POST-WWDC25: Dissonance Engine in Full Force. Battle of the Analysts, and a future at a paradigm shift moment.

Apple is now at the mercy of forces once considered beneath its: presidential whim, trade tariffs, and global supply chain geopolitics. The era of “making its own weather” is over. Apple is reacting, not directing.” This "orthodoxy" is now looking more like a ritual rain dance of superstition.

Pre-amble to WWDC 2025

There are moments in the life of every iconic company when the faithful gather in expectation, the analysts scribble furiously, and the critics find themselves, for once, in demand. Apple, on the eve of WWDC 2025, is at exactly such a juncture. But what is rarely acknowledged—least of all by those who treat Apple as a self-contained climate system, “making its own weather”—is that the thunderclouds now gathering are not random. They are the predictable result of decisions, distractions, and denials that have been visible for years, to anyone prepared to look beyond the latest keynote, or the latest Dan Ives price target.

This piece, written a day before the WWDC2025 of keynote theatre, is not a eulogy for Apple. It is a call to look, with the same cold eye we once turned on Microsoft under Ballmer, on BlackBerry under Balsillie, and on Nokia in its endless season of “platform transitions.”

The facts are not in dispute. The only question is how long the echo chamber can drown them out.

For much of the last decade, Apple’s mythology has had its roots in a particular style of American corporate invincibility: a little bit Jobsian magic, a lot of cash, a balance sheet so bombproof it would embarrass the World Bank. But beneath that, the company’s capacity to will new markets into being, or simply outlast regulatory or technological storms, has always been contingent. It is this contingency—the idea that Apple, like Microsoft in the Ballmer era, BlackBerry in the dying days of the QWERTY mob, or Hewlett-Packard at its “PCs for all” apex, might actually be capable of running out of luck, ideas, or margin—that so many investors, analysts, and even the company itself refuse to contemplate.

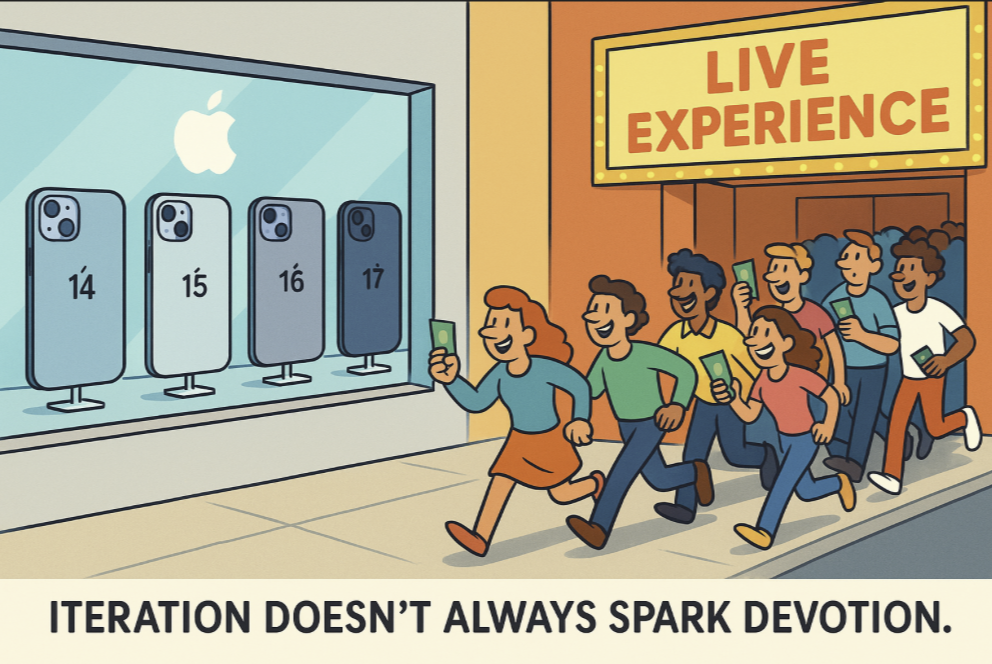

A legend of relentless execution

Today’s Apple is the product of a decade of narrative compounding: a legend of relentless execution, of consumer rapture, of iPhones that practically sell themselves, and of product lines that can be “iterated” into eternity without risk of stagnation. But the reality is now inescapable. The company is not innovating; it is iterating. It is not conquering new categories; it is defending its own pricing power against external threats it cannot control. And the once-daring boardroom now operates with the timidity of a committee whose job is not to build the future, but to avoid blame for missing it.

