The Dan Ives Cheerleading Of The Tech, Palantir and Apple Economy: How Wall Street Keeps Selling the Same AI Fairytale (PT1).

Dan Ives waves the pom-poms again: robotaxis everywhere, “Apple to $5T,” and “Palantir to $1T.” Behind the hype sits the machinery, the pupeteers, rumours feeding analysts feeding markets while reality lags. This piece dissects the puppetry, not the cheer and does not mention the AVP.

Dan Ives is rah-rahing with pom-poms again. Never knowingly under-bullish, this is a point-by-point rebuttal:

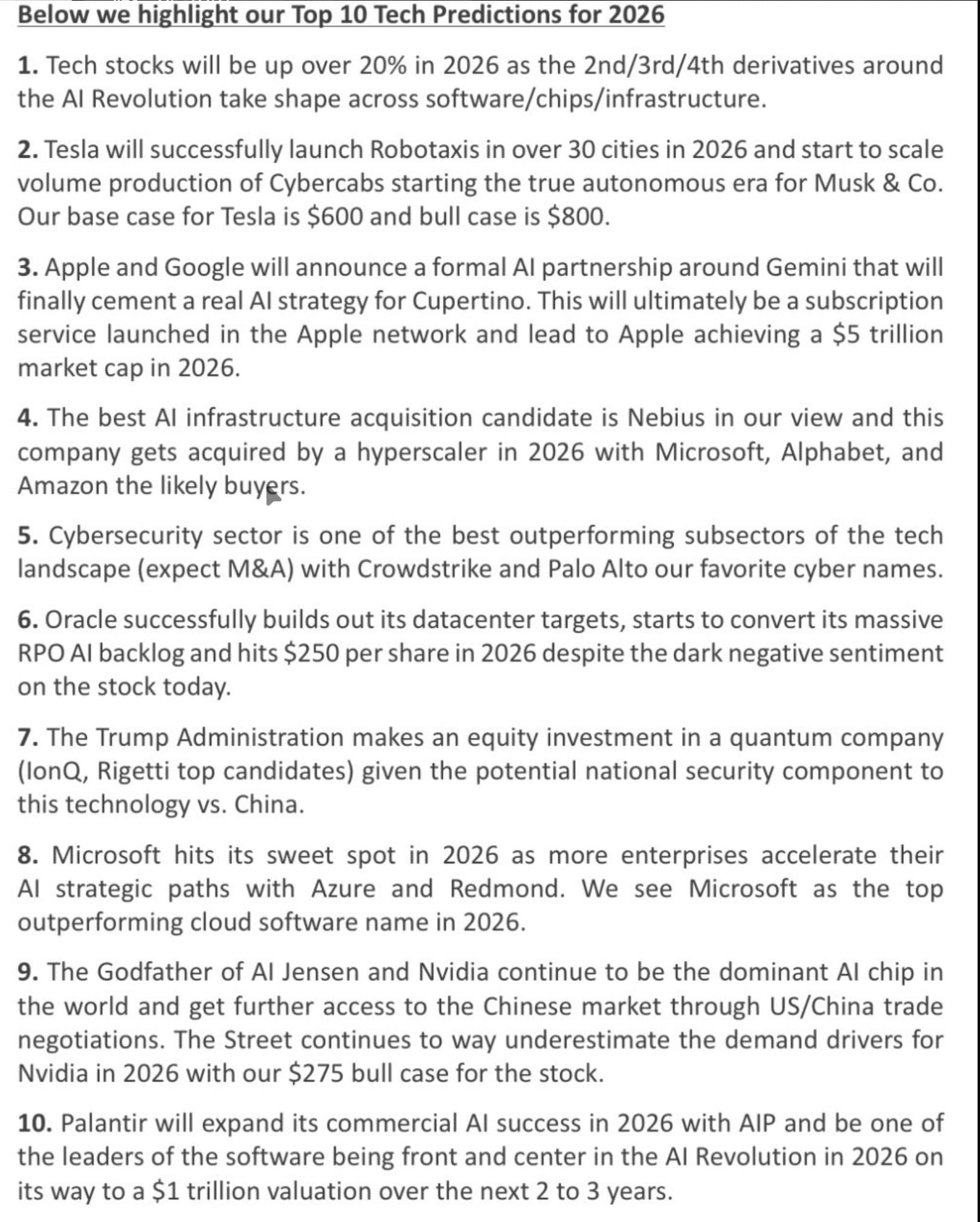

Dan Ives “Top 10 Tech Predictions for 2026”

With:

- a contrarian counter-argument, and

- a brief historical or structural correction where the claim relies on myth, hype, or category error.

It’s Kick-Off Time!

But first a piece of blatant self-promotion for your benefit:

Free early-access invitation: no paywall, no spam.

Why This Matters:

- Real-time Apple, AAPL and AI news

- Real-time RSS feeds

- FYI exclusive Intraday Updates as they happen

- Real-time updates before they hit CNBC

- Real-time chat with other investors

- Real-time chat with Tommo_UK

- Breaking News searchable archives

No noise, just actionable context and live chat and newsflow to discuss , with investors, analysts, and involved consumers.

💌 Not signed up? Here’s a great reason to: Even the free tier gets you in for now. Just subscribe to the newsletter, or check your existing account.

🔔 Access Notice - A Member But Not A Subscriber? Re-Subscribe 🔔

👇 So Firstly

Turn on your Newsletter Subscription if you’re already signed-up as a member by checking your account settings here:

💡 This is where live action, chat, and commentary will happen. Be there when the feed goes live for real-time market insight, member chat, and coverage as it breaks.

Now Back to the Tommo Christmas Takedown Of Dan Ives Top 10 for 2026 Predictions:

1. “Tech stocks up over 20% in 2026 on AI derivatives”

The claim:

