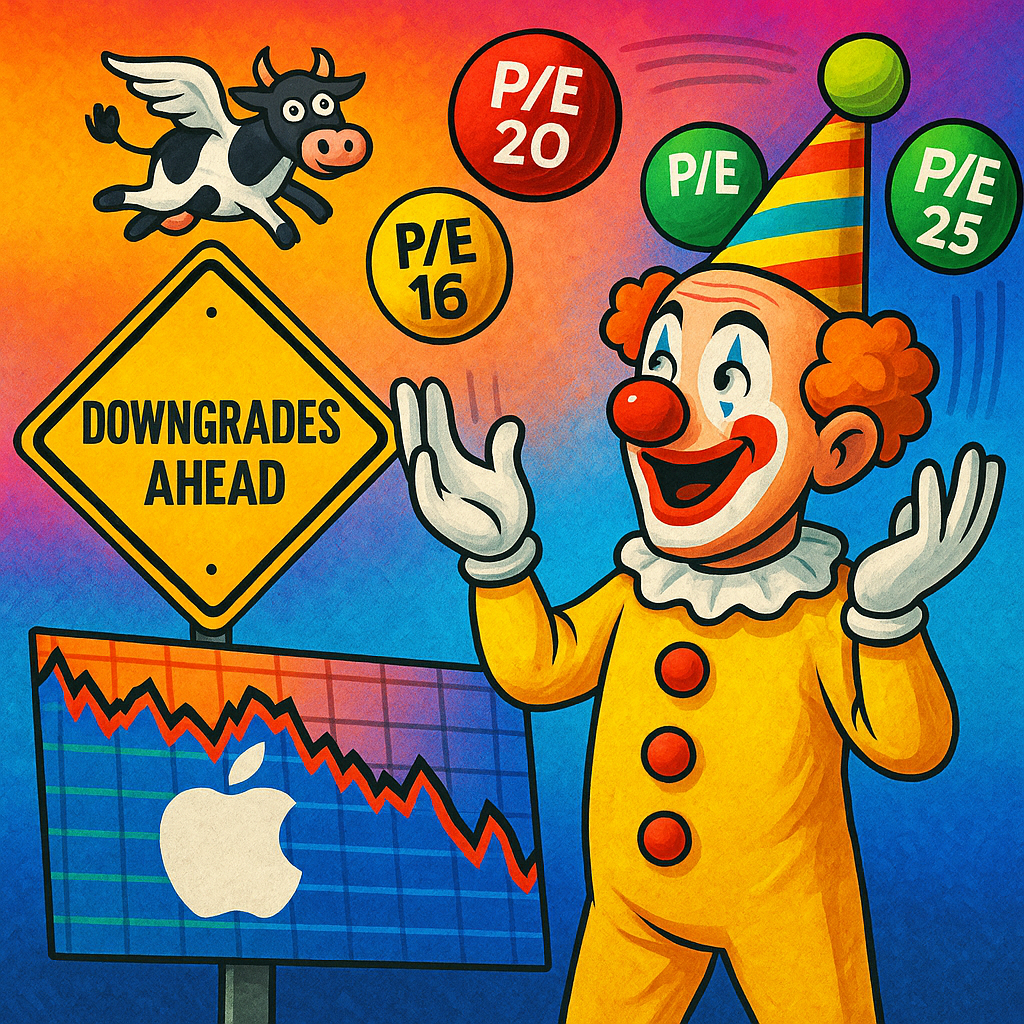

PED 3.0 : “AAPL Downgrades Ahead”

Philip-Elmer De Wit’s now-famous AAPL blog (recommended strongly) comments on a variety of analysts who are sat on the fence with their price targets, prevaricating as usual about when to try not to be too wrong.

Excerpt from the post and well worth a full read:

From Mark Hulbert's "Why Wall Street downgrades of Apple stock are about to pile up" posted Thursday by MarketWatch:

Shares of Apple AAPL — already down 20% since the beginning of the year — are likely to fall even further in coming months.

That prediction is based on the behaviour of Wall Street analysts, who tend to react slowly to developments. Seven of the almost 50 analysts who regularly follow Apple’s stock have downgraded it this year. That leaves a large group of analysts who potentially could join this group of seven, and whose downgrades could cause Apple’s stock to fall even further.

Analysts’ sluggishness in responding to new information is tied to their career and compensation incentives. It’s risky for them to deviate too far from the Wall Street consensus. If they’re wrong, their reputation will suffer and they possibly could lose their job. As such, they are inclined to keep their earnings estimates and buy-hold-sell ratings in the middle of the pack.

/End of quoted section

fyi. has a few observations to make.

Judging from the comments on the article, there’s a lot of debate about the reasons for analysis paralysis, not least nefarious analysts, ignorant analysts, incompetent reporters, and the not-blaming-Apple-but everyone-else instead, which sums up the general confusion about the state of AAPL at the moment and what’s really influencing the stock.