I. THE MACRO BACKDROP: TARIFFS, TRUMP, AND TECHNO-NATIONALISM

The mythos of Apple as “above the fray” of geopolitics has been steadily unravelling since the first rumblings of a trade war nearly a decade ago. But where once there was time to manoeuvre—where even Microsoft, during the lost Ballmer years, could “pivot to devices” at glacial pace and survive—Apple now faces a multi-front assault, not just on its margins, but on the very logistical foundation of its hardware empire.

Historical Parallels:

Think back to Hewlett-Packard, (or Compaq, Cook’s previous employer, before he met Steve Jobs in 1998)--that most American of tech stalwarts, which once believed its mastery of global supply chains made it too big to disrupt. When commodity margins shrank, and the PC world fragmented, HP discovered—too late—that outsourcing wasn’t just a cost advantage; it was a loss of leverage. The result was a decade of serial restructurings, write-downs, and an ultimately fatal inability to control its own fate.

Or consider Motorola, whose global dominance in handsets was gutted by a simple truth: when the world changes, fixed-cost empires can become fixed liabilities overnight. Motorola’s story was one of slow-motion decline, masked by residual brand power, then erased by the shift to new cost regimes they were too slow to meet.

Apple’s Present Tense:

Apple is now on the brink of a similar reckoning. The 2025 tariff threat isn’t just a negotiating tactic; it’s the opening bid in a new kind of techno-nationalism. A 25% tariff is now baseline—100% has been openly discussed. Apple’s fallback, to diversify final assembly to Vietnam and India, is lauded in press releases, but ignored by investors at their own peril: both countries have 8–10% higher costs, no operational scale to match China, and, crucially, no guaranteed trade deals with the next U.S. administration.

Forum sentiment is divided, but cracks are widening:

“Moving to India is just moving the risk, not removing it. Costs go up, but tariffs can follow wherever Apple sets up shop.”

“Apple’s margin, once a given, now feels like a rolling dice game. The world’s most valuable company shouldn’t have to worry about being ambushed by its own supply chain, but here we are.”

Meanwhile, even perennial bulls are hedging. Dan Ives, after a year of missed targets, has pivoted from “China is solved” to “investors need to look past the next few months”—a refrain that would have been familiar at Nokia in the twilight years, or at Microsoft as Vista flopped and Ballmer reassured the faithful.

My read of the data (May 2025):

“The real threat to Apple is not the iPhone upgrade cycle—it’s the company’s exposure to a shifting, unpredictable tariff regime and the absence of genuine growth drivers. If costs rise by 10%, if trade friction becomes the norm, and if Apple continues to paper over this with creative accounting and buybacks, the margin collapse will be swift, and the market will not wait politely for a fix.”

If the last decade of tech history has taught us anything, it is that companies which ignore the interplay of geopolitics, cost structure, and execution risk—believing their own myth of exceptionalism—are the ones most vulnerable to sudden, irreversible decline. Apple, like HP, like Motorola, like every titan before it, is not immune.

II. CONSUMER TRENDS: THE PLATEAUED PREMIUM

Historical Context:

In the late 2000s, BlackBerry ruled the business smartphone market with a product so “sticky” that its users, including world leaders, swore they’d never give it up. Then came iPhone and Android—not as better e-mail machines, but as platforms for everything else. By the time BlackBerry tried to iterate, the world had moved on. Brand loyalty, in the end, was no moat against obsolescence.

