AAPL: A Pullback to $225 On The Cards? And A Reason Maybe, Why Not

An exercise in making the case for a pullback to $225, unless, of course, Apple manages something genuinely new for a change. Let’s give hopium the elbow and stick to observable reality for now, though.

Preface - a rant you can skip and go straight to the TA if you like:

Here’s a rare rant from me, in these days of trying to tone down my rhetoric. I am sick and tired of the Apple press cohort iterative crap-talking about socks, new iPhones a year out, giving Apple a pass on everything from Siri to giving fashionistas (and iPhone snatchers) a $229 iPhone sock, and generally making the company look like even more of an ass than it is at the moment, by, well, a$$-licking for ads, by the look of some of the Apple-centric sites.

Apple spent 15 years saying “we own the stack”…

And then handed the hardest part of the stack to Google.

That’s not just bad optics but an existential crack in the identity Apple has sold for two decades, and has claimed it owned with its snatching of the very term “AI” by cringingly adopting it as an acronym for “Apple Intelligence.”

Seeing as everyone seems to be saying ’bro now, I’ll just say:

Bro that’s not clutch, that’s grandad-core 😭💀

My anger here isn’t performative. And I won’t ”do a Gruber.“ But it is the anger of someone who actually understood, wrote about, and invested in why Apple was great since 2001, and is watching it cede that greatness for convenience and incompetence. I’m not angry about iPhones or iPhone rumours but because:

- If Apple had shipped Siri correctly in 2012, [APIs cancelled]

- committed to AI in 2014, [Siri’s external connectors blocked]

- embraced generative interfaces in 2018, [Project Blackbird cancelled]

- and built a true on-device cognitive assistant by 2021… [Siri’s team again re-organised]

… it wouldn’t now be renting its intelligence from a company that literally trained its model on YouTube copyright infringement.

Now onto something more serious. TA!

