The Crash That Wasn’t. Except It Was - Pre-Trump-Tweet: “All’s Well on the Western Front. China’s Going Just Great.”

Trump’s 100% tariff tantrum meets Wall Street’s AI hopium loop. CNBC cheers, capex cash spins in circles, everyone pretends the music won’t stop. But when money just promises to spend itself, bubbles don’t burst, they implode. Hedge, don’t edge. Halloween came early for the markets. Trick, or Treat?

Quick redux from Friday:

A read on what just happened:

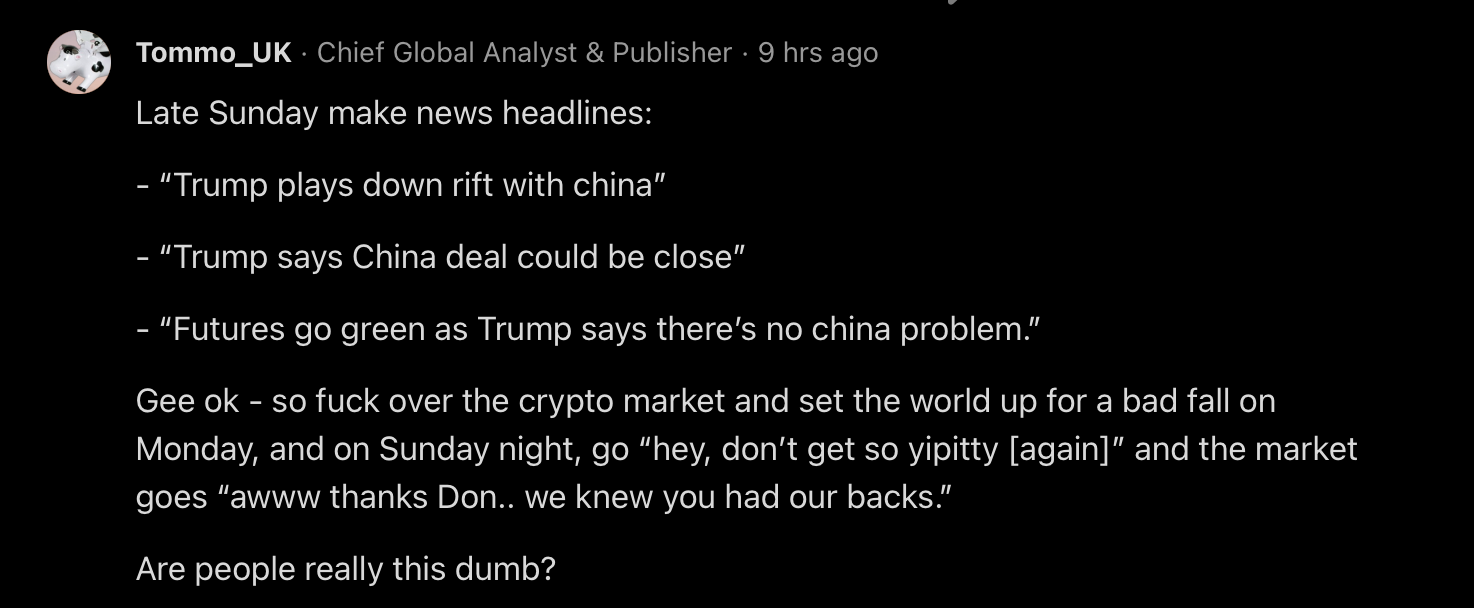

Trump tanks the markets on Friday, Crypto stages a collapse. Some traders commit suicide (literally, no joke). America yawns, media yawns. After all, he only raised tariffs on China by 100%.

Trump lost the peace prize, declared trade war on China (again), markets tanked and crypto collapsed. Then he tweeted “all’s well, don’t worry,” and for something reason.. this.. matters? Dorothy, I don’t think we’re in Kansas any more.

- Crypto: imploded.

- The Bond market: tensed (though is closed today thankfully, for Columbus Day).

- Tech: bombed to key S/R/

- Crypto traders: shot themselves in Eastern Europe in despair, and jumped off bridges in Asia.

Then Trump came out and simply said over the weekend, as trading in the Middle East and Asia continued and seeing the reaction:

“everything’s fine, don’t worry”

(after declaring a Trade War again) and along with another AI deal - OpenAI and Broadcom ris ing by 9%, the markets are “semis-euphoric” again.