Microsoft’s Ballmer-era Windows Mobile, meanwhile, boasted a captive enterprise base and a robust upgrade cycle—right until touch-first design and the app revolution left their “reliable” user base outnumbered and outclassed.

Apple today enjoys a similar luxury. The iPhone and Mac have become benchmarks of incremental excellence: the latest iterations are beautiful, solid, and, for most, functionally indistinguishable from the previous two or three versions. Brand loyalty remains high, but as both BlackBerry and Microsoft learned, loyalty is not the same as growth, and “good enough” never wins the next paradigm.

Data and Detail:

- The iPhone 16 is, by almost every user account, a small marginal step up from the 15—more storage, a brighter display, a slightly better camera. But the excitement is muted.

- Upgrade cycles have lengthened by 30–40% since 2018; most buyers are now on a three- or even four-year device cadence.

- ASP growth (average selling price) is being propped up by storage and “pro” models, not mass adoption or new features.

- Services, once touted as the next engine, have become a margin protector, not a growth engine.

Forum and Analyst Voices:

“My latest iPhone 16 Pro Max is exactly the same as my 15 Pro Max.” (Long-term AAPL holder, June 2025)

“The iMacs are a step back. My Apple TVs feel unchanged since 2021. Apple Watch hasn’t tempted me in two years.”

Laura Martin (Needham): “For the stock to work, it must have the catalyst of an iPhone replacement cycle. We do not foresee that.”

My forum comment:

“Brand loyalty is not the same as growth. All that will do is lead to PE multiple contraction and the stock going nowhere as the air comes out the PE tyres. If people can’t see that, they shouldn’t be investing.”

My a photo of outside the Apple Store in London, the night before the UK Launch

Signal Analysis:

We are witnessing a company that, like BlackBerry and Microsoft before it, confuses retention for relevance. The installed base (2.35B devices) is world-beating, but the once-rabid enthusiasm has quietly given way to polite apathy.

The cycle of “buy, wait, repeat” is being replaced by “buy, wait, maybe skip the next one.” In the forums, you can sense the anxiety masked by bravado:

“Apple will always be superior—look at their hardware!”

But loyalty is not fungible with innovation, and incrementalism is not insurance.

My forum comment:

“There was a time when a new iPhone meant camping outside an Apple Store. In 2025, it’s more like a polite email reminder from your carrier, easily archived. The queues now are for Taylor Swift tickets, not smartphones.”

III. THE LLM/AI REVOLUTION: PLATFORM-AGNOSTIC THREATS

The technology industry has always been shaped by platform shifts. IBM missed the PC software wave and became a legacy “mainframe” business whle Microsot scooped the glory with its WinTel combination. Nokia missed the smartphone OS inflection and became a case study in how fast a hardware leader can become a footnote. Now, Apple, with its legendary vertical integration, is at risk of missing the moment as the locus of innovation moves from device to intelligence—from hardware as platform, to software as the layer that runs on everyone’s hardware.

In 2024–2025, the rise of large language models (LLMs) and generative AI has redefined the next decade of consumer tech. While Apple has, admirably, stuck to its privacy-first, on-device model, it has failed to create the new “paradigm layer” that everyone else will build on. Instead, OpenAI, Google, and Meta have rolled out platform-agnostic SDKs, turning every phone, speaker, and app into a node of their ecosystem—leaving Apple’s AI ambitions feeling, at best, reactive. Maybe this will be addressed at WWDC2025, maybe not, but by the time the platform is ready beyond beta, how much further will the market have moved on?

Gene Munster and others now echo the “Apple has a couple years to get AI right” refrain, which is eerily reminiscent of BlackBerry and Nokia’s “still time to pivot” narrative in their final years of market relevance.

