What Tom Clancy might have written about "Bond Vigilantes," the collapse of the US economy, and the American Empire falling overnight mirroring Rome's fall over 300 years of decline.

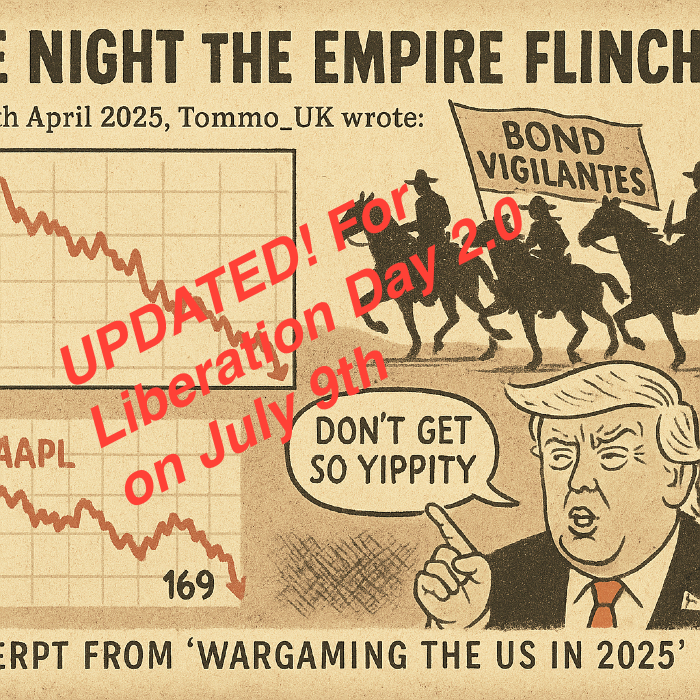

Excerpt from “Wargaming the US in 2025” – Tommo_UK [fiction/reality] It didn’t start with missiles or malware, but a single $9.6B Treasury dump out of Tokyo. Hours later, it spiralled into panic. The night the Empire flinched—and the dollar nearly broke. I’d exited all US assets weeks before.

I wrote this on April 9th as a short story about how the next stage in the global economic war being waged by the US might become a US debt problem backfiring on it through the dumping of US Treasuries. Of course, that's almosst exactly what then happened, and history has a habit of rhyming...

9th July 2025: UPDATE To Article (which is FICTION by the way, but based on real market dynamics): 3 months from the original post, on April 9th, and the day Trump‘a Big Wonderful Tariffs were meant to go into effect, today July 9th 2025, the can has been kicked down the road to August 1st - a Friday - and the day after Apple’s Q3 Earnings on 31st July 2025. Could the timing be any more of a perfect storm, considering the late Tariff and Treasuries Tantrum sent AAPL spiralling down from its $260 high right the way down to $167?

The True Story: By March I'd exited all US assets , and had warned about an impending tresuries and Dollar rout, only averted by DT emerging on a Thursday afternoon from the White House, after Jamie Dimon had convinced him if he didn't stabilise the markets, the US economy could collapse overnight Here's how I described it might - and still could - happen.

It also concided with my prediction AAPL would melt down to $150-170 from what was then still a $225 price point after the March high of $260 which is when I sold. A few days later, AAPL hit $169, rebouding only after DT stoped a market meltdown from happening at lightening speed:

On 9th April 2025, Tommo_UK wrote: "The Night the Empire Flinched" - an excerpt from my "Wargaming the US in 2025" (a fictional piece, but grounded in the reality of what almost happened an narrowly averted, and as they say, fiction can be stranger than truth).

It began at 2:03am Eastern. Not with a missile, or a hack, with a single liquidation order out of Tokyo. $9.6 billion in U.S. Treasuries, quietly offloaded by a Japanese megabank under pressure to cover overnight collateral calls. Barely a tremor. But in the hours that followed, it became something else entirely.

This was no market correction. This was the recoil of a weapon.

At 2:46am, Beijing retaliated: less than 24 hours earlier, the U.S. administration had announced a 134% blanket tariff on all Chinese imports, bypassing WTO rules and triggering diplomatic shock. China responded the only way it could—by weaponising the very heart of U.S. financial dominance: its sovereign debt.

Within 20 minutes, a coordinated selloff had begun—operated through sovereign proxies in Singapore, Hong Kong, and Luxembourg. At 3:12am, the PBOC initiated a $350 billion dump of U.S. Treasuries, masked in part through dark pools and secondary dealer networks. It wasn’t subtle. It wasn’t meant to be.

By 3:30am GMT, Europe opened into fire.