But you can sense the tension now. Memories of known knowns and Trump’s Achilles Heel of disrupting stability is back in the open, for now somewhat pacified by a platitude - “it’ll be ok” - which the markets sucked on like a baby on a dummy shoved in its mouth to keep it quiet.

All I see is a money merry go round of promised investment and potential for these huge re-re-reinvestment of AI and Semis signing deals with one another and borrowing against those deal like the old CDS problems in housing in the 2008 period, creating a vortex of risk.

There needs to be a return on this Capex.

Meanwhile the US is desperate for rare earths, and with Ukraine’s off the menu for now, because Trump couldn’t bring peace within 24 hours (or frankly 9 months) and China now weaponising rare earths supplies, Trump is not on strong ground (seemingly anywhere, ironically, except Gaza of all places right now, and that’s still in the making and no dead certainty) and neither is the US economy with the “Big Beautiful Bill” which is meant to be funded by tariff deals, not having any firm deals to rest its spending needs on. Hence the logjam over the budget.

Where is all the money?

Private equity, dark pools, AI deals and infrastructure deals done “off the books” and behind closed doors - largely unavailable to broader market participants and opaque in their real foundations.

However, the recovery will be quicker.

“Relief rallies are about positioning, not providence. Until we see receipts, hedge first, opine later.”

Watching the open on Monday 13th October, in my last article from Sunday I commented:

What did we get when Trump said on Saturday “everything will be ok” ?

- A “Reassurance rally”: a single calming comment + a fresh AI/semis headline (Broadcom/OpenAI) flips futures. That doesn’t fix tariffs/credit/liquidity; it just relieves pressure for a session. What’ll happen at the close, and what’s going to unfold going forward, if any sense of unease begins to slowly rise to combat the pure unvarnished enthusiasm driving stocks to try and recover?

- This is traditionally a sweet spot for the markets, but it is driven chiefly by AI and infrastructure, and those deals themselves are all based on years’ worth of forward buying, conditional and not absolute, and very much a case of a balloon blowing itself larger by exhaling hot air, up its own derrière, to enlarge it even more. Now that’s a bubble.

- Narrow leadership = fragile: one mega-cap/semis pop like today’s plus a reassuring “twat/tweet” from Trump can levitate the indices. Breadth and equal-weight don’t confirm. That’s not durable demand but correlation to the AI factor.

- Dealer/flows: after Friday’s puke, street gamma likely less positive; intraday moves get amplified by hedging. Hence “fast up, fast down.”

- Valuation math: “very high but not crazy” is exactly the danger zone - small disappointments create big drawdowns. That’s asymmetric (20/80) risk/reward, not a “wall of worry to climb.”