“Apple has a more advanced cloud-based LLM that is rumored to be 150 billion parameters. The more parameters, the bigger the model’s ‘brain.’ This would be comparable to ChatGPT-4o…” (Gene Munster, June 2025)

My response:

“It’s not about the model size, but how it works that matters. Apple’s approach is fundamentally reactive, not proactive—years lost to distractions, missed opportunity for agents/bots, and a lack of urgency or willingness to overhaul the stack for real GenAI transformation.”

My concept of SenseOS was conceived by me as a counterfactual:

“If a single strategist [me] can conceptualise a transformative agent/LLM-based OS in a weekend, why is the world’s most valuable company still ‘waiting for the pieces to come online’ years after the moment called for bold action?”

Apple’s “we’ll get it right in a couple years” mantra ignores the compounding opportunity cost of delay. In tech, platform shifts do not wait for committee signoff. They punish hesitation mercilessly.

IV. THE ANALYST ECHO CHAMBER: DISCONNECTED NARRATIVES

There’s a strange rhythm to Apple’s analyst coverage—a kind of meta-dance where numbers are always “impressive” or “disappointing for the right reasons,” and targets oscillate, but the bullish conviction never wanes. If you look closely, you can spot the same analyst patterns that helped prop up Microsoft in the Ballmer years and BlackBerry in its last gasps: always a new excuse, always a brighter quarter ahead, always a reason not to say the magic is gone.

Dan Ives (Wedbush) is the most emblematic, but not alone.

In April 2024, he was touting a $260 price target and a “supercycle.”

By August 2024 he was raising this to $325 and running with pom poms.

Even in March 2025, he was standing by his $325 PT, having just visited Asia and reconfirming “everything is just tickety-boo”.

Then, we know what happened. Apple fell (as I predicted) to $169 instead of soaring to $325, and Dan, pulling a mea culpa, looked drowned when interiewed on CNBC, saying “nobody could have predicted this” (when yours truly had predicted it and sold out of the US markets when AAPL peaked at $260 - posting in real time that I felt this market was so distorted, it couldnt’ be trusted.

By April, with the stock tumbling to $169 (exactly as predicted), his price target was not retired or re-examined; it was revised after another reality check, back to $270!

At every turn, he reassured investors to “look past the next few months” and “trust in Apple’s long-term story.” This would be farcical if it weren’t so predictable—a cycle that echoes the “just wait for the next Lumia” chorus at Nokia, and Ballmer’s infamous “developers, developers, developers” while missing the paradigm shift. No successful new laches in 5 years is not a sign for playing cheer leader with poms poms on let alone a track record of calling for record highs as the stock plunges to lower lows.

Forum responses now mix open derision and cultish faith:

“He says this every month. Apple bulls need to stop looking through the alternate reality field and see things as they are.” (May 2025)

“Every analyst has to keep their clients happy. The price target is just a flag to rally the faithful.”

“Why is no one asking how, not just why?”