Second-, third- and fourth-order AI derivatives will lift the entire tech complex by >20%.

The problem:

This assumes diffusion without friction.

Historically, platform transitions do not lift “tech” as a bloc. They concentrate returns. The internet did not lift all tech in 2000. Mobile did not lift all tech in 2008–10. Cloud did not lift all tech post-2013. AI will be no different.

Second-order benefits require:

- pricing power,

- margin expansion,

- and actual demand elasticity.

Most “AI derivatives” so far represent cost substitution, not new revenue pools. If AI increases productivity but compresses pricing, equity upside does not follow automatically.

History lesson:

Every major computing shift produces a handful of winners and a long tail of underperformers. Broad optimism usually marks the late phase, not the early one.

2. “Tesla launches robotaxis in 30+ cities”

The claim:

Full autonomous robotaxis at scale in 2026.

The problem:

This conflates a demonstration with deployment (and consumer apathy and lack of safety concerns).

Urban autonomy is not a single technical hurdle; it is a regulatory, liability, insurance, and infrastructure problem. Even Waymo’s carefully geofenced rollout has taken a decade, and it operates under far tighter constraints than Tesla proposes.

Scaling to 30 cities implies:

- regulatory alignment across jurisdictions,

- actuarial acceptance,

- public tolerance for failure modes.

None of these are engineering problems.

History lesson:

Autonomy has followed the same arc since the DARPA Grand Challenge: spectacular demos, glacial deployment. Timelines have consistently slipped by an order of magnitude.

3. “Apple + Google Gemini partnership creates a $5T Apple” [Note: I painted a pathway to a $6T Apple, by Q4 2027, without renting Gemini]

Oh god… this again. I’ve written about the dangers of this here

And also here:

The claim:

A Gemini partnership “cements” Apple’s AI strategy and drives a $5T market cap.