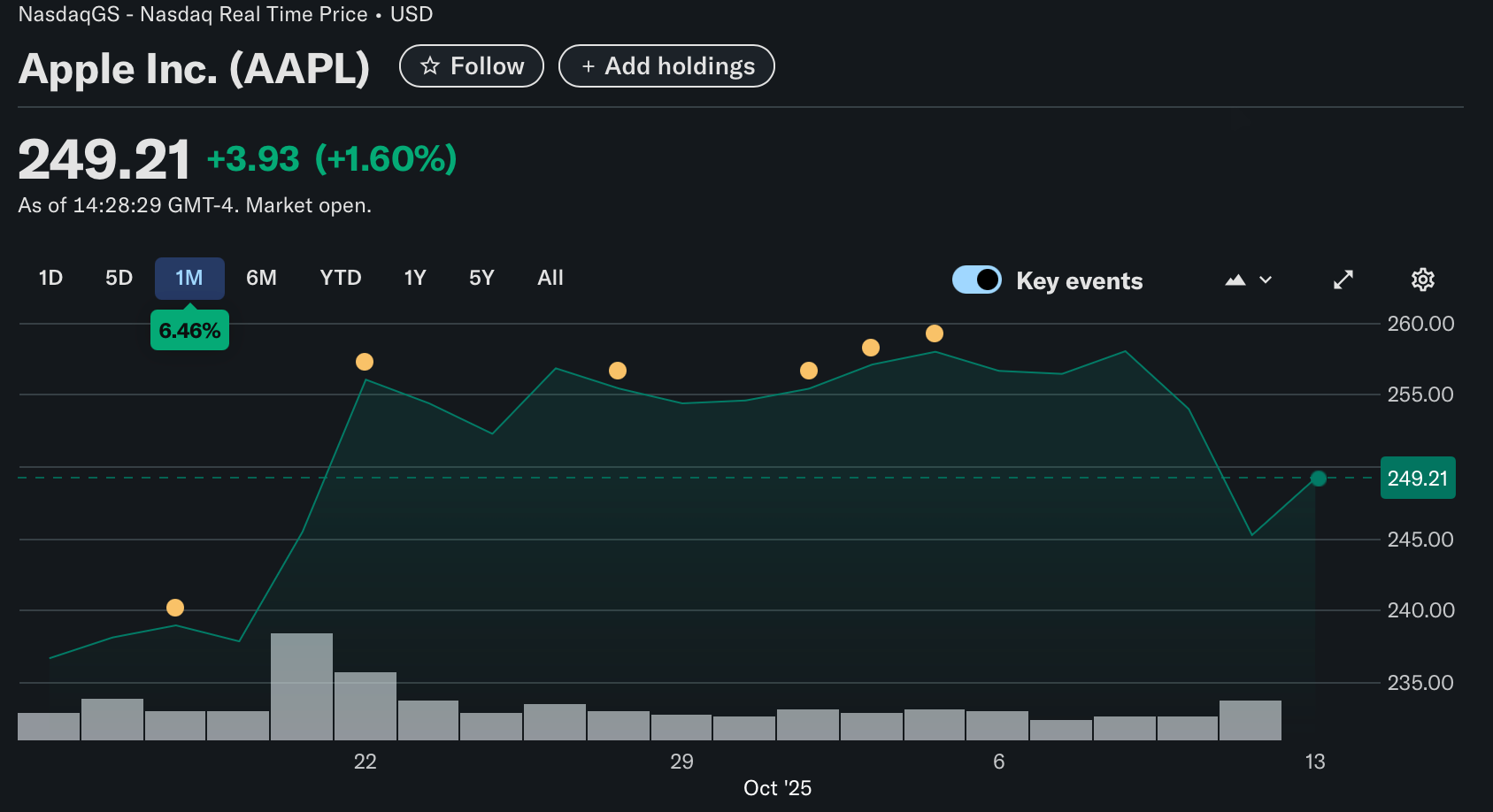

- AAPL tells you positioning, not fundamentals: a +$30 rip to $258 on vibes, a -$13 flush to $245 on a tape bomb, and only a tepid bounce back to ~247–248 despite the “all clear.” That’s not conviction - more like filling air pockets and gaps (more on this at the conclusion).

If you’re in the peanut gallery, determined to just go “la la la I’m not listening,” that’s your prerogative, but why is it ok to take a rather pompous “I’m alright Jack, and I have no worries, and banks are doing fine so all’s well,” when the fundamentals do not support valuations, just future potential at insanely high levels “but that’s ok,“ say talked heads on Bloomberg, “because they’re not crazy high yet.

Hello, but insanely high is the red danger zone right before “crazy” makes the wheels fall off the wagon.

This isn’t a sell call (although Wednesday’s on AAPL was):

Wednesday was an obvious blow-off top @ $258. Terranova and Ives said go all-in, I said sell out. By Friday, AAPL close 26c above my prediction of $245. No victory lap, just a demonstration that a) you can time the market and b) when everyone is waving pom-poms, it means there’s no game being played, just a distraction from what’s really happening.

I’m simply saying

As investors or market watchers, with no bias just watching smoke and signals that no matter whether you’re in or out of the markets, or benefitting from this insane rally built on capex promises which in turn are built on the collateral of future capex income promised from the same counterparties, you literally have a game of musical chairs developing where somewhere, sometime, one of these deals will have to unravel from either execution, demand or other problems, and ricochet back in a contagion like manned pulling down a house of cards.

In other words, love your investments, but hedge against a collapse, for god’s sake, by using the VIX and make sure you’re using “cheap protection” to guard against impact worse than a divorce settlement.

My 2-pence of “advice.”

- Separate price from proof: until there are real receipts not just IOUs being written between AI loss making large caps with hitherto lagging semis until recently written off but now darlings again (AMD, Intel, Broadcom etc) based on real outcomes (earnings, units, margin), treat sharp squeezes as flow, not fact.