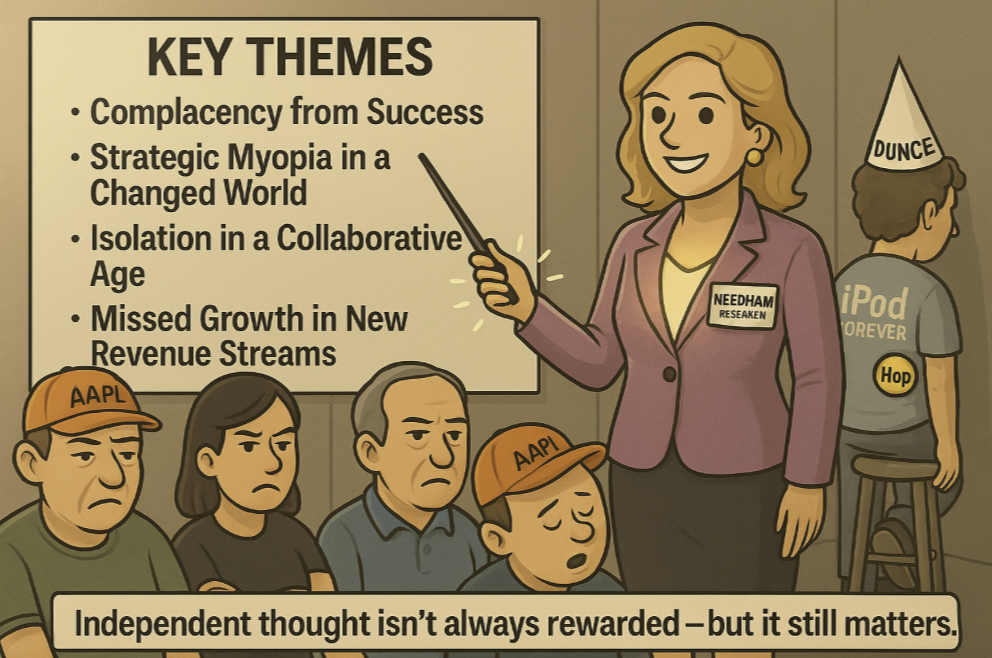

Meanwhile, Laura Martin (Needham) dared to suggest a few days ago that “Apple’s weather-making culture is now a source of complacency,” and was immediately accused of pessimism or “bad timing” for not waiting for WWDC.

This, too, is a historical echo: when Nokia’s stock slid, the “sum of all worries” became a running joke, right up until the floor dropped out.

Here’s a summary of Laura Martin’s analyst note—focused on her philosophical, broad, and deep critique of Apple’s current position, as outlined in the Needham “Hold” rating:

Laura Martin’s Needham Note: A Philosophical Deep Dive on Apple (June 2025)

Laura Martin’s note is more than a tactical downgrade—it’s a diagnosis of Apple’s existential risk in the GenAI era. She opens by acknowledging Apple’s formidable moats: the best-in-class integration of hardware and software, and a global brand built on historical innovation. But Martin’s central concern is that Apple’s very culture—the legendary “we make our own weather” attitude—is now a double-edged sword.

Key Themes:

- Complacency from Success:

Apple’s belief in its self-sufficiency once enabled industry-defining products and a unique brand. Now, Martin argues, that belief is morphing into complacency at precisely the moment GenAI disruption demands urgency and speed. While Microsoft, Google, and Meta are shipping foundational models and GenAI-native platforms, Apple’s capex and product velocity lag noticeably. - Strategic Myopia in a Changed World:

She notes Apple’s habit of underestimating macro risks—slow to react to regulatory shifts, geopolitical tensions (tariffs), and rising competitive threats. This “weather-maker” attitude was an asset in Apple’s ascent, but now risks making the company insular and slow to adapt. - Isolation in a Collaborative Age:

Martin points out Apple’s closed ecosystem is no longer a universal strength. As the world moves toward open, collaborative AI and LLM development, Apple’s insularity isolates it from potential partners and slows GenAI adoption and integration. - Missed Growth in New Revenue Streams:

Apple’s privacy-first self-image, while celebrated, also limits its ability to add new, high-margin revenue streams (like advertising) that could accelerate top-line and margin growth.

Conclusion/Rating:

Martin lowers her rating from Buy to Hold (and drops her $225 price target, without replacement), citing the risk that Apple’s culture is now a drag rather than a driver in a rapidly changing, AI-led landscape. Her note reads as a rare public meditation on the tension between legacy excellence and the perils of ignoring the new playbook—less about numbers, more about narrative, culture, and the psychological risk of a company too enamored of its own legend to see the weather changing around it.

My own commentary cut through the noise:

“Waiting for confirmation is intellectually dishonest—if risk is evident, name it. Apple Bulls also need to take off their Dan Ives dazzling blazer coloured glasses and stop looking through the Alternate Reality Field and see things as they are… cognitive bull***t dissonance clouding our thinking.”

What’s left is a familiar tableau: analysts as cheerleaders, not referees; management on the defensive; investors left to decide whether to join the chorus or step out into the cold air of realism.