The problem:

Outsourcing intelligence is not strategy but more of a dependency. This notion, og a GooPle merger, is the stuff of nightmares but from a user POV and also regulatory. Apple invents, it should never rent. When it does, it fails to own the trajectory and is held back. History shows this.

Apple’s historical advantage was owning the core abstraction layer. Renting cognition from Google inverts that model. It turns Apple from platform originator into distribution veneer.

A subscription layer on top of someone else’s intelligence stack does not create defensibility; it creates margin leakage and strategic exposure, and a deployability anchor stuck in Google’s priorities not Apple’s.

History lesson:

Apple’s greatest wins (iPod, iTunes, Mac, iPhone, Apple Silicon) came from internal architectural control in hardware and software. Its greatest failures (Maps v1, Siri stagnation, car) came from stitched-together dependencies and no internal advocacy. It’s not different this time, Dan.

4. “Nebius acquired by a hyperscaler”

The claim:

Nebius is the best AI infrastructure acquisition target.

The problem:

Hyperscalers don’t acquire infrastructure to gain capacity: they build it to gain control economics.

M&A at this layer only happens when:

- build times are prohibitive, or

- regulatory capture is possible.

Neither condition clearly applies here.

History lesson:

Amazon, Google and Microsoft have consistently preferred vertical integration over infrastructure M&A, precisely because scale economics improve with internalisation. But it’s plausible if not very likely.

5. “Cybersecurity outperforms (CrowdStrike, Palo Alto)”

The claim:

Cybersecurity is a structural winner.

The nuance:

This is directionally correct but cyclically mistimed.

Security spend is reactive, not proactive. It surges after incidents, not during capex booms. AI introduces new attack surfaces, but also new automation that compresses pricing.

History lesson:

Security leaders rotate every cycle. Few remain dominant across paradigm shifts. Outperformance is episodic, not guaranteed and the level of churn in this sector is legendary, often relying on individuals and not organisations for expertise and genius level insight.

6. “Oracle hits $250 on AI data centre execution”

The claim:

Oracle converts AI backlog into durable growth.

The problem:

Backlog is not revenue, and revenue is not margin.

Oracle’s challenge is not building data centres; it is operational credibility in hyperscale competition, where latency, tooling, and developer mindshare matter more than capex. Health have already been mooted, and the game of musical chairs of AI investment being used as collateral to leverage further AI capex investment reminds me of the housing CDS scandal of 2008. Wedbush reminds me of Bear Stearns (albeit Dan Ives is arguably better dressed, in a special kind of way).

History lesson:

Enterprise incumbents often monetise late but they rarely define the economics of the next platform

7. “Trump administration invests in quantum”

The claim:

State-backed quantum investment accelerates leaders like IonQ.

The reality:

Quantum remains a research programme, not a commercial platform. State investment does not imply near-term monetisation; it implies strategic optionality, often over decades.

File this under “Tump Organisation Launches Trump Phone” in terms of market relevance.

History lesson:

Government funding has historically preceded commercial viability by 15–30 years (semiconductors, GPS, networking).

8. “Microsoft is the top AI cloud winner”

The claim:

Microsoft dominates enterprise AI via Azure.

The stronger case:

Microsoft has distribution, not monopoly. Its advantage lies in enterprise inertia, not technical superiority. That makes it a durable participant, but not necessarily the long-term profit maximiser if AI margins compress. First mover advantage does not equate to long term winner. Look at WinTel, the PC, and Windows.

History lesson:

IBM dominated enterprise computing for decades and still underperformed during every major platform shift.

9. “Jensen Huang, Godfather of AI”

(Oh good lord, another clanger of a statement)

The claim:

Jensen Huang as the singular architect of AI.

The correction:

Nvidia enabled AI acceleration; it did not invent AI. GPUs became the substrate because they were repurposed, not designed, for neural computation. This was opportunistic brilliance, not foundational authorship. Jensen is an incredible visionary but it is flatulently incorrect to call him the Godfather of AI.