Let’s take this excerpt from one poster:

“This is so very indicative of the way AAPL cycles, in waves. Sometimes the waves crest, sometimes they trough, but they’re always in motiion. At times, there are huge differences between the peaks and troughs, and ever since Apple “broke through” permanently to higher general valuations, thr frequency has been increasing, as if something were fighting Apple’s steadily building momentum.” (SIC)

And he leads on to conclude, recommending people buy AAPL now (even though it’s been in a downtrend since its $260 peak in March ever since):

“However, this is still just a theory, and it may never be able to prove a correlation. Still, if it’s correct, then what we are presently in is essentially a self-correcting trough in Apple’s valuation. That makes it an excellent time for those still able to invest into more AAPL to do so.”

While I’m all in admiration for those peddling faster on their fitness bikes while going nowhere, using their Fitness+ subscription to keep fit enough while keyboard warrior-ing from the basement to keep up 20 posts a day, I think there’s a few more grounded explanations for price action (5 years of failed launches and stalled earnings growth aside, that is).

And yes, I’m waving at you

Now, I’m all for metaphor—waves, tides, seasons, and cycles have their place. But when it comes to Apple’s share price, we’re not exactly talking about the moon influencing the ocean. What we’re witnessing is not some mystical rhythm of investor psychology, but the ripple effects of an over-extended multiple, inflated during a brief fever dream of “services-driven growth” that the company has never quite substantiated with real momentum.

Froth, unlike broth, tends to evaporate over time

Let’s rewind to 2018/19. Apple broke out its services revenue and Wall Street went full Pavlov. The market rewarded this accounting reframe with a dramatic re-rating of Apple’s valuation—from a PE multiple around 15–18x to one touching 30x at its frothiest. And like all runaway enthusiasm disconnected from earnings growth, this expanded multiple made the stock hyper-sensitive to even modest shifts in sentiment, guidance, or forecasted growth.

It’s momentum, not conviction, acting as helium

It’s not waves we’re riding anymore. It’s leverage. Psychological, not financial. When you apply a 30x multiple to a company with flat earnings, any disappointment hits like a hammer. Every whisper of missed unit sales, underwhelming Vision Pro adoption, AI proving to have no intelligence, a mute SIri, and the company restructure every year or Buffett lightening his load becomes “the reason” for the drop—when in truth, it’s the multiple itself that was bloated from the start. The fall isn’t a trough. It’s gravity re-asserting itself.

This is not a case of unseen “undercurrents” battling Apple’s momentum. There is no mysterious hand damping down its power. There is only a slow, clinical realisation that the 2019-2023 multiple expansion priced in a future that hasn’t, and may not, arrive.

Meanwhile, the buybacks—Apple’s favourite anaesthetic—continue to numb the pain. It’s not a theory that they’re compensating for Berkshire’s selloff. It’s arithmetic. When your float shrinks by 3–4% a year and your largest institutional holder trims exposure by 1.5%, the maths doesn’t justify a moral panic. Especially when the same company is sitting on $60-100B in dry powder and buying its own shares on discount.

That’s the calm arithmetic. Now let’s look at the storm brewing. But let’s talk risk now.

If the proposed tariffs on China/India-assembled iPhones go through (and yes, this is an if, not a certainty but pretty much unavoidable), we’re looking at a scenario where Apple’s cost structure gets meaningfully hit. That doesn’t just nick margins—it potentially triggers YoY earnings contraction. Add to that a high multiple, weak product cycle, muted iPhone replacement rates, and minimal traction from AVP or AI as monetisable categories, and it’s not hard to see why any analyst daring to downgrade isn’t exactly off the reservation but wisely risk-managing not just their clients’ portfolios, but their own reputation.

We’re not in a trough, we’re in a spiralling vortex. Something has got to give soon to go higher, or risk being chucked back to earth with an 18 PE.

So no, we’re not in a “self-correcting trough.” We’re in a period of long-overdue market sobriety, where hopium-fuelled valuations are being quietly walked back. Apple is still a juggernaut. But the idea that it’s under siege from some invisible wave-force rather than basic macroeconomic drag, strategic stagnation, and valuation overshoot is, frankly, giving mysticism far too much credit.