V. THE FAITHFUL AND THE FRUSTRATED: COMMUNITY COGNITIVE DISSONANCE

In every era of tech dominance, there emerges a class of shareholder-evangelists whose belief in the “company story” transcends facts, numbers, or external signals. For Apple in 2025, the forums have become the front line of this phenomenon—a living museum of hope, denial, and periodic exasperation. It’s a playbook as old as Microsoft’s “Windows will always win” crowd, BlackBerry’s “physical keyboard is king” chorus, and the true believers who kept buying Hewlett Packard at every “value inflection point” straight through its lost decade.

The divide is now absolute. On one side, the devout:

“Apple’s products are so superior, the company must be superior.”

“Safe AI is hard—nobody else is even trying.”

“Installed base of 2.35 billion devices means Apple can’t lose.”

On the other: the “frustrated faithful,” sometimes including even the longest holders:

“My fear is Apple has missed it and will not catch up and the stock will grind lower and lower. Like an Intel. Sorry to say but I have been the biggest Apple bull for 24 years. Praying that I am wrong about my gut feeling.” (Forum, June 2025)

My reply in the comments:

“Agreed – it’s what many are echoing, and rightly so, given total failure to execute in over 5 years apart from silicon. My hope is that public humiliation will force a real reboot. I’m not sure it’s possible under the current management though.”

My own commentary has become more clinical, if not gentle:

“There was a time when I was branded a doom merchant for flagging obvious risk. Even though for 25 years I rode this train off and on from 2000 up a wild 11,000% and was probably the most vocal AAPL commentator on the web, Now, every forum is a patchwork of cognitive bias: the Holy Church of Keeping the Faith insists nothing has gone wrong, and any talk of risk is whistling past the graveyard. Two opposing truths can co-exist—but only if we’re actually willing to look at both.”

This dynamic isn’t unique to Apple. At Microsoft, the die-hards argued for years that dominance in enterprise meant “forever profits”—until Google and Apple turned Windows into an afterthought. At BlackBerry, the faith outlasted reality by almost three years. For Apple, the real danger isn’t overt skepticism, but the silencing of skepticism itself.

VI. THE FAILURE TO LAUNCH: FOUR YEARS IN THE WILDERNESS

For every technology giant, there comes a season when launches don’t launch, visions become slogans, and a parade of “next big things” fade into museum pieces—or, more often, expensive write-downs. This is not unique to Apple: Microsoft’s Zune and Kin, HP’s webOS and Autonomy, Nokia’s Ovi and MeeGo, BlackBerry’s PlayBook—all were, at launch, the “turnaround product.” All now serve as cautionary footnotes.

Apple AI and the AVP (“spatial computing”) stand as the current totems of this cycle—a technological marvel rebranded as “future-facing,” but, as of this writing, commercially inert. Apple Car has disappeared into legend, a decade of R&D and billions spent, with not a single vehicle shipped. Siri’s AI reboot, much hyped, is now openly acknowledged as a year “behind schedule,” a phrase that would ring familiar to anyone who tracked Ballmer’s serially delayed “Metro” initiatives at Microsoft.

My running diagnosis has been direct:

“It’s always triage somewhere in Apple putting out a disaster, with no room left for error, mission creep, or delays. Considering the wealth of the company and its FCF and margins, it’s time Apple started doubling its R&D budget and not blowing wads of it on useless concepts or beta products which have resulted in a huge drain on resources and a negative ROI… Business as usual is just not appropriate, not after the crushing disappointments of the last few years.”

Forum wisdom, once bullish, is now anxious:

“Not sure that’s possible under the current management though. I remain hopeful, though.”

“Feels like Apple is suffering from ADHD, a smidgen of PTSD, and a few autism codecs in the mix. Someone, fetch the Ritalin.”

What’s at stake isn’t simply “failure”—it’s the loss of the launch cycle itself. In tech, nothing lasts if it isn’t shipped, and nothing matters if it isn’t adopted. Four years in the wilderness is a warning: in a platform era, the company that can’t escape the desert gets left behind.