Actual lineage:

- Conceptual AI: Turing, McCarthy, Minsky

- Narrative intelligence & interaction: Asimov

- Applied human-AI interface: Apple’s 1987 Knowledge Navigator

- Scalable training: academia + open research

- Hardware acceleration: Nvidia (crucial, but not originary - just the quickest to retool a GPU into a neural PU)

History lesson:

Every platform crowns a visible figurehead. The mythology usually arrives after the economic peak. Then they get stabbed in the back.

10. “Palantir to $1T valuation”

Eeek - the world’s most-favoured company for invading peoples‘ privacy is put on a pedestal by kleptocratic technocrats determined that more surveillance = higher personal gain, and thanks to Wall Street Pom-Poms and governmental vested interests, this is the dark horse candidate for actually coming true.

In fact it’s Stranger Things coming to life, about to take control of you, your world, and turn it upside down.

In fact, Palantir reminds me of the Tyrell Corporation in the making, such is its mission creep into all areas of government and life. I(‘m going to dive a bit deeper into this super-scary blob being encouraged by global governments to come in and take over their systems, and our lives, in a second. First tho:

The claim:

Palantir becomes a trillion-dollar AI software leader.

The problem:

Palantir is a services-heavy platform, not a scalable consumer or developer ecosystem.

Its success is real, but bounded by:

- bespoke deployments,

- political exposure,

- and limited horizontal extensibility.

History lesson:

Trillion-dollar software companies require mass adoption and abstraction. Custom intelligence does not scale that way.

However… and this is where it gets frightening.