The ECB and the Bundesbank, anticipating dollar volatility and facing political pressure to defend the euro, began trimming its dollar holdings. Paris and Amsterdam followed. Then came the City of London.

At 4:07am GMT, the Bank of England authorised emergency liquidity operations and began unloading $120 billion in U.S. Treasuries through its major counterparties in Canary Wharf.

The motivation was tactical: defend sterling, stabilise gilts, and pre-empt margin calls by raising cash. But the effect was catastrophic.

Liquidity in the global Treasury market thinned to vapour. Bid-offer spreads exploded. Algorithmic systems throttled. Then froze.

By 5:00am London time, over $700 billion in Treasuries had been dumped. Yields on the 10-year had jumped from 4.1% to 6.9%—before New York had even switched on the lights.

The contagion wasn’t just financial. It was strategic.

Bond insurers scrambled. Collateral chains snapped. Repo markets across Europe began rejecting even AAA-rated U.S. paper. In Frankfurt, trading desks began marking down U.S. exposure as unpriceable. The euro spiked, not from strength, but from forced rotation. Gold surged. The dollar trembled.

At 6:12am GMT, Tokyo’s Nikkei closed down 9.3%. Japanese authorities began buying yen with dollars, adding to the dump. South Korea did the same. Even sovereign wealth funds in Norway and the Gulf quietly trimmed their Treasury positions, not out of hostility—but self-preservation.

By the time the U.S. East Coast began waking, the damage was irreversible:

$1.1 trillion in Treasuries had been marked for liquidation.

The 10-year yield now sat above 7.5%. Futures were limit down. The S&P 500 pre-market was in freefall. The Fed’s OMO desk had no bidders. Dealers were frozen. There was no “pivot” to rescue this.

Because this wasn’t 2008. Or 2020.

This was the Fed’s nightmare scenario: the collateral itself was being rejected.

At 8:31am EST, headlines hit: “China Dumps Treasuries in $350B Blitz—Trump Tariffs Blamed.” The framing didn’t matter. The effect did. The dollar index cratered. Oil jumped 18% in an hour. Treasury Secretary emergency call lines lit up—but there was no coordinated response. There was no plan for this.

And still, the real damage had already been done—in London, in Frankfurt, in Shanghai, while America slept.

By 10:15am, U.S. bond mutual funds began suspending redemptions. Primary dealers couldn’t clear auctions. Pension funds faced instant solvency crises. Risk parity models detonated. The Fed attempted an emergency QE injection—but the scale required ($2 trillion+ in minutes) exceeded available mechanisms. Foreign confidence was gone. And domestic faith was slipping.

This wasn’t a flash crash. It was a regime collapse.

The U.S. Treasury—long treated as the world’s safest asset—had become a contagion vector.

Not because it failed, but because trust cracked. And trust, once gone, doesn’t bleed. It detonates.

All of it—rates, equities, currencies—pivoted not on war, or revolution, or AI. But on a routine series of sell orders, triggered by a policy miscalculation, amplified by global interdependence, and executed across timezones with algorithmic precision.

By midday in Washington, the United States was no longer in control of its financial destiny.

The very instruments of its post-war dominance—dollar primacy, Treasury issuance, global capital trust—had become liabilities.

This is the scenario outlined in the full version of my "Wargaming the US in 2025" which I actually wrote at the beginning of March 2025 somewhat in advance of all hell breaking loose—not as a prophecy, but as a fragile truth we pretend isn’t real:

An empire of paper is only as strong as the belief it can’t be burned.

And when the world stops believing—they light the match while you’re asleep.

Note: I wrote this as a comment on www.ped30.com but it's part of a larger 28,000 word discussion about the US, and three possible wargame scenarios, written in March 2025 preceding but predicting the tariff tamtrum itself and the possible outcomes of Trump's declaratin of fiscal terror on the world. It discusses how China might take advantage of this and stage economic war instead of military for a change (going against its historical precedent of always over-reaching for thousands of years) and comparing the US decline to the Fall of the Roman Empire. It'll be serialised here on .fyi shortly for all members.

Republicans, Democrats, I couldn't care who you vote for - we have enough problems in England of our own - but don't let the notion of "American Exceeptionalism" blind you; every other empire in history has collpased through over-reach after all. In a digital age what took 300 years can happen in 300 days.

Are you ready for “Liberation Day 2.0,” August 1st 2025 (delayed from April 2nd 2025)?

— Tommo_UK, London Original article April 9th 2025, updated July 9th 2025

Please pass this to your friends, colleagues, investors, liquidators, families, or anyone you think might be interested in real time thought leadership commentary written in real time on the news, about the news, and looking into the future.