VII. THE WAY OUT (IF THERE IS ONE)

Every cycle of industry decline has its “moment of clarity”—the recognition that what worked before no longer suffices. For Microsoft, it was the forced embrace of Satya Nadella’s “cloud-first” pivot, after Ballmer’s endless delay and missed platform shifts. For HP, it came too late—by the time they admitted they needed more than incremental innovation, their relevance was already eroded. For BlackBerry and Nokia, the moment never really came at all.

Apple’s moment is now.

The company has all the ingredients to win again: the brand, the cash, the ecosystem, the residual customer trust. What it lacks, and what I have been pounding the table about for several years, is the willingness to risk margin for growth, to double down on R&D, and to admit that a creative destruction phase is not a threat but a necessity.

My running commentary has been correct. For over 20 years. I have written 53,000 posts now.

Now I say this for the record, after predicting the treasuries tremor, the fall of AAPL from $260 to what I said would be a $150-170 range (it hit $169):

“For the record, I still say $400 for 2027 is possible, but only on flawless execution, and increasingly, I just see the opposite. The window is closing, but not yet closed—Apple can still roar back, but not by iterating legacy lines and praying for the next supercycle. The time to act is now.”

I do not believe in nostalgia as a strategy. The Jobs playbook is finished; the Cook playbook, exhausted. This is the moment for Apple to reinvent itself—culturally, structurally, strategically—or risk becoming the next Intel: essential, profitable, and utterly out of the narrative.

What does it take? Real R&D. Leadership change. A willingness to risk near-term margin for long-term relevance. A break from the cult of “just one more upgrade.” And, above all, a refusal to conflate customer loyalty with actual momentum.

This isn’t pessimism; it’s strategy. The rocket can still launch—but not if everyone keeps pretending the countdown hasn’t already started.

VIII. CONCLUSION: BEFORE THE SHOW

As WWDC 2025 approaches - in a day as I finish this piece - I find myself reflecting on more than just product cycles or analyst targets. This is not about whether Apple “beats” this quarter, or even the next. It’s about the underlying pattern—the rhythm that separates icons from institutions, and living legends from living museums.

I’ve watched this cycle before: the Ballmer-era Microsoft that missed mobile, the BlackBerry faithful that rationalised every lost market, the Hewlett-Packard that managed decline as if it were strategy. Each time, the warning signs were there—complacency at the top, denial in the ranks, and a cheering section convinced that “this too shall pass” was wisdom, not just wishful thinking.

What I’m arguing for—what I’ve always argued for—is not pessimism, but clarity. Hope is not a strategy. History is not destiny. It is perfectly possible for Apple to re-enter growth mode, to recapture innovation, and to lead again. But this will not happen by accident, or by waiting for the “weather” to turn. It will only happen by making the hard choices, acknowledging risk, and embracing change.

The rocket still gleams on the launchpad. But until ground control owns the narrative—and acts, not just reacts—the risk is that, like so many before, Apple will find itself standing still while the world moves on.

So I post this now, before the keynote, because no single event will erase four years of underperformance or fix a culture at risk of calcification. The true question is not what Apple announces today, but whether it can still summon the courage—and the humility—to build what comes next.

This is not a eulogy. It’s an alarm bell. The rocket can still launch—but only if the people in charge stop cheering and start engineering.

Apple at the Crossroads, and Why “Waiting” Is a Mirage: 1 day to go 'til WWDC 2025 liftoff.

With the WWDC keynote seemingly minutes away, here’s what matters more than any one announcement: the hard reality that Apple has not just “fallen a year behind,” but is already running a 5 year deficit in platform vision, ecosystem leverage, and actual shipped innovation.

Worse, while analysts and forum bulls preach patience—“Apple has a year or two to get it right”—the world has stopped running marathons and started sprinting relays. LLMs, agents, and composable AIs are rewriting the rules in months, not years.