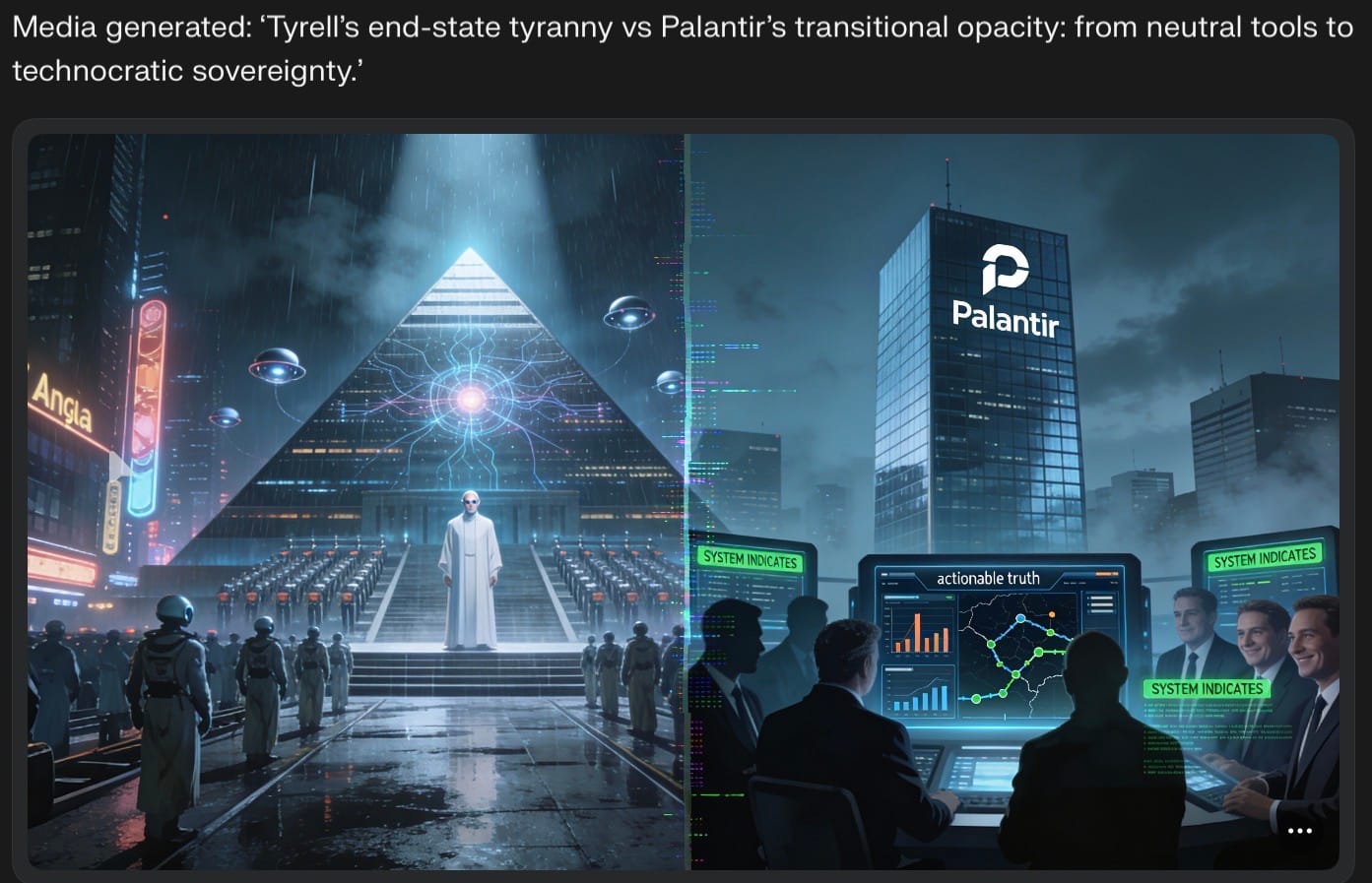

From Ridley Scott’s Tyrell Corporation to Palantir, or… :

“intelligence as infrastructure.”

In Blade Runner, the Tyrell Corporation does not rule the world by law, force, or ideology. It rules by capability. It builds intelligence, controls its limits, and supplies the state with tools the state no longer understands well enough to regulate.

Government still exists, but sovereignty has quietly migrated.

That is the mistake people make when they treat Tyrell as fantasy. The film’s insight is not about replicants. It is about where power moves when cognition becomes proprietary And corporate monoliths get into power (like Tesla and Musk, as an example).

The real Palantir is the direct allegory for the fictional Tyrell Corporation, and it’s respective leaders have a public person broadly similar in terms of perception if not in reality.

Transposed into the present, the closest real-world analogue is not Apple, Google, or OpenAI. It is Palantir Technologies.

Palantir does not create artificial intelligence in the consumer sense. It does something more structurally consequential: it mediates reality for the state. Intelligence agencies, defence departments, police forces, border authorities, and financial regulators increasingly operate inside Palantir’s analytical frameworks. Decisions are not merely informed by Palantir; they are shaped within it.

Obviously governments, investors, and the markets love it.

As a society, we might see Palantir’s mission creep as a greater threat than China to personal freedom and protection from the invasion of privacy.

This is where the Tyrell parallel becomes precise.

In Bladerunner, Tyrell’s founder, Eldon Tyrell, is not a politician. He is a technocrat whose authority rests on being indispensable. When Deckard seeks answers, he does not go to the state. He goes to Tyrell. The corporation has become the epistemic centre. A bit like Musk, on temporary secondment to the White House, briefly became a Tyrell-like figure commanding the President’s ear (for a time - Trump is not known for “being knowingly over-shadowed for long).

But he was there, and the President’s right hand man. Some might say at the outset, given Musk’s funding of Trump’s campaign, and their…. “Collaboration” … of crypto’s rise and the stock market’s subsequent euphoric blow-off top of November 2024 to April 2025, Musk is the direct allegory to Tyrell.

Palantir’s leadership, most visibly Peter Thiel, though the culture extends far beyond any single figure, occupies a similar position in contemporary discourse.