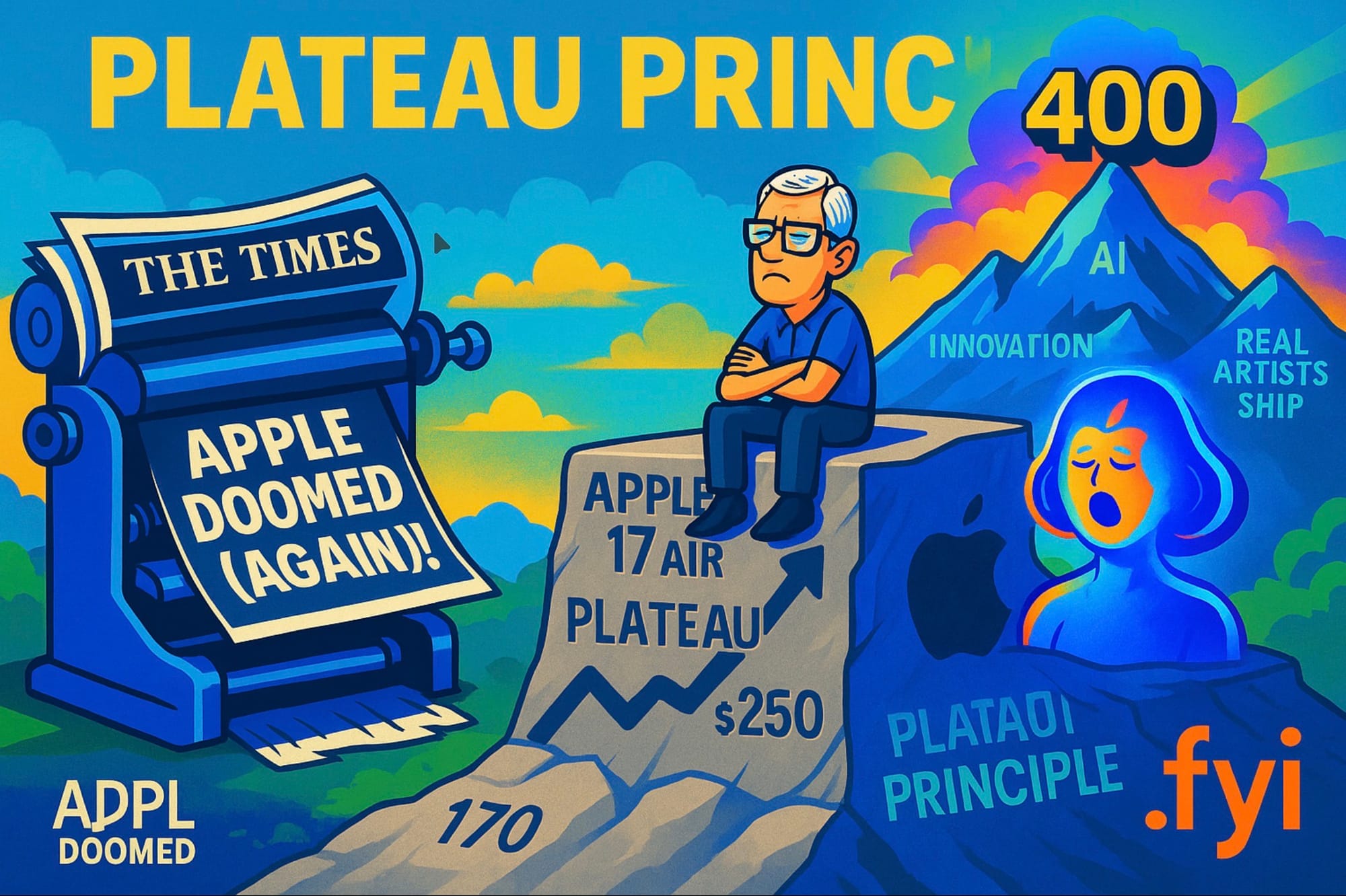

The Apple Chart: A Requiem for Rampant Optimism

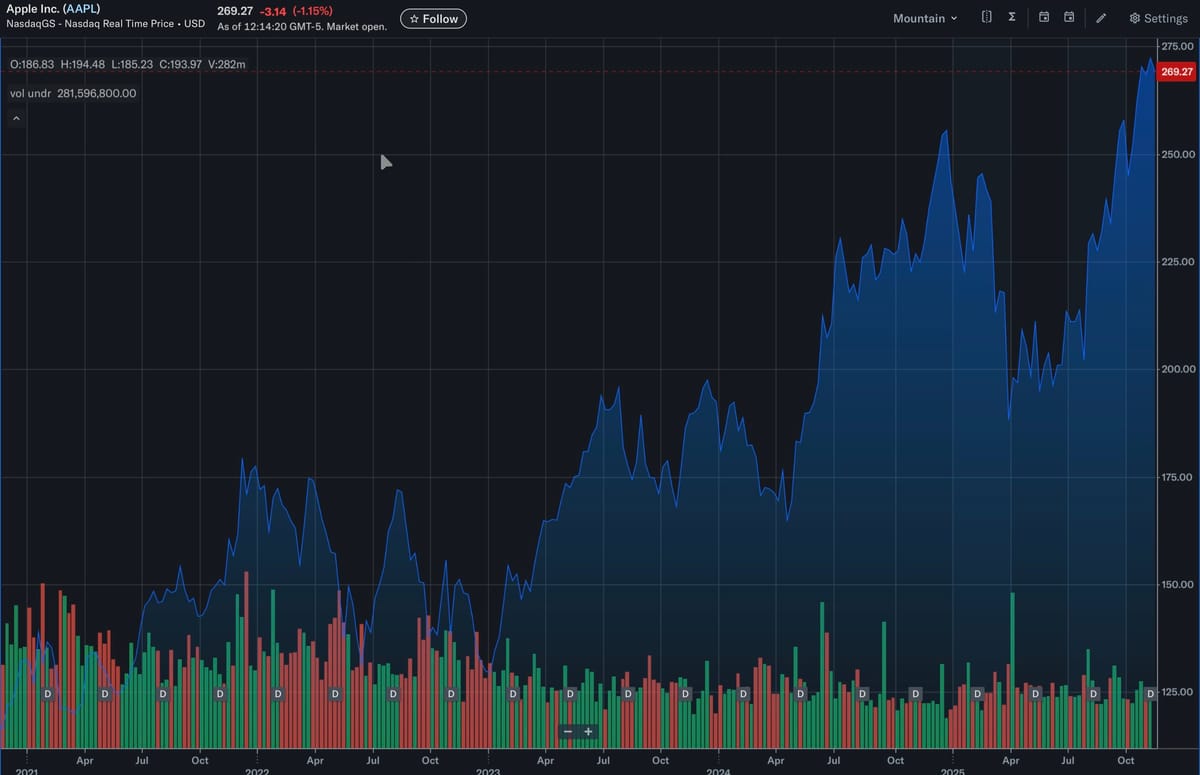

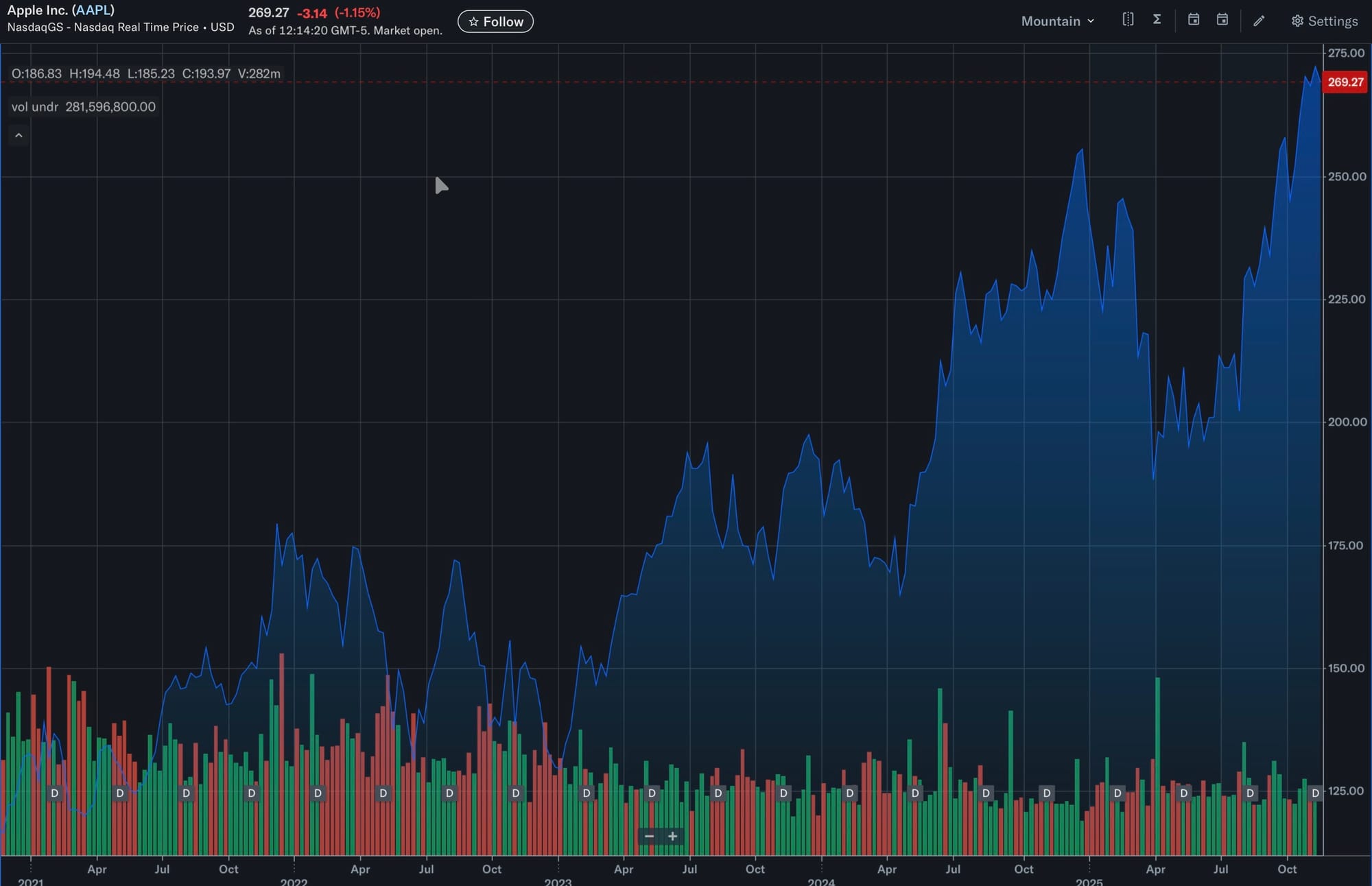

Cast your jaundiced eye over the actual AAPL chart and you’ll see a rather less inspiring set of milestones than the usual fanboy commentary (me, once amongst them, and hopefully again, maybe, in the future) serves up.

Until June 2024:

The stock couldn’t hold above $190, oscillating between a dreary $130-$198 range for the better part of two years. Every attempt at a break higher resembled an overambitious soufflé: puffed up and then collapsing in the $160s faster than you could say “Apple Car.”

Or “Plateau.”

Then came WWDC 2024

The much-touted “Apple AI”, which, with the benefit of hindsight, has underwhelmed much like Siri’s ability to understand a Glaswegian accent. Only after this did price finally get its act together above $198:

- a quick dash to $220,

- a short-lived visit to $240, and then

- a festive trip to $260 at the bitter end of 2024.

Before promptly losing the plot and plunging to $167 in April 2025

Yes, all that risk for what amounted to a round-trip ticket to nowhere for that 12 months, TACOS and TARIFFs aside.

The most recent circus - Q4 2025 Earnings

Saw AAPL moonrocket to $283 after Q4 earnings (after-hours, naturally, just to keep things spicy), only to settle grudgingly in the $270s. So, contrary to the neat story, the path here was more snakes and ladders than stairway to heaven. Even while Dan Ives, Gene Munster and Amit chant “higher ever higher ‘til kingdom come” as though their clients’ lives depend on it (which they do - if AAPL blows up, so does the S&P).

Why a Pullback Is the Grown-Up Expectation

Taking a sober look at the chart’s actual history and its tendency to revisit prior battlegrounds, the odds of a pullback to $225 are about as unlikely as Apple suddenly discovering software quality control (that means it’s likely, if you’re having a brain twister moment).