“People say Apple has a ‘couple of years’ to get AI right. That’s a fantasy. The world moved while Apple was watching the weather, and the opportunity cost isn’t just what Google or OpenAI have gained, but what Apple itself has left unpicked—tens of billions in new services, platforms, and hardware experiences that could have doubled earnings growth and cemented platform lock-in. Instead, we got AVP and vaporware.”

Tariffs, Margins, and the Supply Chain Mirage

Trump’s threats (25%, 100%, pick a number) are not just political noise. Every “Plan B” supply chain shift to India or Vietnam bakes in higher costs and keeps gross margin at the mercy of two governments who aren’t even trade allies yet. Waiting for the next iPhone cycle won’t change that, and anyone who’s lived through HP’s “global pivot” knows that delay is defeat.

“The story that Apple can just ‘wait out’ tariffs or regulatory heat is magical thinking. You can’t cut your way to growth, or lobby your way back to a product cycle that’s already gone stale.”

Loyalty Is Not a Growth Strategy

Forum after forum is filled with some version of:

· “Apple will always figure it out; they have the best products.”

· “Every cycle, the naysayers lose.”

But when my own top and bottom calls hit the mark—and I’m still called a doomsayer for simply arguing the facts—it’s clear the discourse has become unmoored from data.

I don’t predict doom. I predict risk. And when you ignore five years of zero new categories, and the incremental upgrades get so incremental nobody’s sure what they paid for, that’s not healthy skepticism—it’s rational risk management.

AI, LLMs, and the Speed of the New S-Curve

The LLM and agent wave isn’t a “next year” thing—it’s now.

· OpenAI, Google, Meta: LLMs are composable, running everywhere, on any device, transforming verticals at warp speed.

· Apple’s “we have time” mantra is Ballmer at Mobile World Congress in 2007 all over again.

“If a single strategist like me with a laptop can build a SenseOS concept in an afternoon, and Apple can’t ship a real agent platform after four years and $300 billion in buybacks, then something is broken at the top—and the market knows it.”

Opportunity Cost: The Unforgiving Arithmetic of Delay

Every quarter Apple spends waiting is a quarter when competitors entrench, users set habits, and developer ecosystems calcify around other platforms. The “low-hanging fruit” in financial services, health, home, and intelligent agents was within reach—now, it’s being picked by everyone else.

“In a world where the Matrix is being built in the open, every quarter Apple sits out isn’t neutral—it’s negative compounding. By the time a ‘catch-up’ ship is ready, the destination has moved. The marathon runner who waits for a wind shift is now being lapped by relay teams sprinting toward the future.”

How Apple Can Shift Gears—And Why It Must

Waiting two more years—while plausible in the hardware world—is suicide in the new AI regime. The only way out is to shift from marathon runner to sprinter:

· Double R&D now, not after another failed cycle.

· Drop the legal sparring and start out-innovating, not sulking in the shadows.

And most of all, build new things people actually love, not just what they’re willing to tolerate.

“Fans aren’t fanboys. They’re admirers of execution. The moment Apple loses the admiration of those who respect craft, not just legacy, the game is truly up.”

The Signal Before the Keynote

The real question before WWDC isn’t what Apple announces in the next two days. It’s whether anyone at the top recognises how radically the rules of the game have changed—and that time, in this cycle, isn’t elastic.

“This is not a eulogy. It’s a call to arms. Apple still has all the assets, but must start acting like a company that knows the clock is running out—not just the quarter, but the decade.”

Let’s see what happens.

—Tommo_UK - Monday 9th June 2025 at 09:15am, US PST

Meanwhile Mark Gurman ($300 a year subscription for something he writes on a Sunday morning during his ablutions) seems dreadfully excited about something called Liquid Glass. If that's what gets him moist in the morning then he must be sorely lacking in excitement and secondly, I wish I could charge $300 for writing about something like Liquid Glass and then regurgitating everything everyone else has been said on real forums for weeks.