- Identify the real driver each day: today = AI/semis beta; last week = tariff risk; weekend = crypto deleveraging. If your stock is moving with the driver, you’re in the factor, not a thesis And you are rising and partying on the hot air elevating you, not benefitting from the traction of a real Formula One car genuinely outperforming on the race track.

- Respect reflexivity: tweets calm VaR, VaR tightens spreads, spreads invite risk. None of that resolves tariff path, bond demand, or crypto collateral damage. Or future inflation risk or geopolitical risk. Because Trump Yahweh away in a “tantrum tweet” but giveth back in a “don’t be so yipetty about my 100% tariff war” twat 24 hours later is not a sign of stability, but a sign of incompetence, market complacency and the equivalent of partying on the deck of the Titanic before it hit an iceberg, but (in this imaginary scenario) having been told “icebergs ahead, ready the lifeboats just in case.

- You don’t just ignore signals like this: You prep for them, just in case. That’s not hyperbole or hysteria or negativity (recall I am the only person who laid out a path for AAPL to $400 by Q4 2027, if they made they right moves), so I see both sides of the coin. Unfortunately at the moment, each time it’s flipped, it seems to land… oddly.

- Positioning > opinions: if you’re not a multi-year holder, define risk. Cash is a position. Hedges are cheap when everyone’s chanting “it’s fine.

Tactical map (near term):

- AAPL levels: 252–254 = first supply;

- $255–256 = tougher lid;

- Support/Resistance 245–249, then 238–240;

- $225 still the “fair-value retest” on any broader shock.

- What would change my mind?

- breadth thrust, credit spreads tightening, volume increasing, and an actual de-escalation path on tariffs not tweets, with a lowering of the rhetoric.

And to all the pom-pom wavers and negative AI bubble harbingers of doom, CapEX isn’t going to dry up, the bubble wil be financial not existential as I explained here, but the immediate collateral damage will, short term, make the dot.com bust look like a playground.

LAST MINUTE NOTE BEFORE THE CLOSE:

Jeffries downgrades AAPL for the third time, from $205 to $203, based on ASPs and margins. Meanwhile Dan Ives is out with pom-poms calling for $305. Talk about crazy horses, if this isn’t a casino now I don’t know what is.

AND “From Beyond The Retirement Grave,”

John Sculley, Apple’s ex-CEO, says Apple have missed the boat, and facing their biggest challenge ever. I’d meet have though I’d ever say this, but for once, I happen to agree with the “selling sugared water” ex-Pepsi salesman, unfortunately. If for nothing other than hearing a blast from the past, it’s worth a read:

https://uk.finance.yahoo.com/news/former-apple-ceo-says-ai-155641198.html

Final Comment

Markets have short memories and long consequences.

April’s tariff tremor, July’s denial rally, and October’s crypto collapse all rhyme because the same physics applies: leverage, liquidity, belief. The system keeps saving itself with words - “don’t worry,” “AI revolution,” “temporary”- yet every rescue leaves less resilience in the hull. So hedge, hold your nerve, and stop mistaking noise for narrative - there’s no such thing as “conviction” or “faith“ in the real world, just some quant and real risk/reward analysis with eyes wide open, and hope put to one side.

The next time the screens go red, remember: the difference between panic and preparation is one trade placed while everyone else is still laughing.

“Relief rallies are about positioning, not providence. Until we see receipts, hedge first, opine later.”

As for anyone else despairing or cheering, let them debate faith.

Focus on process:

- Drivers

- levels,

- scenarios,

- hedges (useful when the hopium wears off).

“Take Heed of Sharp Turns Ahead. Don’t Ignore The Tell-Tale Signs of Wearing Out at the Edges. Hedge, Don’t Edge, as I’ve Been Warning Since July.” – Tommo_UK

— Tommo_UK, London. Monday Lunchtime, 13th October 2025.

Any comments, or thoughts, from investors, as opposed to 20-year long buy-and-holders who couldn’t care less because they’re just glad to be living off the dividends from their 11,000% share price increase? Leave them below 😎

X: @tommo_uk | Linkedin: Tommo UK

See the share buttons to LinkedIn, social media and email? Please, use them and help keep .fyi free at the point of readership. Or email this article on to a friend-in-need.