The company does not present itself as a neutral contractor. It frames its work as civilisational: defending the West, preserving order, enabling the state to function in a hostile world. “We will keep you safe. You can depend on us to protect your freedoms and way of life,” is the implicit message of all such regimes.

That rhetorical shift matters. When a corporation begins to speak as if it is co-custodian of national destiny, the boundary between supplier and sovereign has already blurred.

Like Tyrell, Palantir benefits from opacity.

Its models are proprietary. Its inference chains are not democratically legible. Outcomes are delivered as actionable truth, not as contestable interpretation. Policymakers act; accountability disperses. When decisions go wrong, responsibility dissolves into the phrase “the system indicated.”

The crucial distinction is temporal.

Tyrell in the fictional dystopian future represents an end state of affairs - “job done” in other words: a world where technocratic power has fully replaced democratic cognition.

Palantir, in the here and now, represents the transitional phase, where that replacement is still justified as efficiency, necessity, or pragmatism.

Tyrell never pretends neutrality. Palantir must, because its legitimacy depends on the fiction that tools do not shape outcomes.

A quick Apple and Tyrell->Palantir allegory

Apple failed to become Tyrell not because it lacked resources, but because it refused - culturally and organisationally - to own cognition and private data as infrastructure and asset. The remaining aura of Steve Jobs and Apple’s founding principles, although much diluted by Cook and his fawning over Trump for special favours, still acts as a moral compass to a degree. Apple has made a point of - uniquely - trying to respect privacy and spyware.

Palantir did not make that choice and has no need to reach out to consumer. It bypassed consumers entirely and embedded itself where power actually executes - commerce, enterprise and government agencies, and where budgets are endless when it comes to enhancing government power and constraints are as lax as an ICE regulations handbook.

Tyrell and Bladerunner shows us here this path leads.

Palantir shows how easily one can get there.

And that is why comparisons such as Ives’ simplistic reductionism that treat Palantir as just another “AI company” miss the point entirely.

The unspoken assumption behind all ten predictions

- Every one of these points relies on the same hidden premise:

- That AI behaves like previous tech cycles eg. incremental, monetisable, and smoothly diffusive.

Well in my opinion, it doesn’t.

AI is deflationary, concentrative, and strategically destabilising. It rewards control layers, not surface narratives and accountability. That is why so many “upbeat” AI rumours now coincide with AAPL selling off, not rallying. Arguably, it’s being said, Apple is the “Anti-AI everywhere” play, a doomed strategy and visibility so considering its shotgun marriage of “Apple Intelligence“ to Google’s Gemini to form “GlooPle” but nevertheless indicative of the friction between the vision of two very different POVs of how AI should be applied.

The market is no longer asking what might happen.

It is asking:

Who actually controls the intelligence layer, and who is just recklessly renting it?

That is the question Ives optimism refuses to answer, and fails to also address the societal questions which will at some point (likely too late) come to be said.

And that’s a wrap on AI - until the next “Top 10“ predictions annoy me led by ignorance, lack of due diligence, and lazy thinking. Dan, love your jackets, but take off the pink spectacles, put down your PomPoms and stop cheerleading the market and society off the cliff like an army of lemmings.

This won’t end well. It never does.

Tommo_UK, London 20th December 2025

© 2025 TOMMO.FYI

💡 Reach out to me using the Confidential Drop Box form below.

CONTACT ME DIRECTLY: discreetly (and anonymously if you prefer)

👉 I’ll reach out personally, selectively, and with respect for your time and position, depending on the nature of your drop.

Lastly, a quick ask:

Please, share this on your social networks. From the post on the FYI site itself if you click through, you’ll see share buttons (or just share the URL), By social media or email, if you can help me, I’d be very grateful.

And a “Thanks,” for being with me on the journey so far.

Some of you have been sparring with me for twenty-plus years across different forums and eras. Agree, disagree, argue… tell me I’m serving the main course - or that my brain is out to lunch: that’s the point.