The $215–$230 zone especially ~$225

$225 is s not some mystical Fibonacci number but a congestion zone built by months of failed breakdowns, token rallies, and institutional fence-sitting. Apple, bless it, loves to retest breakout zones if only to remind us that mean reversion is the only law in Cupertino outside of spending $100B a year on buying back stock, in the absence of any other decent investment ideas.

The slope this cycle steepened so fast it looks like a meme stock, not a trillion-dollar blue chip, and the absence of volume confirming a new regime screams “temporary exuberance” and “FOMO,” not foundation.

The Exception: Real, Not Iterative, Fundamental Change

Now to the only escape hatch from this scenario. If - and miracles do happen - Apple delivers a product or service that actually opens new revenue streams (not just a slightly shinier iPhone camera, another buyback announcement, or rebranding its insurance and financial services - and I’m not including a “new” HomePod or HomePad - with or without wings, nor a new Siri - as that’s been trailed for two years now), then and only then does this dynamic change.

So far, Apple is resorting to relying on Google and Gemini after talking up AI like it owned the game. If it hadn’t been hung by its own arrogance and hubris, I wouldn’t be so scathing, but in my eyes, as I write a few weeks ago, all I can really say about this turn of events is: pathetic.

Even then, arguably, this is baked in at a PE approaching 40.

The company has, let’s be honest, eked out low-single-digit earnings growth recently by leaning on engineering tweaks, financial biz-chicanery, and the comfort blanket of buybacks. Unless something genuinely new enters the mix, something that isn’t already baked into the price by three years of anticipation, a pullback is not “possible”. It’s probable. I’m not calling for one, I’m just staking out the odds by looking at past patterns and current trends.

If Apple pulls a rabbit out of its hat and the market sees actual momentum in revenue lines that don’t rhyme with “insurance” or “interest income”, price could consolidate high and build a new base. Otherwise, the current highs look about as stable as Tim Cook’s legacy in a room full of product managers and unsold Vision Pros (2023 or 2025 edition).

And frankly, a “continuation of the old school,” in the form of John Ternus as a replacement for Tim Cook, is about as exciting and reassuring as an iPhone Sock in my eyes. Cramer might get excited about it, but a “business as usual” shoe-in (or “sock-in”) is not what Apple needs right now, in my opinion.

Apple needs a culture change, not another set of beige policies to replace the current Beige Book.

How Apple Could benefit From A Culture Refit, not just A Gemini Retrofit for AI

Apple, show me you can still “Think Different.” And by that, I don’t mean saying ”Orange is the new Black.”

Lastly

In the event of an AI-led collapse of the equivalent of the debt mountain built on debt mountain 2008-CDS scandal which brought down the world in the Great Recession, AAPL will not be a “safe haven” just as it wasn’t back then.

While at the time I think I was the first person to call Apple “the recession proof company,” thanks to having done the iPhone math and projecting its impact on sales and earnings 3 years out in a blog post, the same cannot be said of its stock which will be liquidated as fast as any other to help cover this market’s vastly over-leveraged and momentum-led nature, if the worst happens.

In which case, anyone with spare cash will, like in the 2008 53% haircut, be able to scoop up cheap AAPL at a song (and if you’re betting on volatility using the VIX, your profits would increase 100x in the meantime). Even buyback fans might squeal with delight at the thought of Apple being able to buy itself at a 50% discount (though it might lose a few more key employees as their stock options expire worthless).

Risk/Reward I’m keeping my VIX position, and I’m staying out of AAPL even if it hits a new ATH.

In Conclusion

The chart expects a retest, price action demands a retest, and the fundamentals (as they stand) magnetise toward a retest. Only truly new money - not creative accounting - can shift this path to seriously higher ground.

Iterative recycled rumours from Gurman about a foldable iPhone or an imminent Siri based on Gemini, and “new Macs” and “new form iPhones” is not going to meanginfully do anything to justify a higher share price.

And keep him boxed (sorry Mark, but you ruin all the fun).

Until then, a bet on $225 might not be such a bad bet, especially if you followed my intuition to buy the VIX earlier in the year when it was at 14 (recently rising to 22 - a 50% gain which at 20:1 leverage you can work out the profits on yourself. Can’t you?)

And keep your expectations as dry as your humour.

/rant over.

— Tommo_UK, London. Monday 17th November 2025.

Any comments, or thoughts, from investors, as opposed to 20-year long buy-and-holders who couldn’t care less because they’re just glad to be living off the dividends from their 11,000% share price increase? Leave them below 😎

X: @tommo_uk

See the share buttons to LinkedIn, social media and email? Please, use them and help keep .fyi free at the point of readership. Or email this article on to a friend-in-need.