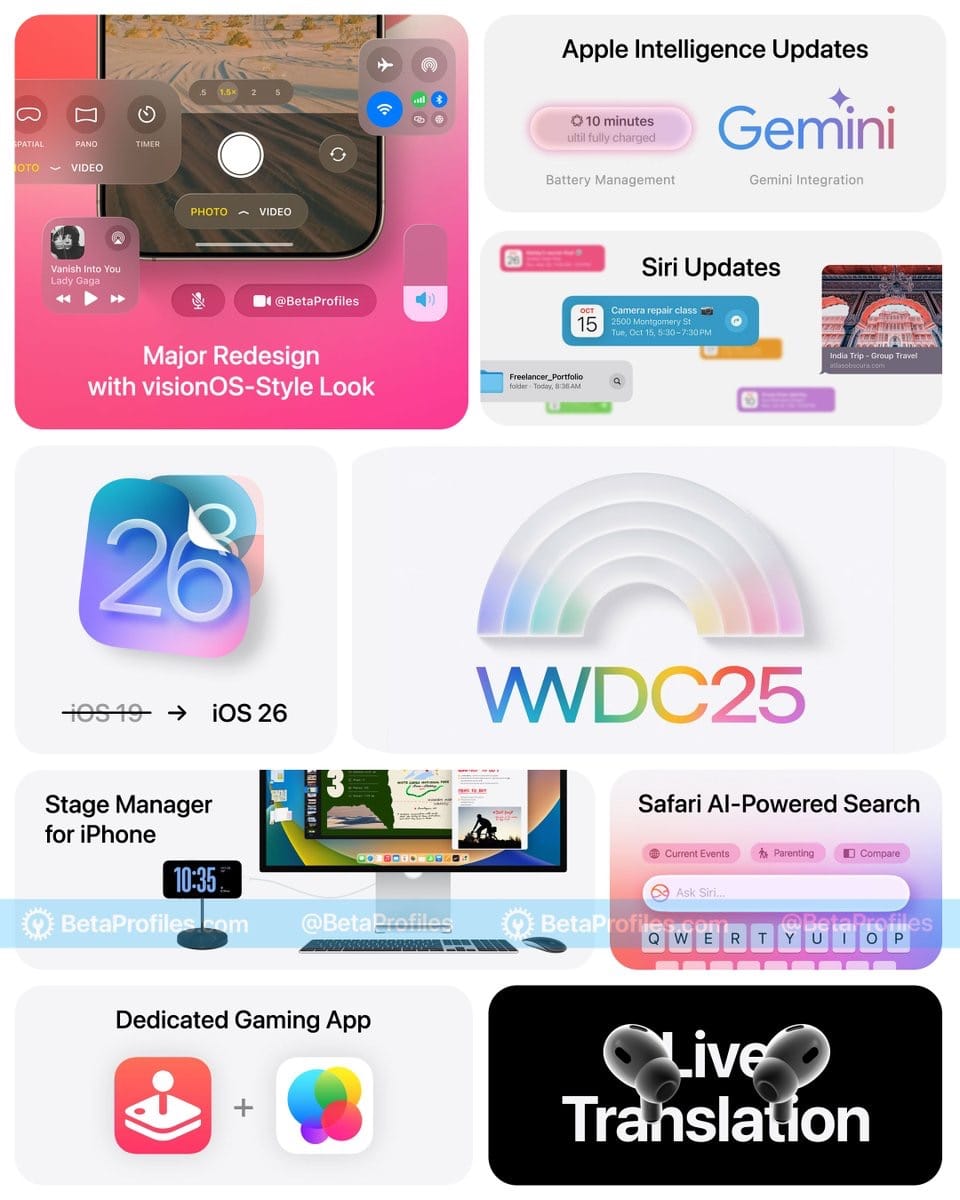

As for the suggestion that now is the “perfect” time to buy—because the stock has fallen 22%—well, I leave that to the personal risk tolerance of the reader. But if the only justification is that it’s cheaper than it was five months ago, I’d suggest it’s less a wave and more a warning. AAPL, sadly, especially when you back out inflation, has gone literally nowhere for three years after all. All eyes on whether WWDC 2025 can turn this around but frankly with infographics like this, it’s looking like a Frankenstein mashup of a Microsoft product launch circa 2005 and a GPT programmed to fit feature bloat onto a single infographic image (admittedly not Apple’s production, but another blogger with an over-active imagination and too much time on their hands).

Something is “On the horizon,” but who the hell knows what? Not an investable thesis at this point, especially after the lies and distractions told and perpetuated by Apple for the launch of AI at WWDC 2024. No passes.”

So… “On the Horizon.” Hopefully that’s not a reference to where the competition already are, rather than an allusion to yet another year’s delay in AI—and more stagnation in the share price. Meanwhile, Apple’s buying up NVDA servers like they’re going out of fashion, having finally admitted they’re two years behind. That stock is soaring. Apple’s? Not so much.

Portfolio diversification has never mattered more than it does now. Don’t put all your Apples in one basket—that strategy stopped working around 2016. Even the now-retired Oracle of Omaha, who “doesn’t trade,” has quietly pruned and rebalanced his AAPL exposure 26 times since then. And while Buffett’s image may be buy-and-hold, the reality is clear to anyone with a modicum of common sense: wise farmers don’t just sit out the winter praying for sun. They prune, harvest, and rotate their crops.

No passes for five years of misses. What will this year bring? Are you buying, selling, or holding, or just sitting back and watching the cowboys and indians slog it out?

Answers in the comments please, of course.

– Tommo

You can subscribe to Philip’s Most Excellent blog at: