety in analyst support. It is the company of iterative improvement, of safety first, and shareholder friendly, not growth boosting initiatives.

It’s BORING.

Companies in this phase do innovate, but they do so defensively. They add capability in ways that reinforce existing structures rather than challenge them. They absorb external advances selectively, translating them into features that fit the current mental model rather than allowing them to redefine it.

Once this phase is named, a great deal of confusion clears.

Analyst commentary that treats every rumoured feature as a proxy for a coming renaissance begins to look like category error. Editorial speculation that frames incremental updates as signs of imminent transformation starts to resemble wish-casting rather than analysis. Even internal announcements take on a different colour, reading less like declarations of intent and more like boundary-setting exercises.

This does not mean decline is inevitable. But it does mean that escape velocity cannot be achieved accidentally, or through iteration alone. It requires a conscious break with the assumptions of the phase itself.

The Choice That Cannot Be Deferred

Which brings us, finally, to the point where politeness becomes a liability.

At the end of this analysis, there are only two positions that can be held simultaneously with intellectual honesty:

Either Apple chooses to do something genuinely disruptive to itself, not cosmetically, but structurally. That would mean re-architecting systems around delegation rather than command, accepting visible imperfection in exchange for learning speed, and allowing new computational models to challenge existing product boundaries.

It would involve reputational risk, internal friction, and a temporary loss of narrative control. Something Apple’s current culture refuses to tolerate and needs to change.

Apple Needs New Brains, And We’re Not Just Taking Siri

Or Apple continues on its present path: integrating external intelligence cautiously, framing autonomy as assistance, and preserving coherence while capability advances elsewhere. In that world, the company remains enormously profitable, deeply influential, and increasingly derivative in the domains that matter most.

There is no third option in which the current decision architecture quietly produces an agentic breakthrough by accident.

That is not a dramatic claim. It is a calm, considered and structural one which simply cannot be rationally denied.

And once it is stated plainly, much of the surrounding noise and the rumours, the speculative upgrades, the breathless anticipation of announcements yet to materialise of eight new iPhone models, seven new something with an i in front of it, gasping asthma attacks about AirTag 2’s and hyperventilating about a new AppleTV with a faster processor but the same old OS begins to recede.

What remains is not cynicism, but… clarity.

The question is no longer whether Apple will surprise the market but whether it is willing to surprise itself. And be “insanely great” not just “good enough,” with a “one more thing” which hasn’t been front run by Mark bloody Gurman and a bunch of paid for shills and rumour monstrous who do nothing but write notes to one another and spin it as news and make money whoring for hits off click through ads. Don’t you see? This is become a parody of itself, and Apple the butt off a bad joke - or perhaps, to crack a bad joke, the rotten core of one.

So this isn’t 2011 again. It’s $272, on 18th December 2025, where hope goes to die if you let it. Like 2023, and 2024.

Will we be saying “et tu, 2026?”

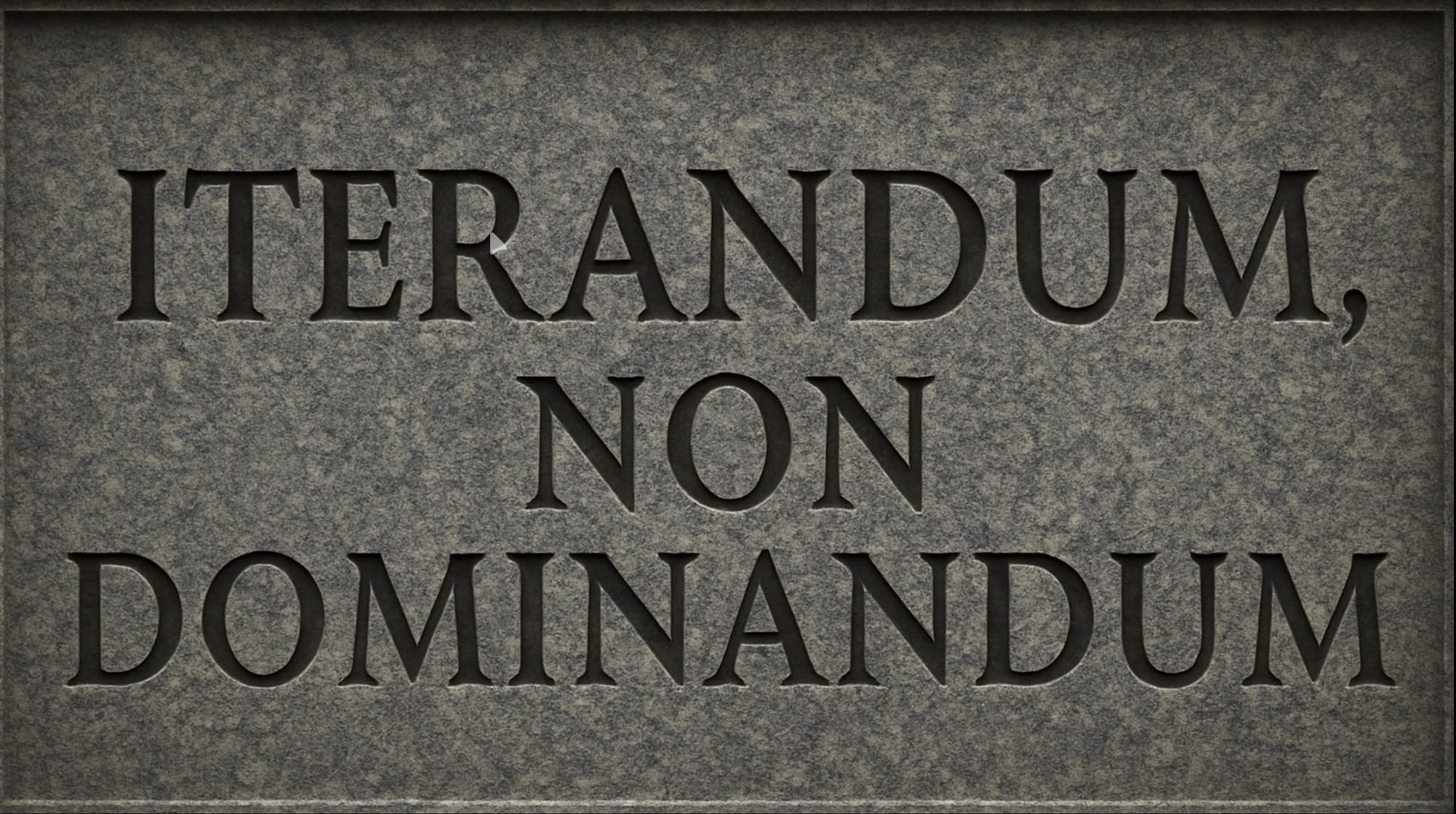

Because at the moment, Tim Cook’s Apple has become “iterate, don’t domintate. Or in another dead language:

Merry Christmas and Happy New Year, The book? It’s on the way And it will make “Apple in China“ look like a prologue

Tommo_UK, London UK, 18th December 2025

Exactly a month on from November 18th’s Article, 2025, and with not much more to add.

© 2025 TOMMO.FYI

💡 Reach out to me using the Confidential Drop Box form below. 👇

CONTACT ME DIRECTLY: discreetly (and anonymously if you prefer)

👉 I’ll reach out personally, selectively, and with respect for your time and position, depending on the nature of your drop.

Lastly, a quick ask:

Please, share this on your social networks. From the post on the FYI site itself if you click through, you’ll see share buttons (or just share the URL), By social media or email, if you can help me, I’d be very grateful.

And a “Thanks,” for being with me on the journey so far.

Some of you have been sparring with me for twenty-plus years across different forums and eras. This is the natural culmination of that long conversation, and I don’t want you to miss it, or stand on the sidelines. Agree, disagree, argue… tell me I’m serving the main course or that my brain is out to lunch: that’s the whole point.

It’s peak critical thinking and that’s why you’re still here. If you’ve got a hand to lend to help with the final design, I’d value it.